Are Churches Tax Exempt In Europe? YES. Churches in Europe are exempt from paying taxes, at least for the time being. This is due to a loophole in the European Union’s VAT (value-added tax) regulations, which churches have exploited for years. Now that the VAT regulations are changing, churches across the continent are scrambling to come up with a new tax plan.

If they can’t find a way to comply, they may have to close their doors or reduce services. Regardless of whether or not your church survives this fiscal crisis, it’s important to understand how it works and what implications this could have on your church’s tax status. Read on to learn more.

What Does The Term

Churches in Europe are tax exempt according to the European Union’s General Data Protection Regulation. This regulation was introduced in May 2018 as a response to the 2018 EU data privacy law, the General Data Protection Regulation (GDPR). The regulation states that “religious organizations and their associations” are exempt from GDPR taxation requirements if their activities fall within one of eight specific categories. According to this regulation, churches fall into the category of “religious organizations providing social services.”

The reason why churches are exempt from GDPR taxation is twofold. First, it is argued that churches provide social services which are considered an important part of society. Second, it is argued that as religious organizations, churches should be exempt from GDPR because it would be unfair for them to have to pay taxes when other private organizations aren’t subject to the same regulations.

There are some exceptions to the exemption rule for churches. For example, church buildings and property are still subject to taxation unless they fall within one of the eight specific categories mentioned earlier. Additionally, taxes on income earned by church members must still be paid like any other individual income tax.

Church Tax Exemption In Europe

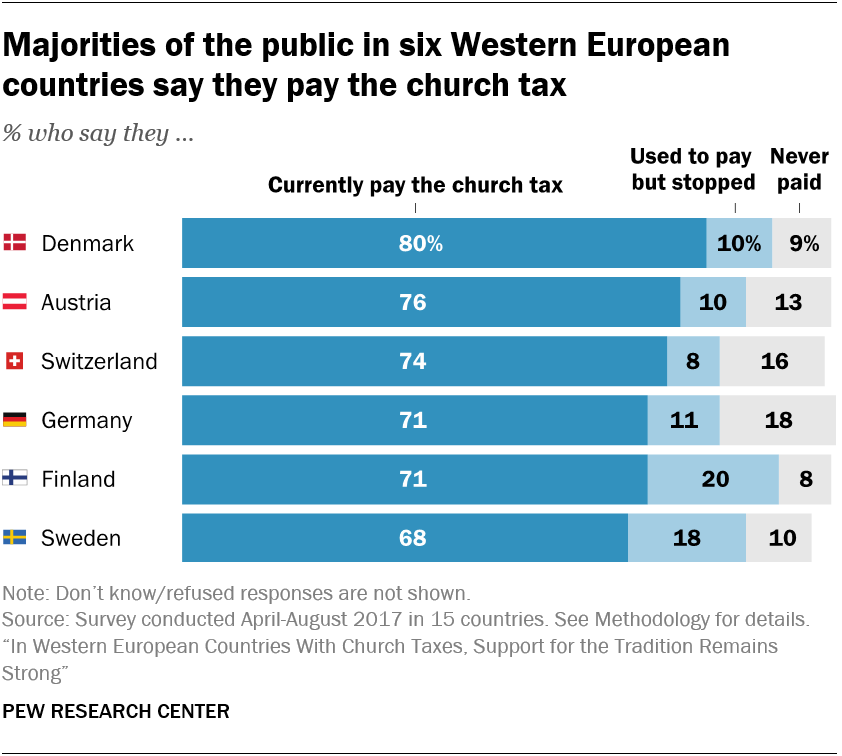

There is no one-size-fits-all answer to this question, as the exemption rules vary from country to country in Europe. However, most churches in Europe are exempt from tax, with a few exceptions. The main difference between countries is how much revenue the government receives from church taxes.

In some countries, such as Greece, the government only receives a small percentage of church tax revenue, while others, such as France, receive a much larger amount. Overall, it’s advisable to consult with a local accountant or financial advisor if you’re interested in taking advantage of any of the specific exemptions that apply to your specific case.

Is Your Church Tax Exempt?

Churches are exempt from property tax in most European countries. This exemption is based on the grounds that churches are considered to be places of worship. In some cases, local governments may provide an exemption for cultural heritage sites. However, churches must still pay income and other taxes.

Background Of Churches In Europe

The history of churches in Europe is fraught with religious and political intrigue. From the rise of Christianity to the present day, churches have played a significant role in European society. Even though they are tax exempt, churches in Europe are still subject to the laws and regulations of the individual countries in which they are located.

Today, there are an estimated 550 million Christians living in Europe, accounting for around 30 percent of the continent’s population. In some countries, such as Germany and France, there are more than one hundred thousand churches. The largest Christian denomination is the Catholic Church, followed by Protestant denominations like the Lutheran Church and the Anglican Church. There is also a large number of Eastern Orthodox Churches operating in Europe.

The first Christian missionaries arrived on European soil in the late second century AD. Over time, Christianity spread throughout Europe thanks to missionary work and the trading networks that were established between different nations. In many cases, rulers granted religious privileges to specific groups or sects in order to gain their support.

This led to a number of schisms within Christianity – most notably between Catholics and Protestants – which continues to this day. Despite their diversity, all European churches share a common heritage dating back to early Christianity. They share similar doctrines and rituals as well as a desire for unity among believers.

Because of this, church leaders have worked together to lobby governments on behalf of their interests. For example, Catholic bishops were instrumental in convincing Pope John Paul II to travel to Poland during his

Taxation Of Churches In Europe

Churches are exempt from property, income, and capital gains taxes in most of Europe. However, some countries (such as France) have a specific tax category for churches and religious organizations. In other countries (such as the United Kingdom), the taxation of churches is based on their income and properties.

Churches that make money through commercial activities may be subject to taxation. As an American church member, you may be wondering if your church is exempt from taxes in Europe. The answer to this question is both yes and no.

While churches in most European countries are not taxed as individual entities, they may still be taxed as part of a religious organization. In some cases, this tax can be quite significant. However, it is important to speak with an expert or tax advisor about your specific situation to ensure that you are taking all the necessary precautions for legal compliance.