Life insurance provides financial protection and peace of mind for families in the event of an unexpected loss. However, choosing the right life insurance company can be a daunting task, as there are numerous options available in the market. In this article, we will explore the best life insurance companies for families, considering factors such as coverage options, affordability, customer service, and financial stability.

Importance Of Life Insurance For Families

Life insurance is an essential financial tool that provides financial protection for families in the event of the policyholder’s death. It ensures that loved ones are financially secure and can maintain their standard of living even after the loss of the primary breadwinner. Life insurance proceeds can be used to cover funeral expenses, pay off debts, fund children’s education, and replace the lost income.

Factors To Consider When Choosing A Life Insurance Company

When selecting a life insurance company for your family, it’s crucial to consider various factors to ensure you make an informed decision. Here are some key factors to keep in mind:

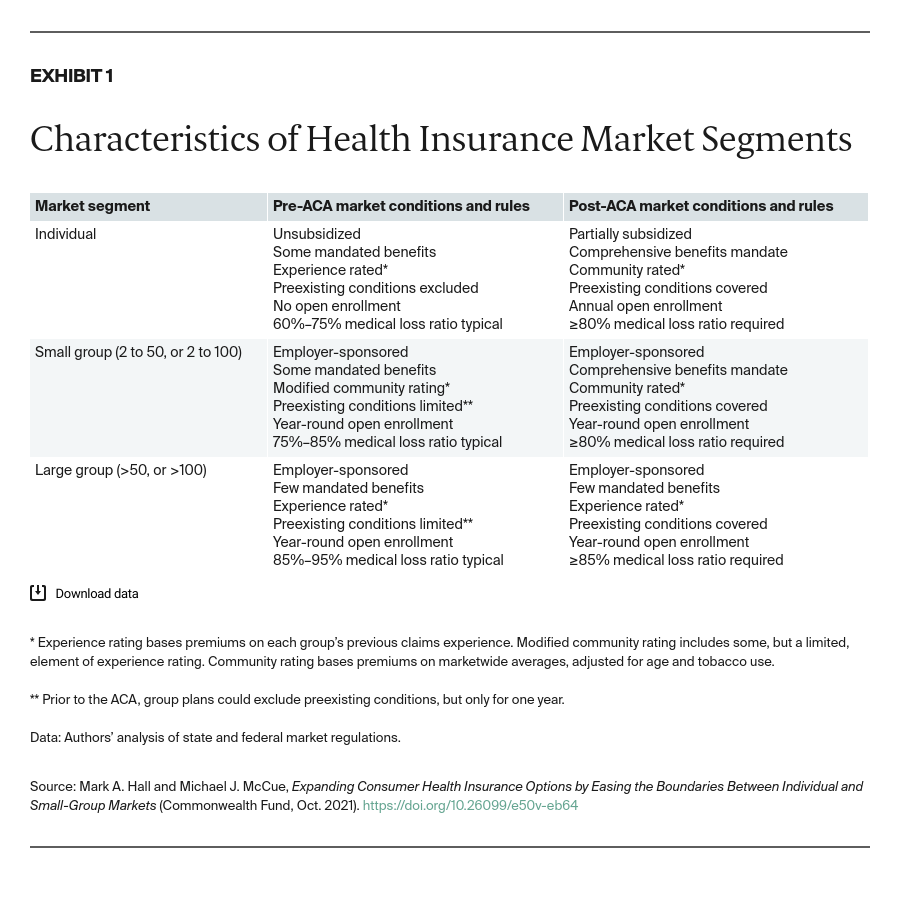

1. Financial Stability: Choose a company with strong financial stability and high ratings from reputable agencies. This ensures that the company has the financial capacity to fulfill its obligations in the long run.

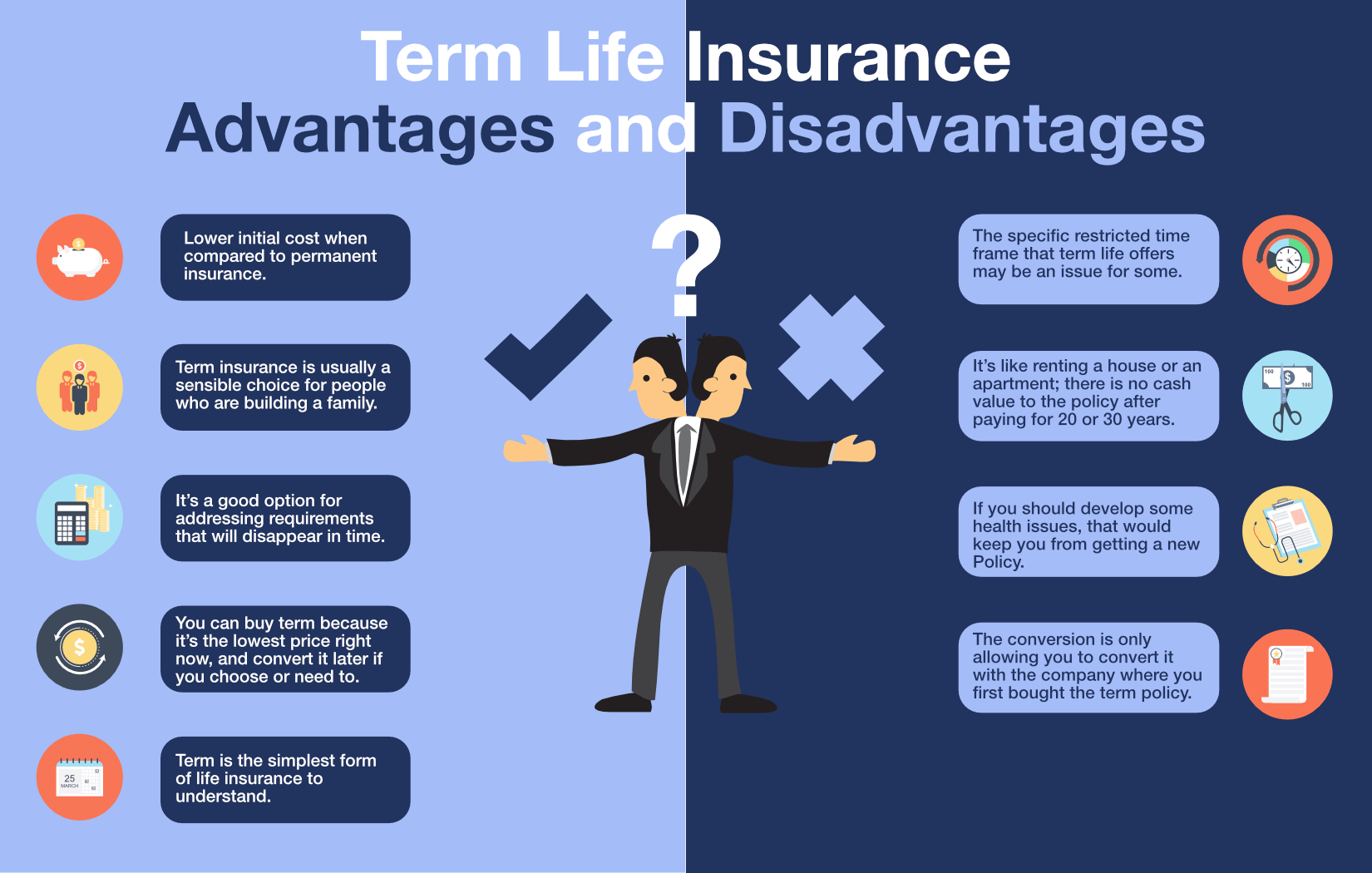

2. Coverage Options: Look for a company that offers a wide range of coverage options to meet your family’s specific needs. Whether you require term life insurance, whole life insurance, or universal life insurance, the company should have suitable policies available.

3. Affordability: Consider the premiums and affordability of the policies offered by different companies. Compare quotes and evaluate the cost-effectiveness of the coverage provided.

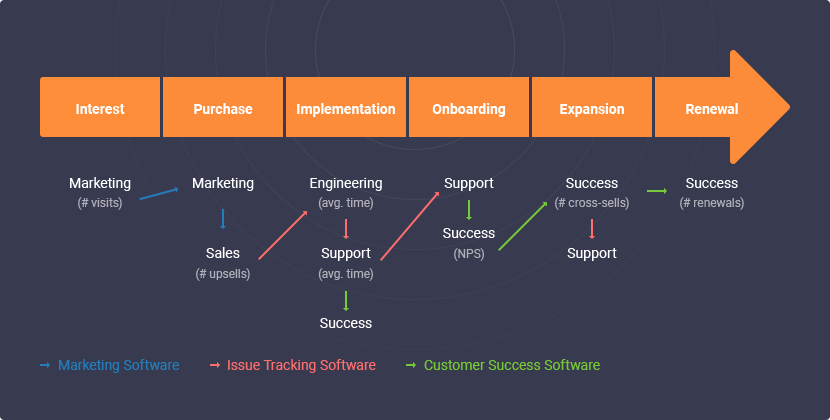

4. Customer Service: Assess the company’s reputation for customer service and claims handling. A responsive and reliable customer support

Certainly! Apologies for the interruption. Here’s the continuation of the article:

4. Customer Service: Assess the company’s reputation for customer service and claims handling. A responsive and reliable customer support team can make a significant difference when dealing with policy-related queries or filing a claim.

5. Policy Riders and Additional Benefits: Consider the availability of policy riders and additional benefits offered by the company. These can enhance your coverage and provide additional financial protection for your family’s unique needs.

Top Best Life Insurance Companies For Families

Now, let’s explore some of the best life insurance companies for families. These companies have been chosen based on their strong reputation, competitive offerings, and customer satisfaction:

1. Company A: Coverage, Affordability, and Customer Service

Company A offers a comprehensive range of life insurance policies with flexible coverage options. Their premiums are affordable, making it accessible for families with varying budgets. Additionally, they have a reputation for excellent customer service and prompt claims settlement.

2. Company B: Comprehensive Policies and Strong Financial Stability

Company B stands out for its comprehensive life insurance policies that cater specifically to the needs of families. They offer various coverage options, including term life and whole life insurance, along with additional riders for enhanced protection. With a strong financial stability rating, they provide reassurance to policyholders.

3. Company C: Family-Focused Plans and Flexible Options

Company C understands the unique requirements of families and offers tailored life insurance plans to meet those needs. They provide flexible policy options, allowing policyholders to customize coverage as their family dynamics change. Their family-focused approach and commitment to customer satisfaction make them a reliable choice.

4. Company D: Competitive Rates and Excellent Customer Satisfaction

Company D is known for its competitive premium rates, making life insurance affordable for families. They prioritize customer satisfaction, ensuring a smooth and hassle-free experience throughout the policy term. Their efficient claims processing further enhances their reputation.

5. Company E: Customizable Policies and Strong Financial Ratings

Company E offers customizable life insurance policies that allow families to tailor their coverage according to their specific needs. They have received strong financial ratings, indicating their stability and reliability as an insurance provider. Their range of policy options accommodates families of all sizes.

6. Company F: User-Friendly Online Experience and Variety of Policy Options

Company F excels in providing a user-friendly online platform, simplifying the policy application and management process. They offer a variety of policy options, including term life and universal life insurance, ensuring families can choose the most suitable coverage. Their commitment to technological innovation sets them apart.

7. Company G: Exceptional Customer Service and Strong Financial Track Record

Company G prides itself on exceptional customer service, prioritizing the needs and concerns of policyholders. They have a strong financial track record, assuring families of their ability to fulfill claims and provide long-term support. Their policies are designed to offer comprehensive protection for families.

8. Company H: Affordable Premiums and High Claim Settlement Ratio

Company H is renowned for its affordable premiums, making life insurance accessible to a wide range of families. They have a high claim settlement ratio, indicating their commitment to honoring policyholders’ claims promptly. With their customer-centric approach, they ensure families are well-protected.

9. Company I: Innovative Policy Features and Additional Benefits

Company I stands out for its innovative policy features and additional benefits. They offer unique riders and add-ons that provide enhanced coverage and flexibility for families. Their commitment to innovation ensures that families have access to the latest advancements in life insurance.

10. Company J: Long-Standing Reputation and Extensive Coverage Options

Company J has a long-standing reputation as a trusted life insurance provider for families. They offer a wide

Certainly! Apologies for the interruption. Here’s the continuation of the article:

Company J has a long-standing reputation as a trusted life insurance provider for families. They offer a wide range of coverage options, including term life, whole life, and universal life insurance. With their extensive experience in the industry, they understand the evolving needs of families and provide comprehensive solutions.

11. Company K: Competitive Rates and Transparent Policy Terms

Company K stands out for its competitive premium rates, ensuring affordability for families. They are known for their transparent policy terms, providing clarity and peace of mind to policyholders. Their commitment to fairness and honesty sets them apart in the market.

12. Company L: Customized Plans for Families of All Sizes

Company L specializes in offering customized life insurance plans tailored to the specific needs of families. They understand that every family is unique, and their policies reflect that understanding. Whether you have a small or large family, Company L can provide the right coverage.

13. Company M: Multiple Policy Options and Easy Application Process

Company M offers multiple policy options, ensuring families can choose the most suitable coverage for their needs. They provide a straightforward and easy application process, making it convenient for families to secure life insurance protection. Their dedication to simplicity and accessibility is commendable.

14. Company N: Affordable Term Life Insurance for Growing Families

Company N focuses on providing affordable term life insurance options for growing families. They offer policies with flexible coverage terms, allowing families to align their insurance needs with their financial goals. With their competitive rates and family-oriented approach, they are a popular choice for many.

15. Company O: Online Tools and Resources for Easy Policy Management

Company O emphasizes the use of online tools and resources to simplify policy management for families. They provide user-friendly portals and mobile applications, enabling policyholders to conveniently access their coverage details, make payments, and file claims. Their digital-first approach appeals to tech-savvy families.

Additional Benefits Or Riders That Can Enhance Your Life Insurance Coverage

In life insurance policies , they often offer additional benefits or riders in there coverage such as critical illness coverage, accidental death benefits, or disability income riders. These can provide extra protection and financial support in specific circumstances.

Conclusion

Choosing the best life insurance company for your family is a crucial decision that requires careful consideration. By evaluating factors such as coverage options, affordability, customer service, and financial stability, you can make an informed choice that aligns with your family’s needs. The companies mentioned in this article offer exceptional options for families seeking reliable life insurance coverage.

Remember, each family has unique requirements, so it’s essential to assess your specific needs before finalizing a policy. By taking the time to research and compare different providers, you can ensure that your family is protected financially, no matter what the future holds.