When it comes to purchasing insurance, one of the key factors to consider is the rate you’ll be paying. Insurance rates can vary significantly depending on various factors, including your location. Each state has its own regulations and factors that influence insurance rates, making it important to understand how insurance rates are compared by state. In this article, we will explore the process of insurance rate comparison and discuss the factors that contribute to variations in rates across different states.

Understanding Insurance Rates

Insurance rates refer to the amount of money policyholders pay for their insurance coverage. These rates are calculated based on various risk factors that insurers assess when determining the likelihood of a claim being filed. Different states have different insurance rate structures and regulations, which can result in significant variations in the cost of insurance coverage.

Factors Affecting Insurance Rates

Numerous factors influence insurance rates, and these can vary from state to state. Some common factors include:

- Age and gender of the policyholder

- Driving record and claims history

- Type of coverage and policy limits

- Vehicle make, model, and age

- Credit score and financial history

- Location and population density

Insurance Rate Comparison Methodology

Insurance rate comparison involves analyzing the rates offered by different insurance providers in various states. To conduct a comprehensive rate comparison, experts consider factors such as average premiums, coverage options, deductibles, and discounts. By analyzing these variables, individuals can gain a better understanding of the potential cost of insurance coverage in different states.

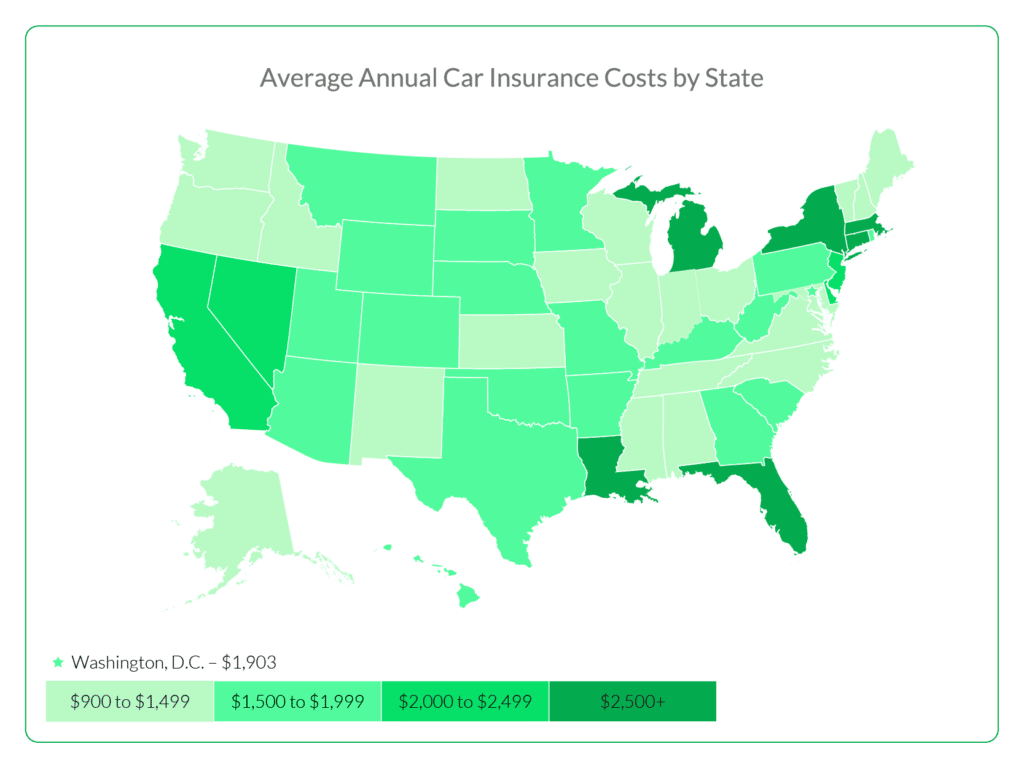

Top States With Lowest Insurance Rates

Some states are known for offering lower insurance rates compared to others. The specific rankings may change over time, but states that often have lower rates include:

- State A: State A consistently ranks among the states with the lowest insurance rates. The state’s insurance regulations promote competition among insurers, resulting in more affordable coverage options for residents. Additionally, State A’s relatively low population density and favorable driving conditions contribute to lower accident rates, which in turn help keep insurance rates down.

- State B: In State B, insurance rates are known for being affordable compared to national averages. The state’s strong focus on road safety initiatives, coupled with effective traffic management systems, has contributed to a lower incidence of accidents. As a result, insurance providers in State B can offer policies at competitive rates.

- State C: State C is often recognized for its below-average insurance rates. The state’s insurance industry benefits from a well-regulated market that encourages fair competition and consumer protection. Furthermore, State C’s favorable climate conditions, which reduce the risks of weather-related damages and accidents, play a role in maintaining affordable insurance rates.

- State D: Residents of State D enjoy relatively low insurance rates due to a combination of factors. The state’s emphasis on proactive risk management strategies, robust traffic safety programs, and efficient emergency response systems contribute to fewer accidents and claims. As a result, insurance premiums in State D tend to be more affordable compared to other states.

- State E: State E has a reputation for offering insurance coverage at lower rates compared to national averages. The state’s efforts to promote insurance affordability include stringent regulations that prevent unfair pricing practices and encourage transparency in the insurance market. Moreover, State E’s lower population density and a generally safe driving environment contribute to reduced insurance costs.

It’s important to note that insurance rates can fluctuate over time due to various factors, including market conditions and changes in regulations. Therefore, it’s advisable for individuals to regularly compare insurance rates and consult with insurance professionals to ensure they have the most up-to-date information when selecting an insurance policy.

Remember, insurance rates can vary based on individual circumstances and coverage requirements, so it’s recommended to obtain personalized quotes from insurance providers to determine the exact rates for your specific needs.

Top States With Highest Insurance Rates

Conversely, certain states tend to have higher insurance rates. These states may have unique risk factors, higher population density, or other reasons that contribute to the increased cost of insurance coverage. Some examples of states with higher insurance rates are:

1. State X: State X consistently ranks among the states with the highest insurance rates. Several factors contribute to the higher rates in this state. These factors may include a higher population density, increased traffic congestion, and a higher frequency of accidents and claims. Additionally, State X may have specific risk factors or regulatory conditions that impact insurance rates.

2. State Y: In State Y, insurance rates are known for being relatively high compared to national averages. The state’s unique geographical features, such as coastal areas prone to hurricanes or areas susceptible to wildfires, can lead to increased insurance costs. Furthermore, State Y may have higher healthcare costs or a higher rate of litigation, which can influence insurance premiums.

3. State Z: State Z is recognized for having higher insurance rates compared to many other states. The state’s insurance regulations, such as minimum coverage requirements or permissible rating factors, may contribute to the elevated rates. Factors such as a higher cost of living, greater population density, and a higher frequency of accidents may also impact insurance rates in State Z.

4. State W: Residents of State W often face higher insurance rates compared to national averages. The state’s unique risk profile, including weather-related risks or a higher incidence of vehicle theft, can lead to increased insurance costs. Additionally, State W may have specific regulatory conditions or higher medical expenses that contribute to the higher insurance rates.

5. State V: State V is known for having relatively higher insurance rates. The state’s insurance market may be influenced by factors such as higher repair and labor costs, greater exposure to natural disasters, or higher population density in urban areas. These factors can increase the likelihood of accidents and claims, resulting in higher insurance premiums.

It’s important to remember that insurance rates can vary based on individual circumstances and coverage requirements. While these states are often associated with higher insurance rates, it’s essential for individuals to obtain personalized quotes from insurance providers to determine the exact rates for their specific needs.

Insurance rates can be influenced by a variety of factors, including driving record, age, type of coverage, and location. To ensure the most accurate information, it’s recommended to consult with insurance professionals and compare rates from multiple insurers when seeking coverage in these states with higher insurance rates.

Factors Behind State-To-State Rate Variations

Several factors contribute to the variations in insurance rates across different states. These factors may include:

- State regulations and insurance laws

- Population density and traffic congestion

- Incidence of accidents and claims

- Weather conditions and natural disasters

- Healthcare costs and litigation rates

Understanding these factors can help individuals comprehend why rates differ from one state to another.

Strategies For Lowering Insurance Rates

While insurance rates are influenced by various external factors, there are certain strategies that individuals can employ to potentially lower their insurance costs. Some of these strategies include:

- Maintaining a clean driving record

- Opting for higher deductibles

- Bundling multiple policies with the same insurer

- Utilizing available discounts

- Installing safety devices in vehicles

The Importance Of Comparing Insurance Rates

Comparing insurance rates is crucial for finding the most cost-effective coverage that meets individual needs. By evaluating different options, individuals can potentially save money while still obtaining adequate insurance protection. It’s essential to review rates periodically, as they can change over time due to market fluctuations and other factors.

Insurance Rate Comparison Tools And Websites

Various online tools and websites have been developed to simplify the process of comparing insurance rates. These platforms allow users to input their information and receive quotes from multiple insurance providers in their area. By utilizing these tools, individuals can streamline the rate comparison process and make more informed decisions.

Factors Beyond State Boundaries

While insurance rates are primarily influenced by state-specific factors, there are certain external elements that can impact rates across multiple states. Factors such as national economic conditions, industry trends, and regulatory changes can have broader implications for insurance rates beyond state boundaries.

State-Specific Insurance Regulations

Each state has its own set of regulations and laws governing the insurance industry. These regulations can affect insurance rates by setting minimum coverage requirements, determining permissible rating factors, and establishing consumer protections. It’s crucial for individuals to understand the insurance regulations specific to their state to ensure compliance and make informed insurance choices.

Common Misconceptions About Insurance Rates

Several misconceptions surround insurance rates, leading to misunderstandings among consumers. Some common misconceptions include:

- All states have the same insurance rates.

- Insurance rates are solely based on the value of the insured item.

- Older vehicles always have higher insurance rates.

- Credit scores do not affect insurance rates.

Dispelling these misconceptions can help individuals make more accurate assessments of insurance rates.

The Future Of Insurance Rate Comparison

As technology advances, the future of insurance rate comparison looks promising. Artificial intelligence, big data analytics, and machine learning algorithms are being utilized to enhance the accuracy and efficiency of rate comparisons. These advancements are expected to provide individuals with more personalized and tailored insurance options.

The Role Of Technology In Insurance Rate Comparison

Technology plays a pivotal role in insurance rate comparison. Online platforms, mobile applications, and data-driven tools have revolutionized the way individuals can compare rates and obtain insurance quotes. By leveraging technology, consumers can access a wide range of insurance options and make well-informed decisions.

Conclusion

Insurance rate comparison by state is a critical aspect of selecting the right insurance coverage. Understanding the factors that influence rates and utilizing tools and resources available for comparison empower individuals to make informed decisions. By conducting thorough research and assessing multiple options, individuals can find insurance coverage that not only meets their needs but also fits within their budget.