Individual market insurance, also known as the individual health insurance market, is a vital component of the healthcare system that provides coverage for individuals who do not have access to employer-sponsored plans or government programs like Medicare or Medicaid. In this article, we will explore the key aspects of individual market insurance, including its benefits, coverage options, and considerations for choosing the right plan for your needs.

What Is Individual Market Insurance?

Individual market insurance refers to health insurance coverage that is purchased directly by individuals and families from private insurance companies. Unlike employer-sponsored plans or government programs, individuals in the individual market must seek out and select a plan that suits their specific healthcare needs.

Importance Of Individual Market Insurance

Individual market insurance plays a crucial role in ensuring that individuals who do not have access to other forms of coverage can still obtain necessary healthcare services. It provides a safety net for self-employed individuals, those between jobs, early retirees, and others who do not have employer-sponsored coverage or government assistance.

Benefits Of Individual Market Insurance

One of the significant advantages of individual market insurance is its flexibility and portability. Since you are not tied to an employer’s plan, you have the freedom to choose a plan that fits your unique circumstances. Additionally, individual market insurance allows you to maintain coverage even if you change jobs or move to a different state.

Individual market insurance offers a wide range of coverage options that can be tailored to your specific healthcare needs. You have the ability to select the level of coverage, such as bronze, silver, gold, or platinum, based on your anticipated medical expenses and budget. This customization ensures that you are only paying for the coverage you truly need.

- Access to a Broad Network of Providers

Individual market insurance plans typically provide access to a broad network of healthcare providers, including doctors, hospitals, and specialists. This network ensures that you have a wide range of options when seeking medical care and allows you to choose providers who meet your preferences and requirements.

Coverage Options In The Individual Market

- Qualified Health Plans (QHPs)

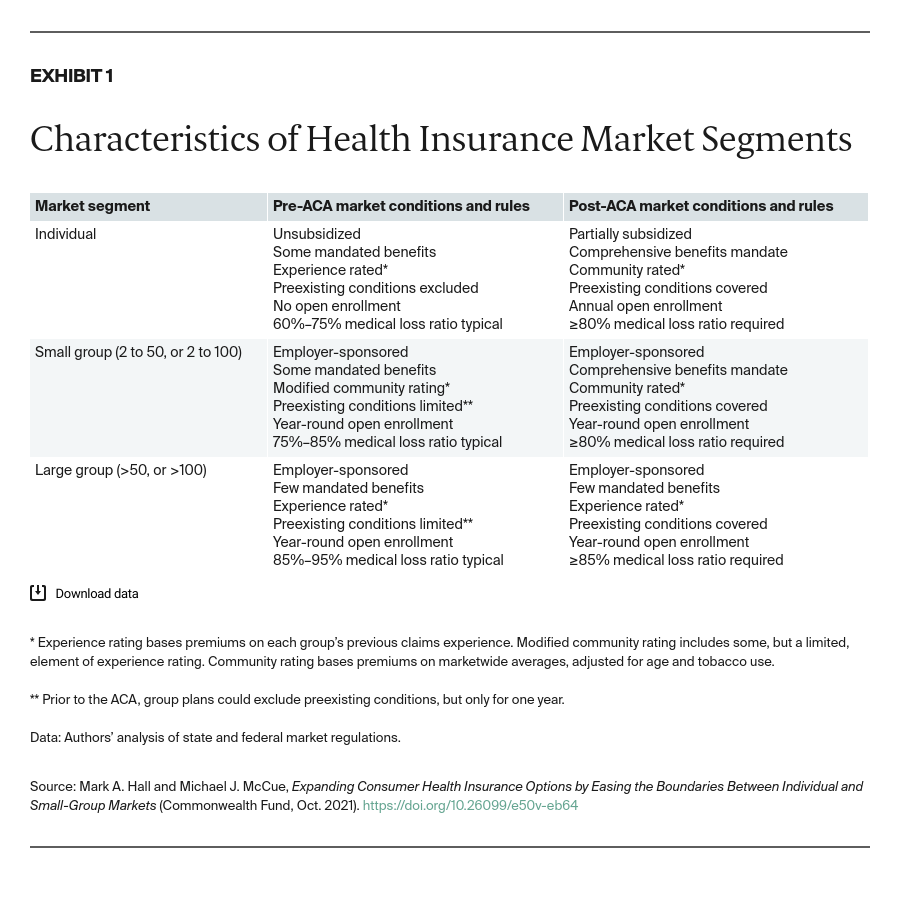

Qualified Health Plans (QHPs) are comprehensive health insurance plans that meet the requirements set by the Affordable Care Act (ACA). These plans provide essential health benefits and must cover pre-existing conditions. QHPs are available through the Health Insurance Marketplace, either operated by the federal government or individual states.

Catastrophic health plans are designed to provide coverage for severe illnesses or injuries. These plans typically have lower monthly premiums but higher deductibles. They are an option for individuals under the age of 30 or those who qualify for a hardship exemption.

- Short-term Health Plans

Short-term health plans are temporary coverage options that can provide insurance for a limited duration, usually up to 12 months. These plans offer basic medical benefits and may be suitable for individuals in transition periods, such as recent graduates or individuals waiting for employer-sponsored coverage to begin.

Factors To Consider When Choosing A Plan

- Premiums and Deductibles

When selecting an individual market insurance plan, it is essential to consider both the monthly premiums and deductibles. Lower premium plans often come with higher deductibles, meaning you’ll pay more out of pocket for medical expenses before your coverage kicks in. It’s crucial to strike a balance between affordability and adequate coverage.

- Network of Providers

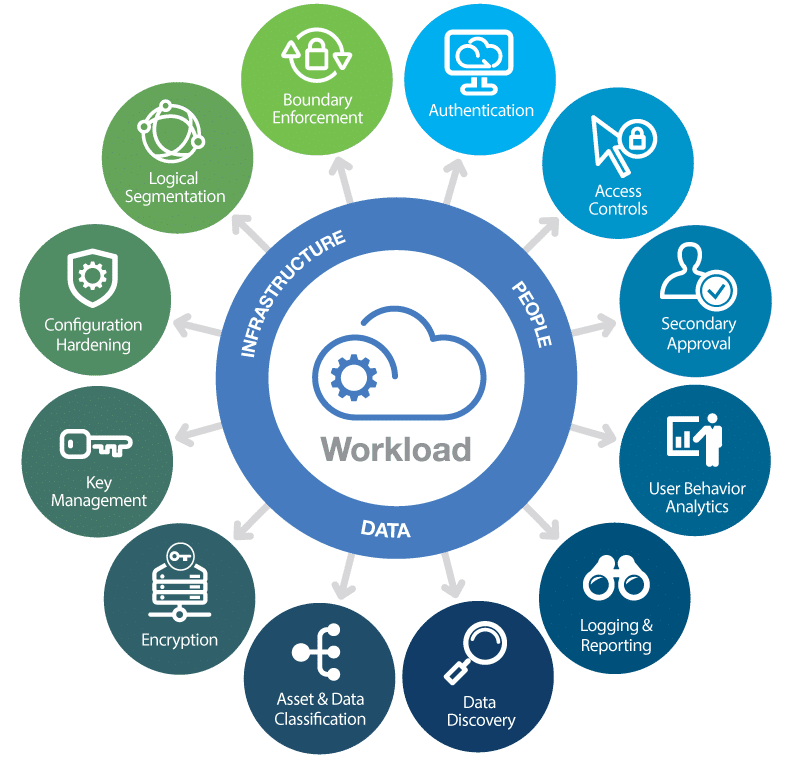

Check the network of healthcare providers associated with the insurance plan. Ensure that your preferred doctors, hospitals, and specialists are included in the network to ensure seamless access to care. If you have specific healthcare needs, such as a pre-existing condition, verify that the plan covers the necessary treatments and medications.

If you take prescription medications regularly, it’s crucial to review the plan’s prescription drug coverage. Understand the copayments, coverage limitations, and formulary lists to ensure that your medications are covered at a reasonable cost.

- Additional Benefits and Services

Some individual market insurance plans offer additional benefits and services, such as telemedicine, wellness programs, or preventive care coverage. Evaluate these extras to determine if they align with your healthcare preferences and can provide added value.

How To Obtain Individual Market Insurance

- Healthcare.gov Marketplace

The Healthcare.gov Marketplace is the federal health insurance marketplace where individuals and families can compare and purchase individual market insurance plans. The Marketplace offers a streamlined process for finding plans, determining eligibility for subsidies, and enrolling in coverage.

- Private Insurance Brokers

Private insurance brokers are licensed professionals who can assist you in navigating the individual market and help you find suitable insurance options. They have in-depth knowledge of different plans and can provide personalized guidance based on your specific needs and budget.

- Directly from Insurance Companies

You can also purchase individual market insurance directly from insurance companies. Many insurance providers have online platforms where you can explore available plans, compare options, and enroll in coverage. Direct purchasing allows you to research and choose a plan at your convenience.

Tips For Maximizing Your Individual Market Insurance

- Understand Your Policy Terms and Conditions

Take the time to read and understand the terms and conditions of your individual market insurance policy. Familiarize yourself with coverage details, exclusions, and any limitations or requirements. Being aware of what is covered and what is not will help you make informed decisions regarding your healthcare.

- Utilize Preventive Care Services

Most individual market insurance plans cover preventive care services, such as vaccinations, screenings, and annual check-ups, at no additional cost. Take advantage of these services to detect and prevent potential health issues before they become more severe.

- Review and Update Your Coverage Annually

Healthcare needs can change over time, so it’s important to review your individual market insurance coverage annually. Evaluate your anticipated medical expenses, changes in your healthcare requirements, and compare available plans to ensure you have the most suitable coverage for the upcoming year.

Are Pre-Existing Conditions Covered Under Individual Market Insurance Plans?

Yes, individual market insurance plans, especially those offered through the Health Insurance Marketplace, are required to cover pre-existing conditions. This means that individuals with existing health conditions cannot be denied coverage or charged higher premiums based on their health status. The Affordable Care Act (ACA) prohibits insurance companies from discriminating against individuals with pre-existing conditions, ensuring that they have access to necessary healthcare services and treatments. It is important to note that this protection applies to all qualified health plans (QHPs) sold through the Marketplace.

Conclusion

Individual market insurance provides a valuable lifeline for individuals and families who require healthcare coverage outside of employer-sponsored plans or government programs. With its flexibility, customizable options, and access to a broad network of providers, individual market insurance ensures that you have control over your healthcare decisions and can receive necessary medical care when you need it most.

When choosing an individual market insurance plan, consider factors such as premiums, deductibles, network of providers, prescription drug coverage, and additional benefits and services. Take advantage of resources like the Healthcare.gov Marketplace, private insurance brokers, or direct purchasing from insurance companies to find the plan that best suits your needs.

To maximize the benefits of your individual market insurance, make sure to understand the policy terms and conditions, utilize preventive care services, and review and update your coverage annually to align with any changes in your healthcare needs.

In conclusion, individual market insurance offers a viable solution for individuals seeking comprehensive healthcare coverage outside of traditional employer-based or government programs. By understanding your options, carefully selecting a plan, and utilizing the available resources, you can gain the peace of mind that comes with having the right insurance coverage for your unique healthcare needs.