Are you interested in learning about options trading? Do you want to explore the potential of generating income through this financial instrument? Options trading can be an exciting venture for individuals seeking to expand their investment portfolio. In this article, we will provide you with a comprehensive guide to options trading, covering everything from the basics to advanced strategies. So, let’s dive in and discover the world of options trading!

Understanding Options Trading

Options trading is a financial derivative that provides individuals with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific timeframe. It offers traders the flexibility to speculate on the direction of a stock’s price movement without owning the underlying asset.

The Basics Of Options

Options consist of two types: calls and puts. A call option gives the holder the right to buy the underlying asset, while a put option grants the holder the right to sell the underlying asset. Both types of options have an expiration date and a strike price, which is the price at which the underlying asset can be bought or sold.

Types Of Options

There are various types of options available for trading, including American options, European options, index options, and more. American options can be exercised at any time before the expiration date, while European options can only be exercised on the expiration date.

Key Terminologies

To navigate the world of options trading effectively, it is crucial to understand key terminologies. Some important terms include premium, intrinsic value, time value, delta, gamma, and theta. Each term plays a significant role in understanding options pricing and trading strategies.

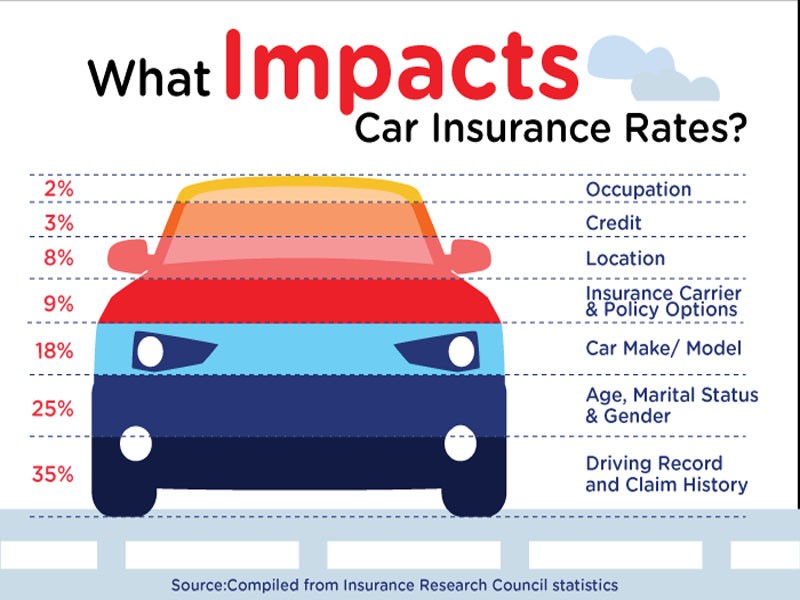

Factors Affecting Options Pricing

Options pricing is influenced by several factors, including the price of the underlying asset, time until expiration, implied volatility, and interest rates. Understanding these factors is essential for evaluating the potential profitability of an options trade.

Advantages Of Options Trading

Options trading offers several advantages over other forms of investment. It allows for potential profit in both rising and falling markets, provides leverage, and allows traders to manage risk effectively through hedging strategies.

Risks Associated With Options Trading

While options trading presents lucrative opportunities, it is important to be aware of the risks involved. Some risks include the potential loss of the premium paid, time decay, and the complexity of options strategies. Proper risk management techniques are crucial for long-term success in options trading.

How To Get Started With Options Trading

To get started with options trading, it is essential to open a brokerage account that supports options trading. Conduct thorough research to find a reputable broker that offers a user-friendly trading platform and provides educational resources for beginners.

- Developing a Trading Plan

Before entering the options market, it is vital to develop a well-defined trading plan. A trading plan outlines your goals, risk tolerance, preferred trading strategies, and rules for entering and exiting trades. Having a solid plan in place will help you make informed decisions and stay disciplined in your trading approach.

- Fundamental and Technical Analysis

To make informed trading decisions, options traders often rely on fundamental and technical analysis. Fundamental analysis involves evaluating the financial health and prospects of the underlying asset and its related market factors. On the other hand, technical analysis involves studying historical price and volume data to identify patterns and trends that can help predict future price movements.

- Popular Options Trading Strategies

Options trading offers a wide range of strategies to capitalize on different market conditions. Some popular strategies include covered calls, protective puts, long straddles, iron condors, and butterfly spreads. Each strategy has its own risk-reward profile and is suitable for specific market outlooks.

- Risk Management Techniques

Effective risk management is crucial in options trading. Traders can employ various techniques to protect their capital and minimize potential losses. These techniques include setting stop-loss orders, diversifying the options portfolio, and using position sizing to manage risk exposure.

- Common Mistakes to Avoid

Novice options traders often make common mistakes that can negatively impact their trading results. Some of these mistakes include overtrading, failing to have an exit plan, not understanding the risks involved, and neglecting to stay updated on market news and events. Being aware of these mistakes can help traders avoid unnecessary pitfalls.

- Learning Resources for Options Trading

There are abundant resources available to enhance your knowledge and skills in options trading. Online courses, books, webinars, and forums can provide valuable insights and strategies shared by experienced traders. Additionally, paper trading or using simulated trading platforms can help beginners practice their trading strategies without risking real money.

Conclusion

Options trading is an exciting and potentially rewarding venture for individuals looking to expand their investment horizons. By understanding the basics, learning different strategies, and practicing effective risk management, you can navigate the options market with confidence. Remember to continuously educate yourself, stay disciplined, and adapt your strategies as market conditions evolve.