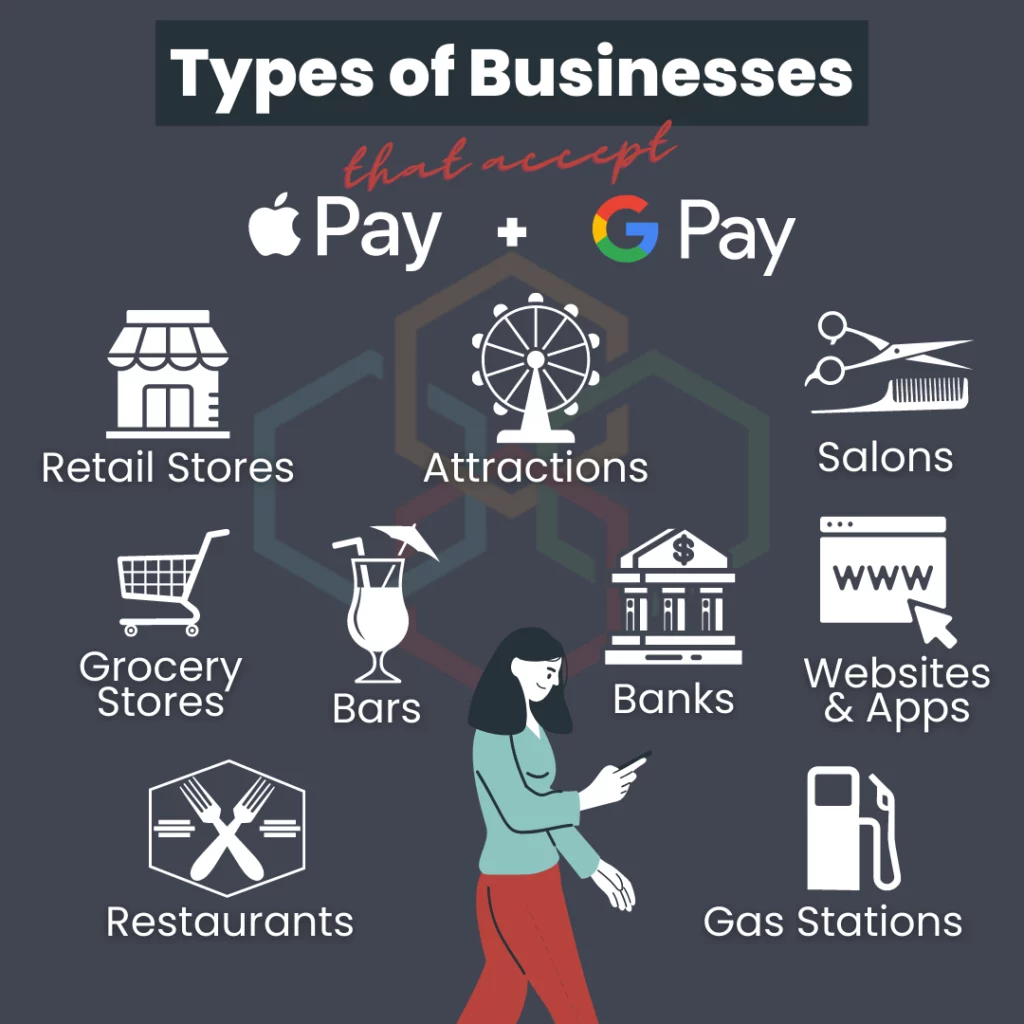

Over the past decade, digital payment methods have gained tremendous traction, revolutionizing the way people make purchases. From online shopping to contactless payments, these methods offer convenience, speed, and security.

Introducing Google Wallet

Google Wallet, launched in 2011, is a mobile payment system that allows users to store credit cards, debit cards, loyalty cards, and gift cards securely on their smartphones. It leverages near field communication (NFC) technology to enable contactless payments. In the rapidly evolving digital landscape, the way we make payments has undergone a profound transformation.

Gone are the days of fumbling for cash or swiping credit cards; instead, consumers now have access to convenient and secure digital payment methods. One such method that has gained popularity is Google Wallet. This article explores the emergence of Google Wallet and how it has revolutionized the payment experience for both consumers and businesses alike.

How Google Wallet Works

When making a purchase at a supported store, users simply need to tap their smartphones on the contactless payment terminal. The transaction data is securely transmitted, and the payment is completed almost instantly, making checkout a breeze.

The Benefits Of Google Wallet For Consumers

- Seamless Transactions: Google Wallet eliminates the need to carry multiple physical cards, streamlining the payment process. With just a tap, users can pay for their purchases effortlessly.

- Enhanced Security: One of the primary concerns with digital payments is security. However, Google Wallet employs multiple layers of encryption and authentication, ensuring that users’ payment information remains secure.

- Loyalty Programs and Offers: Google Wallet also allows users to store loyalty cards and redeem rewards seamlessly, making it an all-in-one solution for both payments and loyalty programs.

The Advantages Of Google Wallet For Merchants

- Streamlined Checkout Process: For businesses, accepting Google Wallet payments means quicker and more efficient checkouts, reducing waiting times for customers.

- Improved Customer Engagement: By integrating loyalty programs and personalized offers into Google Wallet, merchants can enhance customer engagement and retention.

- Simplified Loyalty Programs: With Google Wallet, businesses can simplify their loyalty programs and offer targeted rewards, leading to increased customer satisfaction.

Disadvantages Of Google Wallet For Merchants

Here are some of the disadvantages of Google Wallet for merchants:

- Transaction Fees: While Google Wallet offers convenience for customers, merchants may incur transaction fees for accepting payments through the platform. These fees can eat into the merchant’s profit margins, especially for small businesses with lower transaction volumes.

- Dependence on Technology: Google Wallet relies on NFC technology and a stable internet connection for seamless payments. In cases of technical issues or connectivity problems, merchants may face disruptions in the payment process, leading to customer dissatisfaction.

- Limited Reach: Although Google Wallet has gained popularity, not all customers use the platform for payments. Some customers may prefer alternative payment methods or may not have smartphones with NFC capabilities, limiting the merchant’s ability to cater to a broader customer base.

- Lack of Control over Customer Data: When customers use Google Wallet for payments, some of their data is processed by Google. Merchants may have limited access to this data, which could restrict their ability to personalize marketing efforts and understand customer purchasing behavior.

- Security Concerns: While Google Wallet implements robust security measures, any digital payment system is susceptible to potential hacking attempts or security breaches. In the event of a breach, merchants could face reputational damage and loss of customer trust.

- Delayed Payments: Google Wallet payments typically take a few days to settle and be transferred to the merchant’s bank account. This delay in receiving funds may affect the merchant’s cash flow and financial planning.

- Transaction Disputes: Like any payment method, Google Wallet transactions are subject to potential disputes or chargebacks. Resolving these disputes can be time-consuming for merchants and may result in lost revenue if the resolution favors the customer.

- Compatibility with POS Systems: Integrating Google Wallet with existing point-of-sale (POS) systems may require additional investments in hardware and software updates, especially for older systems that lack NFC capabilities.

- Competition from Other Payment Apps: Google Wallet faces competition from other digital payment apps and platforms. Merchants may need to support multiple payment options to cater to a diverse customer base, which could add complexity to their payment processing systems.

- Reliance on Google’s Policies: As a third-party payment service, merchants must adhere to Google’s terms and policies. Any changes in these policies or service disruptions from Google could affect the merchant’s ability to accept payments through Google Wallet.

Despite these disadvantages, many merchants find value in accepting Google Wallet payments due to its popularity among tech-savvy consumers and the potential to enhance the overall customer experience. It’s essential for businesses to weigh the pros and cons carefully and consider their specific customer demographics and preferences before fully embracing Google Wallet as a payment option.

It’s important for users of Google Wallet to be aware of the transaction fees and stay informed about any updates or changes that Google may make to their fee structure. Understanding the fees can help users make informed decisions about when and how to use Google Wallet for their transactions.

For individuals who frequently send or receive money through Google Wallet, especially using debit or credit cards, the transaction fees can add up over time. In such cases, it might be more cost-effective to use alternative payment methods that offer lower or no transaction fees for certain types of transactions.

On the other hand, for users who primarily use bank account transfers, Google Wallet can be a convenient and fee-free option for sending money to friends, family, or businesses. Bank transfers typically take a few business days to complete, but they are often free of charge, making them a budget-friendly choice.

For businesses considering using Google Wallet as a payment option for their customers, it’s crucial to factor in the transaction fees when calculating their overall costs and pricing strategies. Offering multiple payment methods can be beneficial, but businesses should carefully evaluate the impact of transaction fees on their profitability.

It’s worth noting that Google Wallet, as part of Google Pay, is continually evolving, and its fee structure and features may change over time to adapt to market demands and competition. Users and businesses should regularly check for updates and review the latest terms and conditions provided by Google to stay informed about any modifications to transaction fees and other aspects of using Google Wallet.

Google Wallet offers a convenient and secure way to send and receive money, but users should be mindful of the potential transaction fees associated with certain types of transactions. Understanding the fees and considering alternative payment methods can help users make the most cost-effective decisions when using Google Wallet for their financial transactions. Always refer to the official Google Pay website or contact Google support for the most up-to-date information regarding fees and services related to Google Wallet.

Ways To Link Your Multiple Payment Method To Your Google Wallet Account

Linking multiple payment methods to your Google Wallet account is a straightforward process. Google Wallet provides a user-friendly interface that allows you to add and manage various payment options with ease. Here are the steps to link multiple payment methods to your Google Wallet account:

- Open Google Wallet: First, access the Google Wallet platform. You can do this through the Google Pay website or the Google Pay app, depending on your device and location.

- Sign In: If you’re not already signed in, sign in to your Google account. Make sure you use the same Google account that you wish to link the payment methods to.

- Navigate to Payment Methods: Once you are signed in, find and click on the “Payment methods” or “Add payment method” section within the Google Wallet interface. This is where you can manage your linked payment options.

- Add Credit/Debit Cards: To link a credit or debit card, select the “Add credit or debit card” option. Enter the card details, such as the card number, expiration date, and security code. Google Wallet will likely require you to verify the card for security purposes, which may involve receiving a verification code via email or text message.

- Link Bank Account: If you want to add your bank account as a payment method, choose the “Add bank account” or “Link bank account” option. Provide the necessary information, such as your bank account number and routing number, and follow any additional steps for verification.

- Add Gift Cards or Digital Payment Services: If you have gift cards or other digital payment services available, you can link them as well. Look for the appropriate option within the payment methods section and follow the on-screen instructions to add the gift cards or services.

- Set Preferred Payment Method: After adding multiple payment methods, you can choose a preferred method for transactions. This means that when you make a purchase, Google Wallet will automatically use the selected payment method unless you choose a different one during the checkout process.

- Verify and Confirm: During the process of adding payment methods, Google Wallet may ask for verification to ensure the security of your account and payment information. Follow the provided instructions to complete the verification steps if prompted.

- Manage Payment Methods: Once you have linked your desired payment methods, you can manage them within the Google Wallet interface. You can edit, remove, or add new payment methods as needed.

It’s essential to keep your payment information up-to-date and secure. Be cautious when adding payment methods and ensure you are using a secure internet connection when performing these actions.

Remember that specific steps and options may vary slightly based on the version of Google Wallet or Google Pay that you are using and your country or region. If you encounter any issues or need further assistance, you can refer to the Google Pay support documentation or contact Google’s customer support for guidance.

Google Wallet Vs. Traditional Payment Methods

Google Wallet’s emergence has challenged traditional payment methods, highlighting the need for businesses to embrace digital payment solutions to stay competitive.

Google Wallet’s Integration With Mobile Devices

The widespread adoption of smartphones has fueled the success of Google Wallet, turning mobile devices into digital wallets that users carry wherever they go.

Security And Privacy Considerations

While digital payments offer convenience, ensuring the security and privacy of customer data remains a top priority for businesses and payment providers.

How Businesses Can Implement Google Wallet

Integrating Google Wallet into existing payment systems requires careful planning and execution, but the benefits in terms of customer experience are well worth it.

Success Stories: Brands Thriving With Google Wallet

- Case Study 1: XYZ Electronics

XYZ Electronics implemented Google Wallet, leading to a 20% increase in mobile transactions and a significant rise in customer satisfaction.

- Case Study 2: FashionHub

FashionHub’s integration of Google Wallet resulted in a 15% increase in repeat customers and a boost in overall sales.

The Future Of Google Wallet And Digital Payments

As technology continues to advance, Google Wallet is likely to evolve further, offering even more convenience and innovation in the realm of digital payments.

Conclusion

Google Wallet has revolutionized the way we make payments, providing a seamless and secure solution for both consumers and businesses. Embracing this digital payment method can lead to increased customer satisfaction, improved sales, and enhanced engagement. As we look to the future, it’s evident that Google Wallet will continue to play a pivotal role in shaping the digital payment landscape.