Insurance plays a vital role in today’s world by providing financial protection against unforeseen events. It offers peace of mind and safeguards individuals, businesses, and their assets from potential risks. In this article, we will delve into the various aspects of insurance, its importance, and how to make informed decisions when choosing an insurance policy.

What Is Insurance?

Insurance is a contract between an individual or an entity and an insurance company. It involves the transfer of risk from the insured party to the insurer in exchange for a premium. The purpose of insurance is to provide financial compensation in the event of specified contingencies, such as accidents, illnesses, property damage, or loss.

Types Of Insurance

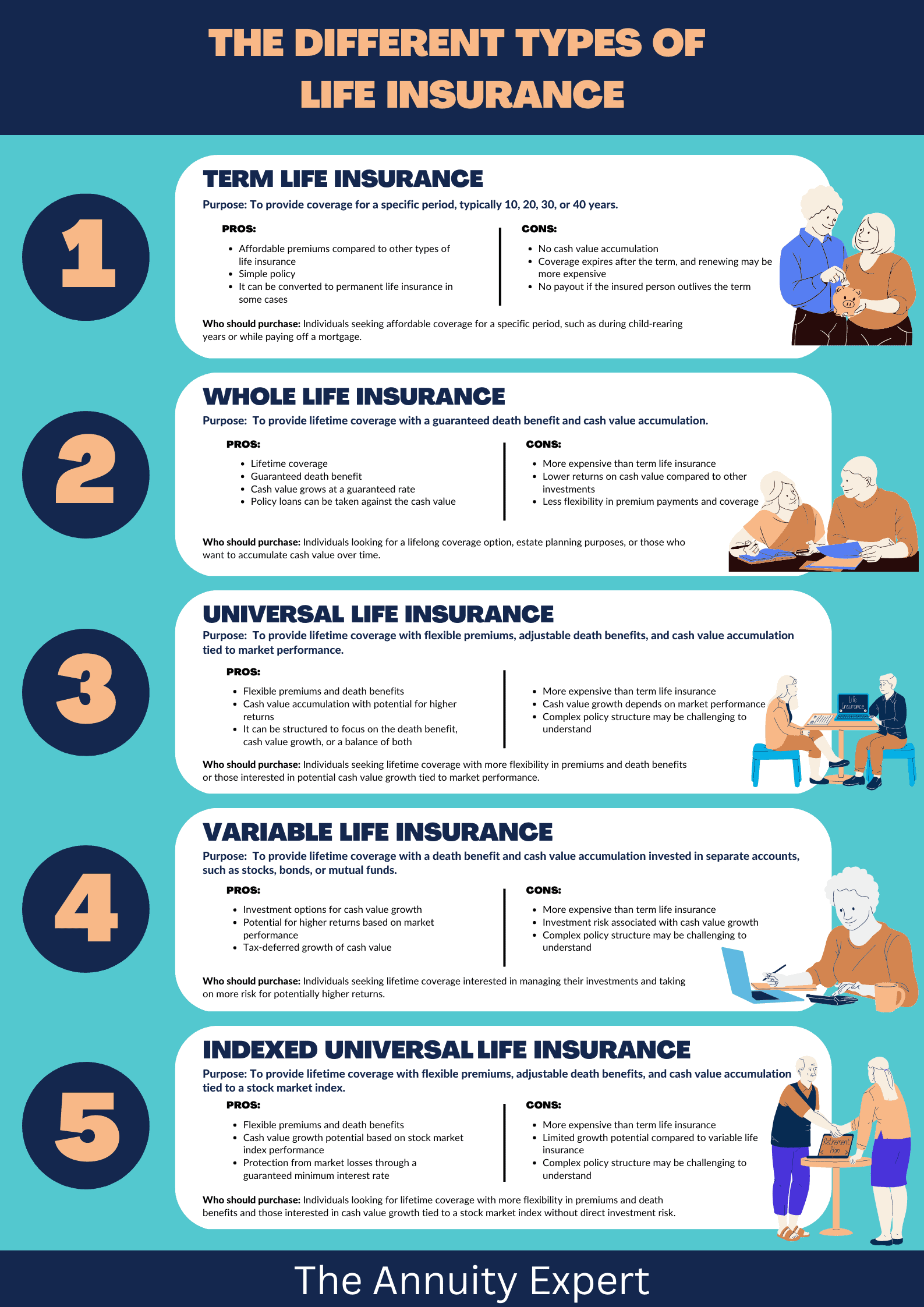

- Life Insurance

Life insurance provides financial protection to the beneficiaries of the insured individual in the event of their death. It ensures that loved ones are taken care of financially and can cover funeral expenses, outstanding debts, and provide income replacement.

Health insurance covers medical expenses incurred by individuals or families. It can include doctor visits, hospital stays, prescription medications, and preventive care. Health insurance plans can vary in coverage, cost, and network of healthcare providers.

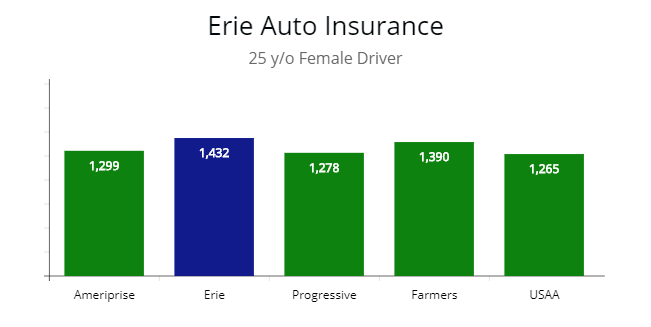

- Auto Insurance

Auto insurance protects vehicle owners against financial loss in the event of accidents, theft, or damage to their vehicles. It can also cover liability for injuries caused to others in accidents involving the insured vehicle.

- Home Insurance

Home insurance provides coverage for homeowners, protecting their property and belongings against damage or loss due to fire, theft, natural disasters, and other specified risks. It also includes liability coverage for accidents that occur on the insured property.

- Travel Insurance

Travel insurance offers coverage for unexpected events that may occur during domestic or international trips. It can include trip cancellation or interruption, emergency medical expenses, lost luggage, and other travel-related risks.

Business insurance protects businesses from financial losses resulting from property damage, liability claims, or interruptions to normal operations. It can include coverage for property, general liability, workers’ compensation, and professional liability.

How Does Insurance Work?

Insurance operates on the principle of risk pooling. When individuals or businesses purchase insurance policies, they contribute premiums to a pool of funds managed by the insurance company. In the event of a claim, the insurer uses these funds to compensate the insured party for their losses.

Factors To Consider When Choosing An Insurance Policy

When selecting an insurance policy, several factors should be taken into consideration:

1. Coverage: Assess the extent of coverage provided by the policy and ensure it meets your needs.

2. Deductibles: Determine the amount you will be responsible for paying out of pocket before the insurance coverage kicks in.

3. Premiums: Evaluate the cost of premiums and consider the affordability in the long term.

4. Exclusions and Limitations: Understand the specific situations or events that are not covered by the policy.

5. Network of Providers: Check if the insurance company has a network of healthcare providers or repair services and assess their quality and accessibility.

6. Customer Service: Research the reputation of the insurance company in terms of customer service, claims processing, and responsiveness.

7. Financial Stability: Evaluate the financial strength and stability of the insurance company to ensure they can fulfill their obligations.

Assessing Insurance Coverage Needs

Determining the right insurance coverage depends on individual circumstances and requirements. Consider the following factors:

1. Personal and Family Situation: Evaluate your dependents, outstanding debts, and financial goals to determine the amount of coverage needed.

2. Asset Protection: Assess the value of your assets, such as your home, car, or business, and choose coverage that adequately protects them.

3. Health Condition: Consider your health status and medical needs when selecting health insurance coverage.

4. Business Risks: Identify potential risks to your business and select appropriate coverage to mitigate those risks.

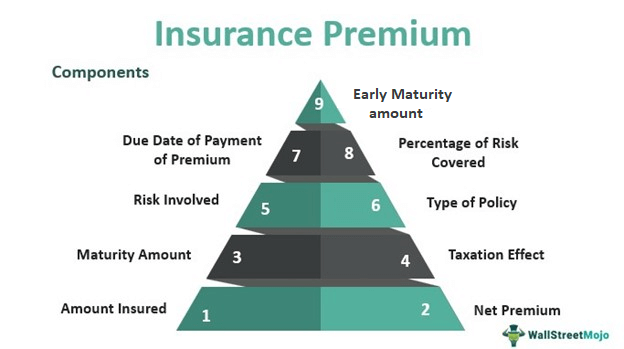

Understanding Insurance Premiums

Insurance premiums are the amount of money paid to the insurance company in exchange for coverage. Several factors influence the calculation of premiums, including:

1. Risk Factors: Insurers consider various risk factors, such as age, health condition, driving record, or location, to assess the likelihood of a claim.

2. Coverage Amount: Higher coverage limits generally result in higher premiums.

3. Deductibles: Opting for higher deductibles can lower premiums but may increase out-of-pocket expenses in the event of a claim.

4. Insurance Score: Insurers may use credit-based insurance scores to evaluate the likelihood of a policyholder filing a claim.

The Claims Process

When an insured event occurs, the policyholder must file a claim to receive compensation. The claims process typically involves the following steps:

1. Reporting the Incident: Notify the insurance company promptly about the event that triggered the claim.

2. Documentation: Provide all necessary documentation, such as incident reports, photographs, or medical records, to support the claim.

3. Investigation: The insurance company assesses the validity of the claim and may conduct investigations if needed.

4. Claim Settlement: If the claim is approved, the insurer will provide compensation according to the policy terms and conditions.

Common Insurance Terms And Definitions

To better understand insurance policies, familiarize yourself with the following common terms:

1. Premium: The amount paid to the insurance company for coverage.

2. Policy: The written contract that outlines the terms and conditions of the insurance coverage.

3. Deductible: The amount the policyholder must pay out of pocket before the insurance coverage applies.

4. Coverage Limit: The maximum amount the insurance company will pay for a covered loss.

5. Exclusions: Situations or events not covered by the insurance policy.

The Importance Of Regular Policy Review

Periodically reviewing your insurance policies is essential to ensure they align with your current needs. Reasons to review your policies include:

1. Life Changes: Significant life events such as marriage, the birth of a child, or purchasing a new home may require adjustments to your coverage.

2. Policy Updates: Insurance companies may update their policies or introduce new coverage options that could benefit you.

3. Cost Considerations: Regular review can help identify potential cost savings or more competitive insurance options.

4. Coverage Gaps: Assessing your policies can reveal any gaps in coverage that need to be addressed.

Insurance And Risk Management

Insurance is an integral part of a comprehensive risk management strategy. It helps individuals and businesses transfer potential risks to an insurance company, providing financial protection against unforeseen events. By having appropriate insurance coverage, you can mitigate the impact of potential losses and safeguard your financial stability.

Tips For Finding The Right Insurance Provider

When searching for an insurance provider, consider the following tips:

1. Research and Compare: Gather information on different insurance companies, their reputation, financial stability, and customer reviews. Compare coverage options and premiums.

2. Seek Recommendations: Ask for recommendations from friends, family, or trusted professionals who have experience with insurance companies.

3. Assess Customer Service: Consider the responsiveness, reliability, and quality of customer service offered by the insurance company.

4. Evaluate Coverage Options: Ensure the insurance company offers the specific coverage you require, tailored to your needs.

5. Review Policy Terms: Carefully read and understand the terms and conditions of the policy, including any exclusions or limitations.

Insurance Fraud: How To Avoid Scams

Insurance fraud is a serious issue that affects both insurance companies and policyholders. To avoid falling victim to scams, follow these guidelines:

1. Be Cautious: Be wary of unsolicited offers, aggressive sales tactics, or deals that seem too good to be true.

2. Verify Credentials: Before purchasing insurance from a provider, verify their credentials and licenses with the appropriate regulatory authorities.

3. Read Policies Carefully: Thoroughly review all policy documents, including the fine print, to ensure you understand the coverage and terms.

4. Report Suspected Fraud: If you suspect insurance fraud or encounter any fraudulent activities, report them to the relevant authorities.

The Future Of Insurance

The insurance industry is continuously evolving to meet the changing needs and demands of policyholders. Some trends and developments shaping the future of insurance include:

1. Digital Transformation: Insurance companies are embracing digital technologies to streamline processes, enhance customer experience, and offer innovative products.

2. Data Analytics: The use of advanced analytics allows insurers to assess risks more accurately, personalize coverage, and detect fraudulent activities.

3. Cybersecurity Insurance: With the rise of cyber threats, cybersecurity insurance is becoming increasingly important for individuals and businesses.

4. Usage-Based Insurance: Insurers are leveraging telematics and IoT devices to offer usage-based insurance, where premiums are based on actual usage patterns.

5. Sustainable Insurance: Environmental, social, and governance (ESG) considerations are gaining prominence, leading to the emergence of sustainable insurance products.

Conclusion

Insurance is a fundamental tool for managing risks and protecting oneself, family, and assets from potential financial losses. By understanding the different types of insurance, factors to consider when choosing policies, and the claims process, individuals and businesses can make informed decisions. Regular policy reviews, selecting the right insurance provider, and being vigilant against fraud are crucial in ensuring adequate coverage. As the insurance industry evolves, embracing technology and addressing emerging trends will shape the future landscape of insurance.