Religious institutions, including churches, synagogues, mosques, and temples, have long enjoyed tax-exempt status in the United States. This means that they are not required to pay federal, state, or local taxes on their income, property, or other assets. However, the reasons for this tax exemption are not always clear, and there are ongoing debates about whether churches should continue to be tax-exempt. In this article, we will explore the history, rationale, and implications of the tax-exempt status of churches in the United States.

Historical Origins

The tax-exempt status of churches can be traced back to the founding of the United States. The First Amendment to the Constitution guarantees the freedom of religion, and the founders believed that this freedom would be best protected if the government did not have the power to tax religious institutions. This principle was reflected in the fact that many of the colonies, and later the states, did not tax churches.

In the 19th century, the federal government began to establish a tax system, but churches were not included among the entities that were required to pay taxes. This was in keeping with the principle that the government should not have the power to tax religious institutions, and it reflected the belief that churches provided important social and moral services that benefited the entire community.

Rationale For Tax Exemption

The rationale for the tax-exempt status of churches is rooted in the belief that they provide important social and moral services that benefit the entire community. These services include education, charity, and spiritual guidance. By not taxing churches, the government recognizes the value of these services and allows churches to use their resources to provide them rather than using them to pay taxes.

Another rationale for the tax-exempt status of churches is that it helps to protect the freedom of religion. If the government had the power to tax churches, it could use that power to restrict or control religious institutions. By not taxing churches, the government ensures that religious institutions are independent and can freely exercise their religious beliefs.

Critics Of Tax Exemption

Despite the historical and rational reasons for tax-exempt status of churches, there are many critics who argue that churches should not be tax-exempt. One of the main criticisms is that it is not fair for churches to enjoy tax exemptions while other non-profit organizations, such as schools and hospitals, are required to pay taxes.

Another criticism is that tax-exempt status allows churches to accumulate wealth, which can be used to influence politics and exert power over their congregations and communities. This can be seen as a violation of the principle of separation of church and state.

Furthermore, critics argue that the benefits of tax-exempt status for churches are not clear. They argue that churches do not provide any unique services that cannot be provided by other non-profit organizations and that the tax exemptions are not necessary for the functioning of churches.

Practical Implications

The tax-exempt status of churches has a number of practical implications. One of the most significant is that it allows churches to accumulate wealth and property without having to pay taxes on them. This can be beneficial for churches, as it allows them to use their resources to provide services to their congregations and communities. However, it can also lead to criticism that churches are amassing wealth at the expense of taxpayers.

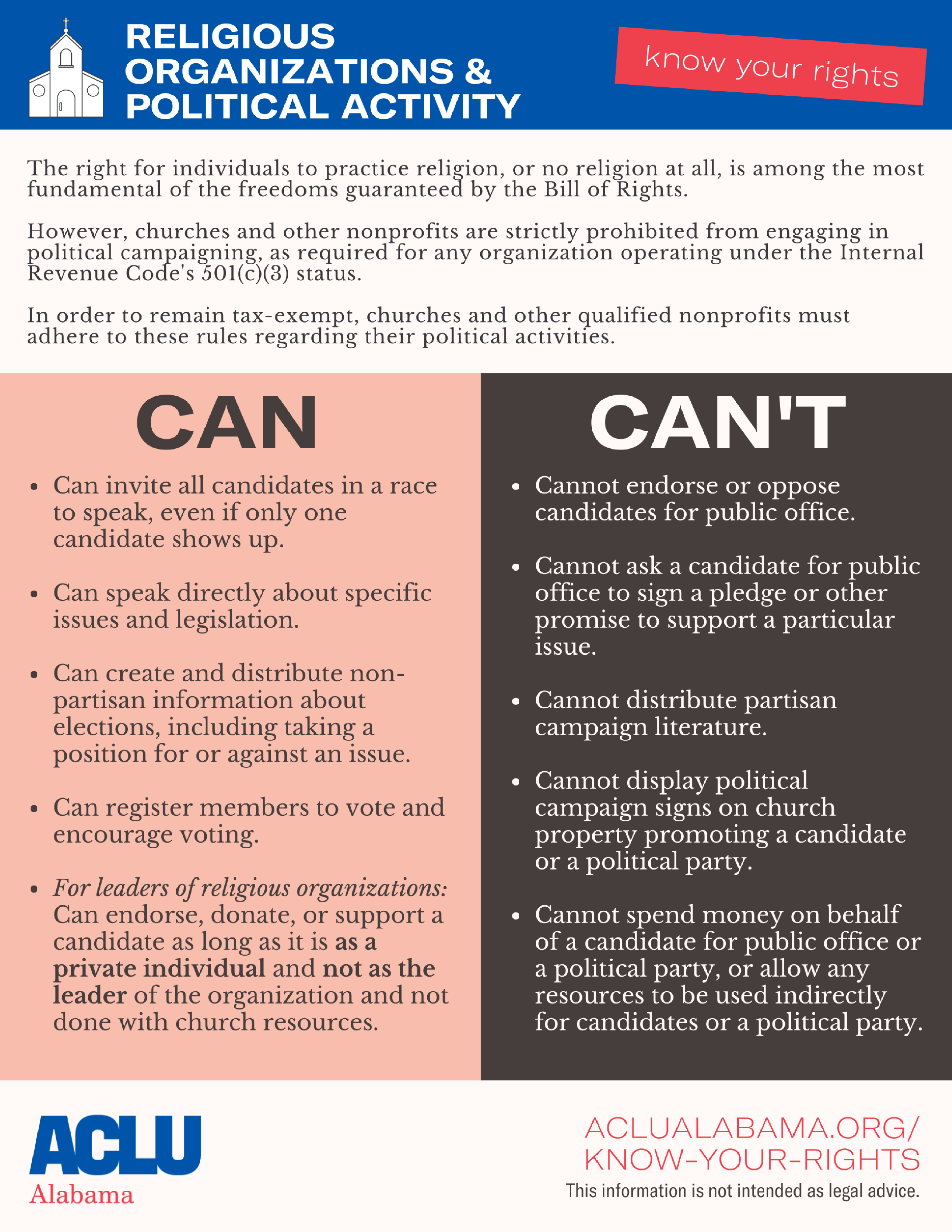

Another practical implication of the tax-exempt status of churches is that it allows them to engage in political activities without having to pay taxes on any income they receive from political activities. This can be beneficial for churches, as it allows them to advocate for their beliefs and values without having to worry about the financial implications. However, it can also lead to criticism that churches are using their tax-exempt status to influence politics and exert power over their congregations and communities.

Tax-exempt status also allows churches to provide their employees with tax-free benefits, such as housing allowances and health insurance. This can be beneficial for churches, as it allows them to attract and retain talented employees. However, it can also lead to criticism that churches are receiving preferential treatment from the government.

Exemptions And Restrictions

It is important to note that while churches are tax-exempt, they are not completely free from taxes. They are still subject to certain taxes, such as sales and property taxes. In addition, there are restrictions on the activities that churches can engage in and still maintain their tax-exempt status. For example, churches are not allowed to engage in political activities that endorse or oppose a particular candidate or political party. They also cannot engage in activities that are primarily for the benefit of private individuals, such as running a for-profit business.

The Future Of Tax-Exempt Status

The tax-exempt status of churches has been a contentious issue for many years, and it is likely to continue to be so in the future. Supporters of tax-exempt status argue that it is necessary to protect the freedom of religion and that churches provide important social and moral services. Critics argue that tax-exempt status is not fair and that it allows churches to accumulate wealth and exert power over their congregations and communities.

In recent years, there has been a growing movement to re-evaluate the tax-exempt status of churches, and some lawmakers have proposed legislation to limit or eliminate the exemptions. However, it is important to note that any changes to the tax-exempt status of churches would likely face significant legal and political challenges.

The tax-exempt status of churches in the United States has a long history and is rooted in the belief that churches provide important social and moral services and that it helps to protect the freedom of religion. However, there are also critics who argue that churches should not be tax-exempt and that the benefits of tax exemptions are not clear. The ongoing debate about the tax-exempt status of churches raises important questions about the role of religious institutions in society and the relationship between religion and the state.

In conclusion, the tax-exempt status of churches is a complex issue with a long history and ongoing debates. While it has practical implications for the functioning of religious institutions, it also raises important questions about the relationship between religion and the state and the role of churches in society.