Every year, the Department of Labor releases a list of exemptions from the Fair Labor Standards Act (FLSA). This law is designed to protect workers from exploitation and ensure that they are paid a fair wage for their labor. One of the most common exemptions is for church employees.

This exemption allows religious organizations to use their own internal rules to determine minimum wage and hours worked. Now, let’s take a closer look at how this exemption works and whether or not it applies to you.

What Is The Fair Labor Standards Act?

The Fair Labor Standards Act (FLSA) is a United States federal law that sets minimum wage, overtime pay, child labor standards, and other workplace protections. Under the FLSA, most workers in the United States are considered employees, not independent contractors. This means that employers must provide workers with certain rights, including minimum wage and overtime pay, and ensure they are given proper breaks and safe working conditions.

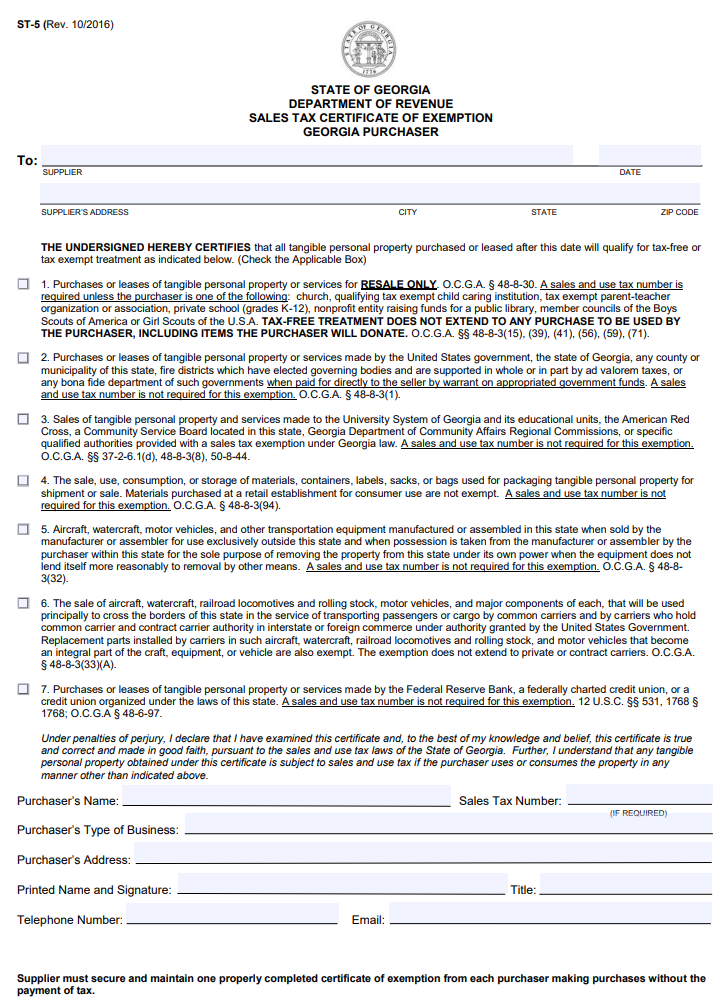

Though the FLSA applies to most workers in the US, some workers are exempt from its provisions. Church employees, for example, are generally exempt from the overtime pay requirement. This is because churches are considered religious organizations under the FLSA.

Other exemptions include employees of small businesses that do not exceed $500,000 in annual revenue or 500 employees in total, agricultural workers who are paid a fair share of their income in relation to overall production costs, and some state government workers.

Are Church Employees Exempt From The FLSA?

The Fair Labor Standards Act (FLSA) is a federal law that regulates the minimum wages and overtime pay of employees in the United States. The FLSA does not apply to employees of religious organizations, unless their employment relates to the operation of the religious organization. Church employees are generally exempt from the FLSA if their duties do not involve any interaction with members of the public.

Who Is Considered A “Church Employee” Under The FLSA?

Under the Fair Labor Standards Act, “employees” are those who are “engaged in an Industry or Business for the purpose of earning wages,” which typically includes employees of religious organizations. This means that most church employees are exempt from the FLSA. However, there are a few exceptions to this rule.

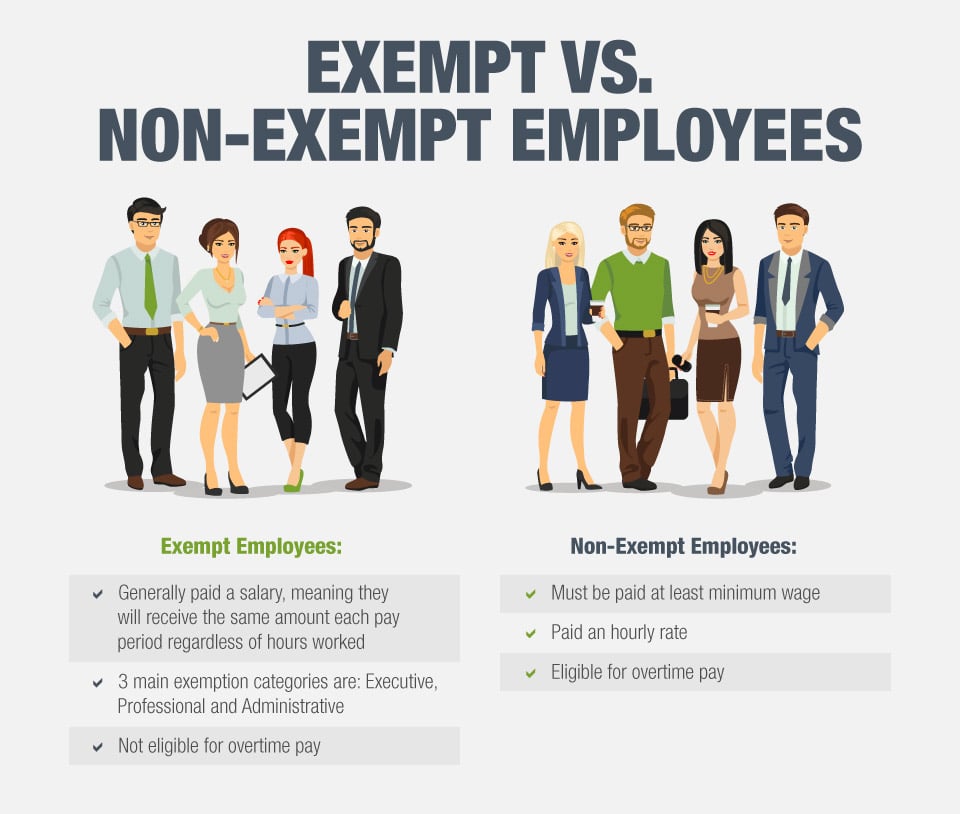

ordained ministers and members of the board of directors or management of a religious organization that employs 50 or more people are considered employees automatically, regardless of how many people they work with. All other church employees must be specifically classified as either hourly paid workers or salaried workers according to their job duties and salary. The classification will determine whether they are protected by the FLSA.

What Are The Responsibilities Of A Church Employee Under The FLSA?

Church employees are typically exempt from the federal minimum wage and overtime provisions of the Fair Labor Standards Act (FLSA). This means that, in general, church employees are not entitled to the minimum wage or overtime pay that is mandated by federal law. However, there are a few exceptions to this rule.

For example, church employees who are hired as full-time executive officers or in high-income positions are generally entitled to receive the minimum wage and overtime pay required by federal law. In addition, some church employees may be entitled to other types of benefits, such as health insurance, retirement plans, and paid vacations. It is important for employers to understand their obligations under the FLSA in order to ensure that they are providing a fair and safe work environment for their church employees.

Are There Any Exemptions To The FLSA For Church Employees?

There are exemptions to the FLSA for church employees, with certain conditions. The first exemption is for executive, administrative, and professional employees. These employees must meet a minimum salary requirement and meet other requirements such as having a college degree or being an experienced employee in their profession.

The second exemption is for religious organizations that are exempt from federal income tax. This exemption allows religious organizations to hire ministers and other church employees without having to pay the full minimum wage and overtime protections.

The final exemption is for amusement park workers. This exemption applies to amusement park workers who receive tips and who are paid on a commission basis only.

Can A Church Employer Terminate An Employee For Exercising Their Rights Under The FLSA?

Generally, employees of a church are exempt from the provisions of the federal minimum wage and overtime laws. However, there are a few exceptions to this rule. Generally, any employee employed in an executive, administrative or professional capacity is automatically exempt from the minimum wage and overtime requirements of the FLSA.

In addition, some state law may also provide exemptions for employees of religious organizations. Finally, certain types of religious training programs operated by churches may also be exempt from the FLSA’s minimum wage and overtime requirements. As a church employee, are you exempt from the Fair Labor Standards Act? The answer to this question is likely yes, depending on your particular employment status.

If you are an independent contractor, for example, you may not be covered by FLSA regulations. However, most church employees are considered to be “employees,” which means that they are protected by FLSA guidelines. As such, most church employees must receive a minimum wage and overtime pay for hours worked over 40 in a week.

Additionally, many employers must provide certain benefits (such as vacation time and health insurance) to their employees under FLSA guidelines. If you are unsure if your employment status qualifies you as exempt or not, speak with an attorney who can help determine your specific rights and obligations under FLSA.