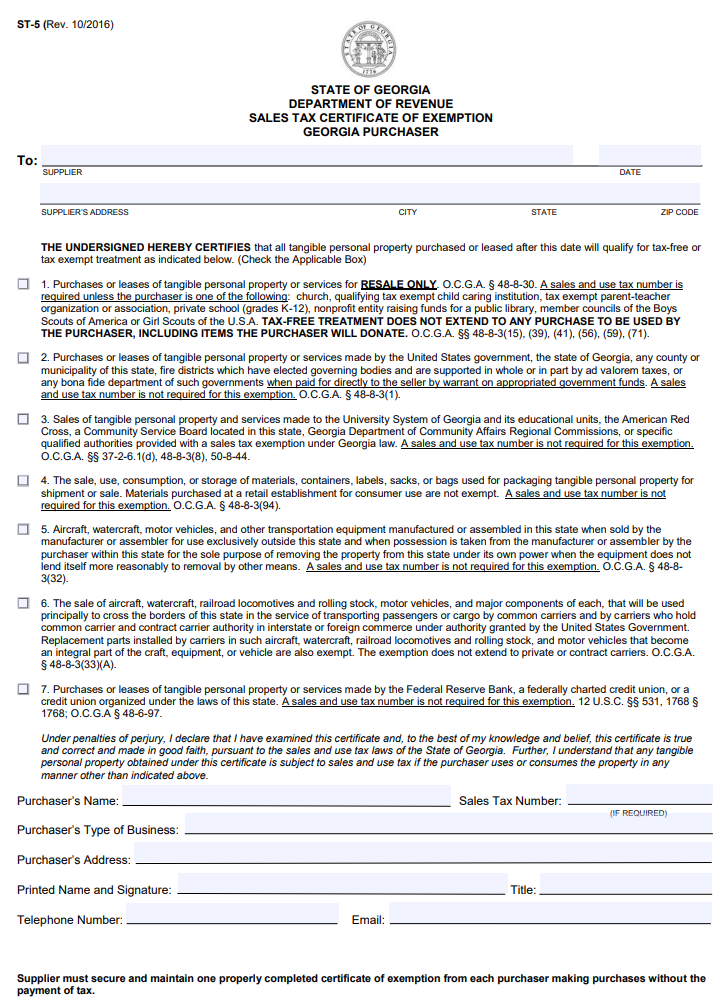

When it comes to sales tax, there are a number of exemptions that apply to different types of businesses. One such exemption is for churches. This means that churches are exempt from paying sales tax in Georgia. However, this does not mean that churches are exempt from all taxes.

Churchs that sell items or services must still pay taxes on those items and services as any other business would. Additionally, churches must follow all the same rules and regulations as any other business when it comes to reporting and paying taxes. If you’re wondering whether your church is subject to sales tax in Georgia, contact your state’s department of revenue for more information.

In Georgia, Churches Are Exempt From Sales Tax

In Georgia, churches are exempt from sales tax. This exemption was created in the early 1900s to help promote Christianity and support religious organizations. Churches are not required to collect sales tax, but they can choose to do so if they wish. Some churches choose to collect sales tax in order to provide a level playing field for their competitors and to generate revenue for the church.

This Exemption Is Based On The Religious Nature Of A Church

Under Georgia law, churches are exempt from sales tax. This exemption is based on the religious nature of a church. Churches must meet certain requirements in order to qualify for the exemption, including that they be organized and operated for religious purposes and that more than half of their activities be conducted for religious purposes.

The Exemption Only Applies To Churches And Their Property

In Georgia, churches and their property are exempt from sales and use taxes. This exemption only applies to churches and their property; it does not apply to church personnel or services. Churches must file a sales tax return if they make a profit from the sale of goods or services.

It Is Up To The Individual County To Decide Whether Or Not To Charge Sales Tax To Churches

Churches in Georgia are not exempt from sales tax, like other organizations. The individual county is responsible for deciding whether or not to charge sales tax to churches. Chances are good that most counties in Georgia do charge sales tax to churches, but it’s always a good idea to check with the relevant authority before making a purchase.

If A Church Loses Its Exemption, It Will Be Charged Regular Sales Tax Like Any Other Business

Churches in Georgia are exempt from sales tax, just like any other business. However, if a church loses its exemption, it will be charged regular sales tax like any other business. This means that churches need to keep track of their tax liabilities and file taxes on a regular basis.

For More Information On Sales Taxes In Georgia, Contact

Are churches exempt from sales tax in Georgia?

There is no definitive answer to this question as it depends on the specific facts and circumstances of each case. However, generally speaking, churches are not exempt from sales taxes in Georgia.

Generally speaking, any business that is organized and operated as a religious institution is considered a “religious organization” for purposes of sales and use tax laws. As such, churches are typically subject to the same sales and use tax laws as other businesses in Georgia. This means that churches are generally required to collect sales and use taxes on purchases made from outside vendors and to remit those taxes to the state government.

While there is no clear-cut answer regarding whether or not churches are exempt from sales tax in Georgia, it is important for church leaders to consult with an experienced tax attorney if they have any questions about their legal obligations related to sales and use taxes.