When it comes to ensuring your peace of mind on Columbia, MO’s roads, having the right car insurance is paramount. Understanding the nuances of Columbia’s car insurance landscape can save you both money and hassle in the long run. In this guide, we’ll break down the essential aspects of Columbia MO car insurance, from coverage options to cost-saving tips.

What Is Columbia MO Car Insurance?

Columbia MO car insurance is a vital financial protection that every vehicle owner and driver in Columbia, Missouri, should have. It’s a type of insurance that provides coverage in case of accidents, damage, or other unforeseen events involving your vehicle. Car insurance ensures that you’re financially safeguarded from the potential financial repercussions that can arise from accidents on the road.

The Importance Of Car Insurance In Columbia MO

Columbia, MO’s busy streets and unpredictable road conditions underscore the significance of having robust car insurance. While the state of Missouri mandates minimum coverage, it’s essential to consider additional coverage options that protect you in various scenarios

Navigating the bustling streets of Columbia MO demands more than just a reliable vehicle and a cautious approach. It requires having the right car insurance to ensure your safety and financial well-being. Car insurance isn’t just a legal requirement; it’s a shield that guards you against unforeseen circumstances on the road.

Accidents can happen at any moment, regardless of how skilled or careful a driver you are. Having car insurance means you’re prepared for the unexpected. It offers protection not only for your vehicle but also for you, your passengers, and others involved in the accident. This safety net ensures that medical bills, repair costs, and legal expenses don’t drain your bank account.

Moreover, car insurance brings peace of mind. Knowing that you’re covered in case of an accident lets you focus on enjoying your time on the road rather than worrying about what could go wrong. It’s a form of financial security that allows you to drive with confidence and enjoy the freedom of the open road.

In Columbia, where traffic can be dense and road conditions unpredictable, having comprehensive car insurance is not just a choice, but a wise decision. Without it, you’re exposed to substantial financial risks and legal consequences. So, whether you’re commuting to work, exploring the city, or embarking on a road trip, having the right car insurance in Columbia MO is an essential investment in your safety and financial stability.

Types Of Car Insurance Coverage

- Understanding Liability Coverage: Liability coverage is the foundation of car insurance. It covers bodily injuries and property damage if you’re at fault in an accident, offering financial protection and legal support.

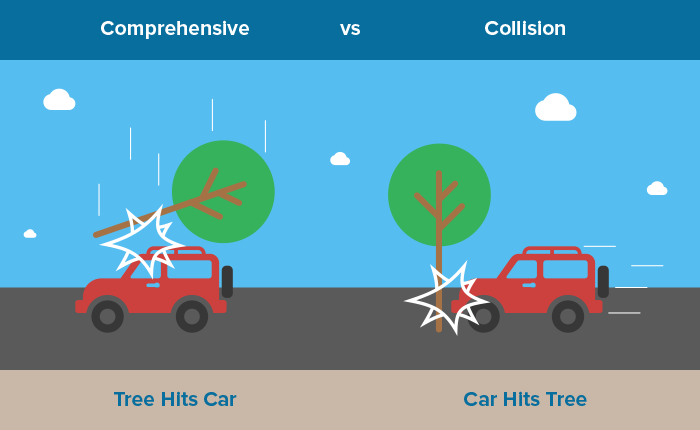

- Comprehensive Coverage: Beyond Collisions: Comprehensive coverage extends protection beyond accidents, covering damage from theft, vandalism, natural disasters, and other non-collision incidents.

- Uninsured/Underinsured Motorist Coverage: This coverage safeguards you when an at-fault driver lacks insurance or has insufficient coverage to pay for your damages and medical expenses.

- Personal Injury Protection (PIP): PIP coverage assists in paying for medical expenses and even lost wages for you and your passengers, regardless of fault.

How To Find Car Insurance Rates In Columbia, MO

Finding the right car insurance rates in Columbia MO involves a bit of research and comparison. Here’s a step-by-step guide to help you navigate through the process:

- Gather Your Information: Before you start comparing rates, gather all the necessary information. This includes details about your vehicle, your driving history, and any additional drivers you want to include in your policy.

- Use Online Comparison Tools: Utilize online car insurance comparison tools. These tools allow you to input your information and receive quotes from multiple insurance providers. This way, you can easily compare rates side by side.

- Contact Local Agents: Reach out to local insurance agents or agencies in Columbia, MO. They can provide you with personalized quotes based on your specific needs and circumstances. Local agents might also be aware of any regional factors that could affect your rates.

- Consider Coverage Options: While comparing rates, also consider the coverage options each insurance provider offers. Make sure the policies you’re comparing are similar in terms of coverage levels and deductibles.

- Look for Discounts: Many insurance companies offer various discounts that can help you save on your premium. These discounts could be related to safe driving records, multiple policies (like bundling car and home insurance), anti-theft devices, and more.

- Read Reviews: Before making a decision, read reviews or testimonials about the insurance companies you’re considering. This can give you insights into their customer service, claims process, and overall satisfaction level.

- Check for Special Programs: Some insurers offer special programs, such as usage-based insurance. This involves installing a device in your car that monitors your driving habits. If you’re a safe driver, you could benefit from lower rates through such programs.

- Understand Policy Details: Don’t just focus on the price; understand the details of the policy. Know what’s covered, what’s excluded, and any limitations or restrictions.

- Customer Service: Consider the quality of customer service each insurance company provides. You’ll want an insurer that is responsive and helpful when you have questions or need assistance.

- Review and Decide: Once you’ve collected quotes, reviewed coverage options, and considered discounts, take your time to review everything. Choose the policy that best aligns with your needs, budget, and preferences.

Remember that finding the right car insurance rates is about more than just finding the cheapest option. It’s about striking a balance between affordability and adequate coverage. By following these steps and being thorough in your research, you can find the car insurance rates that suit you best in Columbia, MO.

Factors Affecting Car Insurance Rates

- Location and Driving Environment: Urban areas might have higher premiums due to increased traffic congestion and accident rates.

- Your Driving History: A Window into Risk: A history of accidents and traffic violations can lead to higher premiums, as insurers consider you a higher risk.

- Vehicle Type and Safety Features: Safer vehicles often come with lower insurance rates, thanks to advanced safety features that reduce the risk of accidents.

- Credit Score’s Influence on Premiums: Insurers sometimes use credit scores to assess the likelihood of you filing a claim. Maintaining good credit can lead to lower premiums.

Navigating Columbia-Specific Regulations

- Minimum Insurance Requirements in MO: Missouri requires a minimum of liability coverage: $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

- Tort System: How It Affects Your Claims: Columbia operates under a tort system, meaning the at-fault party is responsible for covering damages and medical expenses. Insurance plays a pivotal role in this system.

Tips For Finding Affordable Car Insurance

Shop Around: The Power of Comparison

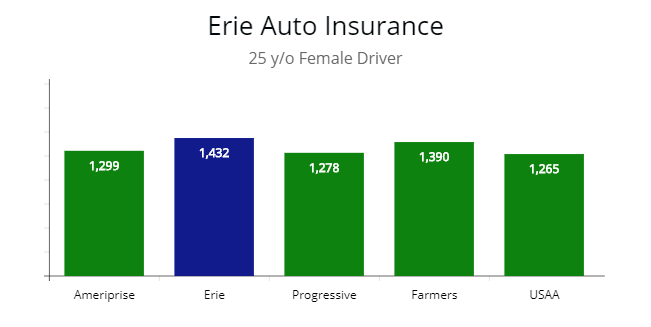

Getting quotes from multiple insurers allows you to compare rates and find the most competitive option.

Bundle Up: Multi-Policy Discounts

Combining your car insurance with other policies, such as homeowners or renters insurance, often leads to discounted premiums.

Raise Deductibles, Lower Premiums?

Increasing your deductible can lower your premium, but be prepared to pay more out of pocket if you need to file a claim.

The Influence of Mileage on Rates

Lower annual mileage can lead to reduced rates, as it lowers the risk of accidents.

Steps To Take After An Accident

Documenting the Scene: Photos and Information

Gather evidence after an accident, including photos, exchange of information with the other party, and eyewitness accounts.

Filing a Claim: Timelines and Process

Notify your insurer promptly and follow their guidance for a smooth claims process.

Special Considerations For Columbia Residents

Weather-Related Insurance Considerations

Columbia’s weather can be unpredictable. Comprehensive coverage can protect against damage from hail, floods, and other weather events.

Addressing Wildlife Collisions

Collisions with deer and other wildlife are common in Columbia. Comprehensive coverage can help cover the costs of repairs.

Understanding No-Fault Insurance

Pros and Cons of No-Fault Systems

No-fault insurance systems are an intriguing approach to car insurance, with their own set of advantages and disadvantages. Let’s take a closer look at the pros and cons of these systems:

Pros:

- Streamlined Claims Process: One of the main benefits of a no-fault system is the streamlined claims process. Regardless of who is at fault in an accident, each party’s own insurance company covers their medical expenses and damages. This can reduce the need for lengthy investigations to determine fault, resulting in quicker settlements.

- Prompt Medical Coverage: In a no-fault system, your medical expenses are covered by your own insurance company immediately after an accident, without having to wait for a determination of fault. This ensures you receive timely medical attention and treatment.

- Reduced Litigation: Since fault is less relevant in a no-fault system, there’s often less need for litigation. This can help reduce the burden on the legal system and lower court costs.

- Simplified Compensation: No-fault systems provide a clear process for compensation, making it easier for individuals to receive the benefits they’re entitled to without getting caught up in complex legal battles.

- Stability in Premiums: With fault playing a lesser role, insurers may experience fewer drastic premium increases based on an individual’s driving record. This can lead to more stable premium rates over time.

Cons:

- Limited Right to Sue: In exchange for streamlined claims, individuals in no-fault systems generally have limited rights to sue for additional damages, especially for non-economic damages like pain and suffering. This can leave some individuals feeling shortchanged in cases of severe injuries.

- Higher Premiums: While premiums might be more stable, they can also be relatively higher in no-fault systems due to the increased coverage provided by insurance companies. This could lead to potentially higher overall costs.

- Complexity in Determining Fault: In traditional fault-based systems, determining fault might be clearer in certain situations. No-fault systems can sometimes be more complex when trying to ascertain who is truly responsible for an accident.

- Potential for Fraud: The simplified claims process in no-fault systems can potentially attract fraudulent claims, as individuals may attempt to take advantage of the system by filing for benefits they’re not entitled to.

- Limited Accountability: Some critics argue that no-fault systems reduce individual accountability for their actions on the road, as they might not face the consequences of their behavior as directly as they would in a fault-based system.

No-fault insurance systems offer benefits like quicker claims processing and reduced litigation, but they also come with limitations on the right to sue and potential higher premiums. As with any insurance system, there’s a trade-off between convenience and the intricacies of individual circumstances. Understanding the pros and cons can help you determine if a no-fault system aligns with your preferences and needs.

The Future Of Car Insurance: Telematics

How Telematics Work: Usage-Based Insurance

Telematics involves using devices to monitor driving habits, potentially leading to personalized insurance rates based on actual behavior.

Privacy Concerns and Opt-Out Options

While telematics offer benefits, concerns about privacy and data collection have led to debates about opt-out choices.

Conclusion

In Columbia, MO, car insurance is your shield against the uncertainties of the road. By understanding coverage options, navigating regulations, and considering factors affecting rates, you can confidently select the right policy to keep you protected.