Car insurance nerdwallet is a crucial component of responsible car ownership. Whether you’re a seasoned driver or a new car owner, understanding the ins and outs of car insurance is essential. In this comprehensive guide, we will delve into the world of car insurance, covering the basics, different types of coverage, factors that affect insurance rates, money-saving tips, and how to choose the right car insurance provider.

What Is Car Insurance?

Car insurance is a contract between a car owner and an insurance company that provides financial protection in the event of accidents, theft, or damage to the insured vehicle. It offers coverage for bodily injury liability, property damage liability, medical payments, collision, comprehensive, and uninsured/underinsured motorist coverage.

Why Is Car Insurance Important?

Car insurance is important for several reasons. Firstly, it is a legal requirement in most states, ensuring that drivers are financially responsible for their actions on the road. Additionally, car insurance protects you from potential financial hardships resulting from accidents, injuries, or property damage. It offers peace of mind knowing that you are protected against unforeseen circumstances.

Types Of Car Insurance Coverage

- Liability Coverage: Liability coverage protects you from legal liabilities if you cause an accident that results in bodily injury or property damage to others. It includes bodily injury liability (BIL) and property damage liability (PDL) coverage.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle in case of a collision with another vehicle or object, regardless of who is at fault. It covers damages to your car caused by accidents.

- Comprehensive Coverage: Comprehensive coverage provides protection for damages to your vehicle caused by events other than collisions. This includes theft, vandalism, natural disasters, and falling objects.

- Personal Injury Protection (PIP): Personal Injury Protection (PIP) coverage covers medical expenses, lost wages, and other related expenses for you and your passengers, regardless of fault, in the event of an accident.

- Uninsured/Underinsured Motorist Coverage: Uninsured/Underinsured Motorist coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage to pay for the damages.

Difference Between Comprehensive And Collision Coverage

Comprehensive and collision coverage are two different types of car insurance coverage that protect your vehicle against different types of risks. Here’s the difference between the two:

1. Comprehensive Coverage: Comprehensive coverage provides protection for damages to your vehicle that are not caused by a collision with another vehicle or object. It typically covers events such as theft, vandalism, fire, natural disasters (like storms or floods), falling objects, and animal collisions.

Comprehensive coverage is optional but may be required if you have a car loan or lease. It helps repair or replace your vehicle if it is damaged or stolen due to covered events. However, it does not cover damages resulting from collisions with other vehicles or objects.

2. Collision Coverage: Collision coverage, on the other hand, covers damages to your vehicle caused by a collision with another vehicle or object, regardless of who is at fault. It helps repair or replace your vehicle if it is damaged in an accident.

Collision coverage is also optional but may be required if you have a car loan or lease. It provides coverage for repairs or replacement of your vehicle, regardless of the cause of the collision. This includes accidents with other vehicles, collisions with stationary objects (like a tree or a fence), or rollovers.

comprehensive coverage protects against non-collision-related damages, such as theft, vandalism, or natural disasters, while collision coverage specifically covers damages resulting from collisions with other vehicles or objects. It’s important to note that both coverages typically have deductibles, which are the amounts you must pay out of pocket before your insurance coverage kicks in.

To ensure adequate protection for your vehicle, you may choose to have both comprehensive and collision coverage. However, the specific coverage options and limits may vary depending on your insurance policy and provider. It’s recommended to review your policy and consult with your insurance agent to understand the extent of coverage provided by each type and determine the best coverage options for your needs.

Factors Affecting Car Insurance Rates

Several factors can affect your car insurance rates. It’s essential to understand these factors to get an accurate estimate and find ways to potentially reduce your premiums.

- Age and Driving Experience: Young and inexperienced drivers typically pay higher premiums due to the higher risk associated with their age group. As you gain more driving experience and maintain a clean driving record, your rates may decrease.

- Vehicle Type and Model: The type of vehicle you drive plays a significant role in determining your insurance rates. Expensive or high-performance cars usually have higher insurance costs compared to more affordable and family-oriented vehicles.

- Location: Your location can impact your car insurance rates. Areas with higher crime rates or higher accident rates may result in higher premiums due to the increased risk.

- Driving Record: A clean driving record with no history of accidents or traffic violations can help lower your insurance rates. On the other hand, a history of accidents or traffic violations may increase your premiums.

- Credit Score: In some states, insurance companies consider credit scores when determining insurance rates. A good credit score can help lower your premiums, as it is seen as an indicator of financial responsibility.

How To Save Money On Car Insurance

Car insurance premiums can vary significantly between providers. Here are some tips to help you save money on your car insurance:

- Compare Quotes from Multiple Providers: Obtain quotes from different insurance providers to compare rates and coverage options. This allows you to find the best value for your specific needs.

- Opt for Higher Deductibles: Choosing higher deductibles can lower your premiums. However, make sure you can afford to pay the deductible amount in case of a claim.

- Bundle Your Policies: Consider bundling your car insurance with other policies, such as homeowner’s insurance, to take advantage of multi-policy discounts offered by many insurance companies.

- Take Advantage of Discounts: Insurance companies offer various discounts, such as safe driver discounts, good student discounts, and discounts for installing safety features in your vehicle. Ask your insurance provider about the available discounts.

How To File A Car Insurance Claim

To file a car insurance claim, follow these steps:

1. Contact Your Insurance Provider: Notify your insurance company as soon as possible after the incident. Most insurance companies have dedicated claims departments and hotlines to report accidents or damages.

2. Gather Information: Collect all the necessary information related to the incident. This may include the date, time, and location of the accident, details of the other parties involved (if applicable), and any relevant documentation such as police reports or photographs.

3. Provide Accurate Details: When reporting the claim, provide accurate and detailed information about the incident. Describe what happened to the best of your knowledge and include any relevant facts or circumstances that may support your claim.

4. Cooperate with the Investigation: Your insurance company may initiate an investigation to assess the validity of your claim. Cooperate fully with the claims adjuster assigned to your case. Answer their questions truthfully and provide any additional information or documentation they request.

5. Obtain Repair Estimates: If your vehicle requires repairs, obtain repair estimates from authorized repair shops or mechanics. Provide these estimates to your insurance company for evaluation.

6. Follow the Claims Process: Your insurance company will guide you through the claims process. They will inform you about the required documentation, such as completed claim forms and any supporting evidence. Follow their instructions closely and submit the necessary paperwork within the specified timeframe.

7. Keep Records: Maintain copies of all the documents related to your claim, including claim forms, correspondence with the insurance company, repair estimates, and any receipts or invoices for expenses incurred as a result of the incident.

8. Resolution of the Claim: Once the investigation is complete and all required documents are submitted, your insurance company will evaluate the claim and determine the appropriate settlement. They will communicate their decision to you and provide instructions on how to proceed.

Remember, it’s crucial to promptly report any accidents or damages to your insurance company to initiate the claims process. By providing accurate and complete information, cooperating with the investigation, and following the instructions of your insurance provider, you can ensure a smoother and more efficient claims experience.

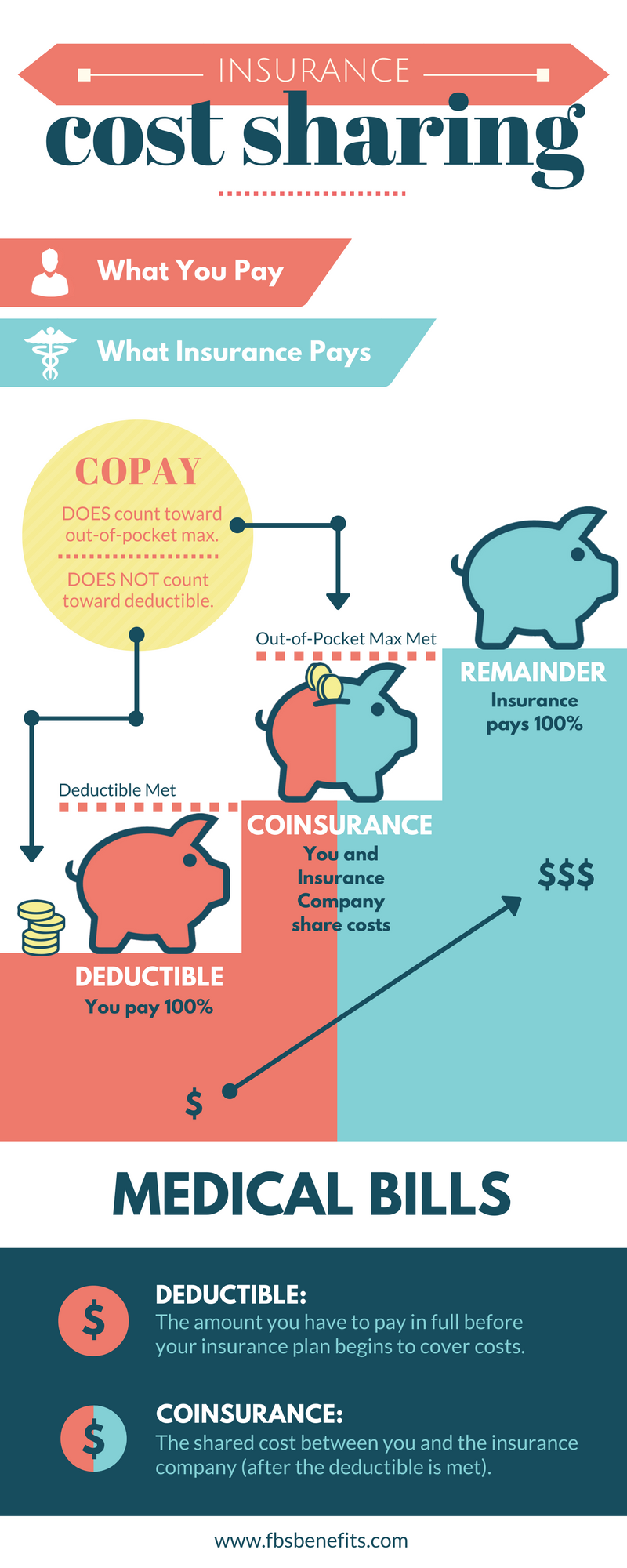

What Is A Deductible?

A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and file a claim for $2,000 in damages, you would pay $500, and your insurance would cover the remaining $1,500.

How Do Deductibles Work?

Deductibles help reduce insurance fraud and allow policyholders to take on a portion of the risk. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums.

Choosing The Right Deductible Amount

When choosing a deductible amount, consider your financial situation and the potential out-of-pocket expenses in case of an accident. Ensure that you can comfortably afford the deductible without causing significant financial strain.

Tips For Choosing The Right Car Insurance NerdWallet

When selecting a car insurance provider, consider the following factors:

- Research the Company’s Reputation

Look for insurance companies with a solid reputation for customer satisfaction, financial stability, and prompt claims processing. Check online reviews and ratings from reputable sources.

- Check Financial Strength and Stability

Ensure that the insurance company has the financial strength to fulfill its obligations in case of a claim. Independent rating agencies, such

- Evaluate Customer Service

Consider the level of customer service provided by the insurance company. Check if they offer 24/7 customer support, easy claim filing processes, and efficient communication channels.

- Review Policy Coverage Options

Examine the coverage options offered by the insurance company. Ensure that they provide the specific coverage types and limits that meet your needs.

- Compare Premium Rates

Obtain quotes from multiple insurance providers and compare their premium rates. However, remember that the cheapest option may not always provide the best coverage. Balance affordability with the quality of coverage and customer service.

Conclusion

Car insurance is a vital aspect of protecting yourself and your vehicle on the road. Understanding the basics, different coverage types, factors affecting insurance rates, and how to save money can help you make informed decisions when selecting a car insurance policy. By following the tips outlined in this guide and conducting thorough research, you can find the right car insurance provider that meets your needs and provides the necessary coverage at a competitive rate.