Dealing with tax debt can be overwhelming and stressful. If you find yourself in a situation where you owe a significant amount of money to the IRS, it’s crucial to seek professional assistance. IRS tax settlement attorneys are legal experts who specialize in resolving tax-related issues and negotiating with the Internal Revenue Service on your behalf. In this article, we will explore the role of IRS tax settlement attorneys, their benefits, and how they can help you achieve a favorable resolution for your tax debt.

Understanding IRS Tax Settlement Attorneys

IRS tax settlement attorneys are legal professionals who specialize in tax law and have extensive experience in dealing with the IRS. They provide expert advice and assistance to individuals and businesses facing tax debt and can help navigate the complex tax system.

The Importance Of Hiring An IRS Tax Settlement Attorney

Hiring an IRS tax settlement attorney is crucial for several reasons. Firstly, tax laws and regulations are complex, and it can be challenging for individuals without legal expertise to understand and navigate them effectively. An experienced attorney can interpret the laws, assess your situation accurately, and devise appropriate strategies to resolve your tax debt.

Assessing Your Tax Debt Situation

Before proceeding with any tax settlement options, an IRS tax settlement attorney will assess your tax debt situation thoroughly. They will review your tax returns, financial records, and any correspondence with the IRS to determine the best course of action. Understanding the full scope of your tax debt is essential for developing a tailored strategy that addresses your specific needs.

Exploring IRS Tax Relief Options

IRS tax settlement attorneys are well-versed in the various tax relief options available to taxpayers. They will evaluate your eligibility for programs such as an Offer in Compromise, Installment Agreements, Innocent Spouse Relief, and more. By exploring these options, they can identify the most suitable solution for your tax debt.

Offer In Compromise: A Viable Solution

One of the most popular tax settlement options is an Offer in Compromise (OIC). This program allows eligible taxpayers to settle their tax debt for less than the full amount owed. IRS tax settlement attorneys will guide you through the complex process of preparing and submitting an OIC, maximizing your chances of a successful outcome.

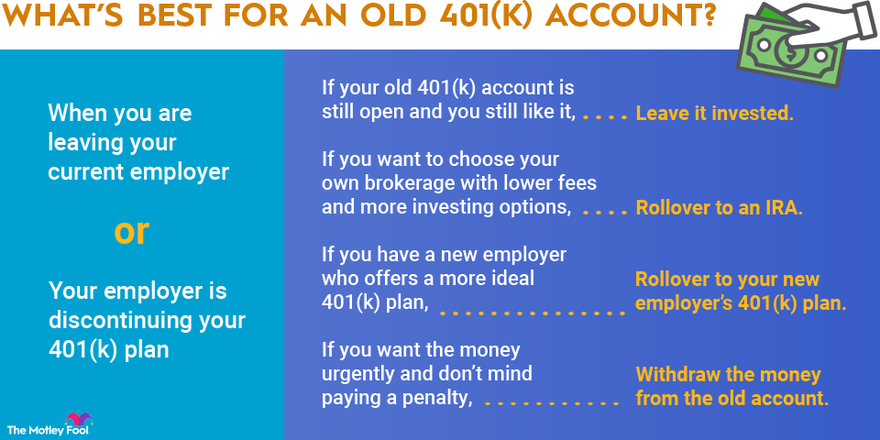

Installment Agreements: Making Payments More Manageable

For individuals who cannot afford to pay their tax debt in a lump sum, installment agreements provide a practical solution. An IRS tax settlement attorney can negotiate favorable terms for an installment agreement, ensuring that your monthly payments are manageable based on your financial situation.

Innocent Spouse Relief: Protecting Unfair Tax Liability

In cases where you may be held responsible for your spouse’s tax debt, innocent spouse relief can provide a solution. IRS tax settlement attorneys can help determine if you qualify for this relief and assist in proving that you should not be held liable for your spouse’s tax obligations.

Negotiating With The IRS: Advocating For Your Rights

Navigating negotiations with the IRS can be daunting, especially when dealing with tax debt. IRS tax settlement attorneys are skilled negotiators who understand the intricacies of tax law and can effectively advocate for your rights. They will communicate with the IRS on your behalf, presenting your case and working towards a favorable resolution.

Appealing IRS Decisions: Contesting Unfavorable Outcomes

If you receive an unfavorable decision from the IRS regarding your tax debt, you have the right to appeal. IRS tax settlement attorneys can guide you through the appeals process, ensuring that your arguments are presented effectively and increasing your chances of a successful outcome.

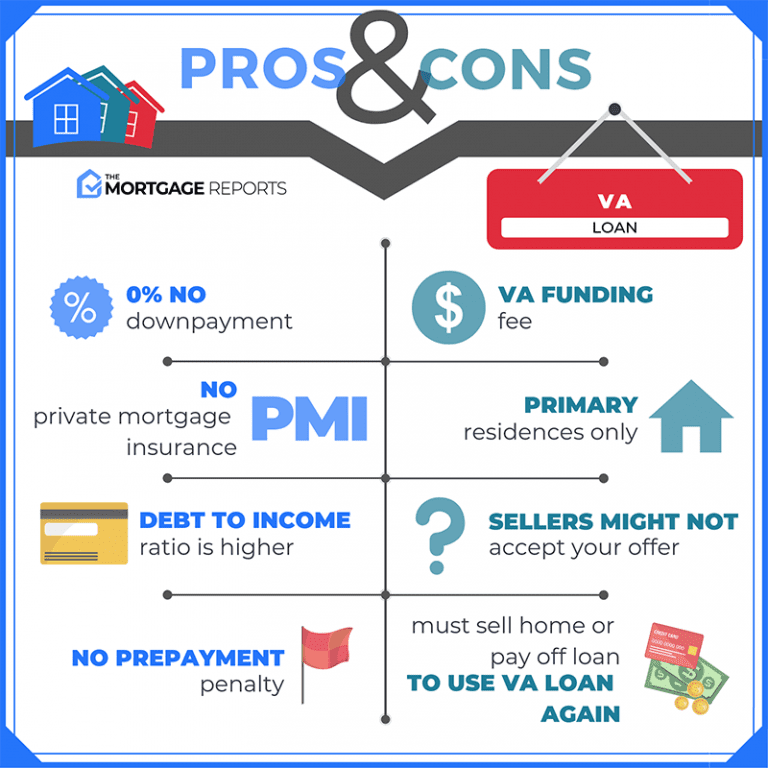

Tax Liens And Levies: Protecting Your Assets

The IRS has the authority to place liens on your property or initiate levies to collect unpaid taxes. IRS tax settlement attorneys can assist in protecting your assets by negotiating the release of tax liens or preventing levies. They will work diligently to find the best resolution that minimizes the impact on your finances and preserves your property.

Avoiding Tax Scams: Working With Legitimate Professionals

When seeking assistance for tax debt, it’s crucial to be wary of scams and fraudulent services. By working with reputable IRS tax settlement attorneys, you can protect yourself from potential scams and ensure that you are receiving legitimate and effective representation. Research and choose an attorney with a proven track record and positive client reviews.

The Cost Of Hiring An IRS Tax Settlement Attorney

While hiring an IRS tax settlement attorney may involve costs, the potential benefits far outweigh the expenses. The cost will vary depending on the complexity of your case and the services provided. However, it’s important to consider the long-term financial relief and peace of mind that professional representation can bring.

Choosing The Right IRS Tax Settlement Attorney

Selecting the right IRS tax settlement attorney is crucial for a successful resolution of your tax debt. When choosing an attorney, consider their experience, track record, and expertise in tax law. Schedule consultations with potential candidates to discuss your case and assess their approach and compatibility with your needs.

Case Studies: Real-Life Examples Of Successful Resolutions

To provide you with a deeper understanding of how IRS tax settlement attorneys can help, here are some real-life case studies showcasing successful resolutions of tax debt. These examples demonstrate the expertise and effectiveness of professional representation in achieving favorable outcomes for individuals facing tax issues.

1. Case Study 1: Resolving a Large Tax Debt Through Offer in Compromise

2. Case Study 2: Successfully Appealing an IRS Decision

3. Case Study 3: Protecting Assets from Tax Liens and Levies

Conclusion

Navigating tax debt can be overwhelming, but you don’t have to face it alone. IRS tax settlement attorneys are invaluable resources when it comes to resolving tax-related issues and negotiating with the IRS on your behalf. Their expertise, knowledge of tax law, and negotiation skills can help you achieve a favorable resolution and alleviate the burden of tax debt.

By seeking professional assistance, such as hiring an IRS tax settlement attorney, you can navigate the complexities of the tax system, explore available relief options, and protect your rights as a taxpayer. Don’t let tax debt consume your life—take proactive steps towards resolving it with the help of a qualified attorney.