In this article, Sell My Structured Settlementwe will explore the process of selling a structured settlement and how it can help individuals unlock their financial freedom. A structured settlement is a series of periodic payments received by an individual as a result of a legal settlement or winning a lawsuit. While these payments can provide stability, there are instances when the need for a lump sum arises, such as for medical emergencies, debt consolidation, or investing in a new venture. Selling a structured settlement can be a viable solution to meet these financial requirements.

What Is A Structured Settlement?

A structured settlement is a financial arrangement in which an individual receives periodic payments over time, usually resulting from a legal settlement or a court-awarded payout. These payments are designed to provide long-term financial support and stability for the recipient.

The Benefits Of Structured Settlements

Structured settlements offer various advantages, including guaranteed income, tax benefits, and protection against poor financial decisions. They can ensure that recipients have a steady income to cover living expenses, medical bills, and other necessities.

When Selling Becomes An Option

Assessing Financial Needs

There are situations where individuals may find themselves in urgent need of a large sum of money. This could be due to unforeseen medical emergencies, outstanding debts, educational expenses, or investment opportunities. In such cases, selling a structured settlement can offer a solution.

Understanding the Selling Process

- Researching Structured Settlement Companies

Before proceeding with the sale, it is crucial to research and select a reputable structured settlement company. Look for firms with a proven track record, positive customer reviews, and fair practices.

- Obtaining Court Approval

The process of selling a structured settlement typically involves court approval. The court will evaluate the need for the lump sum and ensure it aligns with the individual’s best interests.

Upon selecting a suitable company, the individual can request a quote for the structured settlement. The amount offered may be less than the total value of the remaining payments due to factors like interest rates and company fees.

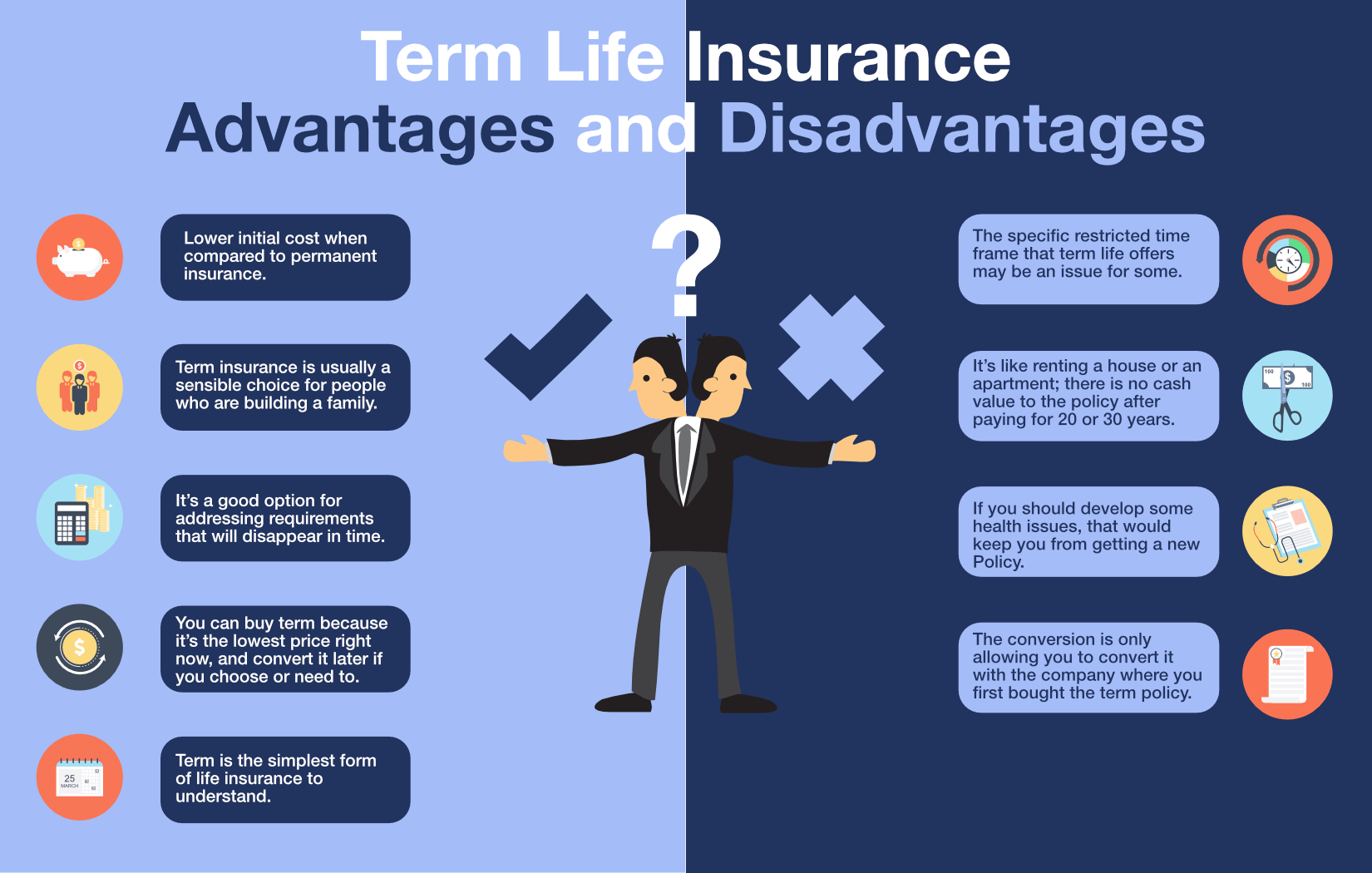

- Weighing the Pros and Cons

Before finalizing the sale, it’s essential to weigh the pros and cons of selling the structured settlement. Consider the impact on future financial stability and any potential alternative options.

The Road To Financial Freedom

- Debt Repayment

For individuals burdened with high-interest debts, selling a structured settlement can provide an opportunity to pay off outstanding balances. By eliminating debts, one can experience reduced financial stress and an improved credit score.

- Investments and Business Ventures

For some, the desire to invest in a new business venture or property can be an exciting prospect. Selling a structured settlement can provide the initial capital needed to embark on these ventures.

- Educational Opportunities

Education is a powerful tool for personal and financial growth. The funds acquired from selling a structured settlement can be used to pursue higher education, enabling individuals to expand their career opportunities and earning potential.

Risks And Considerations

While selling a structured settlement can be beneficial, it’s essential to be aware of potential risks and considerations:

- Long-Term Impact

Before selling, carefully evaluate the long-term impact of receiving a lump sum versus the steady income from the structured settlement. Consider factors like inflation, investment opportunities, and future financial needs.

- Transaction Costs

Keep in mind that there may be transaction costs associated with selling a structured settlement. These costs could include administrative fees, court fees, and the fees charged by the structured settlement company.

- Financial Planning

Consulting with a financial advisor can help ensure that selling a structured settlement aligns with your overall financial plan. They can offer guidance on managing the funds wisely and achieving your financial objectives.

- Scams and Predatory Practices

Be cautious of potential scams and predatory practices. Deal only with reputable structured settlement companies and seek legal advice to safeguard your interests.

The Legal Aspect

- Court Approval

As mentioned earlier, court approval is typically required when selling a structured settlement. The court’s role is to protect the individual from making impulsive decisions that may have adverse long-term consequences.

- Legal Assistance

Engaging an attorney with experience in structured settlement sales can be beneficial. They can help navigate the legal process, ensure your rights are protected, and assist in obtaining court approval.

The Emotional Aspect

- Embracing Change

Receiving a lump sum can be overwhelming for some individuals. It’s essential to be emotionally prepared for this significant change in your financial circumstances.

- Support Network

Lean on your support network of family and friends during this time. Discussing your decision with them can offer valuable insights and emotional support.

Conclusion

Selling a structured settlement can be a strategic move to gain financial freedom and address immediate financial needs. By understanding the selling process, exploring the available options, and weighing the pros and cons, individuals can make informed decisions regarding their structured settlements. However, it is essential to proceed with caution and consider consulting financial advisors or legal experts to ensure the best outcome for one’s financial future.