Are you a business owner struggling with cash flow issues? Do you find yourself waiting for weeks or even months to receive payment for your invoices? If so, it’s time to explore the benefits of factoring. In this article, we will delve into the world of US factoring companies and how they can help you improve your business’s financial health. From understanding the concept of factoring to finding the right company for your needs, we’ll cover it all. So, let’s dive in!

Factoring is a financial solution that allows businesses to improve their cash flow by selling their accounts receivable to a factoring company. Instead of waiting for their customers to pay them, businesses can receive immediate funds by leveraging their unpaid invoices. This alternative form of financing has gained popularity among businesses of all sizes, providing them with the necessary working capital to fuel their growth.

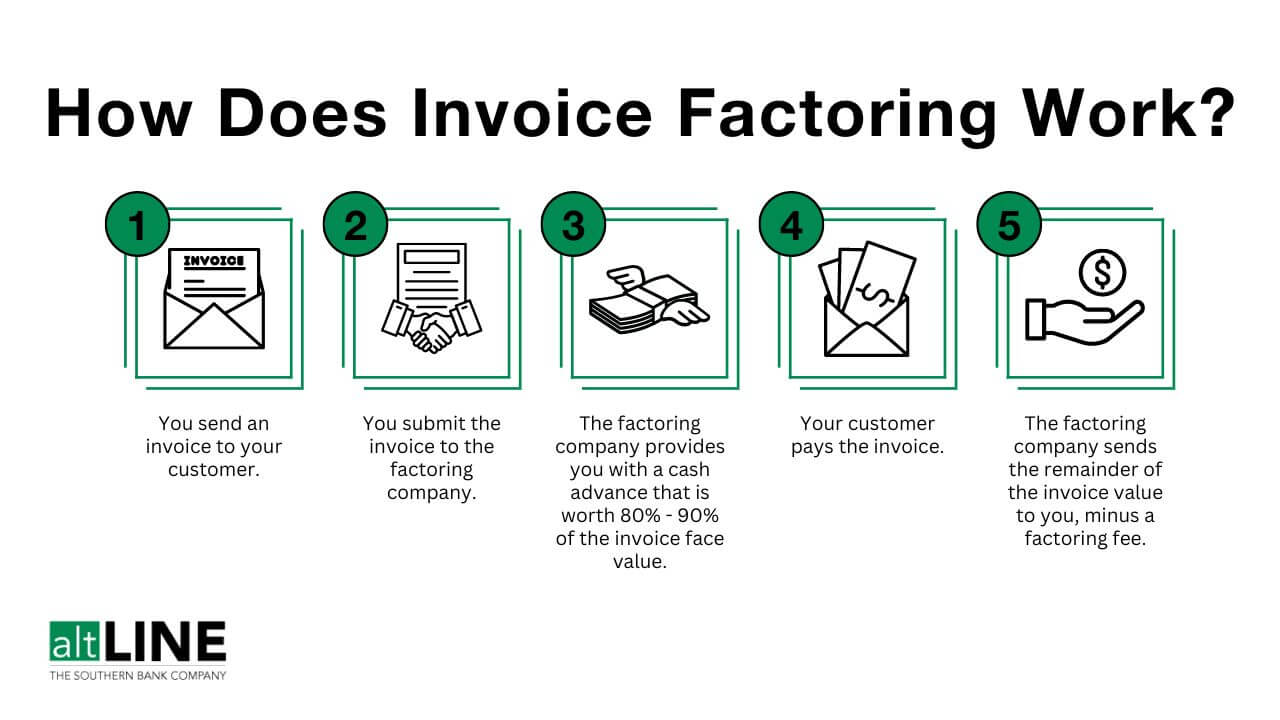

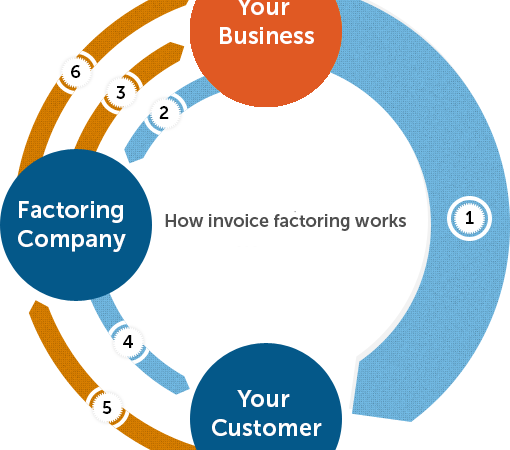

How US Factoring Companies Works

When a business decides to factor its invoices, it enters into an agreement with a factoring company. The business submits its unpaid invoices to the factoring company, which then advances a percentage of the invoice value, typically around 80% to 90%. The factoring company takes on the responsibility of collecting payment from the customers, handling the associated administrative tasks.

Once the customers pay their invoices, the factoring company deducts its fees and disburses the remaining amount to the business. This arrangement allows businesses to access immediate funds and transfer the credit and collection responsibilities to the factoring company.

Benefits Of Factoring

Factoring offers several benefits that can significantly impact a business’s financial stability and growth. Here are some key advantages:

1. Improved Cash Flow: By receiving immediate funds against their invoices, businesses can bridge the gap between invoicing and customer payment, ensuring a steady cash flow.

2. Enhanced Working Capital: The influx of cash allows businesses to cover operational expenses, invest in growth opportunities, and seize market advantages.

3. No Debt Incurred: Factoring is not a loan; it’s a sale of an asset. Businesses receive funds without taking on additional debt, eliminating the need for collateral or a strong credit history.

4. Access to Expertise: Factoring companies often have industry-specific knowledge and experience, which can be valuable for businesses looking to optimize their credit and collection processes.

5. Outsourced Accounts Receivable Management: By partnering with a factoring company, businesses can free up their internal resources from the tasks of credit monitoring, invoicing, and collections.

Types Of Factoring

Factoring companies offer various types of factoring solutions tailored to meet the unique needs of different businesses. The most common types include:

1. Recourse Factoring: In recourse factoring, the business retains the risk of non-payment. If a customer fails to pay, the business must buy back the invoice from the factoring company.

2. Non-Recourse Factoring: Non-recourse factoring provides businesses with protection against customer non-payment. In this type of factoring, the factoring company assumes the risk of non-payment. If a customer fails to pay, the factoring company absorbs the loss, and the business is not obligated to repurchase the invoice.

Choosing The Right Factoring Company

Selecting the right factoring company is crucial for a successful factoring relationship. Here are some factors to consider when making your decision:

1. Industry Expertise: Look for a factoring company with experience in your industry. They will have a better understanding of your business’s specific needs and challenges.

2. Reputation and Reliability: Research the factoring company’s reputation and track record. Read reviews and testimonials from other businesses to gauge their reliability.

3. Terms and Rates: Understand the factoring rates and fees offered by different companies. Compare their terms and choose the one that aligns with your business’s financial goals.

4. Customer Support: A responsive and supportive factoring company can make a significant difference in your experience. Ensure they provide excellent customer service and are readily available to address any concerns.

5. Flexibility: Assess the flexibility of the factoring company in terms of the volume of invoices they can handle and the length of the contract. It’s essential to choose a partner that can accommodate your business’s growth and changing needs.

The Application Process

The application process for factoring is generally straightforward and less cumbersome compared to traditional financing options. It typically involves the following steps:

1. Application Submission: Submit an application to the factoring company, providing details about your business and its financials.

2. Due Diligence: The factoring company will conduct due diligence, including credit checks on your customers and an assessment of your invoices.

3. Approval and Agreement: Upon approval, you will receive the factoring agreement outlining the terms and conditions of the arrangement.

4. Invoice Submission: Submit your unpaid invoices to the factoring company for funding.

5. Funding and Collections: Once the invoices are verified, the factoring company will advance a percentage of the invoice value and take responsibility for collecting payment.

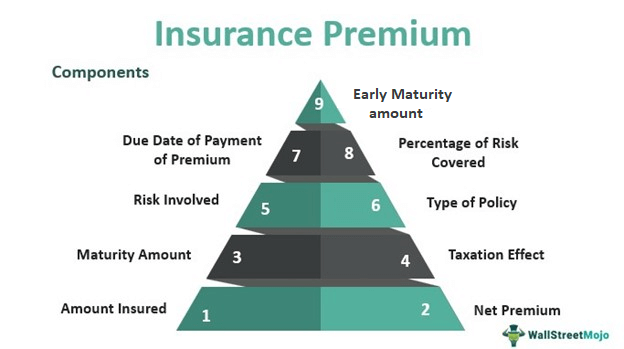

Factoring Rates And Fees

Factoring rates and fees vary depending on factors such as the volume of invoices, the creditworthiness of your customers, and the industry. Generally, factoring fees range from 1% to 5% of the invoice value per month. It’s crucial to carefully review the rates and fees offered by different factoring companies to ensure they align with your business’s financial viability.

Managing The Factoring Relationship

To ensure a smooth and successful factoring relationship, it’s important to maintain open communication and transparency with your factoring company. Here are some tips for managing the relationship effectively:

1. Clear Invoice Submission Process: Establish a streamlined process for submitting invoices to the factoring company to avoid delays or confusion.

2. Timely Customer Information: Keep your factoring company informed about any changes in customer payment terms, disputes, or potential issues that may affect the collection process.

3. Consistent Reporting: Provide regular reports to the factoring company, detailing the status of your outstanding invoices, collections, and any changes in your business’s financials.

4. Collaborative Approach: Work closely with the factoring company to resolve any customer payment issues or disputes, ensuring a proactive and cooperative approach.

Factoring Vs. Traditional Financing

Factoring offers several advantages over traditional financing options, such as bank loans or lines of credit. Here are some key differences:

1. Collateral Requirements: Factoring does not typically require collateral, as it is based on the creditworthiness of your customers. Traditional financing often requires collateral,

Apologies for the interruption. Here’s the continuation of the article:

such as property or equipment, to secure the loan.

2. Credit Requirements: Factoring companies primarily focus on the creditworthiness of your customers rather than your business’s credit history. Traditional financing heavily relies on your business’s creditworthiness and financial statements.

3. Speed of Funding: Factoring provides quick access to funds since it involves selling your invoices. Traditional financing may involve a lengthy application and approval process before receiving funds.

4. Collections and Administrative Tasks: Factoring companies handle collections and administrative tasks related to your invoices, saving you time and resources. Traditional financing requires your business to manage these tasks internally.

5. Debt and Repayment: Factoring is not a loan, so you are not taking on additional debt. The funds received from factoring are based on the sale of your invoices. Traditional financing involves borrowing money that needs to be repaid with interest.

Factoring For Small Businesses

Factoring can be particularly beneficial for small businesses facing cash flow challenges. It provides a viable solution to bridge the gap between invoicing and customer payment. By leveraging factoring services, small businesses can access immediate funds to cover expenses, invest in growth initiatives, and maintain a healthy cash flow.

Factoring For Startups

Startups often struggle to secure traditional financing due to limited operating history or lack of collateral. Factoring offers a viable alternative for startups to obtain working capital. By factoring their invoices, startups can access funds quickly and fuel their growth without incurring additional debt.

Factoring For Industries

Factoring is applicable across various industries, including manufacturing, construction, staffing, transportation, and more. The common factor is having unpaid invoices from creditworthy customers. Regardless of the industry, factoring can help businesses improve cash flow and meet their financial obligations.

Common Misconceptions About Factoring

There are some misconceptions about factoring that are important to address:

1. Factoring is Only for Troubled Businesses: Factoring is a financial tool that can benefit businesses of all sizes, including those in a healthy financial position. It is not exclusive to struggling businesses.

2. Factoring is Costly: While factoring fees exist, the benefits gained from improved cash flow and outsourced collections can outweigh the costs. It’s crucial to evaluate the overall financial impact on your business.

3. Factoring Companies Take Control of Your Business: Factoring companies handle collections, but they do not control your business operations. You retain control and ownership of your business and customer relationships.

4. Factoring Will Harm Customer Relationships: Factoring companies are experienced in handling collections professionally and maintaining positive customer relationships. Communication is key to ensuring a smooth transition.

5. Factoring is the Same as a Bank Loan: Factoring and bank loans are distinct financing methods. Factoring involves selling invoices, while bank loans involve borrowing money with interest. Factoring offers flexibility and does not require collateral.

Conclusion

US factoring companies offer a valuable financial solution for businesses seeking to improve their cash flow and overcome the challenges of delayed customer payments. By leveraging factoring services, businesses can access immediate funds, enhance working capital, and focus on growth initiatives. Whether you’re a small business or a startup, factoring can provide the financial stability you need to thrive in today’s competitive landscape.