Investing in the stock market has become increasingly popular, and many individuals are considering entering this realm to grow their wealth. If you’re new to investing, you might wonder whether you need a brokerage account to buy stocks. In this article, we’ll explore the importance of a brokerage account, its benefits, and how you can get started in the world of stock investing.

Investing in stocks offers an opportunity to participate in the growth and success of companies. However, to engage in stock trading, a brokerage account is typically required. This account serves as a bridge between you and the stock market, facilitating the buying and selling of stocks.

What Is A Brokerage Account?

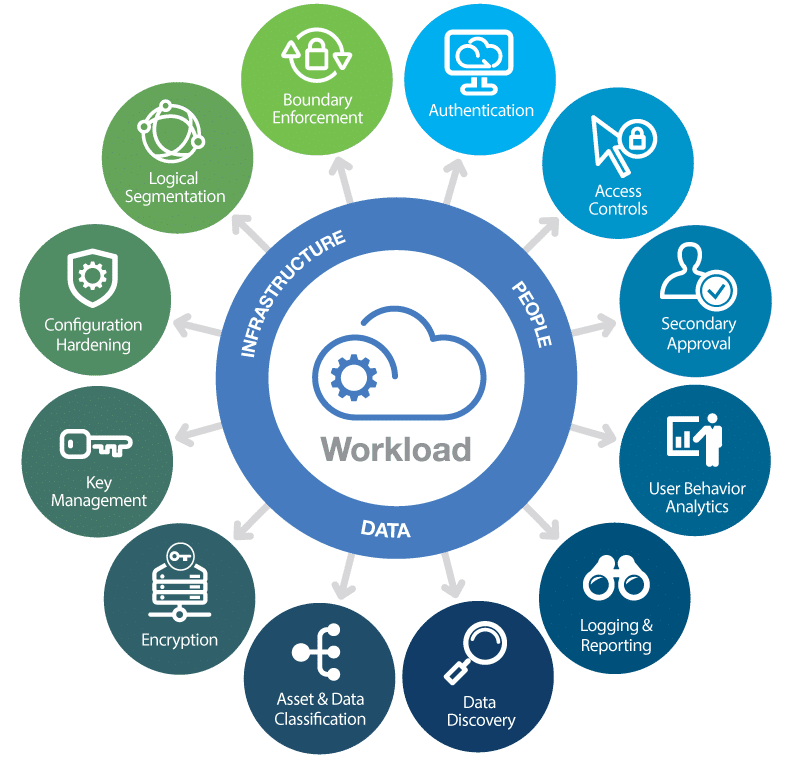

A brokerage account is a type of financial account that allows you to buy and sell various securities, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). It acts as an intermediary between you, as the investor, and the financial markets where these securities are traded.

The Role Of A Brokerage Account

The primary role of a brokerage account is to provide you with a platform to execute your investment transactions. It acts as a custodian for your investments, holding your securities and keeping them secure. Additionally, brokerage accounts offer tools and resources for market research, analysis, and portfolio management.

Benefits Of Having A Brokerage Account

Having a brokerage account offers several benefits for investors:

a) Access to Financial Markets: A brokerage account grants you access to a wide range of financial markets, including stocks, bonds, and other investment opportunities.

b) Ease of Trading: With a brokerage account, you can buy and sell securities with relative ease. The account acts as a hub for executing your trades efficiently.

c) Portfolio Management: Many brokerage accounts provide tools and resources to manage your investment portfolio effectively. You can monitor your holdings, track performance, and make informed decisions.

d) Expertise and Advice: Some brokerage firms offer advisory services, providing expert advice and recommendations tailored to your investment goals and risk tolerance.

Opening A Brokerage Account

To open a brokerage account, you need to follow a few simple steps:

a) Research and Choose a Broker: Start by researching different brokerage firms and comparing their offerings, fees, and customer reviews.

b) Complete the Application: Once you’ve chosen a brokerage firm, visit their website or contact their customer service to begin the account opening process. You’ll need to provide personal information, such as your name, address, social security number, and employment details.

c) Review and Agree to Terms: Carefully review the terms and conditions of the brokerage firm, including any fees associated with the account. Ensure you understand the brokerage’s policies regarding trading, account maintenance, and customer support.

d) Fund Your Account: After your application is approved, you’ll need to deposit funds into your brokerage account. Most brokerage firms offer various funding options, such as bank transfers or wire transfers.

e) Verify Your Identity: As part of the account opening process, you may be required to verify your identity. This could involve providing copies of your identification documents, such as a driver’s license or passport.

f) Start Investing: Once your account is funded and your identity is verified, you’re ready to start investing in stocks and other securities through your brokerage account.

Types Of Brokerage Accounts

There are different types of brokerage accounts available, each catering to different investor needs. Here are three common types:

- Full-Service Brokerage Account

A full-service brokerage account provides a wide range of investment services and personalized advice. These brokers often have dedicated financial advisors who guide you through investment decisions, offer research reports, and provide tailored investment strategies. However, full-service accounts generally have higher fees compared to other types of brokerage accounts.

- Discount Brokerage Account

Discount brokerage accounts offer self-directed investing without the personalized advice provided by full-service brokers. These accounts typically have lower fees and allow investors to trade stocks and other securities independently. Discount brokers often provide online platforms and tools for research and trading.

- Online Brokerage Account

Online brokerage accounts have gained popularity due to their convenience and accessibility. These accounts are primarily managed online, allowing investors to trade securities through web-based or mobile platforms. Online brokers often offer competitive pricing, a wide range of investment options, and user-friendly interfaces.

Choosing The Right Brokerage Account For You

When selecting a brokerage account, consider your investment goals, risk tolerance, trading preferences, and the services provided by different brokers. It’s essential to evaluate factors such as fees, account minimums, customer support, research resources, and the quality of the trading platform.

Funding Your Brokerage Account

To buy stocks through your brokerage account, you’ll need to fund it with sufficient capital. This can be done by transferring funds from your bank account to your brokerage account. Most brokerage firms provide clear instructions and multiple funding options to make this process seamless.

Buying Stocks Through A Brokerage Account

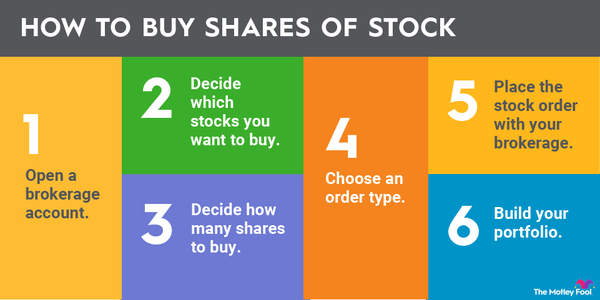

Once your brokerage account is funded, you can start buying stocks. Here’s a simplified process:

a) Research and Analysis: Conduct thorough research on the stocks you’re interested in purchasing. Consider factors such as the company’s financial health, performance, industry trends, and any news or events that may impact the stock’s value.

b) Placing a Trade: Log into your brokerage account and navigate to the trading platform. Enter the stock’s ticker symbol and specify the number of shares you wish to buy. Review the order details and submit the trade.

c) Monitoring and Managing: After purchasing stocks, monitor your portfolio regularly. Stay informed about market trends, news, and any corporate announcements related to your holdings. Consider setting up stop-loss orders or trailing stops to manage risk.

Cost Of Opening A Brokerage Account

The minimum required amount to open a brokerage account varies depending on the brokerage firm. It can range from a few hundred dollars to several thousand dollars. Some brokers also offer no minimum balance options.

Key Considerations When Investing

When investing in stocks or any other securities, it’s crucial to keep the following factors in mind when making investment decisions:

Research and Due Diligence

Thoroughly research and analyze the companies or securities you’re considering investing in. Understand their financials, market position, competitive landscape, and growth prospects. This information will help you make informed investment decisions.

Diversification

Diversify your investment portfolio by allocating your funds across different sectors, industries, and asset classes. Diversification can help mitigate risk by reducing the impact of any single investment’s performance on your overall portfolio.

Risk Management

Understand and manage the risks associated with investing. Every investment carries some level of risk, and it’s important to assess your risk tolerance and establish risk management strategies that align with your financial goals.

Long-Term Perspective

Adopt a long-term perspective when investing in stocks. The stock market can be volatile in the short term, but historically, it has shown positive returns over the long run. Avoid making impulsive decisions based on short-term market fluctuations.

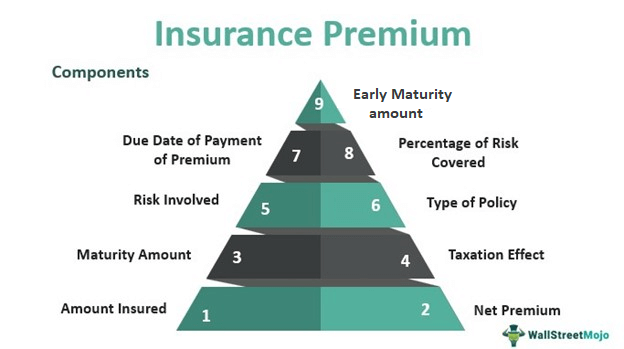

Tax Implications of Investing

It’s essential to consider the tax implications of your investments. Different countries have varying tax rules and regulations regarding investment income, capital gains, and dividends. Consult with a tax professional to understand how your investments may impact your tax obligations.

Conclusion

In conclusion, while it’s not mandatory to have a brokerage account to buy stocks, it is the most common and convenient way for individual investors to enter the stock market. A brokerage account provides access to financial markets, facilitates trading, and offers valuable resources for investors. By choosing the right brokerage account, conducting thorough research, and considering key investment factors, you can embark on your stock market journey with confidence.