When it comes to protecting your vehicle on the roads of Maryland, having reliable car insurance is essential. Among the various insurance providers available, Erie Car Insurance stands out for its exceptional coverage options, competitive rates, and excellent customer service. In this article, we will delve into the world of Erie Car Insurance in Maryland, exploring its benefits, coverage options, and why it’s an ideal choice for motorists in the state.

What Is Erie Car Insurance?

Erie Car Insurance is an insurance company that provides coverage for vehicles in Maryland and several other states across the United States. Founded in 1925, Erie Insurance has established itself as a trusted name in the insurance industry, offering comprehensive coverage plans tailored to the specific needs of their customers.

Coverage Options Offered By Erie Car Insurance

Erie Car Insurance provides a range of coverage options to ensure that Maryland motorists have the necessary protection on the road. Let’s take a closer look at some of the key coverage options available:

Liability coverage is a mandatory requirement in Maryland and helps protect you financially if you are responsible for causing an accident that results in injury or property damage to others. Erie Car Insurance offers liability coverage that includes both bodily injury and property damage liability.

Collision coverage is designed to cover the cost of repairs or replacement for your vehicle in the event of a collision with another vehicle or object. Erie Car Insurance’s collision coverage helps you get your vehicle back on the road quickly, minimizing out-of-pocket expenses.

Comprehensive coverage provides protection for your vehicle against non-collision-related incidents, such as theft, vandalism, fire, or natural disasters. Erie Car Insurance’s comprehensive coverage ensures that you are financially safeguarded from unexpected events that could damage or total your vehicle.

Medical payments coverage, also known as MedPay, helps cover medical expenses resulting from an accident, regardless of who is at fault. Erie Car Insurance’s medical payments coverage can provide peace of mind by ensuring that you and your passengers receive necessary medical treatment without incurring substantial costs.

- Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. Erie Car Insurance’s uninsured/underinsured motorist coverage ensures that you are not left financially burdened in such situations.

Factors Influencing Car Insurance Rates In Maryland

Several factors influence car insurance rates in Maryland. Understanding these factors can help you make informed decisions when selecting your coverage options. Here are some key factors to consider:

- Driving Record

Your driving record plays a significant role in determining your car insurance rates. Drivers with a clean driving history and no prior accidents or traffic violations often enjoy lower insurance premiums.

- Vehicle Type

The type of vehicle you drive can affect your insurance rates. Typically, vehicles with advanced safety features and lower theft rates tend to have lower insurance premiums.

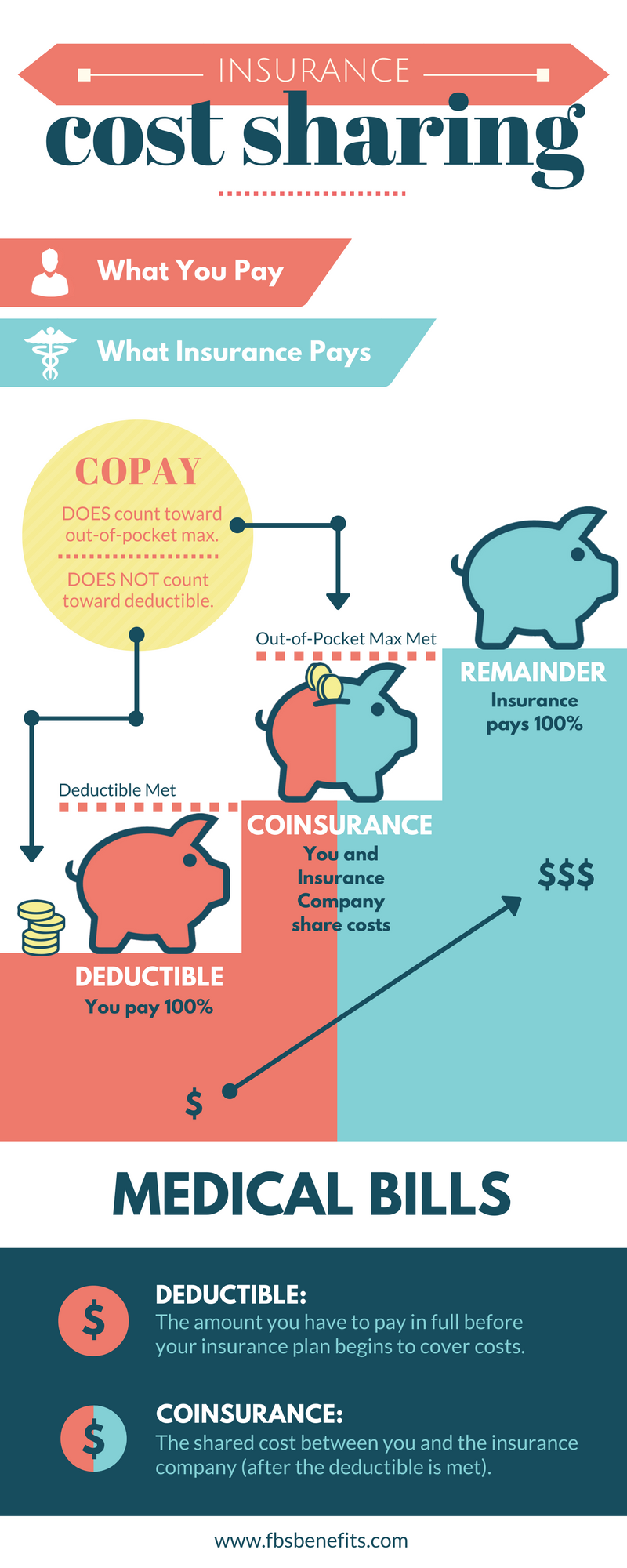

- Deductibles and Coverage Limits

The deductible is the amount you pay out of pocket before your insurance coverage kicks in. Opting for higher deductibles can lower your premiums, but it’s essential to choose a deductible that you can comfortably afford. Coverage limits also influence rates, with higher limits often resulting in higher premiums.

- Credit History

In Maryland, insurance companies may use credit history as a factor when determining rates. Maintaining a good credit score can help secure more affordable insurance premiums.

- Location

Your location within Maryland can impact your car insurance rates. Areas with higher rates of accidents, vehicle theft, or vandalism may result in higher premiums.

Benefits Of Erie Car Insurance In Maryland

Choosing Erie Car Insurance in Maryland comes with several benefits. Let’s explore some of the advantages of opting for Erie:

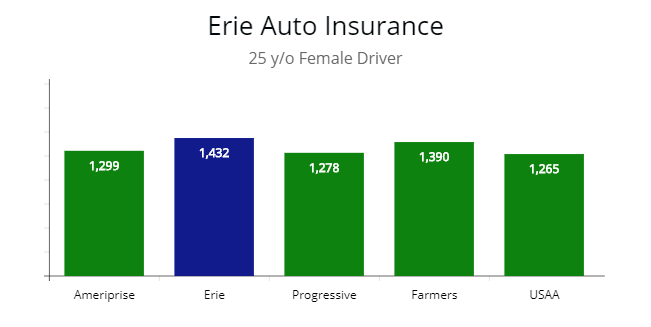

- Affordable Rates

Erie Car Insurance offers competitive rates that are tailored to your specific needs. With various coverage options and flexible payment plans, Erie ensures that you get the coverage you need at a price you can afford.

- Excellent Customer Service

Erie Insurance is renowned for its exceptional customer service. Their dedicated team is always ready to assist you with any questions or concerns you may have, ensuring a smooth and hassle-free insurance experience.

- Additional Policy Features

Erie Car Insurance provides additional policy features that go beyond the standard coverage options. These include rental car coverage, pet coverage, and locksmith services, among others, offering you comprehensive protection for various situations.

- Discounts and Savings Opportunities

Erie Car Insurance offers a range of discounts and savings opportunities to help you save on your premiums. These include multi-policy discounts, safe driving discounts, and discounts for certain vehicle safety features.

How To Obtain Erie Car Insurance In Maryland

Getting Erie Car Insurance in Maryland is a straightforward process. Here are three convenient ways to obtain coverage:

- Online

You can visit Erie Insurance’s official website and request an online quote. By entering your details and providing information about your vehicle, you can quickly receive a personalized quote and proceed with purchasing your policy online.

- Phone

Another option is to call Erie Insurance’s toll-free number and speak with a representative. They will guide you through the process, answer your questions, and help you select the right coverage options for your needs.

- Local Agents

Erie Insurance has a network of local agents across Maryland who can assist you in person. They will provide personalized advice and help you navigate the various coverage options to find the most suitable policy for your situation.

Discounts Available For Young Drivers In Erie Car Insurance

Young drivers often face higher insurance rates due to their limited driving experience. However, Erie Car Insurance offers several discounts specifically designed to help young drivers save on their premiums. Let’s explore some of the discounts available:

1. Good Student Discount: Erie Car Insurance rewards young drivers who excel academically. If you’re a student with good grades, you may qualify for a good student discount. By maintaining a high GPA, typically a B average or higher, you can enjoy reduced insurance rates.

2. Driver Training Discount: Completing a driver’s education or defensive driving course demonstrates your commitment to safe driving practices. Erie Car Insurance offers a discount for young drivers who have successfully completed an approved driver training program. By investing in your driving skills, you not only enhance your safety on the road but also become eligible for savings on your insurance.

3. Youthful Driver Discount: Erie understands that young drivers with limited driving experience may still exhibit responsible behavior on the road. If you have a clean driving record and demonstrate responsible driving habits, you may be eligible for the youthful driver discount. This discount recognizes young drivers who maintain a clean record and rewards them with lower insurance premiums.

4. Multi-Vehicle Discount: If you’re a young driver living in a household with multiple vehicles, you can take advantage of Erie’s multi-vehicle discount. By insuring multiple vehicles under one policy, you can enjoy discounted rates, making it more affordable for young drivers and their families.

5. Auto and Home Bundle Discount: If you have your own car insurance policy with Erie and your parents have a homeowners or renters insurance policy with Erie as well, you can benefit from the auto and home bundle discount. Bundling your insurance policies not only simplifies your coverage but also helps you save on both your car and home insurance premiums.

It’s important to note that the availability and specific requirements for these discounts may vary based on your location and the terms and conditions of Erie Car Insurance. It’s advisable to reach out to an Erie representative or visit their website to get detailed information about the discounts available for young drivers in your area.

By taking advantage of these discounts, young drivers can significantly reduce their insurance costs while still obtaining the necessary coverage to protect themselves and their vehicles on Maryland’s roads. Remember, maintaining a clean driving record, focusing on safe driving habits, and continuing your education as a driver can not only save you money but also contribute to your overall safety on the road. Don’t miss out on these valuable opportunities to save on your car insurance premiums. Contact Erie Car Insurance today to learn more about the discounts available and start enjoying affordable and reliable coverage.

What To Do In Case Of An Accident With Erie Car Insurance

Being involved in an accident can be a stressful and overwhelming experience. However, knowing the proper steps to take can help ensure your safety and protect your interests. If you’re an Erie Car Insurance policyholder and find yourself in an accident, follow these essential steps:

1. Ensure Safety: Your safety and the safety of others involved should be your top priority. If possible, move your vehicle to a safe location away from traffic. Turn on hazard lights to alert other drivers and help prevent further accidents.

2. Check for Injuries: Assess yourself and others involved in the accident for any injuries. If there are serious injuries, call for emergency medical assistance immediately.

3. Contact Authorities: Depending on the severity of the accident, you may need to contact the police to report the incident. They will document the details of the accident and provide an official report, which may be necessary for insurance purposes.

4. Exchange Information: Exchange important information with the other parties involved in the accident. This includes names, contact details, insurance information, and vehicle information. Avoid discussing fault or admitting liability at the scene.

5. Document the Accident: Gather evidence by taking photos of the accident scene, the vehicles involved, and any damages. These visual records can be valuable when filing an insurance claim.

6. Notify Erie Car Insurance: Contact Erie Car Insurance as soon as possible to report the accident and initiate the claims process. They will guide you through the necessary steps and provide instructions on filing a claim.

7. Cooperate with the Claims Process: Work closely with your Erie Car Insurance claims representative. Provide them with all the necessary information and documentation required to process your claim effectively. Be prepared to provide details about the accident, any injuries sustained, and any damages to your vehicle.

8. Follow Repair Procedures: If your vehicle requires repairs, follow the procedures outlined by Erie Car Insurance. They may have preferred repair shops or specific guidelines for choosing a repair facility. It’s essential to inform them before proceeding with any repairs to ensure coverage.

9. Keep Detailed Records: Throughout the claims process, keep detailed records of all communication, including phone calls, emails, and documents exchanged with Erie Car Insurance. This documentation will serve as evidence and help maintain a clear record of the proceedings.

Remember, each accident situation may differ, and the specific steps you need to take can vary based on the circumstances. Always consult your Erie Car Insurance policy documents or contact their customer service for guidance specific to your situation. By following these steps and working closely with Erie Car Insurance, you can navigate the claims process smoothly and efficiently, ensuring that your interests are protected and your vehicle is repaired promptly.

Conclusion

When it comes to car insurance in Maryland, Erie Car Insurance offers a reliable and comprehensive solution. With its range of coverage options, competitive rates, exceptional customer service, and additional policy features, Erie ensures that you have the protection you need on the road. Whether you’re a new driver or an experienced motorist, Erie Car Insurance provides peace of mind and financial security.