If you’ve ever been involved in a car accident, you know how stressful and overwhelming the aftermath can be. One of the most concerning aspects is dealing with insurance claims, especially when your vehicle has been totaled. In this comprehensive guide, we’ll walk you through the process of insurance totaling out a car, from understanding what it means to handling the claims process and exploring your options. Whether you’re a seasoned driver or a new car owner, this article will provide you with valuable insights to make informed decisions during this challenging time.

What Does “Totaling Out A Car” Mean?

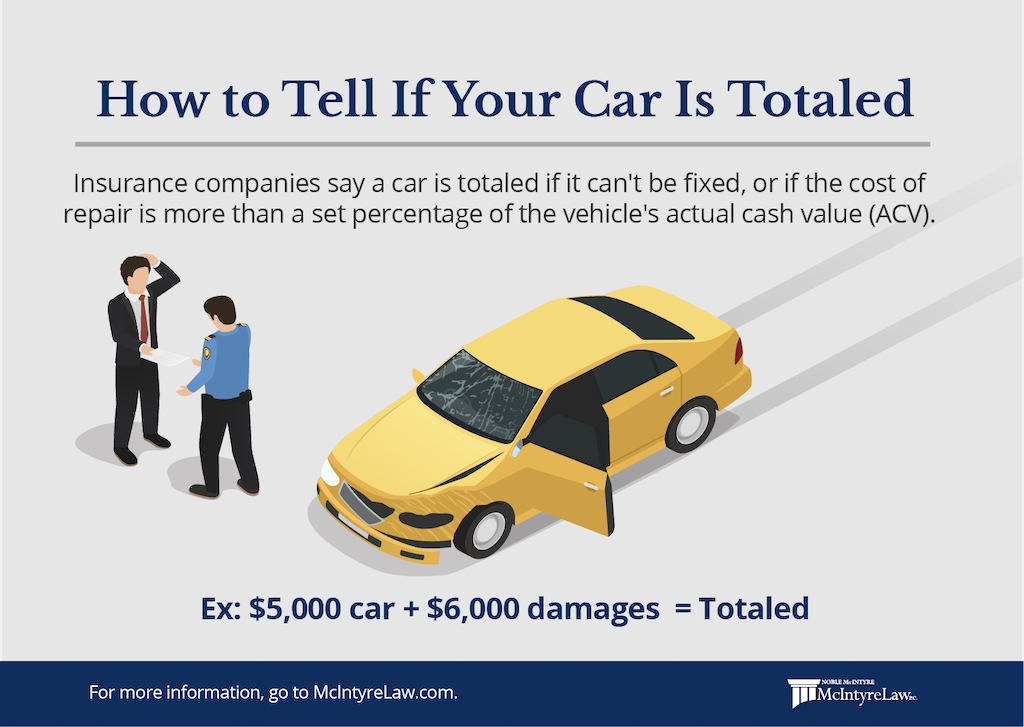

When your insurance company “totals out” your car, it means that the cost of repairing the vehicle exceeds its current market value. In other words, the car is deemed a total loss because the expenses associated with fixing it are too high compared to what the car is worth.

Factors That Determine Total Loss

- Extent of Damage: The severity of the damage plays a crucial role in determining whether a car is totaled. If the repairs needed are extensive and compromise the structural integrity of the vehicle, it may be declared a total loss.

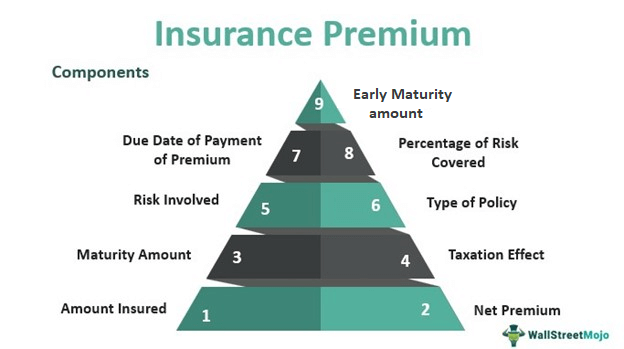

- Market Value vs. Repair Cost: Insurance companies compare the market value of the car before the accident to the estimated cost of repairs. If the repair costs approach or exceed a certain percentage of the car’s value, it’s more likely to be considered a total loss.

- Salvage Value:The salvage value is the estimated value of the car’s parts and materials if it were to be sold as salvage. If the salvage value plus the repair costs exceed the car’s pre-accident value, it’s often a factor in declaring the car a total loss.

The Insurance Claims Process

- Reporting the Accident: After the accident, promptly report it to your insurance company. Provide them with accurate details about the accident, including photos of the damage and a police report if available.

- Assessment by the Insurance Company: An insurance adjuster will assess the extent of the damage and estimate the repair costs. They will also determine the car’s pre-accident value and calculate whether the repair costs justify totaling out the car.

- Receiving the Total Loss Offer: If the insurance company decides to total out your car, they will provide you with a total loss settlement offer. This offer is based on the car’s pre-accident value minus the salvage value.

Understanding Your Options

- Accepting the Total Loss Offer: You have the option to accept the total loss offer and surrender the car to the insurance company. They will then provide you with the agreed-upon settlement amount.

- Negotiating with the Insurance Company: If you believe the total loss offer is too low, you can negotiate with the insurance company. Present evidence of your car’s value, condition, and any improvements you’ve made that could increase its worth.

- Appraisal Disputes: If you and the insurance company cannot agree on the car’s value, you can hire an independent appraiser to assess the vehicle. If their appraisal differs significantly from the insurance company’s, negotiations may continue.

Dealing With Finances And Settlement

- Payoff Amounts and Loan Balances

If you still owe money on a car loan, the insurance settlement will be used to pay off the remaining balance. Any remaining funds will be given to you. If the settlement doesn’t cover the entire loan, you may be responsible for the difference.

Gap insurance covers the difference between the car’s value and the remaining loan balance. It can be helpful if you owe more on the car than it’s worth, ensuring you won’t be left with a debt after a total loss.

- Settlement Amount and Timing

Once you agree on a settlement, the insurance company will provide the funds. The timing varies, but it’s essential to communicate with your insurer to understand when you’ll receive the payment.

Steps To Take Before And After Total Loss

- Maintaining Documentation

Keep records of all communication, including emails and phone calls, with the insurance company. Document the damage and repairs, as this information can be valuable during negotiations.

- Cancelling the Vehicle’s Registration

After a total loss, contact your local DMV to cancel the vehicle’s registration. This step is crucial to prevent any future liability or confusion.

- Exploring Replacement Vehicle Options

Research replacement vehicle options and their costs. Consider factors like safety features, fuel efficiency, and insurance rates when making your decision.

Benefits Of Totaling Out A Car

When your car is declared a total loss, the insurance company takes over the process of handling the claim. This means that you won’t have to worry about finding a repair shop, getting estimates, or overseeing the repair work. The insurance company will take care of the entire process, making it less time-consuming and stressful for you.

- Quick Resolution

Totaling out a car often leads to a faster resolution compared to waiting for extensive repairs. Rather than dealing with prolonged repair times and potential delays in sourcing parts, you can receive a settlement and move forward with finding a replacement vehicle sooner.

- Fair Market Value

Insurance companies typically determine the total loss settlement based on the fair market value of your car before the accident. This means you have the opportunity to receive a payout that reflects the current market conditions and the value of your vehicle at the time of the incident.

- Reduced Risk of Hidden Damages

After a serious accident, there’s always a possibility that there are hidden damages or issues that may not be immediately apparent. Totaling out the car allows the insurance company to assess the overall condition of the vehicle and identify potential safety concerns that might not be visible.

- Potential Upgrade Opportunity

If you were already considering upgrading your vehicle or if your totaled car was older and nearing the end of its life cycle, totaling it out could provide an opportunity to invest in a newer and more advanced model with improved safety features and technology.

- Avoiding Future Repairs

Even if a damaged car is repaired, there’s no guarantee that it won’t experience further issues down the line due to the impact of the accident. Opting for a total loss settlement helps you avoid potential future repair costs that may arise from hidden damages.

- Clearing Outstanding Debt

If you still owe money on a car loan, the total loss settlement can be used to pay off the remaining balance. This can provide you with a clean slate and allow you to explore financing options for a new vehicle without the burden of an existing loan.

- Simplified Decision-Making

Totaling out a car eliminates the need to make difficult decisions about repairs and the potential long-term effects of those repairs. Instead, you can focus on finding a replacement vehicle that meets your needs and preferences.

- Avoiding Diminished Resale Value

Even after extensive repairs, a car that has been involved in a significant accident may experience diminished resale value. Opting for a total loss settlement ensures that you won’t have to worry about potential depreciation affecting the value of your vehicle.

- Peace of Mind

Navigating the aftermath of a car accident can be emotionally taxing. Choosing to total out a car can provide you with peace of mind, knowing that you’re making a decision that prioritizes your safety, financial well-being, and future driving experience.

Best Timing For Filing Claims In Insurance Totaling Out A Car

Dealing with a car accident and the subsequent insurance process can be overwhelming. One crucial decision you’ll need to make is when to file a claim for totaling out your car. Timing plays a significant role in ensuring a smooth claims process and maximizing your benefits. They are;

- Immediate Reporting

The ideal timing for filing a claim after an accident is as soon as possible. Reporting the accident to your insurance company immediately allows them to initiate the claims process promptly. This is particularly important if the damage is severe, as it allows the insurance adjuster to assess the situation quickly and determine the extent of the damage.

- Prompt Assessment

Once you’ve reported the accident, the insurance company will send an adjuster to assess the damage. The sooner this assessment takes place, the faster you’ll receive information about the potential for totaling out your car. Quick assessment can help expedite the decision-making process.

- Gather Necessary Documentation

Before contacting your insurance company, gather all relevant documentation, including photos of the accident scene, vehicle damage, and any relevant medical records if injuries were sustained. This documentation will be crucial in supporting your claim and expediting the process.

- Consultation with a Mechanic

If you’re unsure about the extent of the damage, consider consulting with a qualified mechanic before filing a claim. Their expertise can help you determine whether the repairs are feasible and whether totaling out the car might be a more practical option.

- Understanding Your Policy

Before filing a claim, review your insurance policy to understand the terms and conditions related to total loss claims. Familiarize yourself with the process, coverage limits, and any deductible that may apply. This knowledge will help you make informed decisions during the claims process.

- Consideration of Repair Costs

Evaluate the estimated repair costs and compare them to your car’s market value. If the repair costs are close to or exceed the car’s value, it might be a good time to consider totaling out the car. This decision can help you avoid unnecessary expenses and potential complications down the road.

- Assessment of Personal Circumstances

Take into account your personal circumstances, such as the availability of alternative transportation and your financial situation. If you rely heavily on your vehicle and cannot afford prolonged downtime for repairs, totaling out the car might be a more suitable option.

- Open Communication with the Insurance Company

Maintain open communication with your insurance company throughout the process. Discuss your concerns, ask questions, and seek clarification on any aspects of the claims process that you find confusing. This proactive approach can help ensure a smoother and more efficient process.

- Consideration of Market Factors

Be aware of market factors that could affect the decision to total out a car. Factors such as fluctuations in car values, availability of replacement parts, and potential delays in repairs can all influence the timing of your claim.

- Consultation with Professionals

If you’re unsure about the best timing for filing a claim, consider seeking advice from professionals, such as insurance agents or legal experts. Their insights can help you navigate the complex process and make an informed decision.

The best time to file a claim for insurance totaling out a car is as soon as possible after an accident. Timely reporting, quick assessment, and thorough documentation are key to a successful claims process. By understanding your policy, considering repair costs, and evaluating your personal circumstances, you can make a well-informed decision that aligns with your needs and priorities. Remember that open communication with your insurance company and seeking professional advice can also contribute to a smoother and more favorable outcome.

Conclusion

Dealing with a totaled car can be a daunting experience, but understanding the insurance process can make it more manageable. Remember to promptly report the accident, assess the damage, and carefully consider your options. Whether you decide to accept the settlement or negotiate further, having accurate information will empower you to navigate the situation with confidence.