Car insurance is a crucial component of responsible car ownership. It provides financial protection in case of accidents, damages, or theft. Understanding how car insurance works is essential for every driver. In this article, we will delve into the world of car insurance, discussing its different types, the process of obtaining it, and how to make a claim when needed.

Understanding Car Insurance

Car insurance is a contract between the policyholder and the insurance company, where the policyholder pays a premium in exchange for coverage against specific risks. The insurance company agrees to bear the financial burden in case of covered events. It’s important to note that the terms and conditions of car insurance can vary between providers and policies.

Types Of Car Insurance Coverage

There are several types of car insurance coverage available, each offering different levels of protection:

1. Liability Insurance: This type of insurance covers damages caused to others in an accident where you are at fault. It includes both bodily injury liability (medical expenses, lost wages, and legal fees) and property damage liability (vehicle repairs, damaged property, and legal fees).

2. Collision Insurance: Collision insurance covers repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

3. Comprehensive Insurance: Comprehensive insurance provides coverage for damages to your vehicle caused by non-collision events, such as theft, vandalism, natural disasters, or falling objects.

4. Personal Injury Protection (PIP): PIP insurance covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault.

5. Uninsured/Underinsured Motorist Coverage: This type of coverage protects you if you are involved in an accident with a driver who doesn’t have insurance or has insufficient coverage to pay for damages.

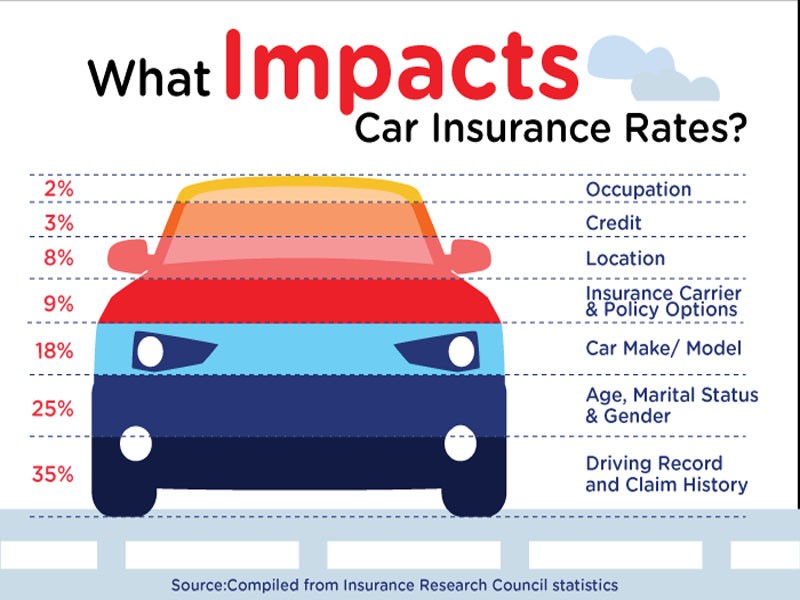

Factors Affecting Car Insurance Rates

When determining car insurance rates, insurance companies consider various factors that help assess the level of risk associated with the policyholder. Common factors affecting car insurance rates include:

- Driving Record: A clean driving record with no accidents or traffic violations usually leads to lower insurance rates.

- Age and Gender: Younger drivers and male drivers tend to have higher insurance rates due to statistical risk factors.

- Location: Insurance rates can vary based on your location. Areas with higher crime rates or higher instances of accidents may have higher premiums.

- Vehicle Type: The make, model, and year of your vehicle can affect insurance rates. Expensive or high-performance cars generally have higher premiums.

- Coverage and Deductibles: The amount of coverage you choose and the deductibles you opt for can impact your insurance rates. Higher coverage limits and lower deductibles typically result in higher premiums.

- Credit History: Some insurance companies consider credit history when determining rates. Those with better credit scores may receive lower premiums.

- Annual Mileage: The number of miles you drive annually can affect your insurance rates. Higher mileage generally leads to higher premiums.

- Marital Status: Married individuals often receive lower insurance rates compared to single individuals.

- Discounts: Insurance companies offer various discounts, such as safe driver discounts, multi-policy discounts, or discounts for certain safety features in your vehicle.

Understanding these factors can help you navigate the car insurance landscape and make informed decisions when choosing coverage.

The Process Of Obtaining Car Insurance

Obtaining car insurance involves several steps. Let’s explore the process in detail:

- Researching and Comparing Insurance Providers

Start by researching different insurance providers. Look for reputable companies with a strong financial standing and positive customer reviews. Consider factors such as coverage options, customer service, and the ease of filing claims.

- Getting Quotes

Request quotes from multiple insurance providers. Provide accurate information about yourself, your vehicle, and your driving history to ensure the quotes are as precise as possible. Compare the quotes to find the best coverage at an affordable price.

- Choosing the Right Coverage

Based on your needs, consider the different types of coverage available and select the ones that best suit your requirements. Remember to comply with any legal requirements regarding minimum coverage.

- Applying for Car Insurance

Once you’ve chosen a provider and coverage, complete the application process. Provide the necessary information, such as personal details, vehicle information, and driving history.

After your application is approved, you’ll be required to pay premiums. Premiums can typically be paid in monthly, quarterly, or annual installments. Choose the payment option that works best for you.

- Making a Car Insurance Claim

When unfortunate events occur, and you need to make a car insurance claim, follow these steps:

Reporting An Accident Or Damage

Contact your insurance company as soon as possible to report any accidents, damages, or thefts. Provide them with accurate details of the incident and any relevant documentation, such as police reports or photographs.

- Working with the Insurance Company

Work closely with your insurance company to navigate the claims process. They may require additional information or documentation to evaluate your claim thoroughly.

- Evaluation and Settlement

The insurance company will assess the damages, evaluate the claim, and determine the coverage applicable. Once the evaluation is complete, they will provide a settlement amount based on the terms of your policy. If you agree with the settlement, the insurance company will compensate you accordingly.

Conclusion

Car insurance is a vital aspect of responsible car ownership. It provides financial protection in case of accidents, damages, or theft. By understanding the different types of coverage, the process of obtaining insurance, and how to make a claim, you can make informed decisions and safeguard your vehicle and yourself from potential risks.