AR Factoring Companies is a method that helps in unlocking cash flow for businesses. Are you a business owner looking for ways to improve your cash flow? If so, you may have come across the concept of AR factoring. In this article, we will explore what AR factoring is, how it works, and the benefits it offers to businesses. So, let’s dive in and uncover the world of AR factoring!

What Is AR Factoring?

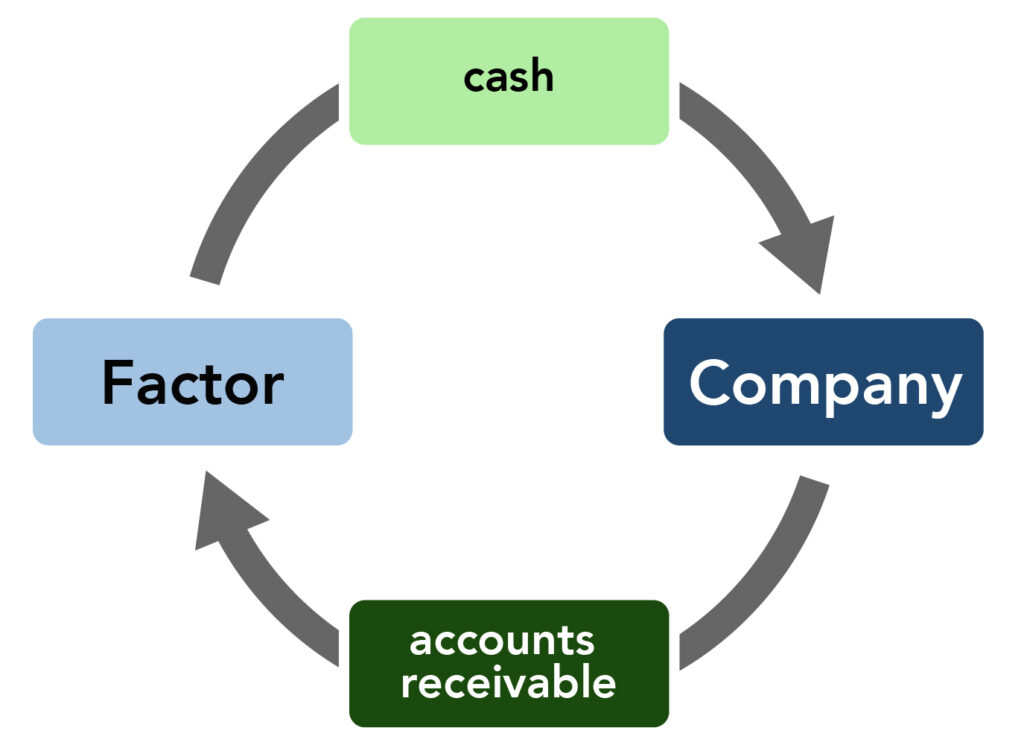

AR factoring, also known as accounts receivable factoring or invoice factoring, is a financial solution that helps businesses improve their cash flow by converting their outstanding invoices into immediate working capital. It involves selling accounts receivable (unpaid invoices) to a third-party financing company, known as an AR factoring company, at a discounted rate.

The Process Of AR Factoring

The process of AR factoring typically involves the following steps:

- Application and Approval

Submit an application to an AR factoring company, providing details about your business and outstanding invoices. The AR factoring company evaluates your invoices and the creditworthiness of your customers to determine the risk involved. - Verification and Funding

Upon approval, the AR factoring company verifies the authenticity of the invoices and confirms the payment terms with your customers. Once the verification is complete, the AR factoring company advances a percentage of the invoice value (usually 70-90%) to your business as immediate funding. - Collection and Payment

The AR factoring company takes over the responsibility of collecting payments from your customers. Your customers make payments directly to the AR factoring company. The AR factoring company deducts their fees and releases the remaining amount to your business, known as the reserve, once the invoices are paid in full.

Benefits Of AR Factoring

AR factoring offers several benefits to businesses:

- Improved Cash Flow

AR factoring provides immediate cash flow by converting unpaid invoices into working capital. This enables businesses to cover expenses, invest in growth opportunities, and meet financial obligations without waiting for customer payments. - Enhanced Working Capital

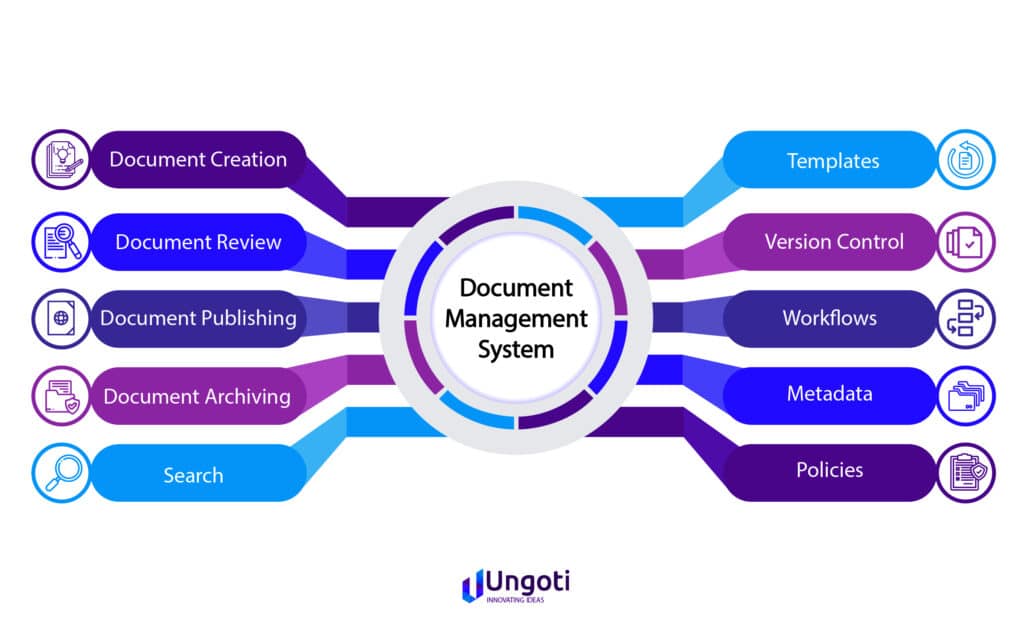

By accessing a portion of the invoice value upfront, businesses can fund their operations and bridge the gap between invoicing and payment cycles. This stability in working capital allows businesses to focus on growth and expansion. - Outsourced Credit Management

AR factoring companies handle credit checks, invoice verification, and collections, relieving businesses of these administrative tasks. This saves time and resources, allowing businesses to concentrate on core operations. - Flexibility and Scalability

AR factoring is a flexible financing solution that grows with your business. The funding available through AR factoring increases as your sales and invoices grow, making it an adaptable option for businesses of all sizes.

Is AR Factoring Right For Your Business?

AR factoring is suitable for businesses that:

- Have outstanding invoices from creditworthy customers.

- Experience cash flow gaps due to long payment cycles.

- Seek to avoid the challenges of traditional bank loans.

- Need immediate funds for operational expenses or growth opportunities.

- Prefer to outsource credit management and collection tasks.

However, it’s essential to assess your business’s unique circumstances and financial goals before deciding if AR factoring is the right fit.

How Long Does The AR Factoring Process Take?

The AR factoring approval and funding process can typically be completed within a week, depending on the complexity of your business and invoices you have.

How To Choose An AR Factoring Company

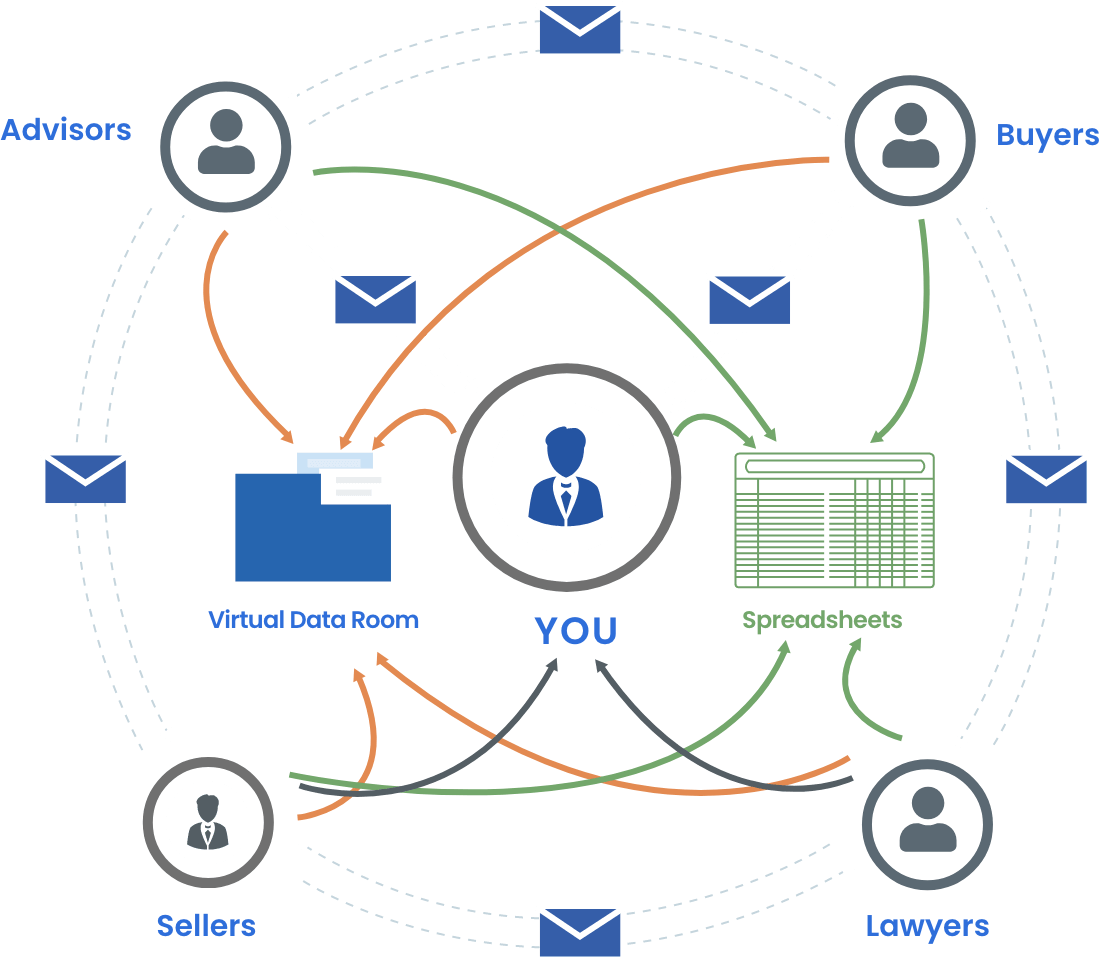

When selecting an AR factoring company, consider the following factors:

- Experience and Expertise

Look for a reputable AR factoring company with industry experience and expertise in your specific business sector. Consider their track record, client testimonials, and industry affiliations.

- Terms and Rates

Evaluate the funding terms and rates offered by different AR factoring companies. Pay attention to factors such as advance rates, discount fees, reserve amounts, and any additional charges. - Customer Service and Support

Choose an AR factoring company that provides excellent customer service and support. They should be responsive to your inquiries, provide clear communication, and offer personalized assistance. - Flexibility and Scalability

Assess whether the AR factoring company can accommodate your business’s growth and changing funding needs. Look for flexible terms that allow you to increase funding as your business expands.

Top AR Factoring Companies In The Market

While there are several AR factoring companies in the market, here are some reputable ones worth considering:

1. Company A: Known for competitive rates and flexible funding options.

2. Company B: Specializes in specific industries and offers tailored solutions.

3. Company C: Provides exceptional customer service and fast funding.

Remember to thoroughly research and compare different AR factoring companies to find the one that aligns with your business requirements.

Case Studies: Success Stories Of AR Factoring

To illustrate the positive impact of AR factoring, let’s explore a couple of case studies:

Company X: Manufacturing Industry

Company X faced cash flow challenges due to long payment terms from their customers. By partnering with an AR factoring company, they were able to access immediate funds and maintain a steady cash flow. This allowed them to invest in new equipment, expand their production capacity, and fulfill large orders without delays.

Company Y: Service Industry

Company Y experienced rapid growth but struggled with limited working capital. AR factoring enabled them to convert their outstanding invoices into cash, providing the necessary funds to hire additional staff, launch marketing campaigns, and secure new business contracts.

These success stories highlight how AR factoring can be a valuable financial tool for businesses in various industries.

Conclusion

AR factoring offers businesses a viable solution to improve cash flow by converting outstanding invoices into immediate working capital. By partnering with reputable AR factoring companies, businesses can experience enhanced cash flow, improved working capital, and outsourced credit management. It’s important to evaluate your business needs, compare different AR factoring companies, and choose the right partner that aligns with your objectives.

In conclusion, AR factoring can be a valuable financial tool for businesses seeking to unlock their cash flow potential and fuel growth. Consider exploring AR factoring as a means to optimize your working capital and propel your business forward.