In the complex world of finance and investments, the term “cash settlement” holds a significant place. Whether you’re a seasoned investor or just starting your journey, understanding cash settlement is crucial to making informed decisions. In this article, we’ll delve deep into the concept of cash settlement, its implications, and how it impacts various financial transactions.

Cash settlement is a fundamental concept in finance that plays a pivotal role in various financial transactions. It involves the transfer of cash to settle a trade or contract, eliminating the need for physical delivery of an underlying asset. This article aims to provide a comprehensive understanding of cash settlement and its significance in today’s financial landscape.

What Is Cash Settlement?

Cash settlement refers to the process of settling a financial transaction by transferring cash between parties involved, instead of exchanging the actual underlying asset. This method is widely used in markets such as stocks, options, bonds, and futures, offering flexibility and convenience to market participants.

Types Of Cash Settlement

- Equity Cash Settlement: Equity cash settlement is prevalent in stock markets. It involves the exchange of cash based on the difference between the contract price and the market value of the underlying stock.

- Options and Derivatives Cash Settlement: Options contracts often employ cash settlement. When an option is exercised, the option holder receives cash equivalent to the difference between the contract’s strike price and the market price of the underlying asset.

- Fixed-Income Cash Settlement: In the realm of bonds and fixed-income securities, cash settlement encompasses the payment of the bond’s face value and accrued interest, without the physical exchange of bonds.

- Futures Cash Settlement: Futures contracts are frequently settled in cash, where the difference between the contract price and the prevailing market price is exchanged in cash.

- Currency Exchange Cash Settlement: Cash settlement is also instrumental in currency trading, allowing traders to settle foreign exchange contracts by exchanging the monetary difference.

- Commodity Cash Settlement: Commodity markets utilize cash settlement, enabling traders to exchange cash based on the fluctuation between contract value and market price, without the need for physical commodity delivery.

- Real Estate Cash Settlement: In real estate transactions, cash settlement is employed to finalize property deals by exchanging the monetary discrepancy between the agreed-upon price and the property’s appraised value.

Cash Settlement In Specialized Markets

Cash settlement extends to specialized markets like energy trading, where it’s used in electricity, oil, and gas contracts. Additionally, it plays a role in environmental markets, facilitating the trading of carbon credits.

Advantages And Considerations Of Different Types Of Cash Settlement

Each type of cash settlement offers distinct advantages, such as efficiency, reduced logistical challenges, and enhanced risk management. However, it’s essential to consider potential drawbacks and market-specific factors.

- Case Studies: Real-Life Applications of Cash Settlement: Examining real-life scenarios, we’ll explore how different types of cash settlement have been implemented to streamline financial transactions and minimize risk.

The Evolution of Cash Settlement Mechanisms

Cash settlement mechanisms have evolved over time to accommodate changing market dynamics and technological advancements, shaping the way transactions are conducted today.

How Does Cash Settlement Work?

In a cash settlement, the parties agree to exchange the monetary difference between the contract’s initial value and its value at the time of settlement. This can be based on various factors, such as market prices, interest rates, or index values. The process is facilitated through a clearinghouse, which calculates and oversees the cash flows between the parties.

Cash Settlement In Different Financial Instruments

- Stocks and Equities: Cash settlement in stock trading occurs when investors trade in contracts that derive their value from the underlying stock prices. Upon the contract’s expiration, the parties exchange the difference between the contract price and the stock’s current market price.

- Options and Derivatives: Options contracts often use cash settlement. When an option is exercised, the option holder receives the difference between the strike price and the market price of the underlying asset in cash.

- Bonds and Fixed-Income Securities: Cash settlement in the bond market involves the payment of the bond’s face value and accrued interest, rather than physically delivering the bonds themselves.

- Futures Contracts: Futures contracts are frequently settled in cash, where the difference between the contract price and the market price is exchanged.

Advantages Of Cash Settlement

Cash settlement, a key concept in the financial world, offers a range of benefits that make it an attractive option for various types of transactions. Whether you’re involved in stock trading, options contracts, or other financial instruments, understanding the advantages of cash settlement can provide valuable insights into why this method is widely adopted. They are;

- Efficiency and Speed: One of the most significant advantages of cash settlement is its efficiency. Transactions are executed swiftly, eliminating the delays associated with physical delivery. This speed is particularly beneficial in fast-paced markets where timely execution is crucial.

- Reduced Logistical Complexities: Cash settlement spares parties from the logistical challenges of transferring physical assets. This simplifies the process, allowing for smoother and more straightforward transactions without the need for handling, transportation, and storage of assets.

- Enhanced Risk Management: Cash settlement contributes to enhanced risk management by reducing exposure to price fluctuations. Parties involved can focus on managing financial risks rather than the complexities of handling physical assets.

- Market Access and Flexibility: Cash settlement provides access to a broader range of markets and assets. Investors can engage in transactions involving assets that may be challenging to physically deliver or manage, expanding their investment opportunities.

- Transparency and Fairness: Cash settlement mechanisms are designed to be transparent and fair. Parties receive a clear and accurate assessment of the transaction’s value based on market conditions, promoting trust and integrity in financial dealings.

- Mitigation of Counterparty Risks: Cash settlement helps mitigate counterparty risks by reducing the dependency on the financial stability of the counterpart. This is especially important in volatile markets, where uncertainties about counterparties can lead to significant risks.

- Global Accessibility; Cash settlement transcends geographical boundaries, enabling international transactions without the challenges of cross-border asset movement. This accessibility enhances market participation and diversification.

- Cost-Effectiveness: The cost-effectiveness of cash settlement stems from the elimination of expenses associated with physical delivery, such as transportation, storage, and insurance. This makes cash settlement an economically viable option.

- Support for Complex Financial Products: Cash settlement accommodates a wide range of financial products, including derivatives and options contracts. Its versatility makes it suitable for intricate trading strategies and innovative financial instruments.

Challenges And Considerations

While cash settlement has its benefits, it’s essential to consider potential risks and drawbacks, such as

- Pricing Discrepancies: Pricing discrepancies can emerge between the contract’s initial value and its value at settlement. This can lead to disputes and potentially impact the accuracy of the transaction’s outcome.

- Counterparty Risks: Cash settlement doesn’t eliminate counterparty risks entirely. The financial stability and credibility of the counterparties involved remain relevant factors that can affect the successful completion of the transaction.

- Market Volatility: In volatile markets, price fluctuations can be significant between the contract initiation and settlement. This volatility can result in unexpected cash flows and potentially alter the anticipated outcomes.

- Regulatory Compliance: Adhering to regulatory guidelines and compliance standards is paramount in cash settlement. Failing to meet these requirements can lead to legal repercussions and affect the validity of the transaction.

- Operational Complexities: Implementing cash settlement processes can introduce operational complexities, especially in cases where parties must manage multiple transactions simultaneously.

- Liquidity Concerns: Liquidity challenges can arise when cash settlement involves illiquid assets. Parties may struggle to find counterparties willing to engage in the transaction, leading to delays or unfavorable terms.

- Reputation and Trust: Maintaining a positive reputation and establishing trust are vital in cash settlement transactions. Any perceived breaches of trust can impact future dealings and relationships.

- Tax Implications: Cash settlement can have tax implications that need to be carefully evaluated and managed. Tax treatment may vary based on jurisdiction, asset type, and transaction structure.

- Integration with Trading Strategies: Integrating cash settlement with specific trading strategies requires careful planning. Factors such as timing, market conditions, and investment objectives must be considered.

- Mitigation Strategies: Addressing these challenges requires a proactive approach. Parties can adopt risk mitigation strategies, such as utilizing derivatives to hedge against potential losses.

Cash Settlement vs. Physical Settlement

Cash settlement differs from physical settlement, where the actual underlying asset is exchanged. Both methods have their merits and are chosen based on specific circumstances.

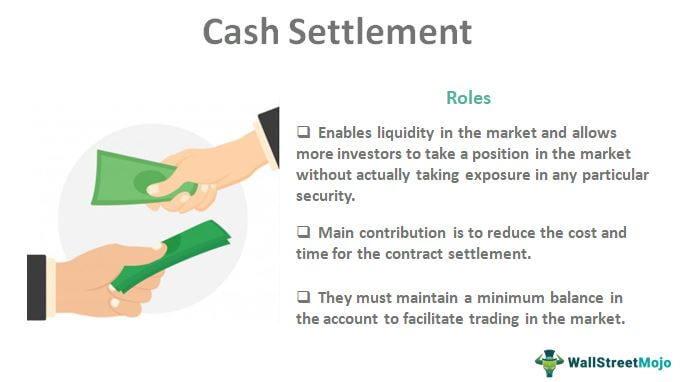

Role Of Cash Settlement In Risk Management

- Understanding Risk Management: Risk management involves the identification, assessment, and mitigation of potential threats that could impact the achievement of financial objectives. It aims to strike a balance between risk and reward, allowing market participants to make informed choices while safeguarding their interests.

- Cash Settlement as a Risk Mitigation Tool: Cash settlement is a valuable risk mitigation tool that helps manage the uncertainties associated with financial transactions. By eliminating the need for physical asset transfer, it reduces operational complexities and facilitates a smoother settlement process.

- Reducing Exposure to Price Fluctuations: One of the key advantages of cash settlement is its ability to reduce exposure to price fluctuations. Market prices can be volatile, and cash settlement ensures that parties involved are protected from adverse price movements.

- Counterparty Risk Mitigation: Cash settlement minimizes counterparty risks by focusing on the exchange of cash rather than relying on the financial stability of the counterpart. This reduces the potential impact of default by a counterparty.

- Liquidity Risk Management: Liquidity risk arises when there’s a challenge in converting assets into cash quickly. Cash settlement contributes to liquidity risk management by providing a more efficient and accessible method of settling transactions.

- Operational Risk Reduction: Operational risks, such as errors in asset delivery or settlement, can disrupt financial transactions. Cash settlement streamlines the process and reduces the likelihood of operational errors.

- Portfolio Diversification and Risk Allocation: Cash settlement enables investors to diversify their portfolios across a range of assets and markets. This diversification strategy helps allocate risks effectively, reducing the impact of a single asset’s poor performance.

- Regulatory Compliance and Risk Mitigation: Cash settlement aligns with regulatory requirements, promoting transparency and fairness in transactions. Adhering to regulations mitigates legal and reputational risks.

- Real-World Examples of Cash Settlement in Risk Management: Real-life examples, such as using cash settlement to manage risk in complex derivatives transactions, illustrate how this mechanism safeguards investments and ensures a more stable financial environment.

- Strategies for Effective Risk Management Through Cash Settlement: To harness the risk management benefits of cash settlement, market participants can adopt strategies such as diversifying portfolios, utilizing options for hedging, and engaging with regulated clearinghouses.

Legal and Regulatory Aspects

Regulatory frameworks influence cash settlement processes, ensuring fairness, transparency, and proper risk management.

Examples of Cash Settlement Scenarios

- Real-Life Trade Example

Let’s consider a real-life example of a cash settlement in the context of stock trading…

Case Study: Cash Settlement in Options Trading

In this case study, we explore how cash settlement works in options trading and its implications for traders.

How To Choose Between Cash Settlement And Other Methods

Deciding between cash settlement and other settlement methods depends on factors such as asset type, market conditions, and investor preferences.

Cash Settlement: A Tool For Portfolio Diversification

Cash settlement provides an avenue for diversifying investment portfolios and managing exposure to various assets.

Common Misconceptions About Cash Settlement

Addressing common misconceptions about cash settlement helps investors make well-informed decisions.

The Future Of Cash Settlement

As financial markets continue to evolve, the role of cash settlement is likely to adapt and transform, shaping the future of trading and investments.

Conclusion

In the dynamic world of finance, cash settlement stands as a pivotal mechanism for facilitating seamless and efficient transactions. Its ability to bridge the gap between various financial instruments and assets underscores its significance in modern markets. The versatility of cash settlement is evident across various financial instruments and markets. From stocks and options to commodities and real estate, cash settlement methods continue to facilitate efficient and secure transactions, contributing to the overall stability of the financial ecosystem.