Are you a resident of Texas looking for auto insurance? Finding the right insurance coverage at an affordable rate can be a daunting task. With so many options available, it’s essential to understand the basics of auto insurance in Texas and how to obtain accurate quotes. In this article, we will guide you through the process of getting auto insurance quotes in Texas, helping you make an informed decision that suits your needs and budget.

The Importance Of Auto Insurance

Auto insurance is crucial for drivers in Texas to protect themselves, their passengers, and their vehicles in case of accidents or other unforeseen events. It provides financial security and covers medical expenses, property damage, and liability claims. Without adequate insurance coverage, you may be held personally responsible for these costs, which can be financially devastating.

Texas Auto Insurance Requirements

In Texas, it is mandatory for all drivers to carry auto insurance that meets the state’s minimum requirements. According to the Texas Department of Insurance, drivers must have liability coverage with at least the following limits:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident involving multiple people

- $25,000 for property damage per accident

These limits ensure that drivers have the necessary coverage to pay for damages and injuries they may cause while driving. It is important to note that these are the minimum requirements, and individuals may choose to purchase additional coverage for added protection.

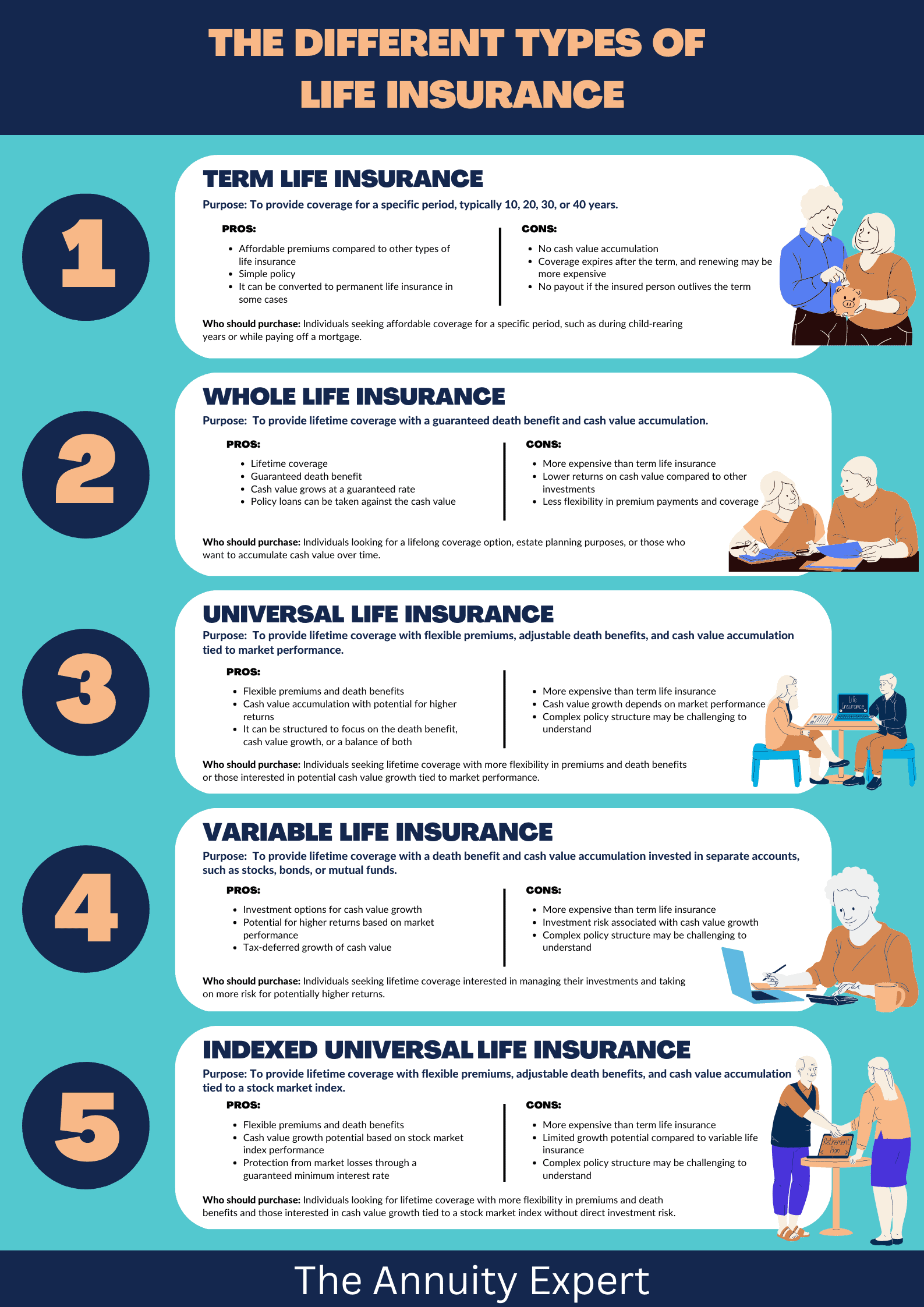

Types Of Auto Insurance Coverage

In addition to the mandatory liability coverage, drivers in Texas can choose to purchase additional types of auto insurance coverage. Some common options include:

- Collision coverage: Covers damage to your vehicle in case of an accident, regardless of fault.

- Comprehensive coverage: Protects against non-collision incidents like theft, vandalism, or natural disasters.

- Personal injury protection (PIP): Covers medical expenses and lost wages for you and your passengers.

- Uninsured/underinsured motorist coverage: Provides coverage if you’re involved in an accident with a driver who has insufficient or no insurance.

Understanding these coverage options is essential when obtaining auto insurance Texas quotes, as they affect the cost and level of protection you receive.

Factors Affecting Auto Insurance Quotes In Texas

Several factors influence the auto insurance quotes you receive in Texas. Insurance companies consider these factors to assess the risk associated with insuring a driver. Here are some key elements that impact your quotes:

- Driving Record and Claims History: Insurance providers examine your driving record to determine your risk level. Traffic violations, accidents, and previous insurance claims can increase your premiums. Maintaining a clean driving record with no accidents or violations can help you secure better rates.

- Vehicle Make, Model, and Age: The type of vehicle you drive significantly affects your insurance rates. Expensive or high-performance cars generally have higher premiums. Additionally, older vehicles may require less coverage, resulting in lower costs.

- Coverage Limits and Deductibles: The coverage limits and deductibles you choose directly impact your insurance premiums. Opting for higher coverage limits and lower deductibles will result in higher premiums but provide greater financial protection in case of an accident.

- Credit Score and Insurance Score: In Texas, insurance companies also consider your credit score and insurance score when calculating your auto insurance quotes. A higher credit score indicates financial responsibility, potentially resulting in lower insurance rates.

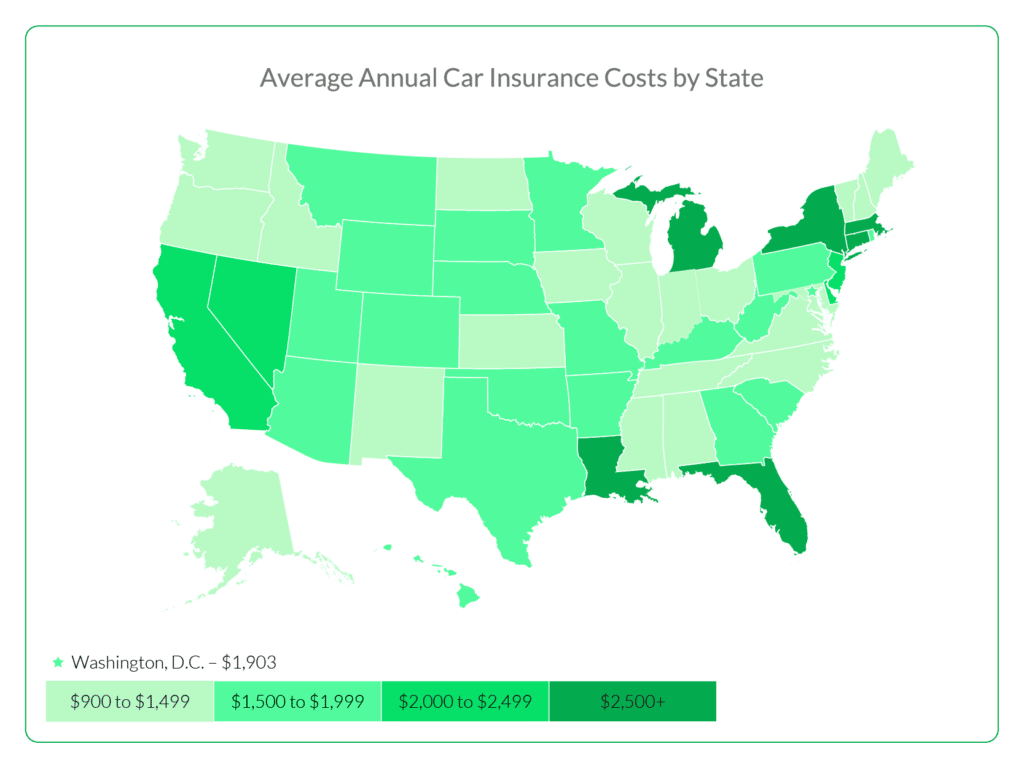

- Location and ZIP Code: The area where you reside and park your vehicle can influence your auto insurance quotes. Urban areas with higher crime rates or a greater likelihood of accidents may lead to higher premiums compared to rural or less congested areas.

How To Obtain Auto Insurance Quotes In Texas

Getting accurate auto insurance quotes in Texas requires research and a thorough understanding of your coverage needs. Follow these steps to obtain quotes:

- Research Different Insurance Providers: Start by researching reputable insurance providers in Texas. Look for companies with positive customer reviews, good financial stability, and a range of coverage options.

- Gather Essential Information: Before requesting quotes, gather all the necessary information. This includes your personal details, vehicle information, driving history, and coverage preferences.

- Request Quotes Online or via Phone: Most insurance providers offer online quote request forms. Fill out these forms with accurate information to receive personalized quotes. Alternatively, you can contact insurance agents directly via phone to discuss your options.

- Compare Quotes and Coverage Options: Once you receive multiple quotes, compare them carefully. Evaluate the coverage limits, deductibles, and any additional features or discounts offered by each provider.

- Ask About Discounts and Special Offers: Don’t forget to inquire about available discounts. Insurance companies may offer discounts for safe driving records, multiple policies, or specific affiliations, such as being a member of certain organizations or alumni associations.

Tips For Choosing The Right Auto Insurance Policy

Selecting the right auto insurance policy goes beyond finding the lowest price. Consider the following tips to make an informed decision:

- Evaluate Coverage Needs: Assess your coverage needs based on your driving habits, vehicle value, and personal circumstances. Ensure the policy provides adequate protection for your specific requirements.

- Consider Financial Stability and Customer Service: Research the financial stability and customer service reputation of the insurance companies you’re considering. Check their ratings with independent rating agencies and read customer reviews to gauge their reliability.

Review Policy Exclusions And Limitations

Read the policy document carefully to understand any exclusions or limitations that may apply. This will help you determine if the coverage meets your specific needs and expectations.

- Assess Deductible Options

Evaluate the deductible options provided by the insurance companies. A higher deductible will lower your premiums but also increase your out-of-pocket expenses in the event of a claim. Choose a deductible that aligns with your financial situation.

- Read and Understand the Policy Document

Before finalizing your decision, thoroughly read and understand the policy document. Pay attention to terms and conditions, coverage details, and any additional provisions. If you have any questions, don’t hesitate to contact the insurance provider for clarification.

How To Lower My Auto Insurance Premiums In Texas

To lower your auto insurance premiums in Texas, consider the following tips:

- Maintain a clean driving record: Avoid accidents, traffic violations, and claims. Insurance companies often reward safe drivers with lower premiums.

- Increase your deductibles: A deductible is the amount you pay out of pocket before insurance coverage kicks in. By increasing your deductibles, you can lower your premiums. Just ensure you can afford the higher deductible amount if you need to file a claim.

- Bundle your policies: If you have multiple insurance policies, such as home and auto insurance, consider bundling them with the same insurance provider. Many insurers offer discounts for bundling policies, resulting in lower overall premiums.

- Inquire about discounts: Ask your insurance provider about available discounts. Common discounts include those for safe driving, good student performance, completion of defensive driving courses, or affiliations with certain organizations.

- Maintain good credit: In Texas, insurance companies may consider your credit score when determining premiums. Maintaining a good credit score demonstrates financial responsibility and can result in lower insurance rates.

- Shop around and compare quotes: Don’t settle for the first insurance quote you receive. Shop around and obtain quotes from multiple providers. Compare the coverage options, deductibles, and premiums to find the best deal for your specific needs.

- Consider the vehicle you drive: Some vehicles are more expensive to insure than others. Before purchasing a new car, research insurance costs for different makes and models. Opting for a vehicle with good safety ratings and lower theft rates can help lower your premiums.

Remember, it’s important to balance affordable premiums with adequate coverage. While cost savings are important, ensure you have sufficient protection in case of an accident or other unforeseen events.

Conclusion

Finding the right auto insurance coverage in Texas is essential for protecting yourself and your vehicle. By understanding the basics of auto insurance, exploring your options, and obtaining accurate quotes, you can make an informed decision that suits your needs and budget. Remember to evaluate the coverage options, consider your specific requirements, and review policy details before finalizing your choice. With the right auto insurance, you can have peace of mind on the roads of Texas.