When it comes to obtaining a home loan, the Department of Veterans Affairs (VA) offers a beneficial program known as the VA loan. This mortgage option provides numerous advantages for eligible individuals, including active duty service members, veterans, and their families. In this article, we will specifically address the question of whether a spouse can apply for a VA loan.

What Is A VA Loan?

A VA loan is a mortgage loan guaranteed by the U.S. Department of Veterans Affairs. It is designed to help eligible service members, veterans, and their families achieve homeownership. VA loans are provided by private lenders, such as banks and mortgage companies, but the VA guarantees a portion of the loan, making it easier for borrowers to obtain favorable terms and conditions.

Eligibility For VA loans

Before discussing spouse eligibility for VA loans, it’s important to understand the general eligibility criteria. The following categories of individuals may be eligible for VA loans:

- Active duty service members: Active duty service members who meet the minimum service requirements are eligible for VA loans. The minimum service requirements vary depending on the specific dates and duration of active duty service.

- Veterans: Veterans who have served in the military and have been discharged under conditions other than dishonorable may qualify for VA loans. The length of service and the period during which the service occurred also play a role in determining eligibility.

- National Guard and Reserve members: National Guard and Reserve members may be eligible for VA loans if they have completed at least six years of service and meet certain criteria, such as an honorable discharge.

Spouse Eligibility For VA Loans

The VA recognizes the importance of supporting the families of service members and veterans. Therefore, there are specific provisions in place to allow spouses to apply for VA loans under certain circumstances.

- Spouses of deceased service members: Spouses of service members who died while on active duty or as a result of a service-related disability may be eligible for VA loans. This benefit is known as the Surviving Spouse Loan Entitlement.

- Spouses of disabled veterans: Spouses of veterans with a service-connected disability may also be eligible for VA loans. In such cases, the disability must be determined by the VA to be permanent and totally disabling.

- Spouses of active duty service members: Spouses of active duty service members can apply for VA loans, but the eligibility requirements may vary. It’s essential to consult with the VA or a VA-approved lender to determine the specific conditions and documentation needed for this category.

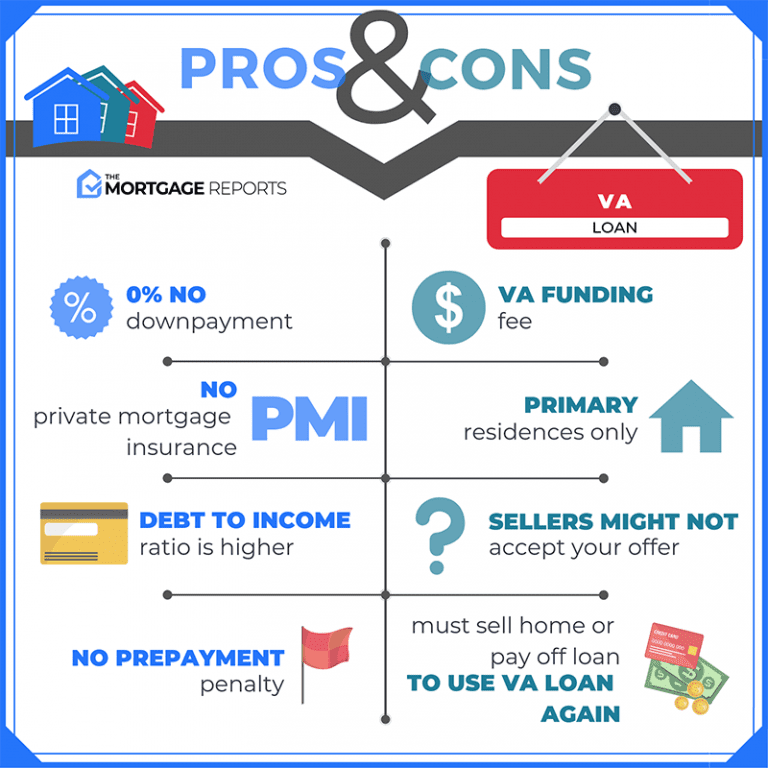

The Benefits Of A VA Loan For Spouses

Spouses who are eligible for VA loans can enjoy several benefits that make this mortgage option attractive. These benefits include:

- No down payment requirement: One of the significant advantages of VA loans is that they typically do not require a down payment. This feature can significantly reduce the upfront costs associated with buying a home.

- Lower interest rates: VA loans often come with lower interest rates compared to conventional mortgages. This can result in substantial savings over the life of the loan.

- No private mortgage insurance (PMI): Unlike conventional loans, VA loans do not require private mortgage insurance (PMI). This can lead to additional savings for borrowers.

- Flexible credit requirements: VA loans tend to have more flexible credit requirements compared to other mortgage options. This can be beneficial for spouses who may have a limited credit history or have encountered financial challenges in the past.

The Application Process For Spouses

If a spouse is eligible for a VA loan, they can follow a similar application process to other borrowers. Here are the general steps involved:

- Obtaining a Certificate of Eligibility (COE): The first step is to obtain a Certificate of Eligibility (COE) from the VA. This document verifies the spouse’s eligibility for a VA loan.

- Meeting income and credit requirements: Spouses need to demonstrate sufficient income and meet certain credit requirements to qualify for a VA loan. Lenders typically assess the spouse’s ability to repay the loan based on their income, employment history, and credit score.

- Finding a VA-approved lender: Next, the spouse should find a lender that is approved by the VA to offer VA loans. Working with a VA-approved lender ensures a smooth and efficient loan process.

- Completing the loan application: The final step is to complete the loan application with the chosen lender. The spouse will need to provide documentation, such as income statements, bank statements, and identification, to support the application.

Limitations On The Type Of Property That Can Be Purchased With A VA Loan By A Spouse

Spouses who are eligible for a VA loan have the flexibility to purchase different types of properties. The VA loan program allows for the acquisition of various property types, including:

1. Single-family homes: Spouses can use a VA loan to buy a single-family home, which typically refers to a detached residential property designed for a single family.

2. Condominiums: VA loans can be used to purchase condominium units that meet the VA’s requirements. These requirements ensure that the condominium complex is well-managed and financially stable.

3. Multi-unit properties: Spouses can also consider purchasing multi-unit properties with up to four units using a VA loan. This can include properties such as duplexes, triplexes, and fourplexes. The spouse can live in one unit and rent out the remaining units, potentially generating rental income.

It’s important to note that while the VA loan program allows for the purchase of various property types, there are certain requirements that must be met. The property must meet the VA’s Minimum Property Requirements (MPRs), which ensure that the property is safe, structurally sound, and provides adequate living conditions.

Additionally, the property must be intended for the spouse’s primary residence. It cannot be used for investment purposes or as a vacation home. However, if the spouse’s circumstances change in the future, such as due to a relocation or change in employment, they may be able to keep the property and rent it out while meeting certain conditions.

Before finalizing a property purchase, it’s advisable for spouses to consult with a VA-approved lender who can guide them through the specific requirements and help them find a property that meets the VA’s criteria. Spouses who are eligible for a VA loan have the flexibility to purchase different types of properties, including single-family homes, condominiums, and multi-unit properties.

However, it’s essential to ensure that the chosen property meets the VA’s Minimum Property Requirements and is intended for the spouse’s primary residence. Consulting with a VA-approved lender can provide valuable guidance throughout.

Income Limitations For Spouses Applying For A VA Loan

When it comes to applying for a VA loan as a spouse, there are no specific income limitations set by the Department of Veterans Affairs (VA). Unlike some other loan programs, the VA loan program does not impose strict income thresholds or caps for eligibility. However, spouses still need to demonstrate sufficient income to repay the loan and meet the lender’s requirements.

During the loan application process, lenders will evaluate the spouse’s income to determine their ability to make the monthly mortgage payments. The lender will typically consider factors such as:

1. Stability of income: Lenders will assess the stability and consistency of the spouse’s income source. This can include employment income, self-employment income, retirement income, and other sources.

2. Debt-to-income ratio: Lenders will analyze the spouse’s debt-to-income ratio, which compares their monthly debt obligations to their gross monthly income. Generally, a lower debt-to-income ratio is preferred by lenders, as it demonstrates the borrower’s ability to manage their financial obligations.

3. Creditworthiness: Although not directly related to income, the spouse’s creditworthiness will also be evaluated by lenders. A good credit score and a positive credit history can enhance the spouse’s chances of loan approval and may also influence the loan terms and interest rates offered.

It’s important for spouses to gather and provide the necessary documentation related to their income during the loan application process. This can include pay stubs, tax returns, bank statements, and any other relevant financial records that demonstrate their income stability and capacity to repay the loan.

While there are no specific income limitations for spouses applying for a VA loan, it’s crucial to note that lenders may have their own internal guidelines and criteria when evaluating the borrower’s income. Each lender may have different requirements and expectations, so it’s advisable for spouses to shop around and compare different lenders to find the one that best suits their financial situation.

There are no specific income limitations imposed by the VA for spouses applying for a VA loan. However, lenders will assess the spouse’s income stability, debt-to-income ratio, and creditworthiness to determine their eligibility and loan terms. It’s essential for spouses to provide accurate and comprehensive income documentation during the loan application process and explore different lender options to find the best fit for their financial needs.

Specific Rquirement For Spouses Of Disabled Veterans

Spouses of disabled veterans may be eligible for VA loans, but there are specific requirements they must meet to qualify for this benefit. The eligibility criteria for spouses of disabled veterans are as follows:

1. Permanent and total disability: The disabled veteran must have a service-connected disability that has been determined by the VA to be permanent and totally disabling. The disability rating assigned by the VA plays a crucial role in determining the eligibility of the spouse.

2. Surviving Spouse Loan Entitlement: Spouses of disabled veterans who meet the criteria mentioned above can apply for the Surviving Spouse Loan Entitlement. This program allows the spouse to use their deceased spouse’s VA loan benefit. In addition to these requirements, spouses of disabled veterans must also meet the general eligibility criteria for VA loans, which include obtaining a Certificate of Eligibility (COE) from the VA.

The COE verifies the spouse’s eligibility for a VA loan and is obtained through the VA’s eBenefits portal or by submitting the necessary documentation to the VA. It’s important to note that the VA loan benefit for spouses of disabled veterans is separate from the Dependent’s Educational Assistance (DEA) program, which provides education and training opportunities to eligible dependents of veterans with service-connected disabilities.

When applying for a VA loan as a spouse of a disabled veteran, it’s advisable to work with a VA-approved lender who is experienced in handling VA loans and familiar with the specific requirements for spouses. The lender can guide the spouse through the application process, assist in obtaining the necessary documentation, and provide valuable support and expertise.

Spouses of disabled veterans can qualify for VA loans if their spouse has a service-connected disability that is determined by the VA to be permanent and totally disabling. These spouses can apply for the Surviving Spouse Loan Entitlement. Obtaining a Certificate of Eligibility (COE) from the VA is an essential step in the application process. Working with a knowledgeable VA-approved lender can greatly facilitate the process and ensure a smooth experience.

VA Loan To Appy For If Service Member Has Passed Away

Spouses of deceased service members may be eligible to apply for a VA loan under certain circumstances. The VA loan program recognizes the importance of supporting surviving spouses and provides the option to apply for a VA loan through the Surviving Spouse Loan Entitlement. To be eligible for a VA loan as a surviving spouse, the following criteria generally apply:

1. Death of the service member: The spouse must be the surviving spouse of a service member who died while on active duty or as a result of a service-connected disability. The cause of death must be verified and documented.

2. VA determination of eligibility: The VA must determine that the surviving spouse meets the eligibility requirements for the Surviving Spouse Loan Entitlement. This determination is typically based on the service member’s cause of death and the surviving spouse’s relationship to the service member.

3. Certificate of Eligibility (COE): The surviving spouse needs to obtain a Certificate of Eligibility (COE) from the VA. The COE verifies the surviving spouse’s eligibility for a VA loan and is an essential document in the loan application process.

It’s important to note that the Surviving Spouse Loan Entitlement may have specific time limitations. For example, the surviving spouse may need to apply for the VA loan within a certain period after the service member’s death. Consulting with the VA or a VA-approved lender is crucial to understand the specific requirements and timeframes associated with the Surviving Spouse Loan Entitlement.

When applying for a VA loan as a surviving spouse, it’s recommended to work with a VA-approved lender who is experienced in handling VA loans for surviving spouses. The lender can guide the surviving spouse through the application process, assist in obtaining the necessary documentation, and provide valuable support and expertise.

Surviving spouses of deceased service members may be eligible to apply for a VA loan through the Surviving Spouse Loan Entitlement. Eligibility is typically based on the cause of the service member’s death and the surviving spouse’s relationship to the service member. Obtaining a Certificate of Eligibility (COE) from the VA is a crucial step in the application process. Working with a knowledgeable VA-approved lender can greatly facilitate the process and ensure a smooth experience.

Conclusion

In conclusion, spouses of eligible service members and veterans can apply for VA loans under specific circumstances. The VA loan program recognizes the importance of supporting military families, and spouses can benefit from features like no down payment requirement, lower interest rates, and flexible credit requirements. If you are a spouse interested in applying for a VA loan, it’s important to understand the eligibility criteria and follow the application process outlined by the VA.