Are Churches S Or C Corporations? Churches have been around for centuries, and they continue to play an important role in society. From providing services to the community to helping people find meaning in their lives, churches are essential. However, one question often arises: are churches S corporations or C corporations? S corporations are small businesses that are treated as separate legal entities from their owners.

This allows them to take advantage of many tax breaks, including the ability to write off expenses immediately. C corporations, on the other hand, are bigger businesses that are treated as part of the corporate entity. This means they must pay taxes on their profits and may not be able to take advantage of some tax breaks. Both types of corporations have their pros and cons, so it’s important to consider which is best for your church before making a decision.

Definition Of A Church

A church is a religious institution that typically comprises a place of worship, clergy, and members. Churches can be considered organizations under the law, as they are often granted legal privileges and protection from some forms of discrimination. When churches are considered organizations under the law, they are typically treated as S corporations.

However, there is no universal definition of what makes an organization a church, so there is variation in how churches are treated under the law. Some courts treat churches as separate legal entities from their members, granting them immunity from certain types of lawsuits. Other courts view church members as part of the church organization itself and grant them similar legal protections to those afforded to organizational employees.

The majority of states allow churches to operate as nonprofit organizations without paying taxes. In contrast, federal tax law treats churches as social welfare organizations, meaning they must pay taxes on income generated from activities unrelated to religion (such as selling religious items).

Taxation Of Churches

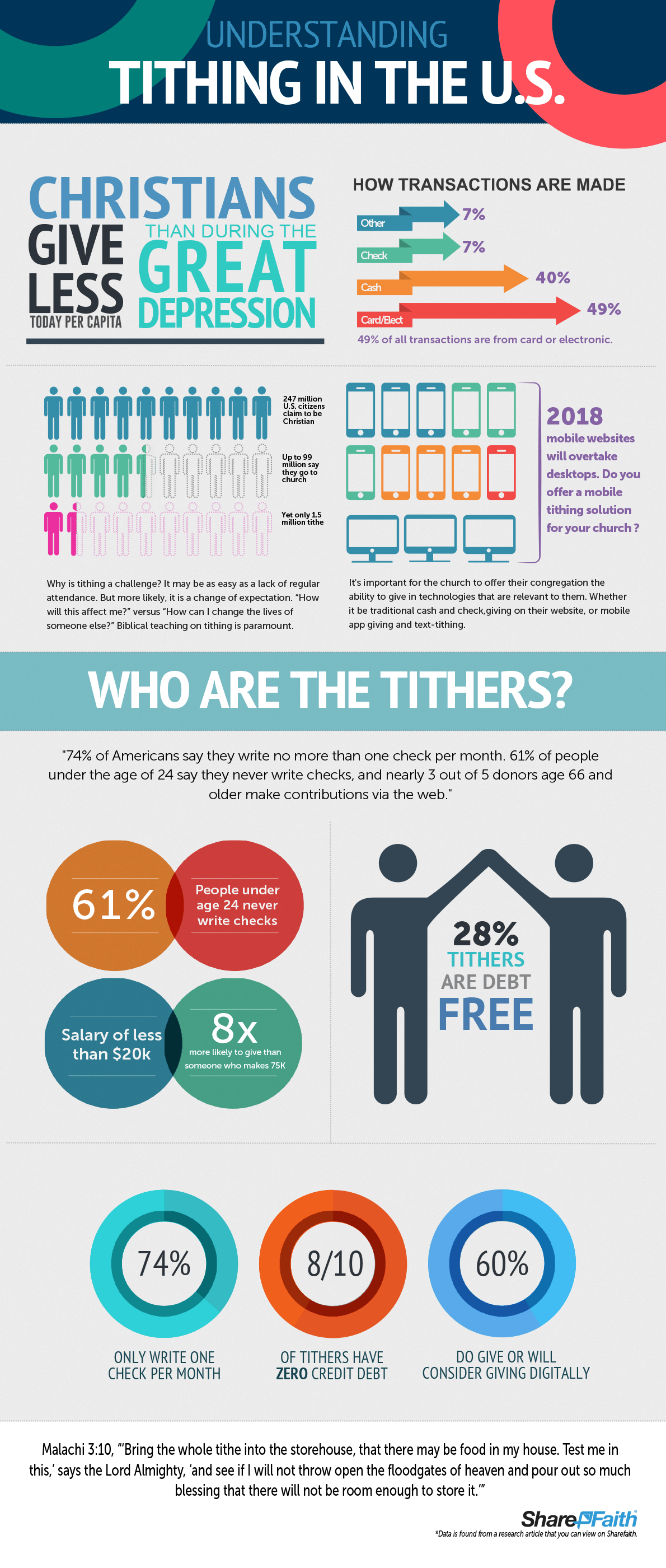

The taxation of churches has been a topic of much debate due to the unique status of churches as non-profit organizations. As a result, there is no universal standard for how churches are taxed.

There are two main types of taxation applicable to churches: property and income Churches are generally treated as C corporations for tax purposes, which means that their income is taxed at the corporate level rather than the individual level. This can lead to significant tax savings since corporate taxes are typically higher than personal taxes.

Churches may also be subject to estate taxes if they dispose of assets worth more than $5 million at once. This tax is only applicable to estates over the age of 70 1/2 and does not apply to trusts or charities.

Differences Between Churches And Corporations

There are a few key differences between churches and corporations. First, churches are not taxed as corporations are. This is because churches are considered 501(c)(3) organizations, which means they are tax-exempt. Churches also have less formal hierarchy than corporations do, with decision-making authority dispersed among all members. Finally, while corporate boards of directors typically represent the shareholders’ interests, church boards generally represent the congregation’s interests.

What Is A Corporation?

A corporation is a legal entity formed by the act of incorporation. A corporation is a separate, distinct, and existing juridical person from its members. Corporations are created for many purposes, such as owning assets, carrying on a trade or business, or producing goods for sale.

Structures Of A Church

A church is a business-like organization that employs people and uses resources to administer religious services. Churches are classified as 501(c)(3) nonprofit organizations, which means they can receive tax-deductible donations.

Church structure is important to understand when examining whether or not churches are businesses.

A church typically has a leader (e.g., pastor), board of directors, staff members, and volunteers who work together to provide religious services. The church also owns property and makes decisions about how to spend its funds. For example, a church may hire a minister to preach sermons or lead religious ceremonies, purchase religious materials such as books or CDs, or finance construction projects for a new building.

Many churches are organized as corporations because it gives the church more flexibility in how it operates and raises money from donors. For example, a church may create subsidiary corporations that operate separate from the main corporation but use the same name and address. This structure allows the church to keep its tax status as a 501(c)(3) nonprofit organization while operating as a business.