When it comes to car insurance, one crucial factor that both insurers and policyholders need to determine is the value of the insured vehicle. Insurance companies rely on accurate valuations to set premiums, determine coverage limits, and calculate claim settlements. But how exactly do insurance companies value a car? In this article, we will explore the methods and factors involved in assessing the value of a vehicle for insurance purposes.

Understanding The Importance Of Car Valuation

Car valuation is a critical aspect of the insurance industry as it helps determine the financial risk associated with insuring a particular vehicle. Insurance companies assess the value of a car to establish premiums, set coverage limits, and calculate claim settlements. Accurate valuations ensure that policyholders receive appropriate compensation in the event of a covered loss.

Depreciation And Its Impact On Vehicle Value

One of the primary factors influencing the value of a car is depreciation. Over time, a vehicle’s value decreases due to factors such as age, mileage, wear and tear, and market demand. Insurance companies take into account the depreciation of a car when determining its value for insurance purposes.

Market Value vs. Replacement Cost

Insurance companies typically consider either the market value or the replacement cost when valuing a car. Market value refers to the current worth of the vehicle in the open market, considering factors such as age, condition, mileage, and regional market trends. On the other hand, replacement cost represents the amount needed to replace the insured vehicle with a similar make, model, and condition.

Factors Influencing Car Valuation

Several factors come into play when insurance companies assess the value of a car. Let’s explore some of the key considerations:

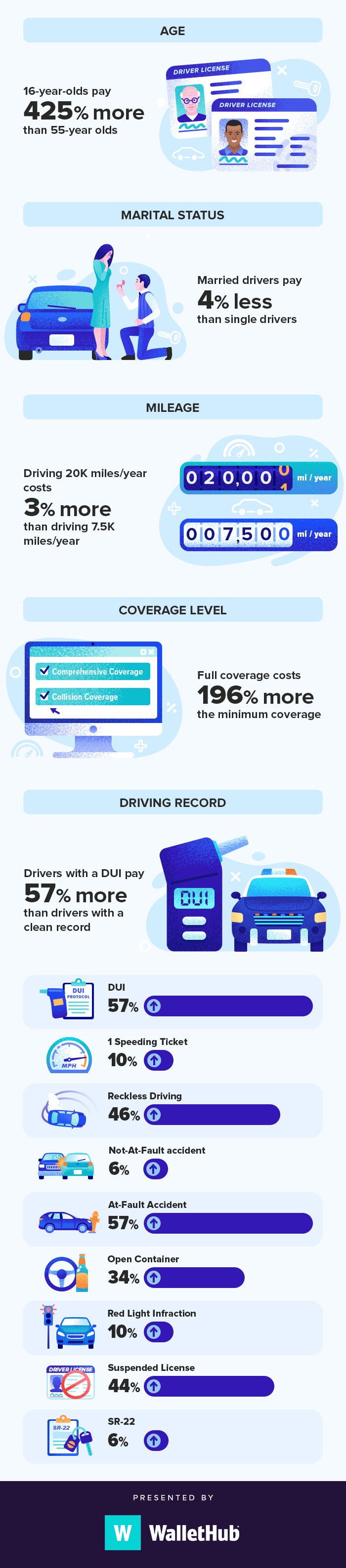

- Age and Mileage

The age of a vehicle is an important factor in determining its value. Newer cars generally have higher values than older ones. Additionally, mileage plays a role in car valuation, as higher mileage often indicates greater wear and tear, potentially affecting the vehicle’s worth.

- Condition and Maintenance History

The condition of the car is crucial in assessing its value. Insurance companies consider factors such as exterior and interior condition, mechanical integrity, and any history of accidents or repairs. A well-maintained vehicle with a clean history will likely have a higher value.

- Make, Model, and Trim

Different car makes, models, and trims have varying values. Some brands and models hold their value better over time, while others may depreciate more quickly. Additionally, rare or limited-edition vehicles often have higher values due to their uniqueness.

- Optional Features and Upgrades

Optional features and aftermarket upgrades can impact a car’s value. Insurance companies take into account additional features such as advanced safety systems, premium audio systems, or custom modifications when determining the value of a vehicle

Regional Market Trends

The regional market where the car is located also affects its value. Supply and demand dynamics, as well as local economic factors, can influence how insurance companies assess the worth of a vehicle. Cars in high-demand regions may have higher values compared to those in areas with lower demand.

Tools and Resources Used by Insurance Companies

Insurance companies utilize various tools and resources to determine the value of a car accurately. Here are some commonly used methods:

- Vehicle Valuation Guides

Insurance companies often refer to industry-standard valuation guides such as Kelley Blue Book (KBB) or the National Automobile Dealers Association (NADA) guide. These guides provide comprehensive information on car values based on factors like make, model, year, mileage, condition, and optional features.

- Online Databases and Marketplaces

Insurance companies also leverage online databases and marketplaces that aggregate data from car sales, auctions, and listings. These platforms help gather real-time information on recent transactions and market trends, enabling insurers to assess the current value of a specific vehicle.

- Appraisal Services

In cases where a car’s value is challenging to determine through standard methods, insurance companies may employ professional appraisal services. Certified appraisers evaluate the vehicle’s condition, history, and market factors to provide an accurate valuation.

- Salvage Value Assessments

In situations where a car is deemed a total loss after an accident, insurance companies consider the salvage value. Salvage value refers to the worth of the damaged vehicle’s parts or its potential resale value. This assessment helps determine the settlement amount for the policyholder.

The Role of Insurance Adjusters

Insurance adjusters play a crucial role in valuing cars during the claims process. These professionals examine the vehicle, review relevant documents, and assess the damage or loss. They consider the previously mentioned factors to arrive at a fair valuation for settlement purposes.

The Claims Process and Car Valuation

When policyholders file a claim for a covered loss, the insurance company evaluates the car’s value as part of the claims process. The valuation helps determine the compensation the policyholder will receive based on their coverage and the extent of the damage or loss.

Negotiating a Fair Settlement

In some cases, the policyholder and insurance company may have differing opinions on the car’s value. It is essential for the policyholder to provide supporting documentation, such as maintenance records, recent appraisals, or market research, to negotiate a fair settlement. Open communication and a willingness to provide additional information can help reach a satisfactory agreement.

Conclusion

Valuing a car is a crucial step for insurance companies to assess risk and provide appropriate coverage and settlements. Various factors, including depreciation, market trends, condition, and regional dynamics, influence the valuation process. By understanding how insurance companies value cars, policyholders can ensure they have the necessary coverage and receive fair compensation in the event of a loss.