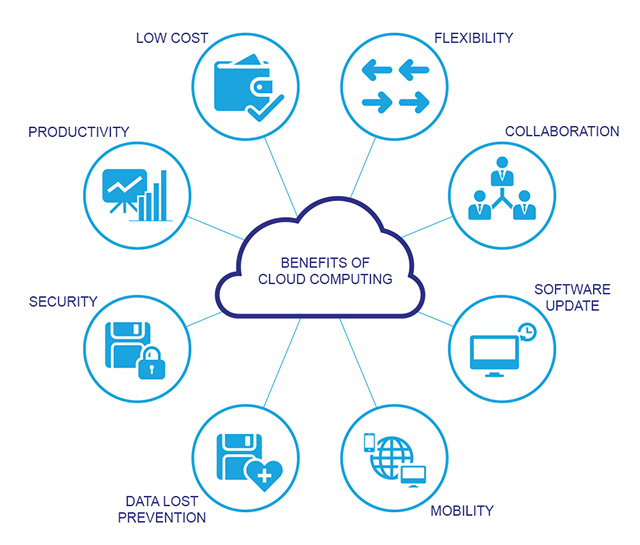

Car accidents can happen unexpectedly, and they often come with financial consequences. That’s where car insurance liability comes into play. In this comprehensive guide, we will explore the various aspects of insurance liability for cars, providing you with a clear understanding of what it entails and why it is essential.

Car insurance liability refers to the coverage that protects you in case you are found legally responsible for an accident. It helps cover the costs associated with bodily injuries or property damage caused to others. Understanding insurance liability is crucial for every driver to ensure they have adequate coverage and financial protection.

What Is Car Insurance Liability?

Car insurance liability is a component of auto insurance that covers the costs if you cause an accident and are held responsible for the damages. It includes two primary types of coverage: bodily injury liability and property damage liability.

Types Of Car Insurance Liability

- Bodily Injury Liability

Bodily injury liability coverage pays for medical expenses, rehabilitation costs, and legal fees if you injure someone in an accident. It helps protect you from potentially high costs associated with medical treatments and other related expenses.

- Property Damage Liability

Property damage liability coverage, on the other hand, covers the costs of repairing or replacing someone else’s property that you damaged in an accident. This can include other vehicles, buildings, fences, or any other structures.

Minimum Liability Coverage Requirements

Each state has its own minimum liability coverage requirements for car insurance. It is important to familiarize yourself with the requirements in your state to ensure you meet the legal obligations. Failing to maintain the required coverage can result in fines, license suspension, or other penalties.

Factors Affecting Car Insurance Liability Rates

Several factors influence car insurance liability rates. Insurance providers consider these factors to determine the risk associated with insuring a particular driver. The main factors include:

- Driving History

Your driving history, including past accidents and traffic violations, can significantly impact your liability rates. Drivers with a clean driving record typically pay lower premiums compared to those with a history of accidents or violations.

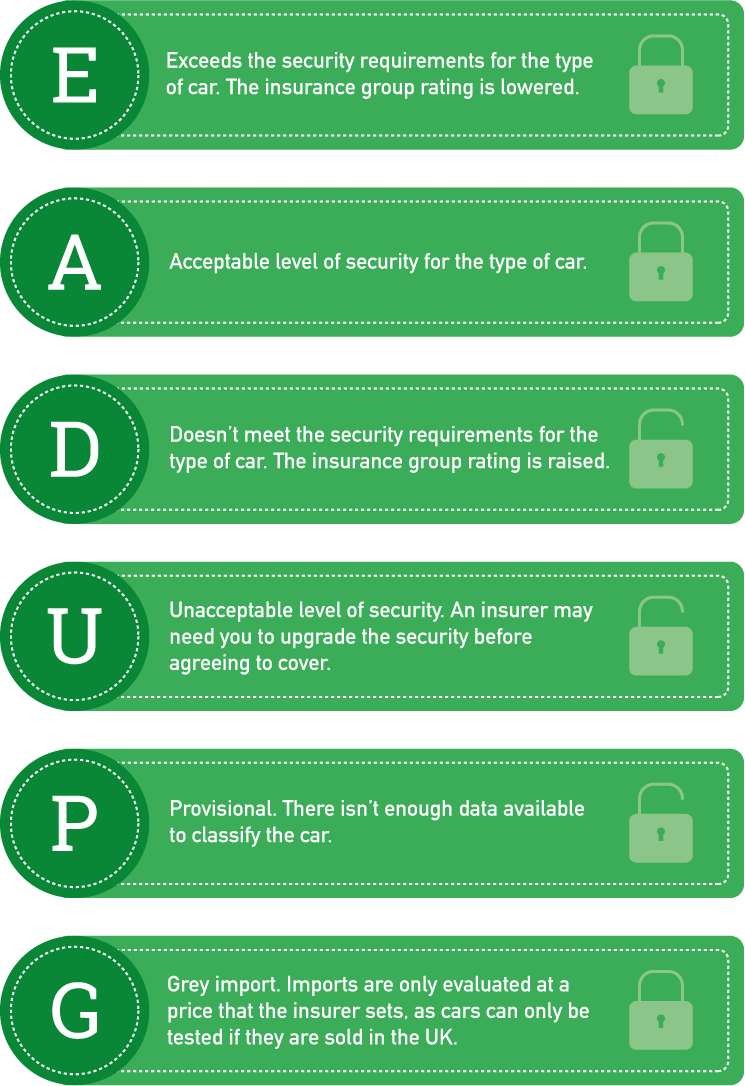

- Vehicle Type

The type of vehicle you drive can also affect your liability rates. Insurance providers consider factors such as the vehicle’s make, model, age, and safety features. Expensive or high-performance cars may result in higher premiums.

- Age and Gender

Young and inexperienced drivers are considered higher risk due to their limited driving experience. Additionally, statistics show that males tend to have a higher accident risk compared to females. These factors can influence liability rates.

- Location

Where you live plays a role in determining your liability rates. Areas with higher population densities or higher rates of accidents and thefts may result in higher premiums. Urban areas are generally associated with increased risks compared to rural areas.

Understanding Liability Limits

When it comes to car insurance liability, it’s important to understand the concept of liability limits. Liability limits refer to the maximum amount your insurance provider will pay in the event of a covered claim. There are two common types of liability limits:

Split limits indicate the maximum amount your policy will pay for bodily injury per person, bodily injury per accident, and property damage per accident. For example, a split limit of $50,000/$100,000/$25,000 means your policy will cover up to $50,000 for each injured person, up to $100,000 total for all injured persons, and up to $25,000 for property damage.

- Combined Single Limit (CSL)

A combined single limit is a single total amount of coverage that applies to both bodily injury and property damage. For instance, if your policy has a CSL of $300,000, that amount can be used to cover both bodily injury and property damage claims as needed.

Uninsured And Underinsured Motorist Coverage

In addition to liability coverage, it’s important to consider uninsured and underinsured motorist coverage. These types of coverage protect you in case you are involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages.

Uninsured motorist coverage comes into play when the at-fault driver is uninsured, while underinsured motorist coverage applies when the at-fault driver’s insurance is insufficient to cover the full extent of your damages.

How Car Insurance Liability Claims Work

In the unfortunate event of an accident, it’s crucial to understand how car insurance liability claims work. Here are the general steps involved:

- Reporting an Accident

After an accident, it’s essential to promptly report the incident to your insurance provider. Provide accurate and detailed information about the accident, including the date, time, location, and any other relevant details.

- Investigation and Settlement

Once the claim is reported, an insurance adjuster will investigate the accident. They will assess the damages, review medical reports, and gather other necessary information. Based on the findings, the insurance company will negotiate a settlement with the affected parties.

Steps To Take After An Accident

Knowing the appropriate steps to take after an accident can help protect your interests and ensure a smooth claims process. Here are some important steps to consider:

- Gather Information

Collect the contact and insurance information of all parties involved in the accident, including witnesses if possible. This information will be crucial when filing your insurance claim.

- Document the Scene

Take photos or videos of the accident scene, including the vehicles involved and any visible damages. This documentation can serve as valuable evidence during the claims process.

- Contact Your Insurance Provider

Notify your insurance provider about the accident as soon as possible. Provide them with all the relevant details and cooperate fully throughout the claims process.

Importance Of Car Insurance Liability

Car insurance liability is not only a legal requirement but also provides crucial financial protection. It safeguards your assets and helps cover the costs of injuries and damages caused to others in an accident where you are found at fault. Without liability coverage, you could be personally responsible for substantial expenses, including medical bills, legal fees, and property repairs.

Conclusion

Understanding insurance liability for cars is vital for every driver. It ensures that you have the necessary coverage to protect yourself and others in the event of an accident. Car insurance liability provides financial support for medical expenses, property damage, and legal fees that may arise from accidents where you are at fault. By maintaining adequate liability coverage, you can have peace of mind knowing that you are prepared for any unforeseen circumstances on the road.