Managing cash flow is a critical aspect of running a successful business. However, late payments from customers can cause significant disruptions and hinder growth opportunities. This is where accounts receivables financing comes into play. By leveraging your outstanding invoices, you can access immediate cash flow and fuel your business expansion.

Are you a business owner looking for a reliable and efficient way to optimize your cash flow? If so, accounts receivables financing might be the solution you’ve been seeking. In this comprehensive guide, we will explore the concept of accounts receivables financing, its benefits, and how it can unlock new avenues for your business growth.

Understanding Accounts Receivables Financing

Accounts receivables financing, also known as invoice financing or factoring, is a financial solution that enables businesses to convert their unpaid invoices into immediate working capital. Rather than waiting for customers to settle their invoices, businesses can sell these invoices to a third-party financing provider, known as a factor, at a discounted rate. The factor then advances a percentage of the invoice value, typically ranging from 70% to 90%, to the business. Once the customer pays the invoice, the factor releases the remaining balance, deducting a small fee for their services.

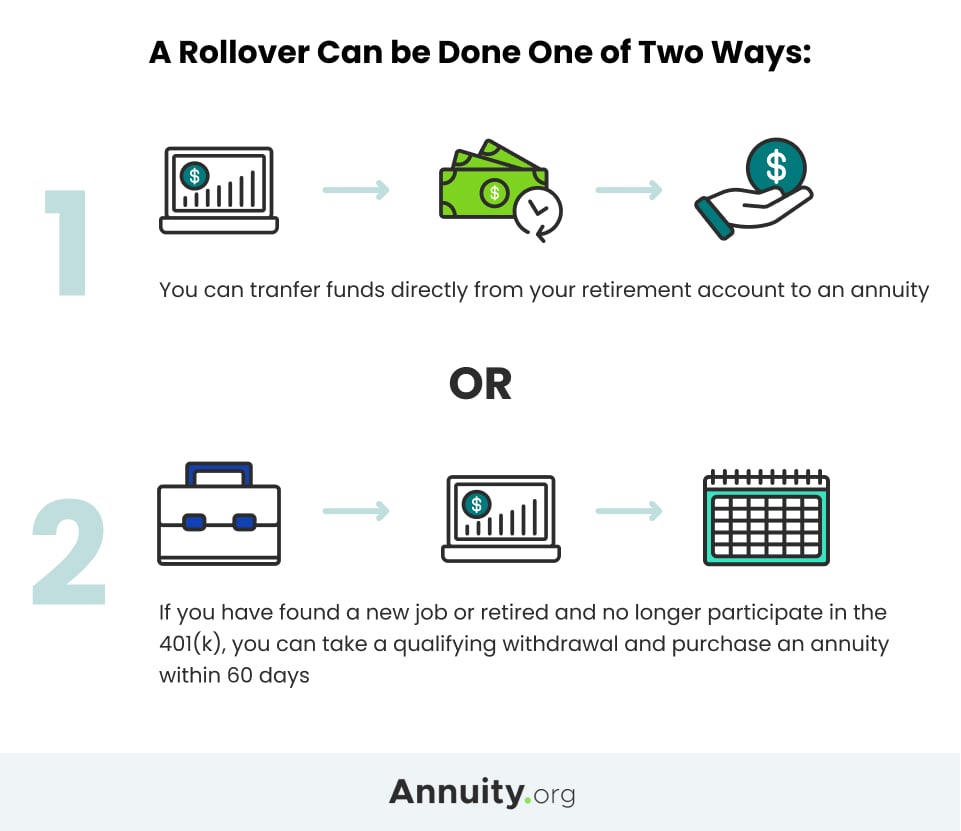

How Does Accounts Receivables Financing Work?

To better understand the process, let’s walk through a typical accounts receivables financing scenario:

1. Application: The business applies for accounts receivables financing by submitting an application to a financing provider. The application typically includes details about the outstanding invoices, customers, and the business’s financial history.

2. Due Diligence: The financing provider conducts due diligence to assess the creditworthiness of the customers and the invoices’ validity. This step helps determine the percentage of the invoice value the business can receive as an advance.

3. Advance Funding: Once the due diligence is complete, the financing provider approves the application and advances a percentage of the invoice value to the business. The funds are usually disbursed within a few days.

4. Customer Payment: The business continues its regular operations while the financing provider waits for the customers to pay the invoices directly. The payment is typically directed to a lockbox or a designated bank account managed by the factor.

5. Remaining Balance and Fee: Once the customer pays the invoice, the financing provider releases the remaining balance to the business, minus their service fee. The fee is usually a small percentage of the total invoice value.

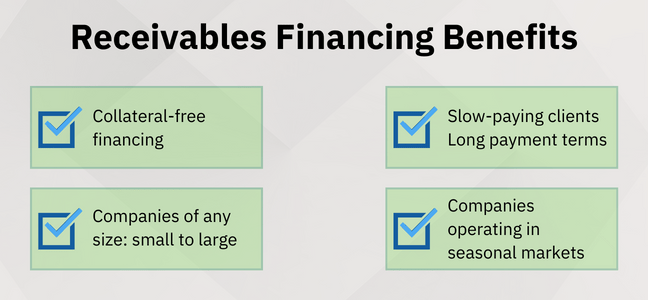

The Benefits Of Accounts Receivables Financing

Accounts receivables financing offers numerous advantages for businesses:

- Improved Cash Flow

One of the primary benefits of accounts receivables financing is the immediate injection of cash into your business. Rather than waiting for customers to pay their invoices, you can access a significant portion of the invoice value upfront. This enables you to meet financial obligations, pay suppliers, and invest in growth initiatives without delay.

- Flexibility and Scalability

Accounts receivables financing is a flexible solution that grows with your business. As your sales volume increases, the available financing also expands. This scalability allows you to take advantage of growth opportunities without being constrained by limited cash flow.

- Mitigating Credit Risks

When you opt for accounts receivables financing, the financing provider assumes the risk of non-payment. They thoroughly assess the creditworthiness of your customers before advancing funds, reducing the risk of bad debt. This provides you with added security and peace of mind.

- Focus on Core Operations

By outsourcing the management of invoices and collections to the financing provider, you can dedicate more time and resources to your core business operations. You no longer have to chase late payments or deal with administrative tasks associated with accounts receivables.

- Choosing the Right Accounts Receivables Financing Provider

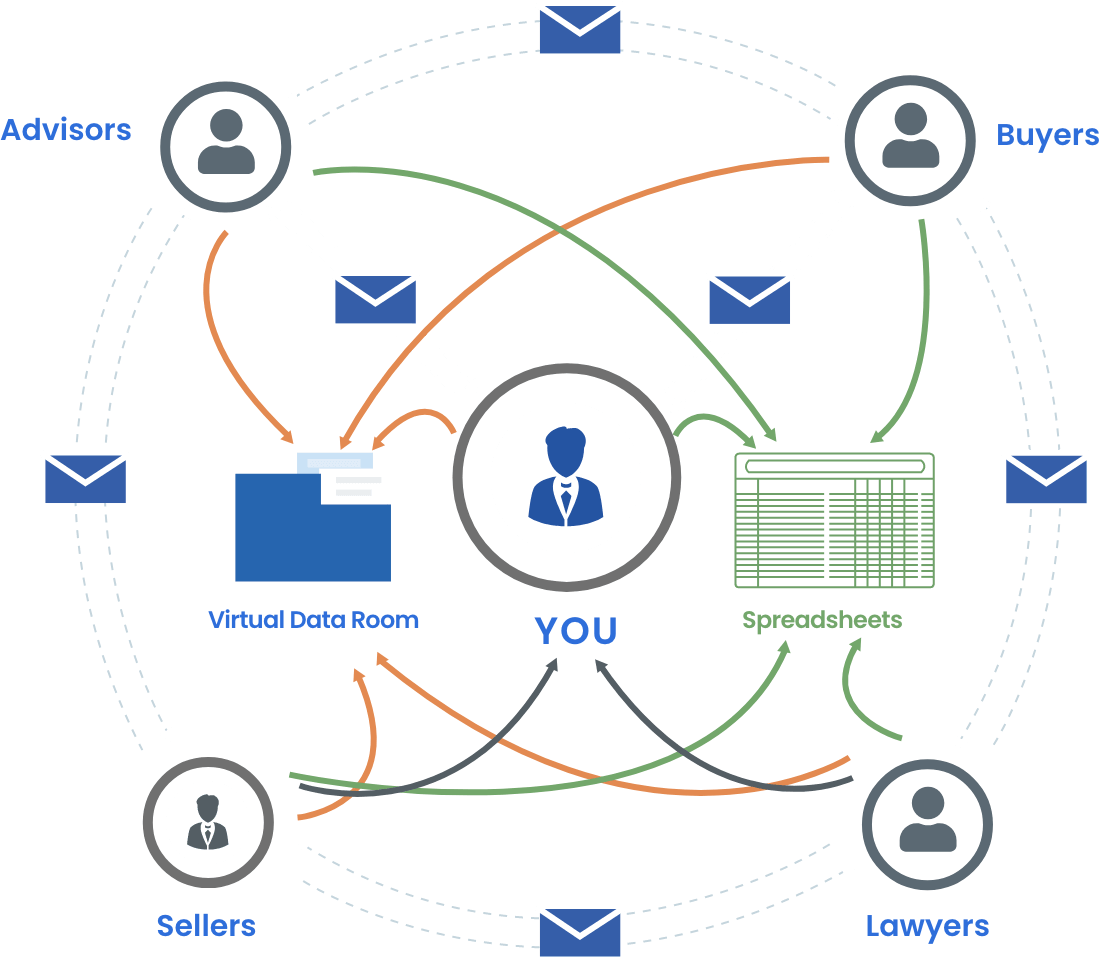

Selecting the right accounts receivables financing provider is crucial to ensure a smooth and successful partnership. Consider the following factors when making your decision:

- Expertise and Reputation

Look for a financing provider with extensive experience in accounts receivables financing. Research their track record, customer reviews, and industry reputation. A reputable provider will have a deep understanding of your business’s unique needs and challenges.

- Terms and Fees

Review the terms and conditions of the financing arrangement carefully. Pay attention to the percentage of the invoice value advanced, the service fee structure, and any additional charges. Ensure that the terms align with your financial goals and are competitive within the market.

- Customer Support

Prompt and reliable customer support is essential for a smooth financing experience. Choose a provider that offers responsive communication channels and readily addresses your inquiries or concerns.

- Compatibility with Your Industry

Certain industries may have specific requirements or regulations when it comes to accounts receivables financing. Ensure that the financing provider has experience working with businesses in your industry and understands the unique dynamics of your market.

Common Misconceptions About Accounts Receivables Financing

Despite its benefits, there are some misconceptions surrounding accounts receivables financing. Let’s address a few of them:

- Negative Impact on Customer Relationships

One common misconception is that financing your invoices may strain your relationships with customers. However, reputable financing providers operate professionally and maintain confidentiality. Your customers will likely not even be aware that you are using accounts receivables financing.

- Limited to Large Corporations

Accounts receivables financing is not exclusive to large corporations. It is a viable option for businesses of all sizes, including small and medium enterprises. In fact, it can be particularly advantageous for smaller businesses that may have limited access to traditional financing options.

- Complexity and Administrative Burden

Some business owners believe that implementing accounts receivables financing will add complexity and administrative burden. However, partnering with an experienced financing provider simplifies the process, as they handle the invoice management, collections, and other administrative tasks on your behalf.

Successful Implementation Of Accounts Receivables Financing

To maximize the benefits of accounts receivables financing, consider the following best practices:

- Proper Cash Flow Management Accounts receivables financing works best when Apologies once again. Here’s the continuation of the article:

Successful Implementation Of Accounts Receivables Financing

To maximize the benefits of accounts receivables financing, consider the following best practices:

- Proper Cash Flow Management

Accounts receivables financing works best when coupled with effective cash flow management. Monitor your receivables closely, identify any slow-paying customers, and maintain regular communication with them to ensure timely payments. By staying on top of your cash flow, you can optimize the effectiveness of accounts receivables financing.

- Clear Communication with Customers

Open and transparent communication with your customers is crucial when implementing accounts receivables financing. Inform them about the financing arrangement and assure them that their payment process remains unchanged. By maintaining a strong customer relationship, you can minimize any potential disruptions.

- Regular Assessment of Financing Terms

Periodically review the terms and conditions of your accounts receivables financing agreement. As your business grows and your financial needs evolve, you may require adjustments to the percentage advanced, the fee structure, or the duration of the agreement. Regularly reassessing the terms ensures that your financing arrangement remains aligned with your business goals.

Case Studies: Real-Life Examples of Businesses Benefiting from Accounts Receivables Financing

Let’s explore two case studies that demonstrate the positive impact of accounts receivables financing:

- Case Study 1: ABC Manufacturing

ABC Manufacturing, a mid-sized manufacturing company, faced cash flow challenges due to slow-paying customers. By leveraging accounts receivables financing, they were able to access immediate funds, allowing them to meet payroll obligations, purchase raw materials, and expand their production capacity. The improved cash flow enabled ABC Manufacturing to take on larger orders and secure new business opportunities, ultimately leading to substantial growth.

- Case Study 2: XYZ Services

XYZ Services, a startup in the service industry, struggled to secure traditional financing due to their limited credit history. They turned to accounts receivables financing as a viable alternative. By factoring their invoices, they obtained the working capital needed to invest in marketing campaigns, expand their team, and upgrade their equipment. This injection of funds propelled XYZ Services’ growth trajectory and helped establish their presence in the market.

Potential Risks And Mitigation Strategies

While accounts receivables financing offers significant advantages, it’s important to be aware of potential risks. Here are a few risks associated with this financing method and strategies to mitigate them:

- Concentration Risk

Relying heavily on a few key customers can expose your business to concentration risk. If one of these customers fails to pay, it can significantly impact your cash flow. To mitigate this risk, diversify your customer base and ensure that no single customer constitutes a substantial portion of your accounts receivables.

- Non-Payment Risk

There is always a risk of non-payment from customers, even after factoring their invoices. To minimize this risk, conduct thorough due diligence on your customers’ creditworthiness before accepting their business. Regularly monitor their payment behavior and take prompt action if any issues arise.

- Contractual Obligations

Review the terms of the financing agreement carefully to understand your contractual obligations. Ensure that you can fulfill the requirements without compromising your business’s financial stability. Seek legal advice if necessary to ensure that the agreement aligns with your best interests.

The Future Of Accounts Receivables Financing

The landscape of accounts receivables financing is evolving rapidly, driven by advancements in technology and changing market dynamics. Going forward, we can expect:

- Technological Innovations

The integration of technology, such as artificial intelligence and blockchain, is revolutionizing the accounts receivables financing industry. Automation and digitization streamline the financing process, making it faster, more efficient, and accessible to businesses of all sizes. Advanced algorithms can assess creditworthiness, predict payment patterns, and facilitate seamless transactions.

- Enhanced Data Analytics

Data analytics plays a crucial role in assessing credit risk and optimizing financing decisions. As data becomes more abundant and accessible, financing providers will leverage advanced analytics to gain deeper insights into customer behavior, industry trends, and payment patterns. This data-driven approach will enable more accurate risk assessments and personalized financing solutions.

- Integration with E-commerce Platforms

The rise of e-commerce has transformed the way businesses operate. Accounts receivables financing is also adapting to this shift by integrating with popular e-commerce platforms. This integration allows businesses to access financing directly within their platform, simplifying the process and accelerating cash flow.

- Increased Competition and Customization

With the growing popularity of accounts receivables financing, we can anticipate increased competition among financing providers. This competition will lead to more favorable terms, lower fees, and greater customization options for businesses. Financing providers will strive to differentiate themselves by offering tailored solutions that meet the unique needs of various industries and business models.

Conclusion

Accounts receivables financing offers a valuable solution for businesses seeking to optimize their cash flow and fuel growth. By converting unpaid invoices into immediate working capital, businesses can overcome cash flow gaps, mitigate credit risks, and focus on core operations. The future of accounts receivables financing is promising, with technological advancements and increased customization opening new doors for businesses of all sizes.

Unlock the potential of your business today with accounts receivables financing and experience the transformative impact it can have on your growth trajectory.