Labor laws are a big part of the American landscape. They protect both workers and employers, ensuring that everyone is treated fairly and without discrimination. One of the most common questions we receive at our law firm is whether churches are exempt from labor laws.

The answer is a little bit complicated, but in general, yes, churches are exempt from certain labor laws. This article will explore the exemptions and explain why churches may fall within them. From there, you can figure out which labor law applies to your situation and take appropriate action.

Church-Owned Businesses Are Exempt From Labor Laws

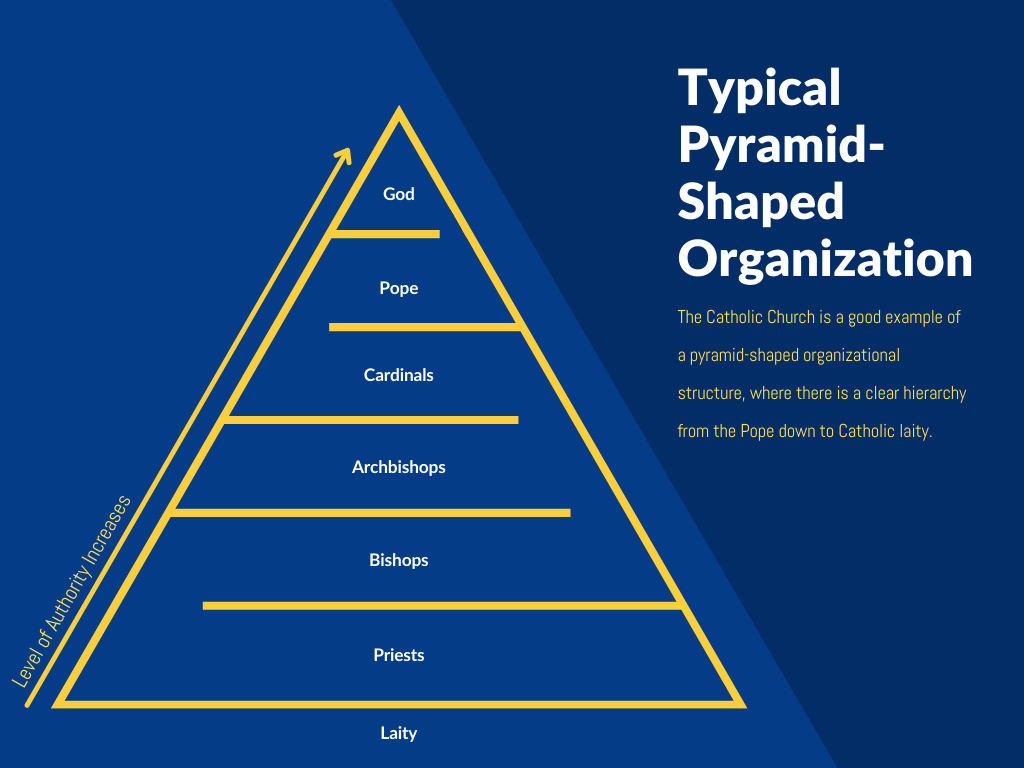

Church-owned businesses are exempt from many employment laws. This exemption is based on the premise that the church is a religious institution and not a business. In general, most labor laws do not apply to religious organizations because they are considered to be charitable institutions.

However, there are some exceptions to this rule.

One exception is the Fair Labor Standards Act (FLSA). The FLSA requires employers to pay their employees minimum wage, overtime pay, and certain benefits. Churches are exempt from the FLSA if they meet two conditions: First, the church must operate primarily for religious purposes and second, the church must not be engaged in any commercial activity.

Therefore, churches that sell goods or services on their premises are subject to the FLSA. Other labor laws that apply to churches include the Occupational Safety and Health Act (OSHA), which regulates workplace safety, and the National Labor Relations Board (NLRB), which protects workers’ rights to unionize and bargain collectively.

Churches Are Not Required To Follow Same Labor Laws As Other Businesses

Churches are not required to follow the same labor laws as other businesses. For example, churches are not required to provide overtime or minimum wage compensation, although they may choose to do so. However, some states have laws that explicitly protect religious organizations from having to comply with certain labor practices.

Some religious groups argue that their religious principles prohibit them from paying employees a fair wage or providing benefits such as health insurance. Others say that they should be exempt from certain labor laws because they are not profit-making enterprises. The issue of whether churches are exempt from labor laws is an ongoing debate in the United States and elsewhere.

What Types Of Labor Laws Does A Church Avoid?

There are a few labor laws that churches may want to avoid. For example, the National Labor Relations Board (NLRB) regulates the relationship between employers and their employees. This means that if an organization is considered a “employer” under the NLRA, it is subject to some of the same regulations as a traditional employer.

Some of these regulations include establishing workplace policies and procedures, giving workers adequate notice of changes, and ensuring that workers have the right to unionize and bargain collectively.

Church-related organizations may also be exempt from other labor laws. For example, Title VII of the Civil Rights Act of 1964 prohibits discrimination based on race, color, religion, sex, or national origin in employment. However, some church-related organizations are exempt from this law because they are religious corporations or associations.

What Are Labor Laws?

There are a few different labor laws that apply to churches and religious organizations. The Fair Labor Standards Act (FLSA) is the most common law that applies to religious organizations. This law establishes minimum wage, overtime pay, and other labor protections for employees in the United States. The Family Medical Leave Act (FMLA) also applies to religious organizations.

This law provides workers with up to 12 weeks of unpaid leave to care for a family member with a serious health condition. Another labor law that applies to religious organizations is the National Labor Relations Board (NLRB). This law protects workers’ rights to unionize and strike.

What Are The Exemptions For Churches?

There are a few exemptions that churches have from labor laws. The first exemption is that churches are not considered “employers.” Churches are considered “independent contractors” under labor law, which means they are not required to provide benefits like health insurance, sick days, and paid vacation.

Another exemption applies to religious organizations with less than fifteen employees. This exemption allows religious organizations to avoid some of the labor laws that apply to businesses with more than fifteen employees, like minimum wage and overtime requirements.

Can Churches Agree To Union Contracts?

Some churches argue that union contracts are against their religious beliefs. Others believe that they should be exempt from labor laws in order to maintain their religious values. Churches have been exempted from many labor laws in the past, but this is likely to change as unions become stronger and more organized.

If one church agrees to a union contract, it could set a precedent for other churches to do the same. This could lead to increased costs for both sides and decreased flexibility for the church. Whether or not churches are exempt from labor laws is a complicated issue that will likely continue to be debated.

In the U.S., there are a number of labor laws that apply to churches and other religious organizations. These laws cover topics such as minimum wage, overtime pay, health and safety requirements, and more. Certain provisions of these laws may exempt religious organizations from having to comply with them, but this is usually determined on a case-by-case basis. If you have any questions about whether your church is subject to a particular labor law, please contact an attorney or visit our website for more information.