The Longshoremen Harbor Workers Compensation Act (LHWCA), also known as the Longshore Act, is a federal law in the United States that provides protection and compensation for workers engaged in maritime occupations. Enacted in 1927, this legislation is crucial for safeguarding the rights of longshoremen and harbor workers, ensuring that they receive the necessary benefits and support in case of work-related injuries or illnesses. In this article, we will explore the key aspects of the Longshoremen Harbor Workers Compensation Act and its significance for maritime workers.

Purpose And Scope Of The Act

The Longshoremen Harbor Workers Compensation Act (LHWCA) is designed to provide compensation and medical benefits to maritime workers who are injured or fall ill during the course of their employment. The Act covers various categories of workers, including longshoremen, harbor workers, shipbuilders, ship repairers, and other individuals engaged in maritime-related activities. It aims to ensure that injured workers receive timely medical treatment and fair compensation, minimizing the financial burden on the employees and their families.

Coverage And Eligibility

To be eligible for benefits under the Longshore Act, an employee must be engaged in maritime employment, which involves work on or near navigable waters of the United States, including piers, docks, terminals, and other facilities used for maritime purposes. This coverage extends to both land-based workers, such as longshoremen, as well as workers on vessels, including ship crew members. Certain exclusions and exceptions exist, and it is essential to consult the Act and seek legal advice for specific cases.

Benefits And Compensation Under The Longshore Act

Under the Longshore Act, injured workers are entitled to receive reasonable and necessary medical treatment related to their work-related injury or illness. This includes doctor visits, hospitalization, surgeries, medications, prosthetic devices, and rehabilitation services. The Act ensures that workers have access to quality medical care to aid their recovery and improve their overall well-being.

In addition to medical benefits, the Longshore Act provides disability benefits to compensate workers for lost wages due to their work-related injury or illness. There are different types of disability benefits available:

1. Temporary Total Disability (TTD): If a worker is unable to work at all while recovering from the injury, they may receive TTD benefits, which typically amount to two-thirds of their average weekly wage.

2. Temporary Partial Disability (TPD): If a worker can perform some work but at a lower earning capacity due to the injury, they may receive TPD benefits, which provide partial compensation.

3. Permanent Total Disability (PTD): In cases where the injury or illness results in permanent total disability, meaning the worker is unable to perform any gainful employment, they may receive PTD benefits for an extended period or for the remainder of their life.

4. Permanent Partial Disability (PPD): If the injury causes a permanent impairment but does not result in total disability, the worker may be eligible for PPD benefits based on the extent of the impairment.

- Rehabilitation Services

Under the Longshore Act, injured workers may also receive vocational rehabilitation services to help them return to suitable employment. Rehabilitation services can include job retraining, career counseling, and job placement assistance. The goal is to enable workers to regain their economic independence and successfully reintegrate into the workforce.

Filing A Claim Under The Longshore Act

- Reporting the Injury or Illness

To initiate the claims process, it is crucial for the injured worker to promptly report the injury or illness to their employer. The report should include details of the incident, the nature of the injury, and the date and time of occurrence. Timely reporting ensures that the employer and insurance carrier are aware of the incident and can initiate the necessary steps for providing benefits and medical treatment.

- Statute of Limitations

Workers covered under the Longshore Act must be aware of the statute of limitations for filing a claim. Generally, a claim must be filed within one year from the date of the injury or the date when the worker last received compensation or medical benefits. Failing to meet this deadline may result in the forfeiture of benefits. However, certain circumstances may warrant an extension of the statute of limitations, such as when the injury or illness manifests later.

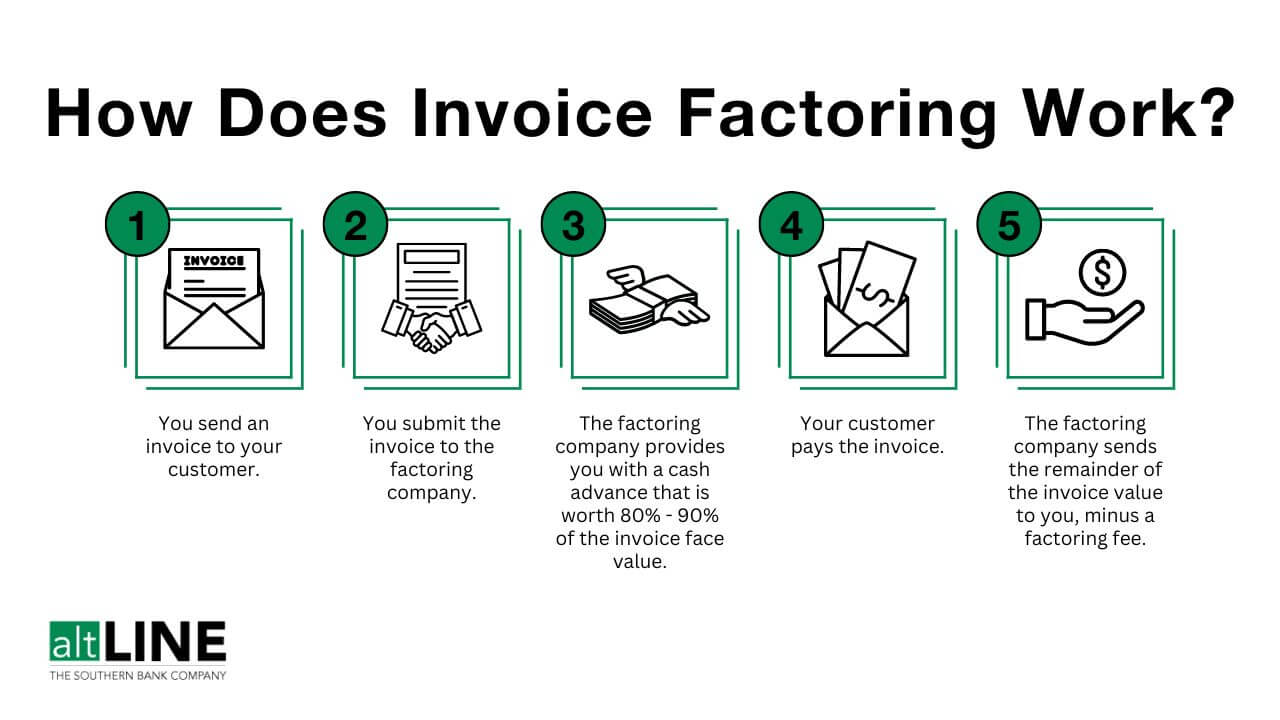

When filing a claim, the injured worker or their representative should complete the necessary forms, including the Employee’s Claim for Compensation form (Form LS-203). Along with the form, supporting documentation, such as medical records, witness statements, and any relevant evidence, should be submitted. It is essential to provide accurate and detailed information to strengthen the claim and ensure a smooth claims process.

Responsibilities Of Employers And Insurers

- Employer’s Obligations

Under the Longshore Act, employers have specific obligations towards their employees. These include:

1. Providing a safe working environment: Employers must maintain a workplace that adheres to safety standards and takes measures to prevent accidents and injuries.

2. Displaying required notices: Employers must prominently display notices informing workers of their rights under the Longshore Act, including the process for reporting injuries and filing claims.

3. Obtaining insurance coverage: Employers are required to secure insurance coverage or self-insure to provide compensation and benefits to injured workers.

- Insurance Coverage

Employers typically obtain insurance coverage through insurance carriers authorized to provide Longshore Act coverage. The insurance carrier is responsible for handling claims, providing benefits to injured workers, and ensuring compliance with the requirements of the Longshore Act. They play a crucial role in the claims process and work closely with employers and injured workers to facilitate the provision of benefits and services.

- Dispute Resolution and Legal Assistance

In case of disputes or disagreements regarding a claim, the Longshore Act provides mechanisms for resolving these issues. Initially, efforts are made to reach a voluntary agreement between the injured worker, employer, and insurance carrier. If a resolution cannot be achieved, the case may be referred to an administrative law judge within the Office of Workers’ Compensation Programs (OWCP) for a formal hearing. Parties involved in the claims process have the right to legal representation, and injured workers may seek the assistance of an attorney specializing in Longshore Act cases.

Amendments And Updates To The Longshore Act

- The 1972 Amendments

The Longshore Act underwent significant amendments in 1972 to expand its coverage and enhance benefits for maritime workers. These amendments, commonly known as the 1972 Amendments, extended coverage to include additional categories of workers, such as shipbuilders, ship repairers, and other waterfront workers. The amendments also introduced improvements in disability compensation rates and expanded the scope of medical benefits.

- Recent Developments and Case Studies

Since the 1972 Amendments, the Longshore Act has seen further updates and interpretations through court cases and administrative decisions. Recent developments have focused on addressing specific issues related to coverage, benefits, and the application of the Act to modern maritime industries. These developments continue to shape the implementation and understanding of the Longshore Act, ensuring its relevance in a changing work environment.

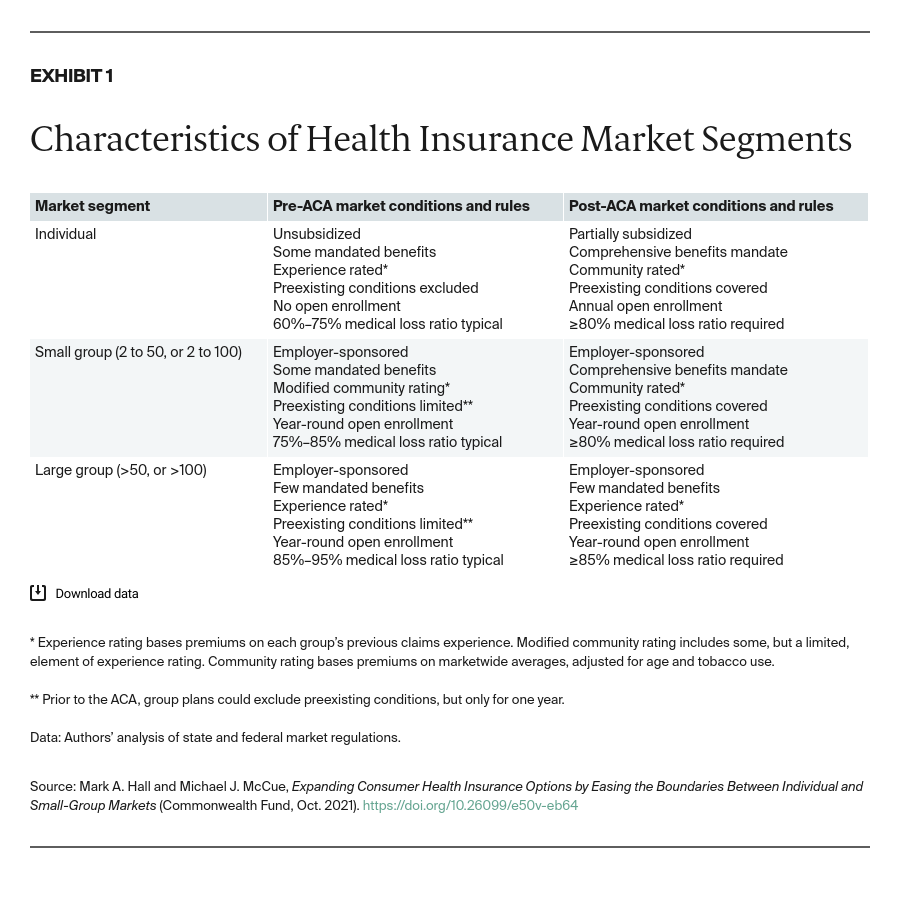

Comparison With State Workers Compensation Laws

While the Longshore Act provides coverage for maritime workers engaged in activities on navigable waters, state workers compensation laws govern injuries and illnesses occurring on land. The Longshore Act is a federal law, and its jurisdiction extends to workers involved in maritime employment across the United States. State workers compensation laws vary by state, and coverage may differ based on the nature of employment and the specific provisions of each state’s legislation.

- Benefits and Differences

State workers compensation laws and the Longshore Act offer similar benefits to injured workers, such as medical treatment and disability compensation. However, there are differences in terms of coverage limits, benefit rates, and eligibility criteria. Maritime workers covered under the Longshore Act may have access to specific benefits tailored to the nature of their work, such as vocational rehabilitation services. Understanding the distinctions between state laws and the Longshore Act is crucial for workers and employers to ensure the appropriate application of benefits.

Challenges And Controversies Surrounding The Longshore Act

- Fraudulent Claims and Abuse

Like any compensation system, the Longshore Act faces challenges related to fraudulent claims and abuse. Some individuals may attempt to exploit the system by filing false or exaggerated claims, leading to increased costs and potential harm to the integrity of the Act. To mitigate these challenges, insurance carriers and employers employ measures to investigate claims thoroughly and detect any fraudulent activity.

- Adequacy of Benefits

Critics of the Longshore Act have raised concerns about the adequacy of benefits provided to injured workers. Some argue that the benefit rates and durations may not adequately compensate workers for their losses and the long-term effects of their injuries. Advocacy groups and legal experts have called for periodic reviews of benefit rates to ensure they remain in line with the evolving needs of injured workers and their families.

- Future Reforms and Improvements

The Longshore Act continues to evolve through legislative amendments, court decisions, and stakeholder discussions. Future reforms and improvements may focus on addressing the challenges and controversies surrounding the Act. These reforms could include measures to strengthen fraud detection and prevention, reassessing benefit rates to ensure adequate compensation, and exploring ways to streamline the claims process for injured workers.

Conclusion

The Longshoremen Harbor Workers Compensation Act (LHWCA) plays a vital role in ensuring the protection and well-being of maritime workers in the United States. By providing compensation and medical benefits to workers injured or fallen ill during the course of their employment, the Act safeguards their rights and supports their recovery. Understanding the purpose, coverage, and benefits of the Longshore Act is crucial for both workers and employers in navigating the claims process and ensuring the proper implementation of the Act’s provisions.

The Longshore Act’s evolution over the years, including the 1972 Amendments and recent developments, reflects the commitment to adapt to the changing needs of the maritime industry. While challenges such as fraudulent claims and concerns about benefit adequacy exist, efforts to address these issues are ongoing. Future reforms and improvements will continue to shape the Longshore Act, enhancing its effectiveness and ensuring the well-being of maritime workers.