When it comes to owning a car, having the right insurance is crucial. Car insurance provides financial protection in case of accidents, damages, or theft. However, finding affordable car insurance that meets your needs can be a daunting task.

In this article, we will explore the topic of the cheapest car insurance in Austin, Texas. We will discuss key factors to consider, tips for obtaining affordable rates, and provide recommendations to help you secure the best coverage without breaking the bank.

What Is Car Insurance?

Car insurance is a contract between you and an insurance provider that protects you financially in the event of an accident, theft, or damages to your vehicle. It typically consists of different coverage types, such as liability, collision, and comprehensive, which offer varying degrees of protection.

- Insurance: Understanding The Basics And Making Informed Decisions

- Definition Of Collision Insurance: Protecting Your Vehicle From Accidents

Types Of Car Insurance Coverage

1. Liability Coverage: This coverage pays for damages and injuries you cause to others in an accident. In taxas this type of insurance is legally approved by the government because of its ability to cover for expenses like medical bills, burial expenses if the victime died as a result of the accident, lost wages, and some reparation money for either the vehicle that was damaged or the property.

2. Collision Coverage: It covers the repairs or replacement of your vehicle in case of a collision. That is expenses you incurred in an accident with a car you have not finished paying for. This type of insurance pays either the amount of money you have in your insurance declaration page or pays out the actual value of your car during repair or replacement.

3. Comprehensive Coverage: This coverage protects against non-collision incidents like theft, vandalism, or natural disasters. The collision coverage have some similarities with this coverage but it major aim is on covering the cost of your car repairs or replacing it.

4. Uninsured/Underinsured Motorist coverage – This type of insurance coverage pays out money for damages that are bodily injuries like lost of eyes and property damage. if you’re in an accident caused by a driver who doesn’t have insurance this type inusrance will cover you. Although Texas law requires insurance, but some drivers ignores it but with this type of insurance you will be covered.

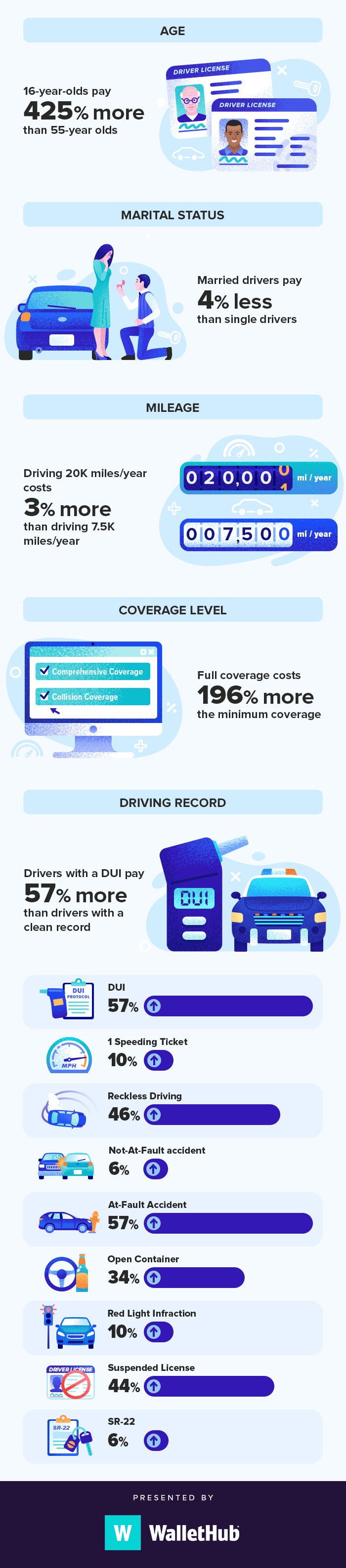

Factors That Affect Car Insurance Rates

To determine car insurance rates, insurance companies consider several factors. Understanding these factors can help you find affordable options that suit your circumstances.

- Age and Driving Experience

Younger and inexperienced drivers often face higher insurance premiums due to their higher risk of accidents. As you gain more driving experience and maintain a clean record, your rates may decrease. - Vehicle Type and Model

The make, model, and age of your vehicle play a significant role in insurance pricing. Expensive or high-performance cars usually have higher insurance costs due to increased repair and replacement expenses. - Driving Record and Claims History

Having a history of accidents, traffic violations, or previous insurance claims can increase your insurance rates. Maintaining a clean driving record demonstrates responsible behavior and may lead to lower premiums. - Credit Score

In many states, including Texas, insurance companies use credit scores to assess the risk profile of policyholders. Maintaining a good credit score can positively impact your insurance rates. - Location

Where you live affects car insurance rates. Urban areas with higher traffic volumes and crime rates may result in higher premiums compared to rural areas.

How To Find Affordable Car Insurance In Austin

Finding affordable car insurance in Austin requires some research and consideration. Here are some effective strategies to help you secure the best rates:

- Shop Around and Compare Quotes

Don’t settle for the first insurance provider you come across. Take the time to shop around and obtain quotes from multiple companies. Compare the coverage options, deductibles, and premiums to find the most cost-effective policy that suits your needs. - Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. However, ensure that you can afford the deductible amount in case of an accident or claim. - Opt for Bundled Policies

Consider bundling your car insurance with other policies, such as homeowner’s or renter’s insurance, to take advantage of multi-policy discounts offered by insurance companies. - Maintain a Good Credit Score

A good credit score not only benefits your financial health but can also help reduce your car insurance rates. Pay your bills on time, keep your credit utilization low, and regularly monitor your credit report for accuracy. - Take Advantage of Discounts

Insurance companies offer various discounts that can significantly reduce your premiums. These discounts may include safe driver discounts, discounts for completing defensive driving courses, low-mileage discounts, and discounts for certain professions or affiliations. Inquire about available discounts and take advantage of them to lower your costs.

Recommended Car Insurance Companies In Austin

When searching for the cheapest car insurance in Austin, consider these reputable companies:

- Company A: Competitive Rates and Excellent Customer Service

Company A offers affordable car insurance rates while maintaining a strong focus on customer satisfaction. They provide customizable coverage options and have a reputation for efficient claims processing. - Company B: Tailored Coverage Options for Every Budget

Company B understands the diverse needs and budgets of drivers in Austin. They offer a range of coverage options and work closely with customers to find policies that fit their requirements without breaking the bank. - Company C: Specialized Insurance for High-Risk Drivers

If you have a less-than-perfect driving record or fall into the high-risk category, Company C specializes in providing insurance solutions for drivers in these situations. They offer competitive rates and strive to find coverage options that meet the needs of high-risk drivers.

What Are The Minimum Car Insurance Requirements In Austin, Texas?

In Austin, Texas, drivers are required to have at least the minimum liability coverage of 30/60/25. This means $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage. With this your car insurance in Austin is assured, provided you meet up with this demands required by the insurance company. Both you, your car and your passenger are covered dependeing on the type you requested for.

Conclusion

Securing affordable car insurance in Austin is possible with careful consideration and research. By understanding the factors that affect insurance rates, comparing quotes, and taking advantage of available discounts, you can find the best coverage that fits your budget and provides the necessary protection. Remember to review your policy periodically and make adjustments as needed to ensure you continue to have the most cost-effective coverage.

Read Also: