Car insurance is a crucial aspect of vehicle ownership. It provides financial protection in the event of accidents, theft, or damage to your vehicle. When purchasing car insurance, it’s essential to understand how insurance companies categorize vehicles into different groups. In this article, we will explore the concept of car insurance groups and provide you with a comprehensive car insurance groups table.

What Are Car Insurance Groups?

Car insurance groups are classifications that insurance companies use to assess the level of risk associated with insuring a particular vehicle. The groups range from 1 to 50, with Group 1 being the least risky and Group 50 being the most expensive to insure. These groups provide insurers with a standardized way of determining insurance premiums based on a vehicle’s characteristics.

How Are Car Insurance Groups Determined?

Car insurance groups are determined by a variety of factors, including the vehicle’s value, repair costs, performance, safety features, and security measures. Insurance companies analyze historical data on claims and accidents to assess the risk associated with each vehicle model. Based on this data, vehicles are assigned to different insurance groups.

Importance Of Car Insurance Groups

Understanding car insurance groups is crucial when purchasing a new vehicle or renewing your insurance policy. By knowing which group your car belongs to, you can estimate the insurance premium and choose a vehicle that suits your budget and insurance needs.

Factors Affecting Car Insurance Groups

Several factors influence the assignment of vehicles to specific car insurance groups. Here are some key factors considered by insurance companies:

- Vehicle Value

The value of the vehicle is an essential factor in determining car insurance groups. Generally, vehicles with higher market values are placed in higher groups since they would cost more to repair or replace in the event of an accident or theft.

- Repair Costs

The cost of repairs significantly impacts the car insurance group. Vehicles that require expensive parts or specialized repairs are likely to be assigned to higher insurance groups. On the other hand, vehicles with readily available and affordable parts are placed in lower groups.

- Performance and Power

The performance and power of a vehicle also influence the insurance group. Cars with high-performance engines and faster acceleration are generally considered riskier and, therefore, fall into higher insurance groups.

- Safety Features

Safety features play a vital role in determining car insurance groups. Vehicles equipped with advanced safety features, such as anti-lock braking systems (ABS), electronic stability control (ESC), and multiple airbags, are more likely to be assigned to lower insurance groups.

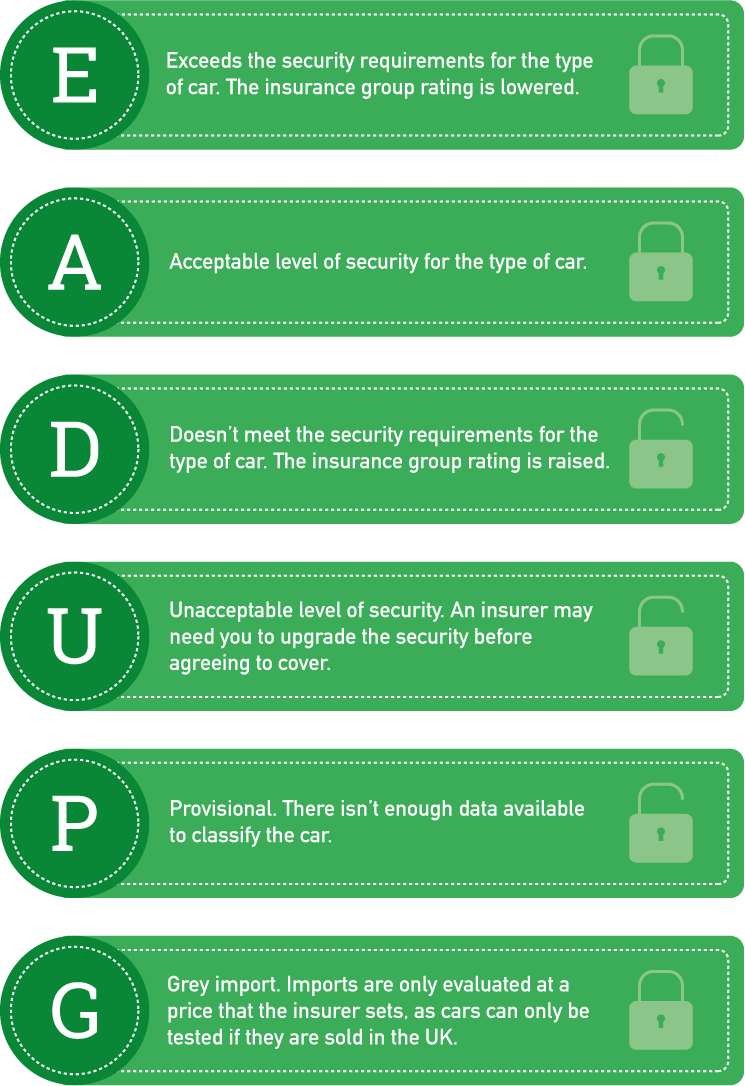

- Security Measures

The security features of a vehicle impact its insurance group as well. Cars equipped with effective security systems, such as immobilizers, alarms, and tracking devices, are seen as less susceptible to theft and are placed in lower insurance groups.

Car Insurance Group Ratings

Car insurance groups range from 1 to 50, with Group 1 offering the lowest insurance premiums and Group 50 representing the highest. The exact rating system may vary between insurance providers, but the general principle remains the same. Vehicles in Group 1 have lower risks associated with them, while those in Group 50 are considered high-risk.

The car insurance groups table provides a comprehensive breakdown of the ratings and the associated insurance premiums. You can refer to this table to get a better understanding of the insurance group your vehicle falls under.

Car Insurance Groups Table

| Insurance Group | Description | Examples |

| Group 1 | Lowest insurance premiums | Volkswagen up!, Ford Ka, Toyota Aygo |

| Group 10 | Mid-range insurance premiums | Ford Focus, Vauxhall Astra, Honda Civic |

| Group 25 | Higher insurance premiums | BMW 3 Series, Mercedes-Benz C-Class, Audi A4 |

| Group 40 | Very high insurance premiums | Porsche 911, Jaguar F-Type, BMW M5 |

| Group 50 | Highest insurance premiums | Aston Martin DBS, Bentley Continental GT, Ferrari 812 |

Benefits Of Understanding Car Insurance Groups

By understanding car insurance groups, you can make informed decisions that may result in cost savings. Vehicles in lower insurance groups typically have lower insurance premiums, allowing you to save money on your car insurance policy.

- Insurance Premium Estimation

Knowing the insurance group of a vehicle helps you estimate insurance premiums accurately. You can use the car insurance groups table and consult with insurance providers to get quotes based on the specific group your vehicle falls under.

- Vehicle Selection

When purchasing a new car, being aware of the insurance group can assist you in making an appropriate choice. You can select a vehicle that fits your budget, taking into account not just the purchase price but also the insurance costs associated with it.

Tips For Reducing Car Insurance Premiums

While car insurance groups determine the baseline premiums, there are several steps you can take to reduce your insurance costs further:

- Opt for Higher Deductibles

Choosing a higher deductible can lower your insurance premium. However, it’s important to ensure that you can afford to pay the deductible amount in the event of a claim.

- Install Security Devices

Installing additional security devices, such as immobilizers, alarms, or tracking systems, can lower the risk of theft and reduce your insurance premium.

- Maintain a Good Driving Record

Maintaining a clean driving record with no accidents or traffic violations demonstrates responsible driving behavior, which can lead to lower insurance premiums.

- Bundle Policies

Consider bundling your car insurance policy with other types of insurance, such as home or life insurance, to take advantage of multi-policy discounts offered by insurance providers.

Purpose Of Car Insurance Groups Table+

The purpose of car insurance groups is to provide a standardized classification system that helps insurance companies assess the level of risk associated with insuring different vehicles. By categorizing vehicles into specific groups, insurance companies can determine appropriate insurance premiums based on the characteristics of the vehicle.

The main purposes of car insurance groups are:

1. Risk Assessment: Car insurance groups allow insurance companies to evaluate the risk level associated with insuring a particular vehicle model. By analyzing historical data on claims and accidents, insurers can assess the likelihood of a specific vehicle being involved in an accident or requiring repairs.

2. Premium Calculation: Car insurance groups help determine the insurance premiums for different vehicles. Vehicles in higher-risk groups are generally associated with higher premiums, as they are more likely to be involved in accidents or require expensive repairs. On the other hand, vehicles in lower-risk groups are typically associated with lower insurance premiums.

3. Policy Customization: Car insurance groups provide insurers with a framework for customizing insurance policies based on the risk profile of each vehicle. Insurance companies may offer different coverage options, deductibles, or terms based on the group in which a vehicle is classified.

4. Consumer Guidance: Car insurance groups also serve as a guide for consumers when choosing a vehicle to purchase or insure. By understanding the insurance group of a vehicle, individuals can estimate the potential insurance costs associated with that particular model. This knowledge helps consumers make informed decisions based on their budget and insurance needs.

Overall, car insurance groups serve as a valuable tool for both insurance companies and consumers. They help insurers assess risk, determine premiums, customize policies, and enable consumers to make informed decisions when selecting a vehicle and purchasing car insurance.

Can I Switch Car Insurance Groups By Modifying My Vehicle?

Car insurance groups are determined based on various factors such as the vehicle’s value, repair costs, performance, safety features, and security measures. Modifying your vehicle may affect its car insurance group, but it is important to note that the changes may not always result in a different group assignment.

If your modifications enhance the safety features or security measures of the vehicle, it could potentially lead to a lower car insurance group. For example, installing an advanced alarm system or anti-theft device might be viewed positively by insurance companies, potentially reducing the group rating.

On the other hand, modifications that increase the vehicle’s performance or power may result in a higher car insurance group. Cars with upgraded engines or modifications that enhance acceleration and top speed may be considered riskier to insure, leading to a higher group rating.

It’s crucial to communicate any modifications to your insurance provider to ensure that your policy accurately reflects the current state of your vehicle. Failing to disclose modifications can lead to coverage issues or even the denial of a claim in the future.

Keep in mind that insurance companies have their own criteria for assessing modifications and determining car insurance groups. Therefore, it’s advisable to consult with your insurance provider directly to understand how any modifications may impact your vehicle’s group rating and subsequent insurance premiums.

Conclusion

Understanding car insurance groups is essential for making informed decisions when it comes to purchasing car insurance. By knowing the factors that influence insurance group ratings and utilizing the car insurance groups table, you can estimate insurance premiums, select an appropriate vehicle, and potentially save money on your car insurance policy.