In the world of real estate, there are many terms and acronyms that buyers and homeowners need to familiarize themselves with. One such acronym that often comes up in conversations about mortgage payments is PITI. If you’re new to the real estate industry or looking to buy a home, you might be wondering, “What does PITI stand for in real estate?” In this article, we will explore the meaning of PITI, its components, and why it is essential for homeowners and potential buyers to understand this term.

When it comes to homeownership, there’s more to consider than just the purchase price of the property. Along with the cost of the house, you need to take into account other expenses associated with owning a home, such as property taxes, insurance, and mortgage interest. PITI is an acronym that encompasses all these elements, and understanding its meaning is crucial for anyone involved in the real estate market.

Understanding PITI

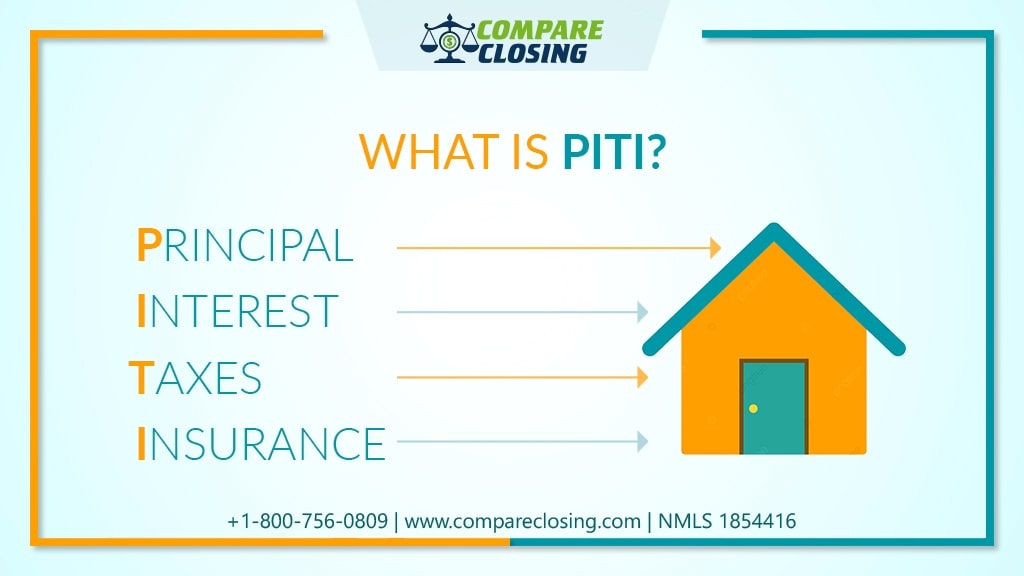

PITI stands for Principal, Interest, Taxes, and Insurance. It represents the four main components of a mortgage payment. Each element plays a significant role in determining the total amount you need to pay each month to your lender.

The Components Of PITI

Let’s take a closer look at each component of PITI:

- Principal

The principal is the initial amount borrowed to finance the purchase of a home. It does not include any interest charges or fees. As you make mortgage payments, a portion of the payment goes towards reducing the principal balance.

- Interest

Interest is the cost charged by the lender for borrowing money. It is calculated based on the interest rate and the remaining balance of the loan. In the early years of a mortgage, a significant portion of the payment goes towards interest.

- Taxes

Taxes, specifically property taxes, are assessed by local governments based on the value of the property. They are typically paid annually but are divided into monthly payments as part of the mortgage payment. Property taxes contribute to funding local services such as schools, infrastructure, and emergency services.

- Insurance

Insurance in the context of PITI refers to homeowners insurance. It provides coverage for potential damages to the property caused by fire, theft, natural disasters, and other covered events. Lenders require homeowners insurance as a condition for obtaining a mortgage.

Why PITI Is Important

Understanding PITI is crucial for several reasons:

- Accurate Budgeting: Knowing your PITI allows you to budget accurately and plan for monthly mortgage payments.

- Estimating Affordability: Calculating your PITI helps determine how much you can afford when buying a home.

- Loan Approval: Lenders use PITI calculations to assess your financial capability and determine whether you qualify for a mortgage.

- Comparing Loan Options: Comparing PITI across different loan options helps you choose the most suitable mortgage for your needs.

Calculating PITI

To calculate your PITI, you can use a mortgage calculator or follow this simple formula:

PITI = Principal + Interest + Taxes + Insurance

First, determine the principal amount, which is the initial loan amount you borrowed to purchase the property. Next, calculate the interest by multiplying the loan balance by the interest rate. Add the property taxes, which are usually estimated based on the property’s assessed value and local tax rates. Lastly, include the cost of homeowners insurance, which is typically determined by the insurance provider. By adding these four components together, you can determine the total monthly mortgage payment.

Factors That Affect PITI

Several factors can influence the amount of your PITI:

- Loan Amount: The higher the loan amount, the higher the monthly mortgage payment.

- Interest Rate: A higher interest rate will result in a larger portion of the payment going towards interest.

- Property Taxes: The property tax rate and the assessed value of the property affect the tax portion of PITI.

- Homeowners Insurance: The cost of insurance can vary based on factors such as the property’s location, value, and the coverage selected.

Understanding these factors helps you evaluate the affordability of a property and compare different mortgage options.

How PITI Affects Home Affordability

PITI plays a crucial role in determining the affordability of homeownership. When you apply for a mortgage, lenders consider your income, debts, and the PITI amount to assess your ability to make timely payments. It’s essential to have a clear understanding of your financial situation and calculate your PITI to ensure you can comfortably afford your monthly mortgage obligations.

PITI vs. Monthly Mortgage Payment

While PITI represents the total monthly payment, it’s worth noting the difference between PITI and the monthly mortgage payment. The monthly mortgage payment only includes the principal and interest portion, excluding taxes and insurance. Understanding this distinction can help you accurately assess your financial commitments and plan your budget accordingly.

Tips For Managing PITI

Managing your PITI effectively is crucial for maintaining financial stability as a homeowner. Consider the following tips:

- Budget Wisely: Create a detailed budget that accounts for your PITI and other essential expenses.

- Plan for Escrow: If your lender includes taxes and insurance in your monthly payment, set aside funds in an escrow account to ensure you can make these payments when due.

- Reassess Insurance Coverage: Periodically review your homeowners insurance coverage to ensure it adequately protects your property and belongings.

- Stay Informed: Keep track of any changes in property tax rates or insurance costs to adjust your budget accordingly.

- Prioritize Savings: Allocate a portion of your income towards savings to cover unexpected expenses or emergencies related to your home.

By following these tips, you can effectively manage your PITI and maintain financial stability as a homeowner.

How To Calculate Your PITI If You Are Considering Buying A Home

To calculate your estimated PITI, you can use an online mortgage calculator or consult with a lender. Provide information such as the loan amount, interest rate, estimated property taxes, and insurance costs. The calculator or lender will then generate an estimated monthly PITI payment based on these inputs. This can help you evaluate the affordability of a potential home purchase and determine if it fits within your budget.

Remember, it’s important to consult with professionals, such as lenders or financial advisors, to get personalized advice based on your specific financial situation and goals.

The Importance Of Budgeting

Budgeting is a critical aspect of homeownership, and understanding PITI is essential for creating an accurate budget. By carefully considering your income, expenses, and the PITI amount, you can ensure that your mortgage payments fit comfortably within your financial capabilities. Proper budgeting also allows you to save for future goals and build equity in your home.

Conclusion

In conclusion, PITI stands for Principal, Interest, Taxes, and Insurance. It represents the four main components of a mortgage payment. Understanding PITI is vital for homeowners and potential buyers as it helps with accurate budgeting, estimating affordability, and comparing loan options. By comprehending how each element contributes to the total payment, individuals can make informed decisions when entering the real estate market.