If you’re a business owner looking to maintain a steady cash flow while managing your operations and growth, you may have come across the concept of factoring. Factoring can be a valuable financial solution that provides immediate working capital by selling your accounts receivable to a third-party known as a factoring company. In this article, we’ll explore the world of public factoring companies and how they can help businesses unlock their cash flow potential.

What Is Factoring?

Factoring is a financial arrangement in which a business sells its accounts receivable (unpaid invoices) to a third-party, known as a factor, at a discounted rate. This provides immediate cash flow to the business, allowing it to cover operational expenses, invest in growth opportunities, or manage unexpected costs. Public factoring companies are specialized firms that engage in factoring transactions with businesses of all sizes across various industries.

The Role Of Public Factoring Companies

Public factoring companies act as intermediaries between businesses and their customers. They purchase the accounts receivable from the business and assume responsibility for collecting payment from the customers. By doing so, they provide immediate cash to the business, eliminating the need to wait for customers to pay their invoices.

Benefits Of Public Factoring

Public factoring offers several benefits to businesses, including:

- Improved Cash Flow: Factoring provides immediate cash, allowing businesses to meet their financial obligations promptly and seize growth opportunities.

- No Debt Incurred: Factoring is not a loan, so businesses can access cash without incurring debt or adding liabilities to their balance sheets.

- Fast and Flexible: Public factoring companies typically provide quick funding, allowing businesses to access cash within a few days. The amount of funding can also grow as the business grows.

- Outsourced Collections: By selling their accounts receivable, businesses transfer the responsibility of collecting payments to the factoring company, saving time and resources on collections.

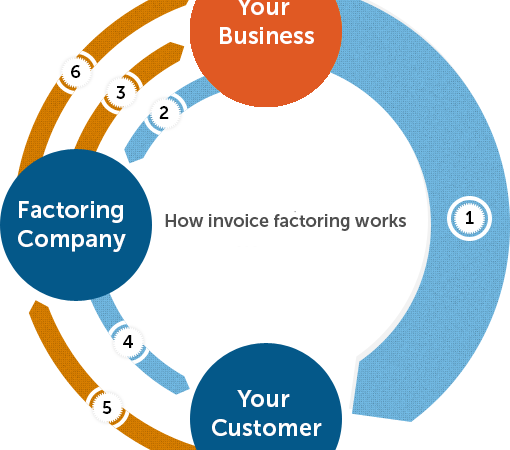

How Public Factoring Works

The process of public factoring typically involves the following steps:

1. Application: The business applies to a public factoring company, providing details about their accounts receivable and customers.

2. Due Diligence: The factoring company evaluates the creditworthiness of the business’s customers to determine the risk involved.

3. Approval: If approved, the factoring company offers a funding agreement specifying the terms, rates, and advance rates.

4. Selling Invoices: The business sells its accounts receivable to the factoring company, receiving an immediate cash advance (typically 80-90% of the invoice value).

5. Collection: The factoring company assumes responsibility for collecting payments from the customers.

6. Reserve Release: Once the customers pay their invoices, the factoring company deducts their fees and releases the remaining reserve amount to the business, minus any applicable fees.

Qualifying For Public Factoring

Public factoring companies typically consider the creditworthiness of the business’s customers rather than the business itself. This means that even businesses with limited credit history or low credit scores can qualify for factoring as long as their customers have a good payment track record.

Choosing The Right Public Factoring Company

When selecting a public factoring company, it’s crucial to consider the following factors:

- Industry Expertise: Look for a factoring company that specializes in your industry. They will have a better understanding of your unique needs and challenges.

- Rates and Fees: Compare the rates, fees, and terms offered by different factoring companies to ensure you’re getting a competitive deal.

- Transparency: Choose a factoring company that provides clear and transparent information about their processes, fees, and funding terms.

- Customer Support: Evaluate the quality of customer support provided by the factoring company. A responsive and helpful team can make a significant difference in your experience.

Factors To Consider When Evaluating Public Factoring Companies

When evaluating public factoring companies, consider the following factors:

- Advance Rates: Determine the percentage of the invoice value that the factoring company offers as an upfront advance.

- Reserve Amount: Understand the portion of the invoice value held as a reserve and when it will be released.

- Credit Checks: Find out how the factoring company assesses the creditworthiness of your customers and whether they offer non-recourse or recourse factoring.

- Collection Process: Inquire about the factoring company’s collection practices and whether they have a professional and effective approach to collecting payments from customers.

Public Factoring vs. Other Financing Options

Public factoring offers distinct advantages over other financing options:

- No Debt: Unlike loans, factoring doesn’t create additional debt for the business.

- Quick Funding: Factoring provides faster access to funds compared to traditional financing options like bank loans.

- Credit Flexibility: Factoring is based on the creditworthiness of the business’s customers, making it accessible to businesses with limited credit history.

- Scalability: Public factoring can accommodate the growth of the business, providing increased funding as sales volume expands.

Public Factoring Companies And Industry-Specific Expertise

Public factoring companies often specialize in specific industries, such as manufacturing, transportation, healthcare, or construction. Partnering with a factoring company that understands the unique dynamics of your industry can be beneficial in terms of industry-specific expertise, tailored solutions, and efficient collections.

Public Factoring And Small Businesses

Small businesses can greatly benefit from public factoring. It allows them to maintain a consistent cash flow, fulfill orders, pay suppliers, and invest in growth opportunities without relying heavily on traditional loans or credit lines.

Public Factoring For Startups

Startups often face challenges when it comes to securing financing due to their limited operating history. Public factoring can provide startups with the necessary working capital to cover operational expenses and fuel growth, allowing them to bridge the gap between invoicing and receiving payments.

Common Misconceptions About Public Factoring

There are several misconceptions about public factoring that need clarification:

- Factoring is Not a Loan: Factoring involves selling accounts receivable, not borrowing money.

- Negative Impact on Customer Relationships: Public factoring companies work professionally and maintain positive relationships with customers during the collection process.

- Only for Troubled Businesses: Factoring is a viable financing option for businesses of all sizes and financial situations.

- Loss of Control: While factoring involves outsourcing collections, businesses still retain control over their operations and decision-making.

Case Study: Real-Life Example of Public Factoring Success

[Insert a real-life case study of a business that benefited from public factoring, highlighting the positive outcomes, improved cash flow, and growth opportunities.]

Alternatives To Public Factoring

While public factoring can be a suitable financing solution for many businesses, it’s essential to explore other alternatives, such as:

- Business Loans: Traditional bank loans or lines of credit may provide long-term financing options for businesses with established credit and financial stability.

- Trade Credit: Negotiating extended payment terms with suppliers can alleviate cash flow constraints.

- Invoice Financing: Similar to factoring, invoice financing allows businesses to borrow against their accounts receivable but without transferring the collection responsibility to a third party.

Conclusion

Public factoring companies play a crucial role in helping businesses unlock their cash flow potential. By providing immediate working capital through the purchase of accounts receivable, public factoring enables businesses to meet their financial obligations, pursue growth opportunities, and maintain a healthy cash flow. When considering public factoring, it’s important to select a reputable company with industry expertise, transparent terms, and excellent customer support. By leveraging the benefits of public factoring, businesses can navigate financial challenges with confidence and focus on achieving their long-term goals.