Are you considering purchasing a new home? Did you know that you can use a Rollover IRA (Individual Retirement Account) to finance your dream home? Many people are unaware of the potential benefits and opportunities that come with utilizing their retirement funds for real estate purchases. In this article, we will explore the concept of using a Rollover IRA for a home purchase, discussing the advantages, eligibility criteria, and the step-by-step process to make this a reality. So, if you’re curious about how you can leverage your retirement savings to buy a new home, keep reading!

What Is A Rollover IRA?

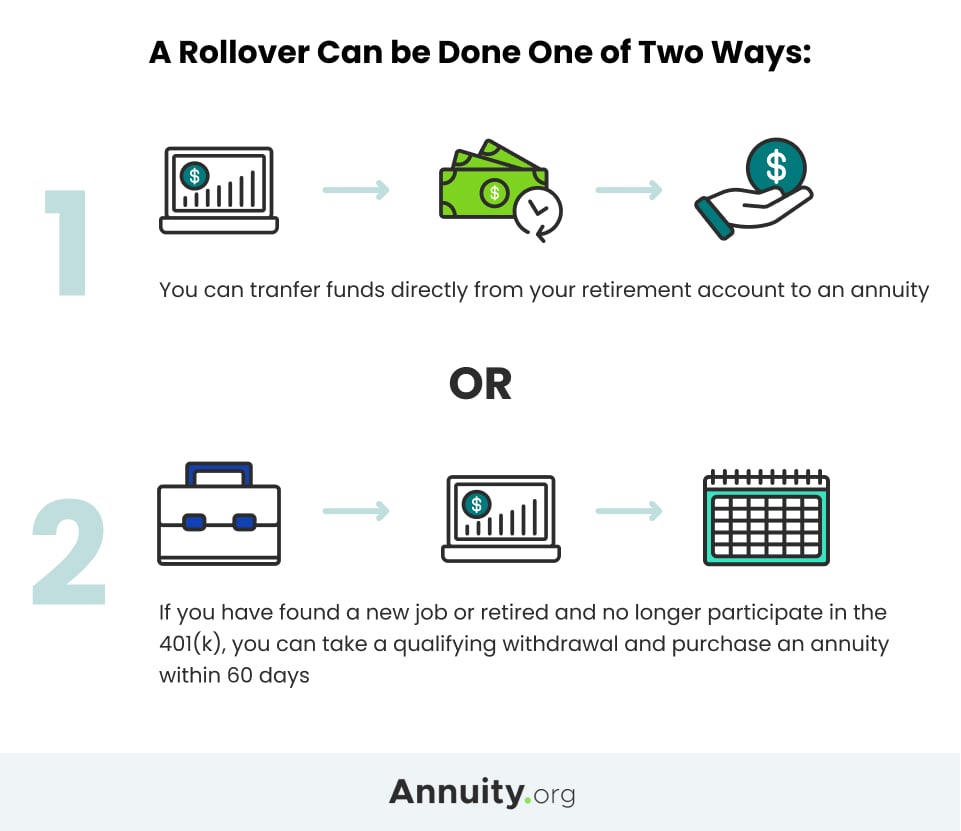

A Rollover IRA is an individual retirement account that allows you to transfer funds from a qualified retirement plan, such as a 401(k) or another IRA, into a new account. This process ensures that your retirement savings continue to grow tax-deferred. By rolling over funds into an IRA, you gain more control over your investments and have the flexibility to explore various investment options.

Understanding The Benefits Of Using Rollover IRA For Home Purchase

Using a Rollover IRA for a home purchase can offer several advantages. Some of the key benefits include:

- Tax Benefits: By utilizing a Rollover IRA, you can potentially defer taxes on the funds until you withdraw them. This can be advantageous if you anticipate being in a lower tax bracket during retirement.

- Avoiding Early Withdrawal Penalties: Generally, withdrawing funds from a traditional IRA before the age of 59½ results in a 10% penalty. However, using a Rollover IRA for a qualified home purchase can help you avoid these penalties.

- Larger Down Payment: Utilizing your Rollover IRA funds can provide a significant boost to your home purchase budget, allowing you to make a larger down payment. This can lead to better mortgage terms and lower monthly payments.

Eligibility Criteria For Utilizing A Rollover IRA For Home Purchase

While using a Rollover IRA for a home purchase can be advantageous, there are specific eligibility criteria to consider:

- First-Time Homebuyer Status: Generally, to use a Rollover IRA for a home purchase, you must be a first-time homebuyer. This means you haven’t owned a home in the past two years.

- Qualified Expenses: The funds withdrawn from your Rollover IRA must be used for qualified expenses related to purchasing or building your primary residence. These expenses include down payment, closing costs, and any necessary renovations.

- Time Limits: There is a time limit within which you must utilize the funds withdrawn from your Rollover IRA for a home purchase. Typically, this timeframe is 120 days.

Steps To Use Your Rollover IRA For A Home Purchase

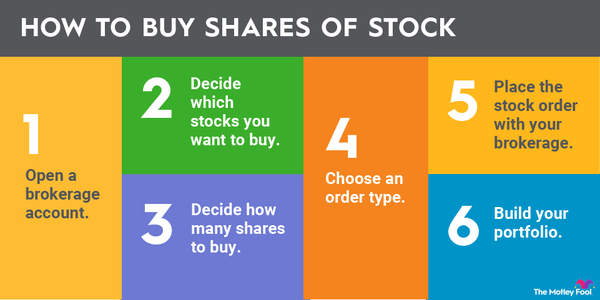

Now, let’s explore the step-by-step process to use your Rollover IRA for a home purchase:

- Step 1: Evaluate your eligibility: Determine if you meet the eligibility criteria for using a Rollover IRA for a home purchase, such as being a first-time homebuyer and having qualified expenses.

- Step 2: Research and consult with professionals: Seek guidance from financial advisors or tax professionals who specialize in retirement accounts and real estate transactions. They can help you understand the specific rules and regulations related to using a Rollover IRA for a home purchase.

- Step 3: Confirm your Rollover IRA balance: Check the balance of your Rollover IRA to determine the amount you can withdraw for your home purchase. Consider factors like your budget, the price of the property, and any additional costs involved.

- Step 4: Initiate the rollover: Contact the financial institution where your Rollover IRA is held and inform them about your intention to use the funds for a home purchase. They will guide you through the necessary paperwork and procedures to initiate the rollover.

- Step 5: Withdraw the funds: Once the rollover process is complete, you can withdraw the desired amount from your Rollover IRA. Ensure that you follow the IRS regulations regarding qualified distributions.

- Step 6: Utilize the funds for your home purchase: Use the withdrawn funds for your home purchase, including the down payment, closing costs, and other qualified expenses. Keep track of your expenses and maintain documentation for future reference.

- Step 7: Comply with the time limits: Remember to utilize the withdrawn funds within the specified time limit, typically 120 days, to avoid penalties or tax implications.

Considerations And Potential Risks

While using a Rollover IRA for a home purchase can be beneficial, there are considerations and potential risks to keep in mind:

- Retirement Savings Impact: Withdrawing funds from your Rollover IRA may reduce your retirement savings and impact your future financial security. Carefully evaluate the amount you need for your home purchase and consider the long-term implications.

- Market Volatility: If you choose to invest the withdrawn funds in real estate, be aware of the risks associated with market fluctuations. Real estate values can change over time, and there’s a possibility of not earning the expected returns.

- Tax and Penalties: Ensure that you comply with the IRS rules and regulations regarding using a Rollover IRA for a home purchase. Failing to meet the criteria or utilizing the funds improperly may result in taxes, penalties, or other financial consequences.

Tax Implications And Penalties

Using a Rollover IRA for a home purchase can have tax implications and potential penalties. Here are some important points to consider:

- Traditional IRA: Withdrawals from a traditional Rollover IRA for a qualified home purchase may be subject to income tax. Consult with a tax professional to understand the specific tax implications based on your situation.

- Roth IRA: If you have a Roth Rollover IRA, qualified distributions for a home purchase may be tax-free, as long as certain requirements are met. Again, it’s advisable to consult with a tax expert for personalized advice.

- Early Withdrawal Penalties: If you withdraw funds from your Rollover IRA before the age of 59½ and don’t meet the qualified exceptions, you may be subject to a 10% early withdrawal penalty in addition to income taxes.

Alternatives To Using A Rollover IRA For Home Purchase

Using a Rollover IRA for a home purchase is not the only option available to you. Here are some alternative strategies to consider:

- Traditional Mortgage: Opting for a traditional mortgage allows you to keep your retirement savings intact. This route involves securing a home loan from a financial institution, with various terms and interest rates available based on your financial situation.

- Home Equity Loan or Line of Credit: If you already own a home or have significant equity in your current property, you can explore a home equity loan or line of credit. This option allows you to borrow against the value of your home to finance your new home purchase.

- Down Payment Assistance Programs: Investigate down payment assistance programs offered by government agencies or local organizations. These programs provide financial aid to eligible homebuyers, helping them cover a portion of their down payment or closing costs.

- Delayed Retirement: If purchasing a home is a top priority, you might consider delaying your retirement to allocate more funds towards your home purchase. This option allows you to continue saving for retirement while fulfilling your homeownership goals.

- Real Estate Investment: Instead of using your Rollover IRA, you could explore real estate investment options to grow your wealth. Investing in rental properties or real estate investment trusts (REITs) can provide an alternative path to building a real estate portfolio.

It’s essential to weigh the pros and cons of each alternative and consult with professionals to determine the best approach based on your financial goals and circumstances.

Expert Tips For Utilizing Your Rollover IRA Effectively

To maximize the benefits of using a Rollover IRA for a home purchase, consider the following expert tips:

- Plan and Budget: Carefully plan your home purchase and establish a budget that includes all associated costs. This helps ensure that you withdraw the appropriate amount from your Rollover IRA without jeopardizing your retirement savings.

- Seek Professional Guidance: Consult with financial advisors, tax professionals, and real estate experts who can provide personalized advice tailored to your specific situation. They can help you navigate the complexities of using a Rollover IRA for a home purchase.

- Research Potential Investment Opportunities: If you choose to invest the withdrawn funds in real estate, conduct thorough research and due diligence. Explore different properties, analyze market trends, and consider factors such as location, potential rental income, and long-term growth prospects.

- Understand Tax Implications: Familiarize yourself with the tax rules and regulations surrounding using a Rollover IRA for a home purchase. Stay updated on any changes in tax laws that may affect your situation.

- Evaluate Long-Term Financial Impact: Before making any decisions, assess the long-term impact on your retirement savings and overall financial well-being. Consider factors such as potential growth, future income needs, and the stability of your retirement plan.

By following these expert tips, you can make informed decisions and optimize the use of your Rollover IRA for a home purchase.

Conclusion

Utilizing a Rollover IRA for a home purchase can be a viable option for first-time homebuyers looking to leverage their retirement savings. It offers tax benefits, helps avoid early withdrawal penalties, and provides the opportunity for a larger down payment. However, it’s crucial to carefully evaluate the eligibility criteria, consider the potential risks and tax implications, and consult with professionals to make informed decisions.

Remember, using a Rollover IRA for a home purchase is just one strategy among several alternatives available. Explore different options, assess your long-term financial goals, and choose the approach that aligns with your needs and priorities.