Term life insurance is a type of life insurance that provides coverage for a specified period, known as the term. Unlike permanent life insurance policies, such as whole life or universal life, term life insurance offers protection for a set number of years, typically ranging from 10 to 30 years. In this article, we will delve into the definition of term life insurance, its key features, benefits, and why it may be a suitable option for individuals seeking financial security for their loved ones.

In this fast-paced world, securing the financial future of your loved ones is of paramount importance. Term life insurance offers a straightforward and affordable way to provide protection for a specific period, ensuring your family’s financial stability in case of the unexpected.

What Is Term Life Insurance?

Term life insurance is a type of insurance policy that offers coverage for a predetermined term. It provides a death benefit to the policyholder’s beneficiaries if the insured individual passes away during the term of the policy. Unlike permanent life insurance policies, term life insurance does not accumulate cash value over time.

How Does Term Life Insurance Work?

When you purchase a term life insurance policy, you pay regular premiums for the specified term, usually on a monthly or annual basis. If the insured person dies within the term of the policy, the beneficiaries named in the policy receive the death benefit. However, if the insured person outlives the policy term, the coverage ends, and there is no payout.

Choosing The Right Term Length

One of the crucial decisions when buying term life insurance is selecting the appropriate term length. It depends on various factors, such as your financial obligations, the age of your dependents, and the duration for which they will need financial support. Common term lengths include 10, 15, 20, or 30 years.

Determining The Coverage Amount

Determining the coverage amount is essential to ensure your loved ones are adequately protected. Consider factors like outstanding debts, mortgage payments, education expenses, and future financial goals. It’s crucial to strike a balance between affordability and the level of coverage needed.

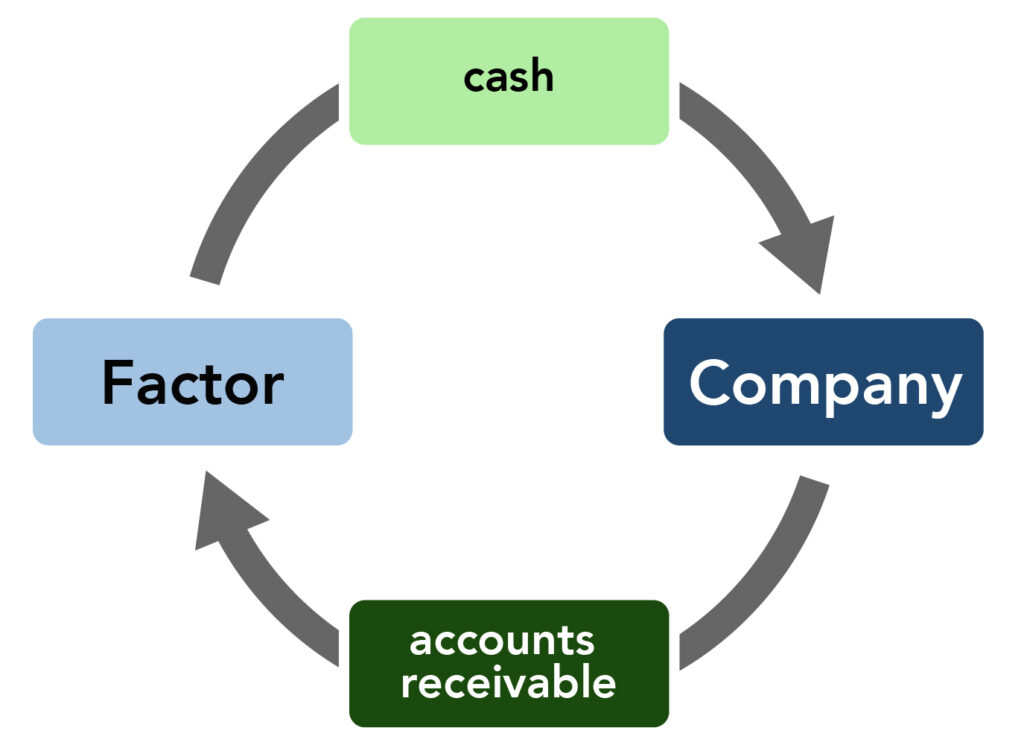

Convertibility And Renewability Options

Some term life insurance policies offer convertibility and renewability options. Convertibility allows you to convert your term policy into a permanent life insurance policy without undergoing a medical examination. Renewability, on the other hand, enables you to renew your term policy at the end of the term without requalifying for coverage.

Premium Payment Options

Term life insurance policies usually offer two premium payment options: level term and increasing term. In a level term policy, the premium remains the same throughout the term. In an increasing term policy, the premium gradually increases over time. Choosing the right premium payment option depends on your budget and financial circumstances.

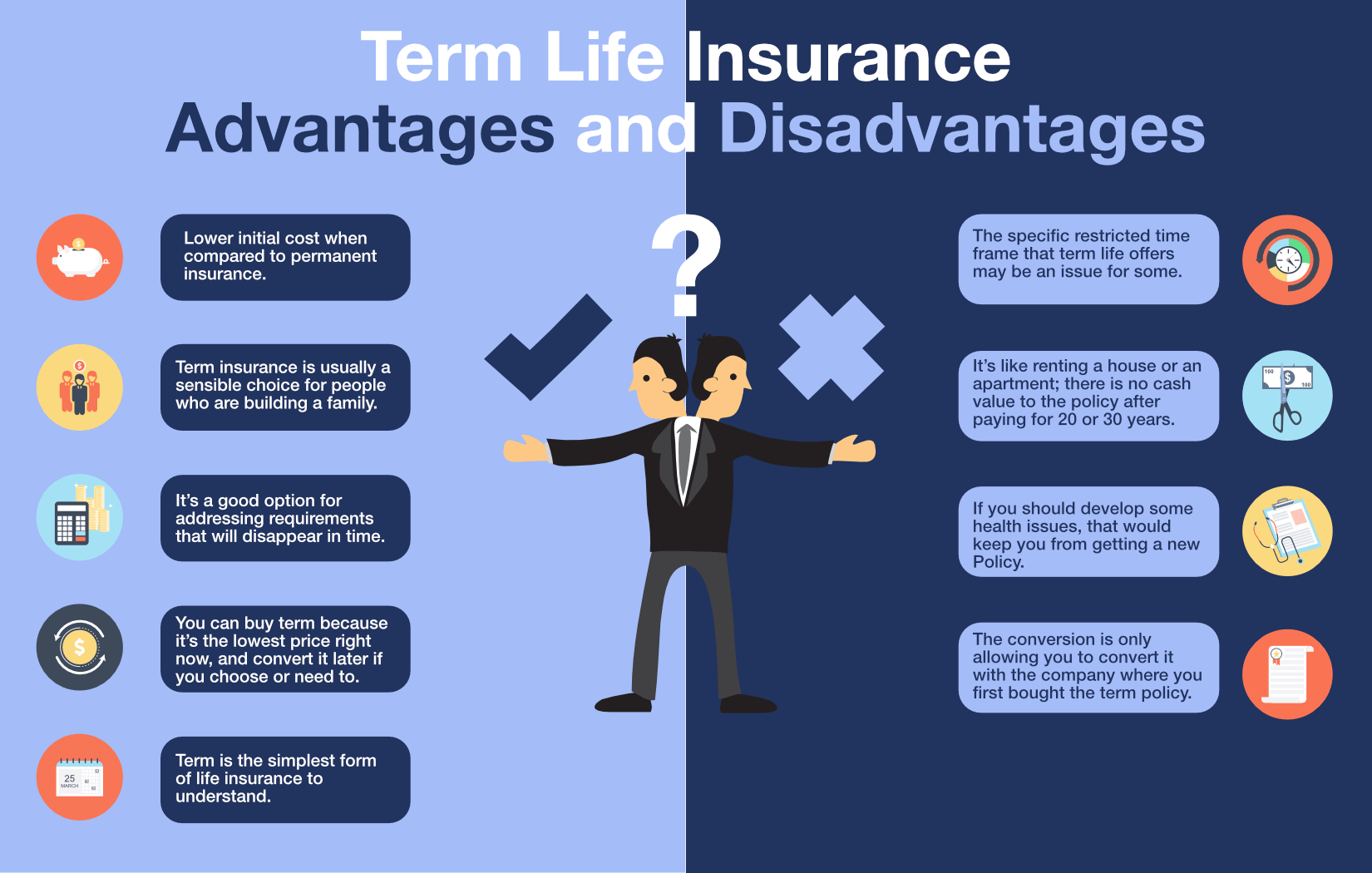

Benefits of Term Life Insurance

Term life insurance offers several benefits that make it an attractive choice

for individuals seeking life insurance coverage. Let’s explore some of these benefits:

- Affordable Coverage

Term life insurance is generally more affordable compared to permanent life insurance policies. Since it provides coverage for a specific term and does not accumulate cash value, the premiums tend to be lower. This affordability makes term life insurance accessible to a wider range of individuals.

- Temporary Financial Protection

Term life insurance is designed to provide temporary financial protection during specific periods when individuals may have higher financial obligations or responsibilities. For example, if you have young children or outstanding debts, a term life insurance policy can offer peace of mind knowing that your loved ones will be financially secure in case of your untimely passing.

- Flexibility for Life Changes

Term life insurance allows flexibility to align with your changing life circumstances. You can select a term that coincides with major milestones like paying off your mortgage, sending your children to college, or reaching retirement. This flexibility ensures that you have coverage precisely when you need it the most.

- Estate Planning Tool

Term life insurance can serve as an essential tool in estate planning. It can help cover estate taxes, debts, and other financial obligations, ensuring that your assets are preserved for your beneficiaries. By incorporating term life insurance into your estate plan, you can create a financial safety net for your loved ones and mitigate potential financial burdens.

- Riders and Additional Coverage

Many term life insurance policies offer riders and additional coverage options that can be customized to meet your specific needs. Common riders include accelerated death benefit riders, which allow you to access a portion of the death benefit if you are diagnosed with a terminal illness. Other riders may provide coverage for critical illness, disability, or accidental death.

- Comparing Term Life Insurance Policies

When considering term life insurance, it’s important to compare policies from different insurance providers. Look for factors such as premium rates, coverage options, convertibility and renewability provisions, and the financial stability and reputation of the insurance company. By comparing multiple policies, you can make an informed decision and choose the one that best suits your needs.

Conclusion

Term life insurance offers a practical and affordable solution to protect your loved ones financially for a specified period. With its flexibility, temporary coverage, and various benefits, it is worth considering for individuals seeking financial security and peace of mind. Remember to assess your needs, choose an appropriate term length, determine the coverage amount, and compare policies before making a decision.