Are you looking for ways to manage your retirement funds effectively? A rollover IRA brokerage account could be the solution you need. In this article, we will explore what a rollover IRA brokerage account is, how it works, and the benefits it offers. Whether you’re a seasoned investor or just starting your retirement planning journey, this guide will provide valuable insights to help you make informed decisions. So, let’s dive in and discover the world of rollover IRA brokerage accounts.

Understanding Rollover IRA

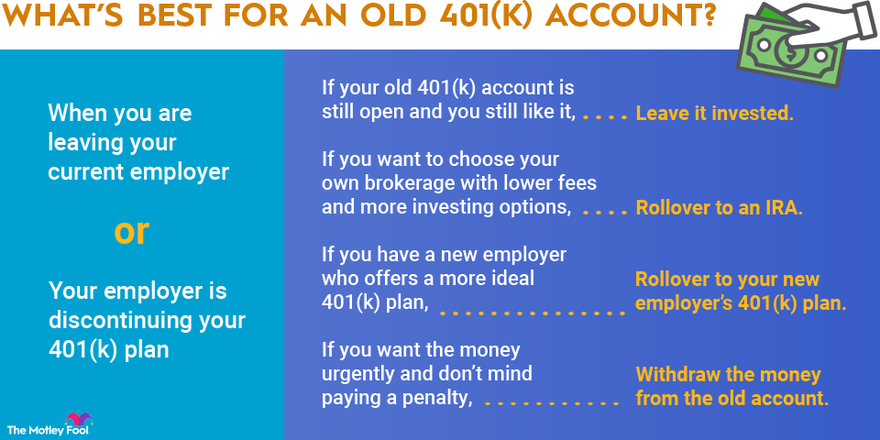

Retirement planning is a crucial aspect of financial stability. As you transition from one phase of life to another, it’s essential to ensure that your retirement funds are managed efficiently. A rollover IRA is a retirement account that allows you to transfer funds from a previous employer’s retirement plan, such as a 401(k), into an individual retirement account (IRA). This enables you to maintain control over your investments and continue growing your savings.

What Is A Rollover IRA Brokerage Account?

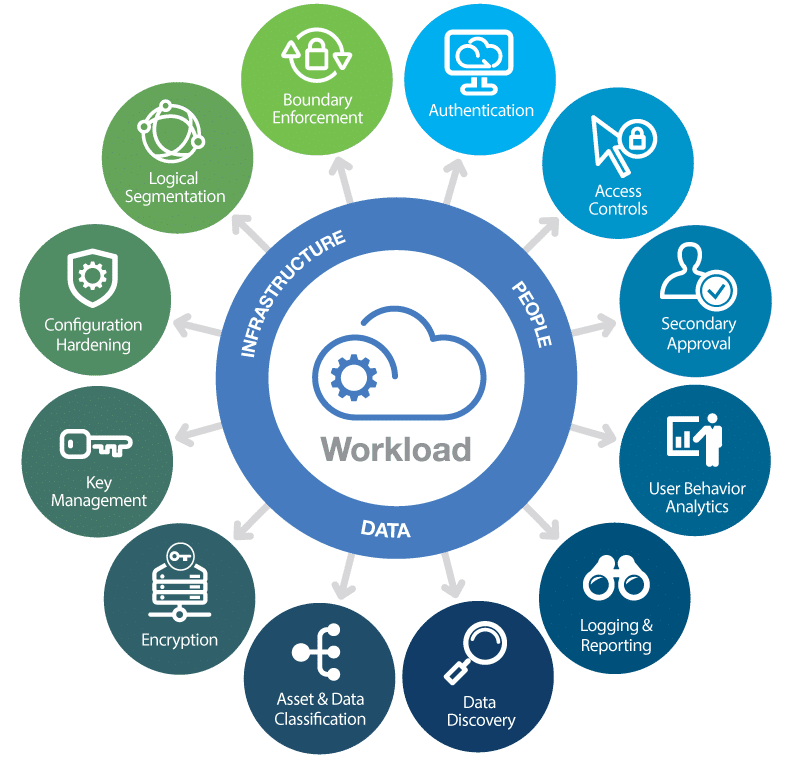

A rollover IRA brokerage account combines the benefits of a traditional IRA with the flexibility and investment options offered by a brokerage account. With a rollover IRA brokerage account, you have the freedom to invest in a wide range of assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and more. This account type allows you to take a proactive approach to managing your retirement funds and tailoring your investments to your financial goals.

How Does A Rollover IRA Brokerage Account Work?

To open a rollover IRA brokerage account, you first need to have funds from a previous employer’s retirement plan that you want to transfer. You can initiate a rollover by contacting your plan administrator and requesting a direct transfer to an IRA custodian or brokerage firm. Once the funds are transferred, you can begin investing them in various financial instruments through your rollover IRA brokerage account.

Benefits Of A Rollover IRA Brokerage Account

- Flexibility: A rollover IRA brokerage account offers you the flexibility to choose from a wide range of investment options based on your risk tolerance and financial goals.

- Control: By managing your own investments, you have control over the direction of your retirement funds, allowing you to make decisions aligned with your investment strategy.

- Consolidation: Consolidating your retirement funds from multiple employer plans into a single rollover IRA brokerage account simplifies your financial management and provides a holistic view of your retirement savings.

- Tax Advantages: A rollover IRA brokerage account offers potential tax advantages. Depending on the type of IRA you choose (traditional or Roth), you may benefit from tax-deferred growth or tax-free withdrawals during retirement.

- Investment Opportunities: With a rollover IRA brokerage account, you can explore a wide range of investment opportunities, including individual stocks, bonds, index funds, real estate investment trusts (REITs), and more. This diversification can help enhance the growth potential of your retirement portfolio.

- Professional Guidance: Many brokerage firms provide access to research, tools, and expert advice to help you make informed investment decisions. This guidance can be invaluable, especially if you’re new to investing or need assistance in managing your retirement funds.

Choosing The Right Rollover IRA Brokerage Account

When selecting a rollover IRA brokerage account, consider the following factors:

- Fees and Expenses: Compare the fees associated with the account, including maintenance fees, transaction fees, and fund expense ratios. Look for low-cost options that align with your investment strategy.

- Investment Options: Assess the range of investment options available within the brokerage account. Ensure that it offers the types of investments you’re interested in and suits your risk tolerance and long-term goals.

- Customer Service: Evaluate the quality of customer service provided by the brokerage firm. Prompt and reliable customer support can be essential when you need assistance or have questions about your account.

- Technological Tools: Consider the availability of user-friendly platforms, mobile apps, and investment tools provided by the brokerage firm. These features can enhance your overall investment experience.

Opening A Rollover IRA Brokerage Account

To open a rollover IRA brokerage account, follow these steps:

1. Research and compare different brokerage firms to find one that meets your needs.

2. Contact the selected brokerage firm or visit their website to initiate the account opening process.

3. Complete the necessary paperwork, which may include providing personal information, beneficiary details, and information about the retirement plan you’re rolling over.

4. Arrange for a direct transfer of funds from your previous employer’s retirement plan to the new rollover IRA brokerage account.

5. Once the funds are transferred, you can begin investing according to your chosen strategy.

Managing Your Rollover IRA Investments

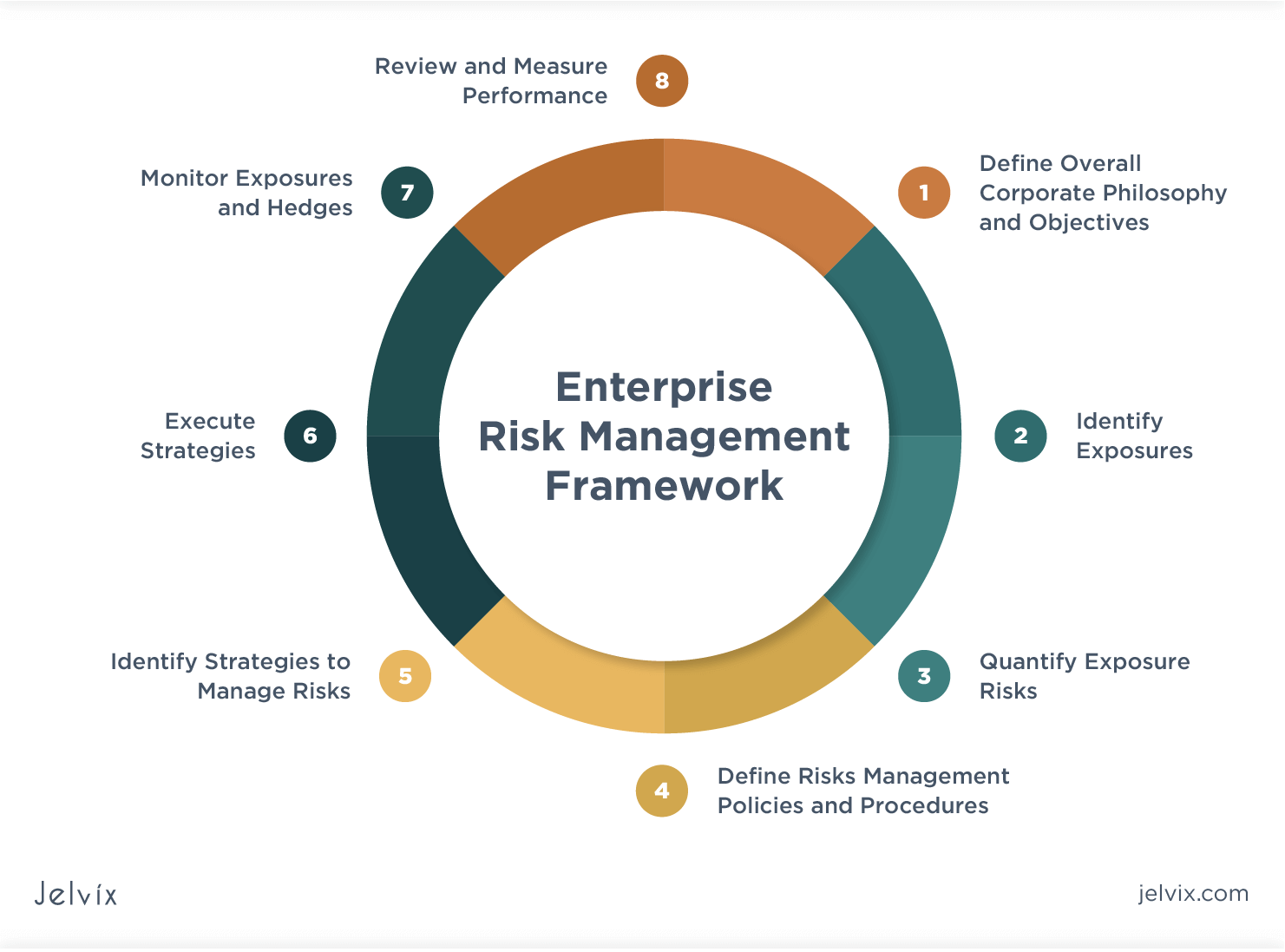

Proper management of your rollover IRA investments is crucial for long-term growth. Consider the following tips:

1. Set Clear Goals: Define your financial goals and time horizon for retirement. This will help guide your investment decisions.

2. Diversify Your Portfolio: Allocate your investments across different asset classes to reduce risk. Diversification can help protect your portfolio from market volatility and potentially enhance returns.

3. Review and Rebalance: Regularly review your portfolio’s performance and rebalance it if necessary. Adjust the allocation of your investments to maintain the desired asset mix.

4. Stay Informed: Stay updated on market trends and economic conditions that may impact your investments. This knowledge can help you make informed decisions.

5. Consult Professionals: Consider seeking advice from financial advisors or investment professionals who can provide personalized guidance based on your financial situation and goals.

Tax Considerations For Rollover IRA Brokerage Accounts

Tax implications play a significant role in retirement planning. Here are a few key tax considerations for rollover IRA brokerage accounts:

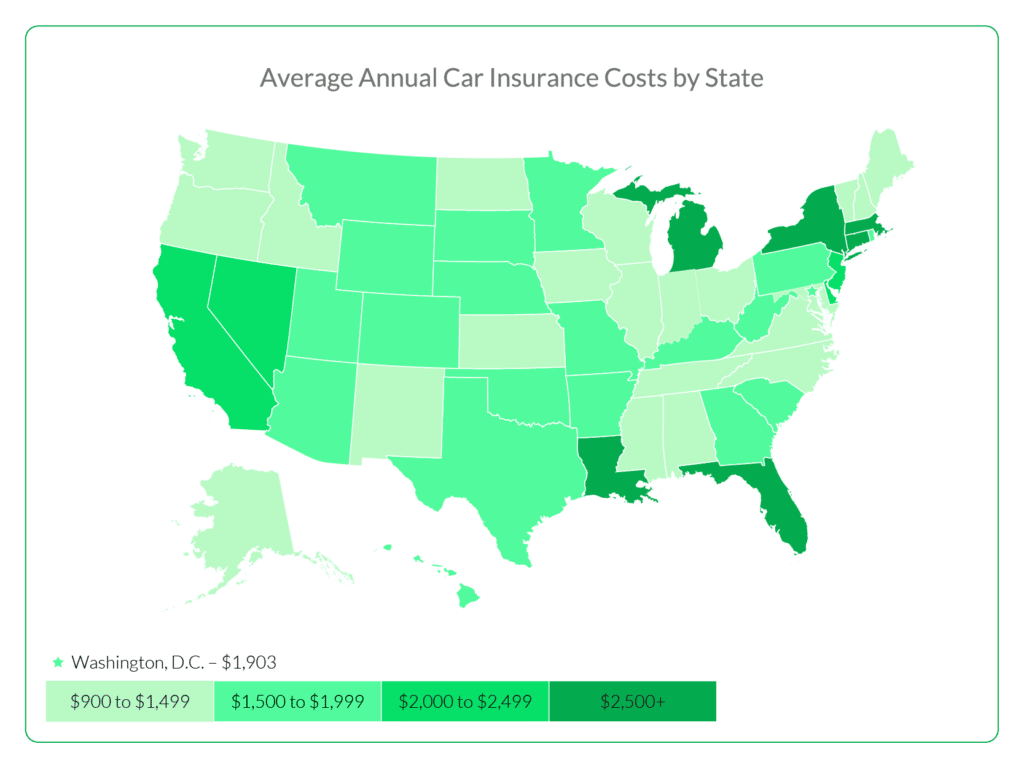

- Traditional IRA: Contributions to a traditional IRA are often tax-deductible, reducing your current taxable income. However, withdrawals during retirement are subject to income tax.

- Roth IRA: Roth IRA contributions are made with after-tax dollars, meaning they are not tax-deductible. However, qualified withdrawals in retirement are tax-free.

- Tax-Deferred Growth: Both traditional and Roth IRAs offer tax-deferred growth, meaning you don’t pay taxes on investment gains until you make withdrawals.

- Required Minimum Distributions (RMDs): Traditional IRAs have RMD requirements, which mandate that you start taking withdrawals after reaching age 72 (or age 70½ if born before July 1, 1949). Roth IRAs do not have RMDs during the account owner’s lifetime.

- Early Withdrawal Penalties: Withdrawing funds from a traditional IRA before age 59½ may result in early withdrawal penalties and income tax liability. Roth IRAs offer more flexibility, allowing for penalty-free withdrawals of contributed funds (not earnings) before retirement age.

It’s important to consult with a tax professional or financial advisor to understand the specific tax implications of your rollover IRA brokerage account based on your individual circumstances.

Monitoring And Adjusting Your Rollover IRA Investments

Regularly monitoring and adjusting your rollover IRA investments can help ensure that your portfolio stays aligned with your goals. Consider the following practices:

- Review Performance: Evaluate the performance of your investments periodically. Assess how they are performing relative to your expectations and make adjustments if necessary.

- Rebalance if Needed: If certain investments have grown significantly or declined in value, rebalance your portfolio to maintain your desired asset allocation.

- Stay Updated: Stay informed about market trends, economic conditions, and changes in the investment landscape. This knowledge can guide your decision-making process.

- Seek Professional Advice: If you are unsure about managing your investments or need expert guidance, consider consulting with a financial advisor or investment professional.

By actively monitoring and adjusting your rollover IRA investments, you can optimize your portfolio’s performance and ensure it remains aligned with your long-term objectives.

Common Mistakes To Avoid With Rollover IRA Brokerage Accounts

While rollover IRA brokerage accounts offer flexibility and control, it’s important to avoid certain common mistakes. These include:

1. Procrastination: Delaying the process of rolling over your retirement funds can result in missed opportunities for growth and potential tax advantages.

2. Overconcentration: Placing too much of your portfolio in a single investment or asset class can expose you to unnecessary risk. Diversification is key.

3. Ignoring Fees: High fees can eat into your returns over time. Pay attention to the fees associated with your brokerage account and choose low-cost options whenever possible.

4. Lack of Regular Review: Failing to review and adjust your portfolio regularly can result in an outdated asset allocation that doesn’t align with your goals.

5. Not Seeking Professional Advice: Investing can be complex, and it’s beneficial to seek guidance from professionals who can provide tailored advice based on your financial situation.

Rollover IRA vs. Traditional IRA: What’s The Difference?

A rollover IRA and a traditional IRA share similarities but differ in terms of how funds are contributed. While a rollover IRA is specifically designed for transferring funds from a previous employer’s retirement plan, a traditional IRA allows you to contribute funds directly, either through deductible or nondeductible contributions. Additionally, the rules for required minimum distributions and contribution limits may vary between the two account types. It’s essential to understand these distinctions and consult with a financial advisor to determine which option is most suitable for your needs.

Rollover IRA vs. Roth IRA: Which is Right for You?

When choosing between a rollover IRA and a Roth IRA, consider the following factors:

- Tax Considerations: Rollover IRAs and Roth IRAs have different tax treatments. With a rollover IRA, contributions may be tax-deductible, and withdrawals are taxed as ordinary income. Roth IRA contributions are made with after-tax dollars, and qualified withdrawals are tax-free. Assess your current and future tax situation to determine which option aligns with your tax strategy.

- Current and Future Income: If you anticipate being in a higher tax bracket during retirement, a Roth IRA may be advantageous as it allows tax-free withdrawals. However, if you expect your income to decrease in retirement, a rollover IRA’s tax-deductible contributions might provide immediate tax benefits.

- Withdrawal Flexibility: Roth IRAs offer more flexibility in terms of withdrawals. Contributions to a Roth IRA can be withdrawn penalty-free at any time, while earnings can be withdrawn tax-free after age 59½ and holding the account for at least five years. Rollover IRAs have stricter withdrawal rules and may incur penalties for early withdrawals.

- Estate Planning: Consider how each account aligns with your estate planning goals. Roth IRAs have no required minimum distributions (RMDs) during your lifetime and can be passed on to beneficiaries tax-free. Rollover IRAs have RMD requirements, and distributions may be subject to income tax.

Assessing your individual circumstances, financial goals, and tax considerations will help determine whether a rollover IRA or a Roth IRA is the better fit for your retirement strategy.

Maximizing Your Rollover IRA Contributions

To maximize the benefits of your rollover IRA, consider these strategies:

1. Contribute the Maximum: Take advantage of the annual contribution limits for IRAs. As of 2021, the contribution limit is $6,000 ($7,000 if age 50 or older). Contributing the maximum amount allows for potential tax advantages and increased retirement savings.

2. Catch-Up Contributions: If you are age 50 or older, take advantage of catch-up contributions. You can contribute an additional $1,000 on top of the regular contribution limit.

3. Consider Tax Deductibility: Evaluate the tax deductibility of your contributions. If eligible, tax-deductible contributions can lower your current taxable income.

4. Automate Contributions: Set up automatic contributions to your rollover IRA. Consistent contributions over time can help grow your retirement savings.

5. Review Contribution Limits: Stay informed about any changes to the contribution limits. Adjust your contributions accordingly to maximize your retirement savings potential.

By employing these strategies, you can make the most of your rollover IRA contributions and increase the likelihood of achieving your retirement goals.

Conclusion

A rollover IRA brokerage account provides a powerful tool for managing your retirement funds. By understanding the concept of a rollover IRA, its benefits, and the considerations involved, you can take control of your retirement planning and tailor your investments to align with your financial goals. Remember to assess your risk tolerance, consult with professionals when needed, and stay informed about the tax implications and investment options available to you.