In the world of auto insurance, understanding the different types of coverage available is essential. One such coverage is Personal Injury Protection (PIP) auto insurance. PIP provides financial protection for medical expenses and other related costs in the event of an auto accident. This article aims to shed light on the definition, workings, benefits, and requirements of PIP auto insurance.

What Is PIP Auto Insurance?

PIP auto insurance, also known as no-fault insurance, is a type of coverage that pays for medical expenses, lost wages, and other costs resulting from an auto accident, regardless of who is at fault. Unlike traditional liability insurance, which focuses on compensating the other party involved, PIP coverage provides benefits to the policyholder and their passengers.

How Does PIP Auto Insurance Work?

When an accident occurs, PIP coverage kicks in to provide immediate financial assistance. The policyholder and their passengers can receive benefits such as medical treatment expenses, rehabilitation costs, lost wages, and funeral expenses, depending on the extent of the coverage and the policy terms. PIP coverage is often designed to be paid out regardless of who caused the accident, hence the term “no-fault insurance.”

PIP Coverage Limits

PIP auto insurance policies come with coverage limits, which determine the maximum amount the insurance company will pay for each type of benefit. These limits can vary depending on the state and the policy chosen. It is important for policyholders to review and understand the coverage limits of their PIP insurance to ensure they have adequate protection in case of an accident.

Benefits Of PIP Auto Insurance

There are several benefits to having PIP auto insurance. Firstly, it provides prompt coverage for medical expenses and other costs, eliminating the need to wait for the determination of fault in an accident. This allows policyholders to receive necessary medical treatment without delay. Additionally, PIP coverage can also include benefits for lost wages, essential services, and funeral expenses, providing comprehensive financial protection.

PIP Vs. Medical Payments Coverage

While PIP auto insurance covers medical expenses and other related costs, it is important to note the difference between PIP coverage and Medical Payments (MedPay) coverage. MedPay coverage is an optional add-on to an auto insurance policy that solely focuses on medical expenses resulting from an accident. Unlike PIP, MedPay coverage does not typically include benefits for lost wages, essential services, or funeral expenses.

PIP Auto Insurance Requirements

The requirements for PIP auto insurance vary from state to state. Some states have mandatory PIP coverage, while others offer it as an optional add-on to the auto insurance policy. It is crucial for policyholders to familiarize themselves with the specific PIP requirements in their state to ensure compliance with the law and to protect themselves adequately in the event of an accident.

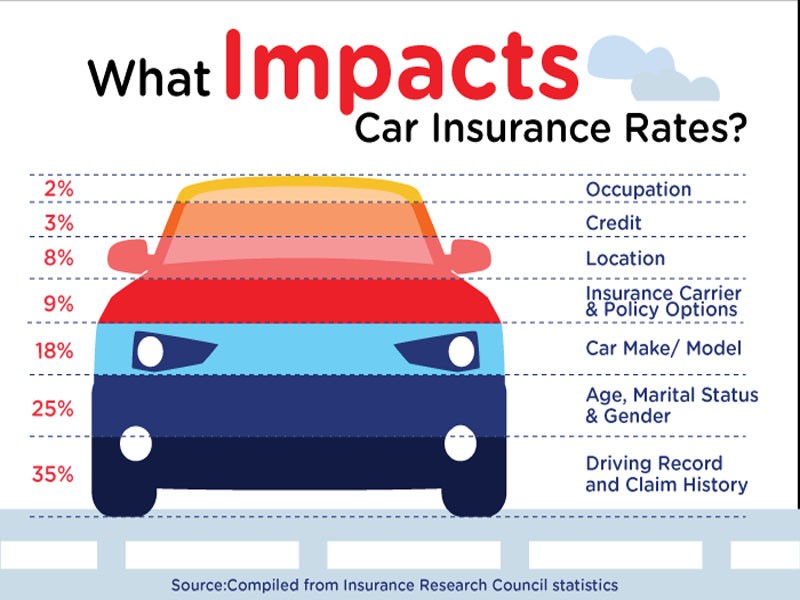

PIP Auto Insurance Costs

The cost of PIP auto insurance can vary depending on various factors such as the state of residence, driving history, coverage limits, and deductibles. Generally, states with mandatory PIP coverage tend to have higher insurance premiums compared to those where it is optional. Policyholders can also choose to adjust their coverage limits and deductibles to suit their budget and needs. It is recommended to obtain quotes from different insurance providers to compare prices and find the most affordable option.

Conclusion

In conclusion, PIP auto insurance, or personal injury protection, is a type of coverage that provides financial protection for medical expenses, lost wages, and other related costs resulting from an auto accident. It offers prompt assistance regardless of fault and ensures policyholders and their passengers receive necessary benefits. Understanding the definition, workings, benefits, and requirements of PIP auto insurance is crucial for every driver to make informed decisions and ensure adequate protection on the road.