Car insurance is an essential component of responsible vehicle ownership. It not only provides financial protection in the event of an accident but is also required by law in most states, including Maryland. If you’re a driver in Maryland, it’s crucial to understand the average cost of car insurance to ensure you are adequately covered without straining your budget. In this article, we will explore the factors that influence car insurance rates in Maryland and provide insights into how you can obtain affordable coverage.

Understanding Car Insurance

Car insurance is a contract between an individual and an insurance company, providing financial protection in the event of accidents, theft, or other damages. It offers coverage for property damage, medical expenses, and liability arising from an accident. Car insurance policies typically have premiums, deductibles, and coverage limits that dictate the extent of financial protection provided.

Factors Affecting Car Insurance Rates

Several factors influence car insurance rates, and understanding them can help you estimate the cost of your policy. Here are the key factors that insurers consider:

- VehicleType and Age

The make, model, and age of your vehicle significantly impact your insurance rates. Newer and more expensive cars generally have higher premiums because they are costlier to repair or replace. Additionally, certain vehicles may be more prone to theft or have higher safety ratings, affecting insurance costs.

- Driving Record and Claims History

Your driving record plays a crucial role in determining your car insurance rates. Insurance companies assess your history of accidents, traffic violations, and claims to gauge the level of risk you pose as a driver. Drivers with clean records are considered less risky and often enjoy lower premiums.

- Coverage Limits and Deductibles

The coverage limits you choose and the deductibles you’re willing to pay also affect your car insurance rates. Higher coverage limits provide more protection but come at a higher cost. On the other hand, opting for higher deductibles can lower your premiums but requires you to pay more out of pocket in case of an accident.

- Location

Your location influences your car insurance rates due to varying levels of traffic congestion, crime rates, and the likelihood of accidents. Urban areas and regions with higher rates of vehicle theft and accidents generally have higher insurance premiums.

- Credit Score

In some states, including Maryland, insurance companies consider your credit score when determining your rates. Studies have shown a correlation between credit history and the likelihood of filing insurance claims. Maintaining a good credit score can result in lower premiums.

- Marital Status

Insurance companies often offer lower rates to married couples, as statistics indicate that married individuals are involved in fewer accidents compared to single drivers. If you’re married, you may be eligible for discounted car insurance rates.

Minimum Car Insurance Requirements In Maryland

Maryland law requires drivers to carry minimum liability insurance coverage. The state’s minimum requirements include:

- $30,000 bodily injury liability per person

- $60,000 bodily injury liability per accident

- $15,000 property damage liability per accident

It’s important to note that these are the minimum requirements, and drivers may choose to purchase additional coverage for enhanced protection.

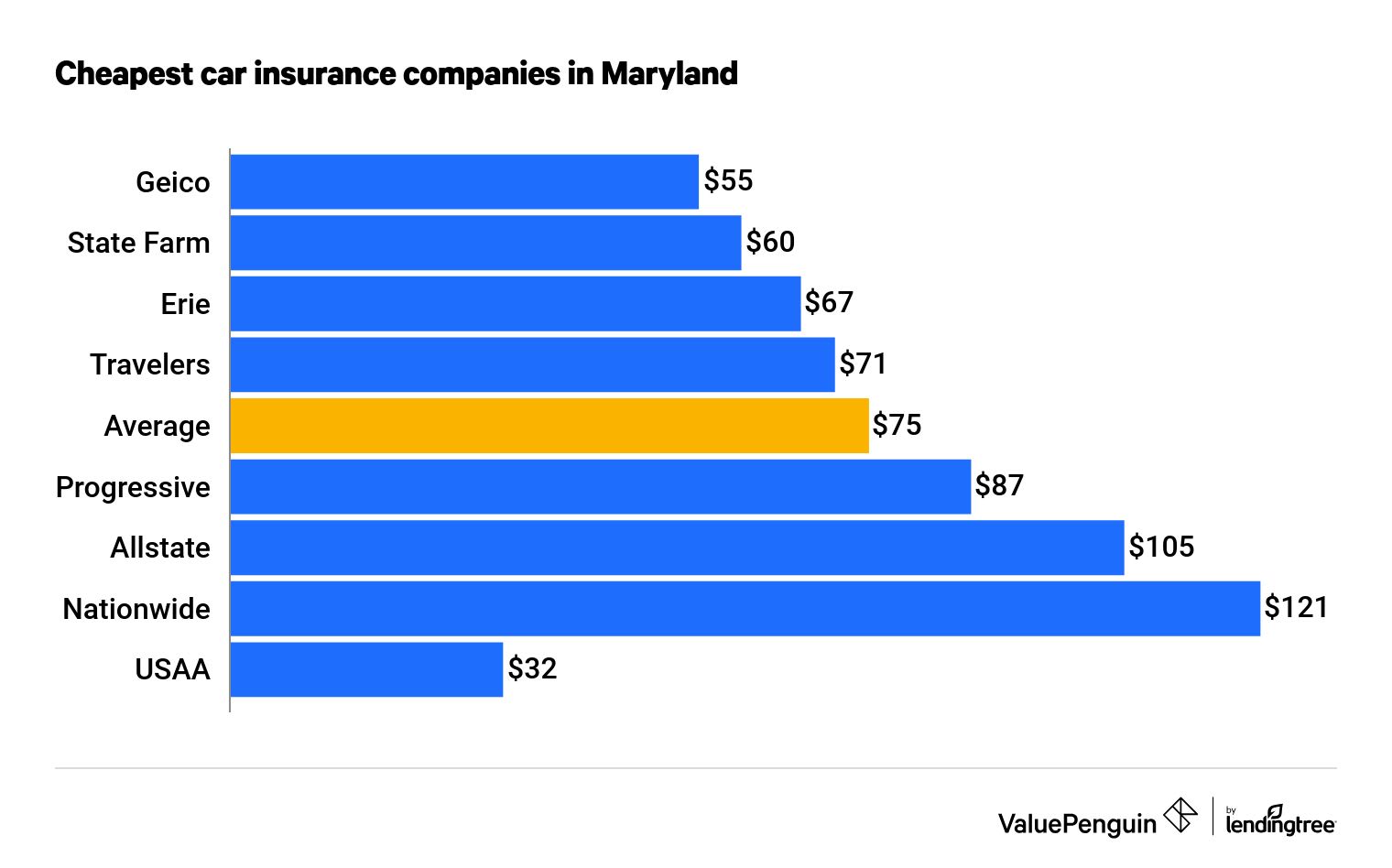

Average Cost Of Car Insurance In Maryland

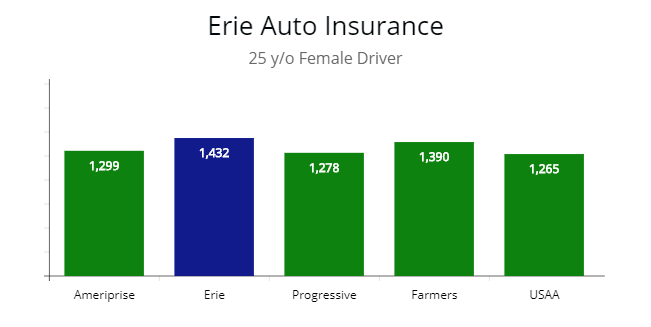

The average cost of car insurance in Maryland varies depending on several factors, including the driver’s age, driving record, coverage limits, and the insurance company. According to recent data, the average annual premium for car insurance in Maryland is approximately $1,200.

However, it’s important to remember that this is only an average, and individual rates can vary significantly. Young drivers and those with a history of accidents or traffic violations may face higher premiums, while drivers with clean records and good credit scores can often find more affordable options.

Consequences Of Driving Without Car Insurance In Maryland

Driving without car insurance in Maryland can have serious consequences. The state of Maryland has strict laws regarding car insurance, and failing to comply with these requirements can lead to various penalties and legal issues. Here are the consequences you may face if you drive without car insurance in Maryland:

1. Fines: If you are caught driving without insurance in Maryland, you can expect to receive a significant fine. The amount of the fine may vary depending on the circumstances, but it can range from several hundred dollars to several thousand dollars. Repeat offenses can result in higher fines.

2. License Suspension: Driving without insurance can also lead to the suspension of your driver’s license. The Maryland Motor Vehicle Administration (MVA) has the authority to suspend your license if you are found to be driving without the required insurance coverage. The length of the suspension can vary, but it can last for several months or even longer.

3. Vehicle Registration Suspension: In addition to license suspension, driving without insurance can result in the suspension of your vehicle’s registration. This means that you will not be able to legally operate your vehicle until you provide proof of insurance and pay any required fees.

4. SR-22 Requirement: If you are caught driving without insurance in Maryland, you may be required to file an SR-22 form. An SR-22 is a document that proves you have the necessary insurance coverage. You will need to maintain this filing for a specified period, typically three years, and any lapse in coverage or failure to file the SR-22 can result in further penalties.

5. Legal Consequences: Driving without insurance is not only a violation of Maryland state law but also puts you at risk of legal consequences if you are involved in an accident. If you are found to be at fault for an accident while uninsured, you may be held personally responsible for the damages and medical expenses of the other party. This can lead to lawsuits and financial hardships.

6. Difficulty Obtaining Insurance in the Future: Driving without insurance can have long-term consequences for your ability to obtain insurance in the future. Insurance companies may view you as a high-risk driver, and as a result, you may face higher premiums or have difficulty finding an insurance provider willing to cover you.

It is important to remember that car insurance is not only a legal requirement but also provides financial protection in the event of an accident. It is always recommended to carry the minimum required insurance coverage and ensure that your policy is up to date to avoid the consequences associated with driving without insurance in Maryland.

Premiums Of Car Insurance In Maryland

The cost of car insurance premiums in Maryland can vary based on several factors. Insurance companies consider various elements when determining the premium for an individual’s car insurance policy. Here are some key factors that can influence car insurance premiums in Maryland:

1. Driving Record: One of the significant factors that affect car insurance premiums is your driving record. If you have a history of accidents, traffic violations, or other driving infractions, insurance companies may consider you a higher risk, resulting in higher premiums. Conversely, a clean driving record with no accidents or violations can lead to lower insurance premiums.

2. Age and Experience: Young and inexperienced drivers typically face higher insurance premiums compared to older, more experienced drivers. This is because statistics show that younger drivers are more likely to be involved in accidents. As you gain more experience and maintain a good driving record, your insurance premiums may decrease over time.

3. Location: Your location within Maryland can impact your car insurance premiums. Urban areas tend to have higher premiums due to factors such as increased traffic congestion, higher crime rates, and a greater likelihood of accidents and theft. Insurance companies take these factors into account when determining the risk associated with insuring a vehicle in a specific location.

4. Type of Vehicle: The type of vehicle you drive also plays a role in determining your car insurance premiums. Expensive cars, high-performance vehicles, and vehicles with a higher risk of theft or damage may lead to higher insurance premiums. On the other hand, vehicles with advanced safety features and good safety ratings may result in lower premiums.

5. Coverage and Deductibles: The level of coverage you choose and the deductibles you select can affect your insurance premiums. Opting for higher coverage limits and lower deductibles generally leads to higher premiums, as it increases the potential financial risk for the insurance company.

6. Credit Score: In some states, including Maryland, insurance companies may consider your credit score when calculating your car insurance premiums. Studies have shown a correlation between credit history and the likelihood of filing insurance claims. Maintaining a good credit score can help lower your insurance premiums.

7. Discounts: Insurance companies often offer various discounts that can help lower your car insurance premiums. These discounts may include safe driver discounts, discounts for completing defensive driving courses, multi-policy discounts (bundling car insurance with other types of insurance), and discounts for installing anti-theft devices or safety features in your vehicle.

It’s important to note that the average cost of car insurance in Maryland can vary based on individual circumstances. To get an accurate estimate of the premiums you may pay, it’s recommended to request quotes from multiple insurance providers and compare the coverage options and rates they offer.

Tips For Finding Affordable Car Insurance

While car insurance costs can add up, there are strategies to help you find more affordable coverage without compromising on protection. Consider the following tips:

1. Compare Multiple Quotes: Obtain quotes from different insurance providers to compare rates and coverage options. This allows you to find the most competitive offer that suits your needs.

2. Bundle Insurance Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance. Consolidating your insurance needs can lead to savings.

3. Maintain a Good Driving Record: Safe driving habits not only keep you and others safe but also result in lower insurance premiums. Avoid accidents and traffic violations to enjoy reduced rates.

4. Opt for Higher Deductibles: Choosing higher deductibles can lower your premiums. Assess your financial situation to determine the deductible amount you’re comfortable with.

5. Take Advantage of Discounts: Inquire about available discounts, such as those for safe driving courses, anti-theft devices, or good student performance. These discounts can significantly reduce your premiums.

Conclusion

Securing the right car insurance coverage is crucial for drivers in Maryland. By understanding the factors that influence car insurance rates and implementing strategies to find affordable coverage, you can protect yourself and your vehicle without straining your budget. Remember to compare quotes, maintain a clean driving record, and explore potential discounts to secure the best possible rates.