Churches are often thought of as places of worship, but in actuality, they are businesses. And businesses can be profitable, provided they do a few things right. In this blog post, we will explore some of the things churches should do to ensure they are running as successful businesses. From marketing to finances, read on to discover some of the steps churches need to take in order to thrive and grow.

Definition Of A Church

A church is an organization that offers religious services. These services may include worship, prayers, and sermons. Churches are also sometimes involved in social welfare or charitable work.

Types Of Churches

There are a variety of types of churches, each with its own unique features and purposes.

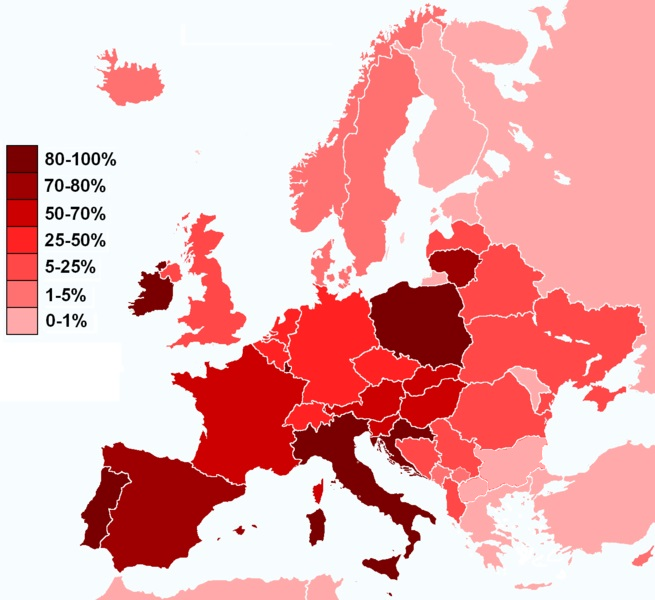

Evangelical Protestant churches are typically characterized by their low tolerance for any form of sin or deviation from strict biblical doctrine. Many have rules prohibiting wearing anything that could be seen as sexy or suggestive, such as tight clothing or excessive makeup.

Catholic churches operate under different hierarchical structures and denominations. There are Catholic churches that emphasize the importance of obedience to church authorities, while others emphasize personal faith in Jesus Christ alone.

Church congregations can also vary drastically in size, from small independent congregations to large denominations with millions of members worldwide. Some large denominations, like the Presbyterian Church (USA), have federated into regional associations so that their congregations are closer to one another and can share resources more effectively.

Taxable Activities Of Churches

Every organization has to pay taxes, even churches. Taxes are payments made to the government as part of income or business activity. Churches are exempt from paying taxes on their normal income, but they must pay taxes on any income they earn from taxable activities. Taxable activities of a church include worship, education, ministerial services, and charity work.

Churches As Businesses

Churches are businesses. They are run like any other business with a mission to make money. Churches must adhere to the same laws and regulations as any other business in order to operate legally and ethically. In spite of this, many churches still try to blur the line between church and business. This is done in a few ways.

One way is through commercial ventures such as ministries that sell products or services outside of the church. These ventures can be incredibly lucrative for churches, especially if they are marketed well and attract large crowds. However, these ventures often come with ethical concerns since they put profits before the gospel message.

Another way churches blur the line between business and religion is by using their resources to promote their own personal beliefs rather than ministering to people in need. For example, one church may donate money to a political campaign while another might fund research into a cure for cancer. Both actions serve their purpose but put the church’s own interests above those of its congregation.

Overall, churches should be considered businesses just like any other. They have goals and objectives just like any other organization, and they must abide by the same rules and regulations as everyone else in order to remain legal and ethical.

Tax Implications

It is no secret that churches can generate a significant amount of income. This income can come from various sources, such as membership fees, tithes and donations. However, there are also tax implications that churches must be aware of.

When it comes to taxes, churches are classified as 501(c)(3) organizations. This means that they are allowed to receive tax-deductible contributions from individuals and corporations. Churches must also file annual Form 990s (tax returns) to disclose their income and expenses.

If a church receives more than $25,000 in contributions from one individual or corporation in a given year, it must file an IRS Form 8886 (Financial Disclosure Statement for Church Activity). This form discloses the identities of the donors and the amounts they contributed. If a church fails to file this form, it may be subject to penalties.

Additionally, churches must follow certain rules when it comes to their investment portfolio. For example, they cannot invest in companies that produce illegal drugs or firearms. Additionally, they must make sure that their investments are consistent with their religious beliefs.

In short, churches should be aware of the tax implications associated with their business activities and take appropriate measures to ensure compliance with all applicable regulations.

Limitations Of Churches As Businesses

The first limitation of churches as businesses is that they are exempt from many taxes and regulations that other businesses must obey. For example, churches do not have to pay income taxes, Social Security taxes, or Medicare taxes. Churches also generally are not subject to the same rules about employee benefits and antitrust laws as other businesses.

Another limitation is that churches cannot openly market their products or services to the public. They can market themselves to members only, and they can’t use advertising or other means to attract customers from outside the church community.

Churches also have limited opportunities for growth. They can’t create new jobs or expand their operations beyond their current boundaries. And they often can’t take actions that might violate the religious beliefs of their members.

These limitations mean that churches can’t be as aggressive in pursuing business opportunities as businesses with more liberal restrictions on what they can do. Churches sometimes have to settle for projects that are less risky and offer higher returns than ventures targeting a broader audience would allow.

There is no denying that many churches are businesses. From renting out space to holding services, churches generate revenue in a variety of ways. This means that pastors and members must be mindful of tax laws and other regulations that apply to businesses.

Additionally, churches should keep careful records of their transactions so they can identify any issues down the line. All in all, churches are important economic engines, and it’s important for leaders to understand how they work and play by the rules.