As a small business owner, you understand the importance of efficient financial management. Account and payroll software can greatly simplify your financial processes, saving you time and effort. These software solutions automate tasks, such as bookkeeping, invoicing, and payroll calculations, allowing you to focus on growing your business.

Are you a small business owner looking for the best account and payroll software to streamline your financial operations? Managing finances and payroll can be a daunting task, especially when you have limited resources and time. Fortunately, there are numerous software solutions available in the market that cater specifically to the needs of small businesses. In this article, we will explore some of the best account and payroll software options that can help you efficiently manage your finances and payroll processes. So, let’s dive in!

The Importance Of Account And Payroll Software For Small Businesses

Managing accounts and payroll manually can be prone to errors and time-consuming. Account and payroll software provide accurate and reliable calculations, reducing the chances of mistakes. Moreover, these software solutions generate reports and financial statements, providing you with valuable insights into your business’s financial health.

Key Features To Consider

When choosing account and payroll software for your small business, it’s essential to consider certain key features. These features include:

- Invoicing: Look for software that allows you to create professional invoices and automate the invoicing process.

- Expense Tracking: The software should enable you to track and categorize expenses easily.

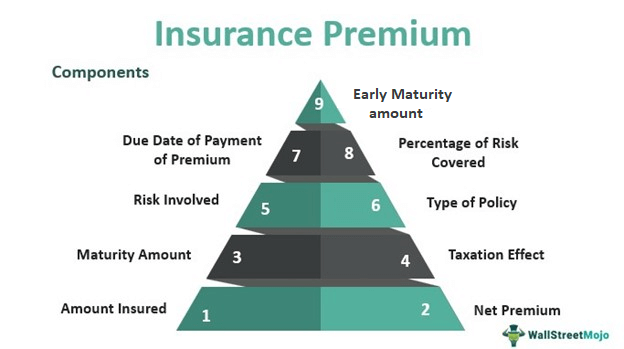

- Payroll Management: Ensure the software offers comprehensive payroll management capabilities, including tax calculations, direct deposit, and employee benefits administration.

- Reporting and Analytics: Look for software that provides detailed reports and analytics to help you make informed financial decisions.

- Integration: Consider software that integrates with other tools you use, such as customer relationship management (CRM) or point-of-sale (POS) systems.

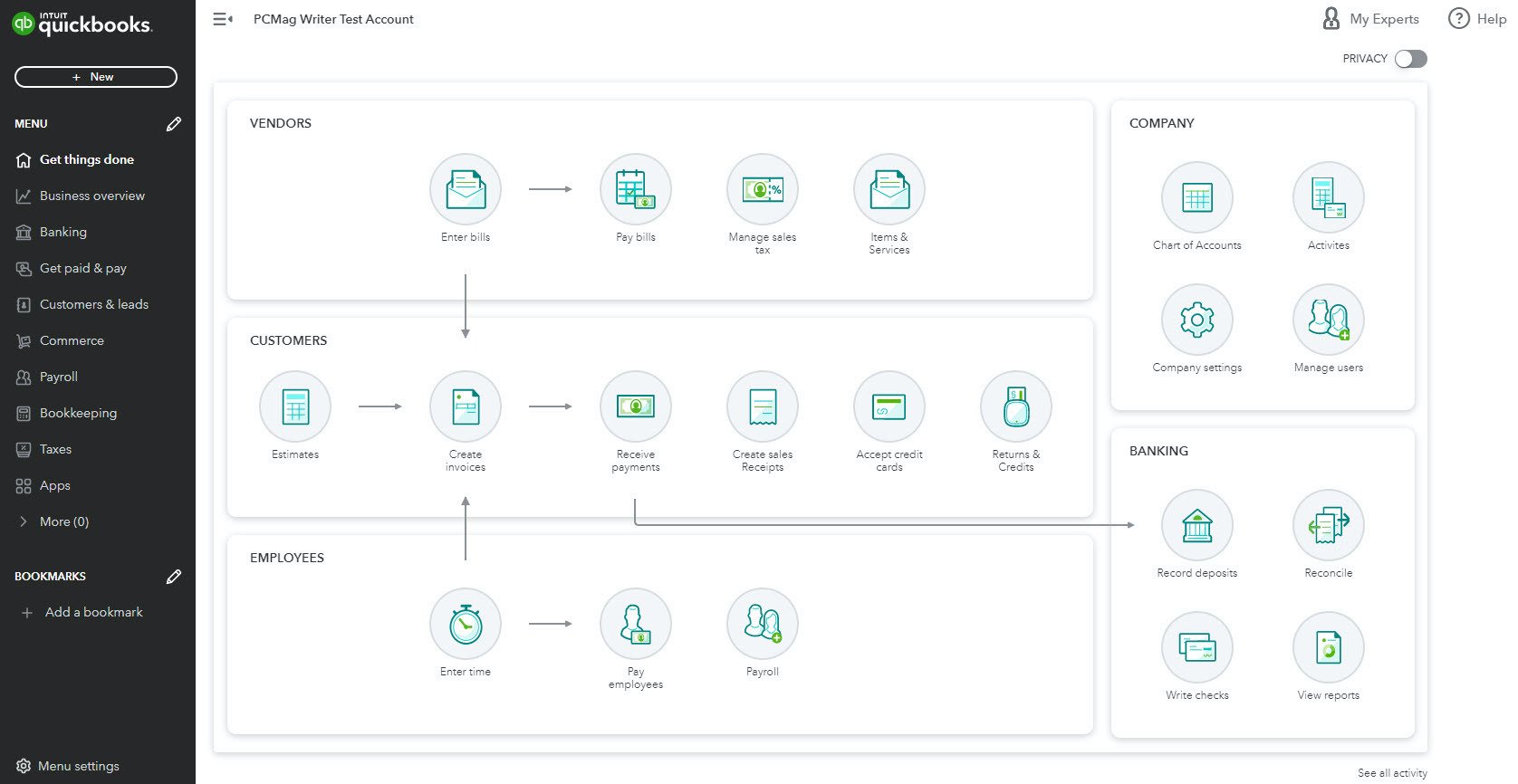

- User-Friendly Interface: Opt for software with an intuitive and user-friendly interface, making it easy for you and your team to navigate and use effectively.

Top Account And Payroll Software For Small Business

Let’s now explore some of the top account and payroll software options available for small businesses:

- Software A

Software A is a comprehensive accounting and payroll solution designed specifically for small businesses. It offers a user-friendly interface and a wide range of features, including invoicing, expense tracking, payroll management, and financial reporting. With its intuitive dashboard, you can easily monitor your business’s financial health and make data-driven decisions.

- Software B

Software B is a cloud-based accounting and payroll software that provides small businesses with a robust set of features. It offers automated invoicing, expense tracking, and payroll management. With Software B, you can easily reconcile bank transactions, generate financial reports, and track employee time and attendance. Its mobile-friendly interface allows you to access your financial data on the go.

- Software C

Software C is an all-in-one accounting and payroll solution designed for small businesses. It offers features such as invoicing, expense tracking, inventory management, and payroll processing. With Software C, you can automate recurring transactions, handle multiple currencies, and generate detailed financial reports. Its user-friendly interface makes it suitable for small business owners with limited accounting knowledge.

- Software D

Software D is a popular choice among small businesses for its simplicity and affordability. It provides basic accounting and payroll functionalities, including invoicing, expense tracking, and payroll calculations. While it may not have advanced features like some other software options, Software D is ideal for small businesses with straightforward financial needs and a tight budget.

Comparison Of Software Features And Pricing

Here’s a comparison of the key features and pricing of the account and payroll software mentioned above:

| Software | Key feature | Pricing |

| Software A | Invoicing, expense tracking, payroll management, financial reporting | Starting at $XX/month |

| Software B | Automated invoicing, expense tracking, payroll management, mobile accessibility | Starting at $XX/month |

| Software C | Invoicing, expense tracking, inventory management, payroll processing | Starting at $XX/month |

| Software D | Basic accounting and payroll functionalities | Starting at $XX/month |

Please note that pricing may vary depending on the software provider and additional features included in each package. It’s advisable to visit the respective websites or contact the software providers for detailed pricing information.

Factors To Consider When Choosing Account And Payroll Software

When selecting account and payroll software for your small business, keep the following factors in mind:

- Scalability

Choose software that can scale with your business as it grows. Ensure it can accommodate increased transaction volumes, additional employees, and expanded reporting needs.

- Ease of Use

Opt for software that has a user-friendly interface and intuitive navigation. This will save you time and minimize the learning curve for you and your team.

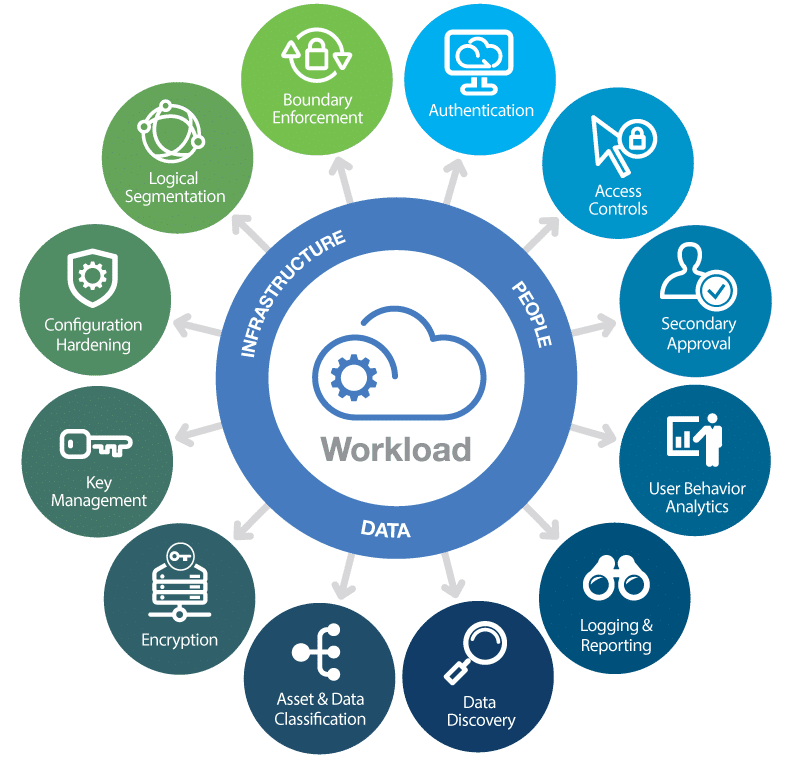

- Integration with Other Systems

Consider software that integrates seamlessly with other tools you use, such as CRM, POS, or e-commerce platforms. Integration simplifies data transfer and eliminates the need for manual entry.

- Customer Support

Check the availability and quality of customer support provided by the software vendor. Prompt and helpful support can make a significant difference when you encounter issues or have questions.

Kind Of Support Can I Expect From The Software Provider

Software providers typically offer customer support, which may include phone, email, or chat assistance. Some providers may also provide online documentation, tutorials, or a knowledge base to help you troubleshoot common issues or learn how to use the software effectively. Consider the level of support that suits your needs when selecting a software provider.

Remember, choosing the right account and payroll software for your small business can have a significant impact on your financial management processes. Evaluate your requirements, compare features and pricing, and consider factors such as scalability, ease of use, integration, and customer support to make an informed decision.

Conclusion

In conclusion, selecting the right account and payroll software is crucial for small businesses to manage their finances efficiently. Consider your specific needs, budget, and growth plans when evaluating different software options. By automating tasks, tracking expenses, and generating accurate reports, account and payroll software can simplify your financial processes and allow you to focus on growing your business.