In an ever-evolving business landscape, companies must navigate intricate financial and administrative tasks to ensure their operations run smoothly. One of these tasks is managing payroll – a vital component that directly impacts employee satisfaction and business success. However, as businesses expand and regulations evolve, payroll management has grown more complex, leading many organizations to seek external assistance. Enter 3rd party payroll companies, a strategic solution that allows businesses to streamline payroll processes while focusing on their core competencies.

The Growing Complexity Of Payroll Management

Over time, payroll management has transformed from simple salary calculations to a multifaceted process involving tax deductions, compliance with labor laws, benefits administration, and more. This complexity can overwhelm internal payroll departments, potentially leading to errors, delays, and non-compliance issues. As businesses strive for efficiency and accuracy, the need for specialized expertise becomes evident.

What Are 3rd Party Payroll Companies?

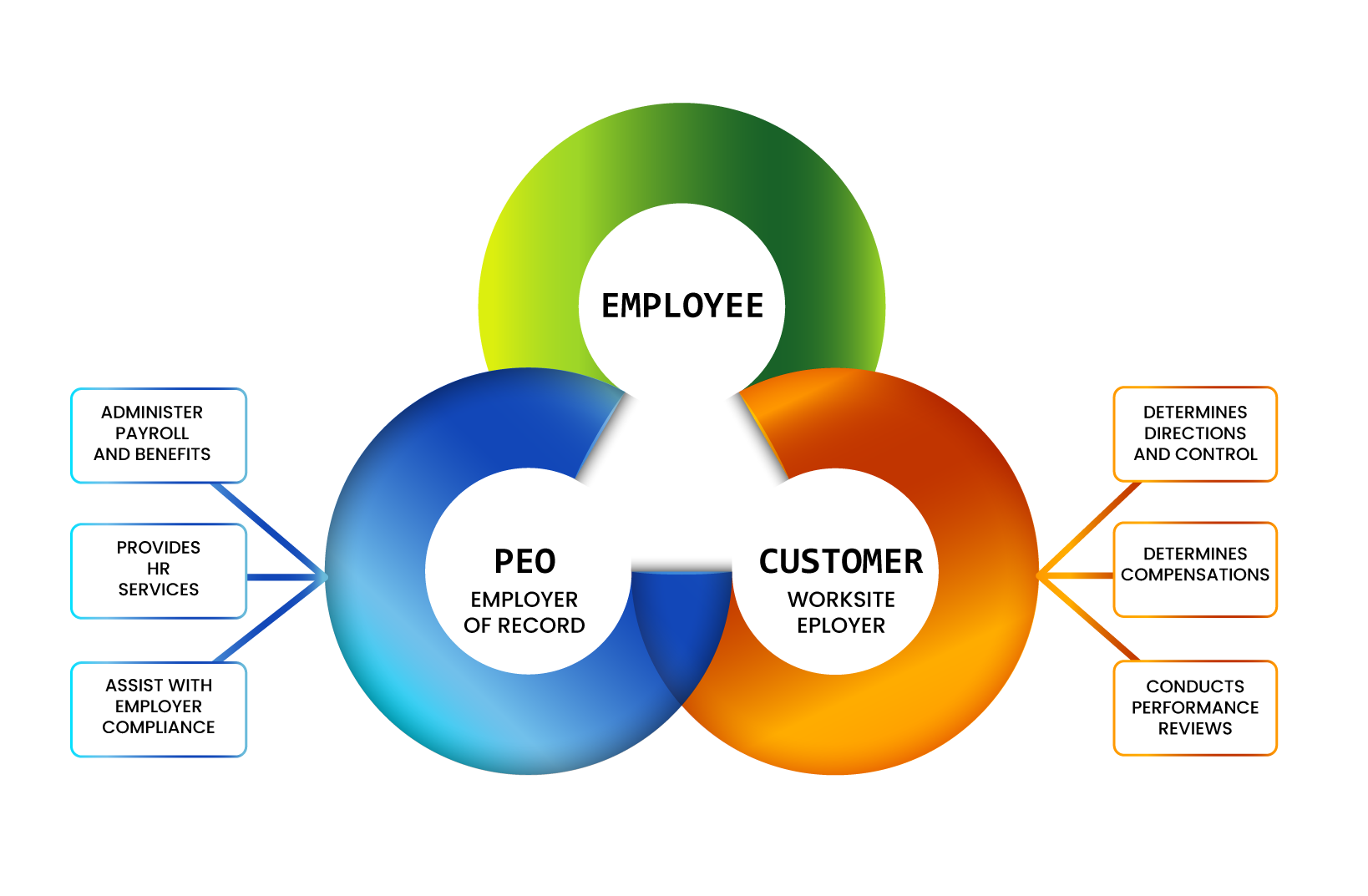

3rd party payroll companies are external service providers specializing in payroll management and related tasks. These companies assume responsibility for calculating employee salaries, withholding taxes, ensuring legal compliance, and managing benefits. By outsourcing payroll, businesses can offload these time-consuming tasks to experts, allowing them to allocate resources strategically and concentrate on their core operations.

Advantages Of Outsourcing Payroll

- Ensuring Compliance and Accuracy

Navigating the labyrinth of tax codes, labor laws, and regulatory requirements can be daunting. 3rd party payroll companies are well-versed in these intricacies, minimizing the risk of costly compliance errors. This expertise ensures that employee salaries are accurately calculated, taxes are withheld correctly, and reporting is timely and accurate.

Maintaining an in-house payroll department involves substantial costs, including salaries, software, training, and infrastructure. Outsourcing payroll can lead to significant cost savings, as businesses only pay for the services they require. Moreover, the streamlined processes of 3rd party payroll companies reduce the likelihood of errors and time wastage.

- Tailored Services for Diverse Business Needs

Every business is unique, with distinct payroll requirements. 3rd party payroll companies offer customizable solutions that cater to specific business needs. Whether a company has a remote workforce, variable compensation structures, or complex benefit packages, these service providers can adapt their offerings accordingly.

Payroll involves handling sensitive employee information. Reputable 3rd party payroll companies employ advanced security measures to protect data, mitigating the risk of breaches and identity theft. This level of data security provides peace of mind to both businesses and their employees.

Drawbacks/ Disadvantages Of Outsourcing Payroll

- Limited Control and Flexibility

When you outsource your payroll functions, you’re essentially entrusting a third party with a critical aspect of your business. This shift in responsibility means you may have less control over the payroll process and the timing of certain tasks. Some businesses prefer to have direct control over payroll to address unique situations or make real-time adjustments. Outsourcing can limit your flexibility in responding to unexpected changes or last-minute requests.

- Confidentiality and Data Security Concerns

Outsourcing payroll requires sharing sensitive employee information with an external entity. While reputable 3rd party payroll companies prioritize data security, there’s always a risk associated with sharing confidential data. Breaches, data leaks, or mishandling of sensitive information could potentially damage your company’s reputation and lead to legal and financial repercussions.

- Communication Challenges

Effective communication is essential for accurate payroll processing. When you outsource, you introduce an additional layer of communication between your business, the payroll company, and your employees. Miscommunications or delays in conveying changes or updates could result in errors in employee payments or tax filings. It’s crucial to establish clear communication channels and protocols to mitigate this risk.

- Potential for Service Disruptions

Outsourcing involves relying on an external provider to deliver timely and accurate services. While most reputable payroll companies strive for consistency, there’s always a possibility of service disruptions due to technical issues, system upgrades, or even the financial health of the service provider. Such disruptions could lead to payroll delays, affecting employee morale and trust.

While outsourcing payroll can initially lead to cost savings in terms of staff and infrastructure, it’s important to consider the long-term financial implications. Service fees, especially for additional services or customization, can add up over time. Depending on your business’s growth and evolving needs, the cumulative costs of outsourcing may eventually surpass the cost of maintaining an in-house payroll department.

- Compliance and Accountability

While outsourcing payroll can help ensure compliance with tax laws and labor regulations, the ultimate responsibility still lies with your business. If the outsourced payroll company makes an error or fails to comply with legal requirements, your business could still face penalties and legal consequences. It’s crucial to choose a reputable and reliable payroll provider to minimize this risk.

- Employee Perception and Trust

Outsourcing payroll might raise concerns among your employees about the security of their personal and financial information. Some employees may worry about the accuracy of their payments or the confidentiality of their data. Transparent communication and addressing employee concerns are essential to maintain trust and confidence in the outsourcing arrangement.

However, outsourcing payroll offers significant benefits, it’s important to recognize and address the potential disadvantages. Each business is unique, and the decision to outsource should be based on a thorough assessment of your specific needs, risk tolerance, and long-term objectives. By understanding both the advantages and drawbacks, you can make an informed choice that aligns with your business’s overall strategy and ensures a smooth and successful outsourcing experience.

Factors To Consider When Choosing A 3rd Party Payroll Company

Here are the key factors that should guide your decision-making process.

- Expertise and Industry Experience

The first and foremost factor to consider is the level of expertise and industry experience possessed by the 3rd party payroll company. Assess their track record in managing payroll for companies similar to yours. A company with a proven history of delivering accurate and compliant payroll services can significantly reduce the likelihood of errors and non-compliance issues.

- Range of Services Offered

Payroll management encompasses various tasks beyond simple salary calculations. Consider the range of services the company offers, including tax filing, benefits administration, time and attendance tracking, and more. Opt for a company that provides comprehensive services that align with your business needs.

- Technology and Security Measures

In the digital age, technology plays a crucial role in payroll processing. Evaluate the technology stack used by the 3rd party payroll company. Robust security measures, data encryption, and secure servers should be non-negotiable. Additionally, inquire about the software’s user-friendliness and accessibility.

Every business has unique payroll requirements. Ensure that the 3rd party payroll company can tailor their services to accommodate your specific needs. Scalability is equally important – as your business grows, the company should be able to seamlessly adapt to increased payroll demands.

- Reputation and Client References

Research the reputation of the 3rd party payroll company within the industry. Look for client testimonials and references to gain insights into their service quality and client satisfaction. Reach out to current clients to inquire about their experiences and any challenges they’ve faced.

- Compliance and Legal Knowledge

Staying compliant with tax regulations and labor laws is paramount. A reputable payroll company should have deep knowledge of legal requirements and be equipped to handle changes in regulations. Inquire about their compliance processes and how they ensure accurate tax filings.

- Customer Support and Communication

Effective communication and responsive customer support are essential in a successful partnership. Evaluate the company’s customer support channels and response times. Clear communication is crucial for addressing issues promptly and avoiding payroll disruptions.

- Pricing Structure and Transparency

Understanding the pricing structure is vital to avoid unexpected costs. Inquire about the pricing model, any additional fees, and how costs may change as your business evolves. Transparency in pricing ensures a healthier long-term partnership.

- Integration with Existing Systems

If you’re already using HR or accounting software, ensure that the 3rd party payroll company’s systems can integrate smoothly. Integration reduces manual data entry and minimizes errors.

- Data Handling and Confidentiality

Payroll involves handling sensitive employee data. Inquire about the company’s data handling practices, data storage security, and protocols for preventing breaches.

- Service Level Agreements (SLAs)

A well-defined Service Level Agreement outlines the company’s commitments regarding payroll accuracy, processing times, and issue resolution. Clear SLAs ensure expectations are met.

- Cultural Alignment

A cultural fit between your business and the 3rd party payroll company can lead to a more harmonious partnership. Consider their values, work culture, and approach to client relationships.

- Trial Period and Onboarding Process

Before committing, inquire about the possibility of a trial period. This allows you to assess their services firsthand. Additionally, understand the onboarding process and how smoothly they transition your payroll functions.

Making The Transition To Outsourced Payroll

Transitioning to a 3rd party payroll arrangement requires effective communication and planning. Clearly define responsibilities, establish timelines, and communicate the benefits to employees. A well-executed transition can lead to improved efficiency and employee satisfaction.

Common Misconceptions About 3rd Party Payroll Companies

Several misconceptions surround outsourcing payroll. Addressing these misconceptions, such as loss of control or increased costs, can help businesses make informed decisions based on accurate information.

Realizing Long-Term Business Goals

By outsourcing payroll, businesses can redirect their focus towards strategic initiatives and long-term goals. This shift in priorities can foster innovation, growth, and enhanced competitiveness in the market.

Case Studies: Success Stories with 3rd Party Payroll

Examining real-life examples of companies that have successfully outsourced their payroll functions highlights the transformative impact on their operations, employee satisfaction, and overall business performance.

The Future Of Payroll Management

As technology continues to evolve, so does the field of payroll management. The integration of artificial intelligence, data analytics, and automation holds the potential to revolutionize payroll processes, making them even more efficient, accurate, and user-friendly.

Conclusion

In the ever-changing landscape of business, 3rd party payroll companies have emerged as indispensable allies, enabling organizations to streamline payroll processes, ensure compliance, and achieve cost-effective operations. By partnering with these experts, businesses can refocus their resources, embrace innovation, and propel themselves towards sustained success.

Choosing a 3rd party payroll company is a significant decision that requires careful evaluation of multiple factors. By considering expertise, services, technology, communication, compliance, and more, businesses can make an informed choice that positively impacts their operations and employee satisfaction. Remember that each business’s needs are unique, so take the time to align the selected company with your specific requirements.