When it comes to auto insurance, one size does not fit all. The average cost of auto insurance in Texas can vary significantly based on various factors. It’s essential to have a clear understanding of what influences these costs and how you can navigate the Texan auto insurance landscape efficiently. In this article, we’ll break down the key determinants of auto insurance costs in Texas, providing you with valuable insights to make informed decisions.

Factors Affecting Auto Insurance Costs

- Location Matters : The place you call home in Texas plays a vital role in determining your auto insurance premium. Urban areas typically have higher rates due to increased traffic, crime, and accident risks.

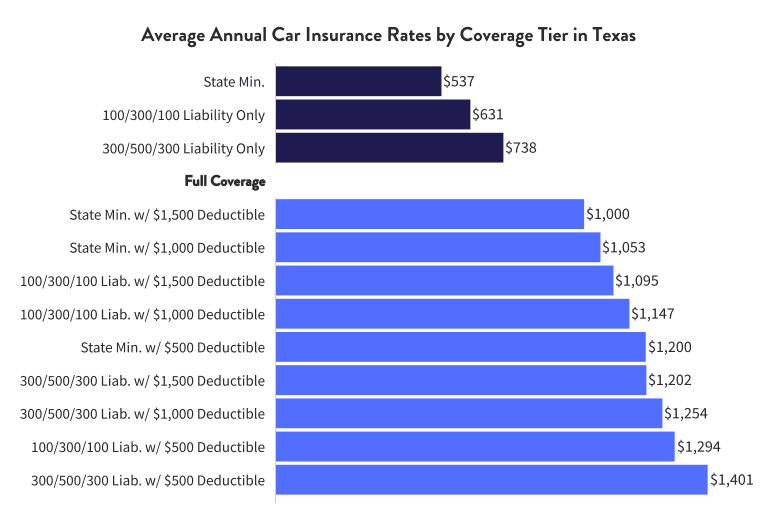

- Coverage Types: The type of coverage you choose directly impacts your insurance costs. Texas requires a minimum liability coverage, but additional coverage options like comprehensive and collision will increase your premiums.

- Your Driving History: Your past driving record has a substantial influence on your insurance rates. A clean record will result in lower premiums, while accidents or traffic violations can significantly raise you costs.

- Age and Gender: Younger drivers and males often face higher premiums as they are statistically considered riskier to insure.

- Vehicle Type: The make and model of your car also affect your insurance costs. Luxury or high-performance vehicles typically come with higher premiums.

- Credit Score: In Texas, your credit score can be used as a factor in determining your auto insurance rates. Maintaining a good credit score can help lower your premiums.

- Deductible Amount : Choosing a higher deductible will lower your premium but increase your out-of-pocket expenses in case of a claim.

- Discounts and Bundles: Many insurance companies offer discounts for safe driving, bundling multiple policies, or having anti-theft devices installed in your vehicle.

Advantages Of Average Cost Of Auto Insurance In Texas

The Average Cost of Auto Insurance in Texas has several advantages for both drivers and the state as a whole. Let’s delve into these advantages:

- Legal Compliance: Having auto insurance is mandatory in Texas. It ensures that all drivers are financially responsible for any accidents they may cause. This legal compliance helps protect the rights and finances of those involved in accidents.

- Financial Security : Auto insurance provides financial security to drivers. In case of an accident, it helps cover medical expenses, property damage, and legal fees. Without insurance, individuals might struggle to cover these costs on their own.

- Peace of Mind: Knowing you have insurance coverage brings peace of mind. You can drive without constantly worrying about the financial repercussions of an accident.

- Protection from Uninsured Drivers: Texas has a relatively high number of uninsured drivers. If you’re in an accident with one of them, your auto insurance can step in to cover your expenses, ensuring you’re not left in a difficult financial situation.

- Flexible Coverage Options: Auto insurance in Texas offers various coverage options. Drivers can choose a plan that suits their needs and budget. This flexibility allows individuals to tailor their coverage to their specific circumstances.

- Reduced Litigation: Auto insurance can help reduce litigation. When both parties involved in an accident have insurance, claims are typically settled through the insurance companies, reducing the need for lengthy and expensive legal battles.

- Financial Responsibility: Insurance encourages financial responsibility among drivers. Knowing they have to pay premiums motivates individuals to drive safely and avoid accidents, ultimately reducing the number of accidents on the road.

- Support for Accident Victims: Auto insurance provides essential support to accident victims. It covers medical expenses, rehabilitation, and lost wages, ensuring that injured parties receive the necessary care and compensation.

- Economic Impact: The auto insurance industry contributes significantly to the Texan economy. It provides jobs, generates revenue, and supports local businesses, making it an essential economic driver in the state.

- Funding for State Programs: The revenue generated through auto insurance premiums often goes towards funding state programs and initiatives. These funds can be used for road maintenance, safety programs, and other essential services.

The Average Cost of Auto Insurance in Texas offers numerous advantages, including legal compliance, financial security, peace of mind, and protection from uninsured drivers. It also contributes to reducing litigation, promoting financial responsibility, and supporting accident victims. Moreover, it has a positive economic impact and helps fund state programs.

Disadvantages Of Average Cost Of Auto Insurance In Texas

While auto insurance in Texas offers numerous benefits, it also comes with certain disadvantages. Let’s explore some of the disadvantages of the Average Cost of Auto Insurance in Texas:

- Financial Burden: Auto insurance premiums can be a significant financial burden, especially for low-income individuals and families. Paying these premiums regularly can strain already tight budgets.

- Premium Variability: Auto insurance premiums in Texas can vary widely based on factors such as age, gender, location, driving history, and the type of vehicle. This variability can lead to higher costs for some individuals, making insurance less affordable.

- High Rates for Young Drivers: Young drivers, particularly teenagers, often face exorbitantly high insurance premiums due to their perceived higher risk. This can discourage young people from getting behind the wheel legally.

- Uninsured Motorists: Despite mandatory insurance laws, Texas still has a significant number of uninsured drivers. This can lead to financial hardship for insured drivers involved in accidents with uninsured motorists.

- Complexity of Policies: Auto insurance policies can be complex, with many technical terms and conditions. This complexity can make it challenging for policyholders to fully understand their coverage.

- Claim Denials: Some insurance companies may deny claims or offer settlements that are less than what policyholders expected. This can lead to disputes and dissatisfaction among policyholders.

- Deductibles and Out-of-Pocket Costs: High deductibles mean that in the event of an accident, drivers must pay a substantial amount out of pocket before insurance coverage kicks in. This can be financially challenging, especially if the deductible is high.

- Rate Increases: Insurers may raise premiums after an accident, even if the policyholder was not at fault. This can result in higher long-term costs for drivers with a claim history.

- Limited Coverage: Basic auto insurance in Texas covers only liability, leaving drivers responsible for their own medical expenses and vehicle repairs in the event of an accident, regardless of fault.

- Cancellation of Policies: Insurance companies can cancel policies for various reasons, including a poor driving record or missed payments. This can leave drivers without coverage and make it challenging to find affordable insurance elsewhere.

- Difficulty for High-Risk Drivers: Drivers with a history of accidents or traffic violations may find it challenging to secure affordable insurance, potentially leading to driving without coverage, which is illegal.

Auto insurance in Texas provides essential protection, it has its disadvantages, including financial burdens, premium variability, high rates for young drivers, and the persistence of uninsured motorists. The complexity of policies, claim denials, and out-of-pocket costs can also pose challenges for policyholders. It’s essential for consumers to carefully review their policies and explore their options to find the most suitable coverage for their needs and budget.

Types Of Auto Insurance In Texas

Auto insurance in Texas comes in various types, each offering different levels of coverage to suit the diverse needs of drivers. Here are the main types of auto insurance in Texas:

- Liability Insurance

Bodily Injury Liability: This type of insurance covers medical expenses, legal fees, and other costs if you injure someone in an accident for which you are at fault. It also covers the legal defense if you are sued.

Property Damage Liability: Property damage liability covers the cost of repairing or replacing another person’s property, such as their vehicle, fence, or building, if you are at fault in an accident. - Personal Injury Protection (PIP): PIP insurance covers medical expenses for you and your passengers regardless of who is at fault in an accident. It may also cover lost wages and other related expenses.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): UM coverage protects you if you are in an accident with a driver who does not have insurance. UIM coverage comes into play when the at-fault driver’s insurance is insufficient to cover your expenses. It helps bridge the gap between their coverage and your actual costs.

- Collision Coverage: Collision insurance covers the cost of repairing or replacing your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: Comprehensive insurance provides coverage for damage to your vehicle caused by factors other than collisions. This includes damage from theft, vandalism, natural disasters, and falling objects.

- Medical Payments Coverage (MedPay): MedPay covers medical expenses for you and your passengers, similar to PIP. However, it may have more limited coverage and does not typically include lost wages.

- Towing and Labor Coverage: This optional coverage pays for towing and labor costs if your vehicle breaks down or needs assistance while on the road.

- Rental Reimbursement Coverage: Rental reimbursement coverage helps pay for the cost of renting a vehicle while your car is being repaired after an accident.

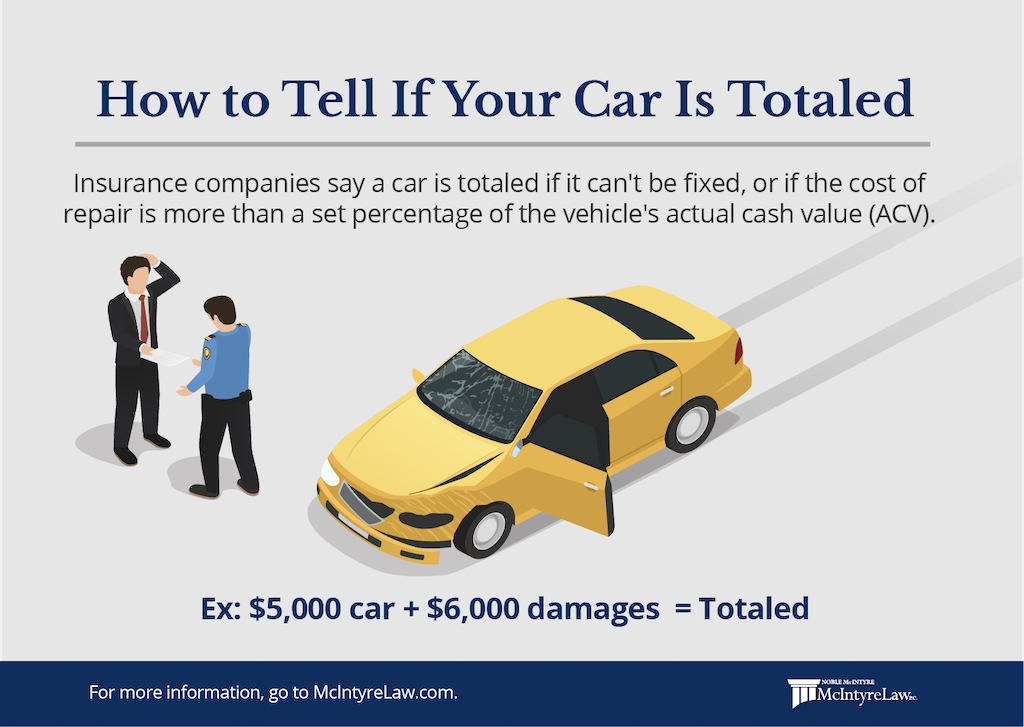

- Gap Insurance: Gap insurance is beneficial if you have a loan or lease on your vehicle. It covers the difference between the vehicle’s actual cash value and the amount you owe on the loan or lease if your car is totaled.

- Classic Car Insurance: This specialized insurance is designed for vintage or classic cars. It provides coverage tailored to the unique needs of classic car owners, including agreed value coverage.

- Commercial Auto Insurance: Commercial auto insurance is for vehicles used for business purposes. It provides coverage for business-owned vehicles and may include liability, collision, and comprehensive coverage.

- SR-22 Insurance: SR-22 is not a separate type of insurance but rather a certificate filed with the state to prove that you meet the minimum liability insurance requirements after certain violations, such as DUI convictions.

It’s important for Texas drivers to carefully assess their needs and budget when choosing auto insurance coverage. Many drivers opt for a combination of these coverage types to ensure they are adequately protected on the road.

Requirement For Auto Insurance In Texas

Auto insurance requirements in Texas are established to ensure that drivers have financial responsibility in case of accidents. To comply with Texas law, you must meet certain minimum auto insurance requirements:

Liability Coverage

- Bodily Injury Liability: You must have coverage of at least $30,000 per injured person, up to a total of $60,000 per accident if more than one person is injured.

- Property Damage Liability: You must have coverage of at least $25,000 for property damage per accident.

Proof of Insurance

- You must carry proof of insurance in your vehicle at all times. Most drivers use an insurance ID card provided by their insurance company as proof.

Electronic Verification

- The state of Texas uses an electronic database to verify insurance coverage. Insurance companies are required to report insurance status regularly to this database. Failure to maintain coverage could result in fines and penalties.

Minimum Coverage Verification

- If requested by law enforcement or during the vehicle registration process, you must provide proof of insurance coverage. Failure to do so can lead to fines and possible suspension of your driver’s license and vehicle registration.

SR-22

- If you have been involved in certain violations, such as DUI convictions or driving without insurance, you may be required to file an SR-22 certificate with the state as proof of insurance coverage. This certificate is typically provided by your insurance company.

Financial Responsibility

- Drivers in Texas are required to have a means of financial responsibility in case of accidents. While most people fulfill this requirement by purchasing auto insurance, other options include posting a surety bond or making a deposit with the Comptroller of Public Accounts.

It’s essential to note that driving without the minimum required insurance coverage in Texas is illegal and can result in severe consequences, including fines, suspension of your driver’s license, and impoundment of your vehicle. Additionally, having insurance is not only a legal requirement but also a responsible way to protect yourself and others on the road in the event of an accident.

Tips To Lower Your Auto Insurance Costs

- Shop Around: Don’t settle for the first quote you receive. Compare prices from multiple insurance providers to find the best deal.

- Maintain a Clean Driving Record: Safe driving habits can help you avoid accidents and traffic violations, keeping your premiums low.

- Choose Your Vehicle Wisely: Consider insurance costs when purchasing a vehicle. Opt for a car that is both safe and economical to insure.

- Bundle Your Policies: Combining your auto insurance with other policies, like home insurance, can lead to significant discounts.

- Increase Your Deductible: If you have a good financial cushion, opting for a higher deductible can result in lower premiums.

- Ask About Discounts: Inquire with your insurer about available discounts and take advantage of them whenever possible.

Conclusion

Navigating the world of auto insurance in Texas can be complex, but understanding the factors that influence your premium can help you make informed decisions. By considering your location, coverage types, driving history, and other crucial elements, you can take steps to lower your auto insurance costs. Remember to shop around, maintain a clean record, and explore discounts to ensure you get the best value for your money.