Introduction

Church budgets are a common topic of discussion for pastors and churches across the country. But what does it actually take to develop one? And how do you keep it up-to-date as your congregation grows and changes? This blog post will answer these questions and more, providing tips on how to develop a church budget, keep it updated, and manage finances effectively. From estimating expenses to setting thresholds for red flags, this article has everything you need to get started.

The Basics of Church Budgeting

Church budgets are a wise financial decision. They can help churches stay organized and on track, while also providing funds for ministries that are important to the congregation.

There are several steps involved in developing a church budget. The first step is to assess what the church needs and wants. This includes looking at what ministries and programs the congregation is most interested in supporting. Once this information is compiled, it’s important to create a spending plan that reflects these priorities.

Church budgets can be complicated, but with a little planning they can be an effective way to support your ministry goals while staying within your financial limits.

Types of Income and Expenses

Types of Income and Expenses

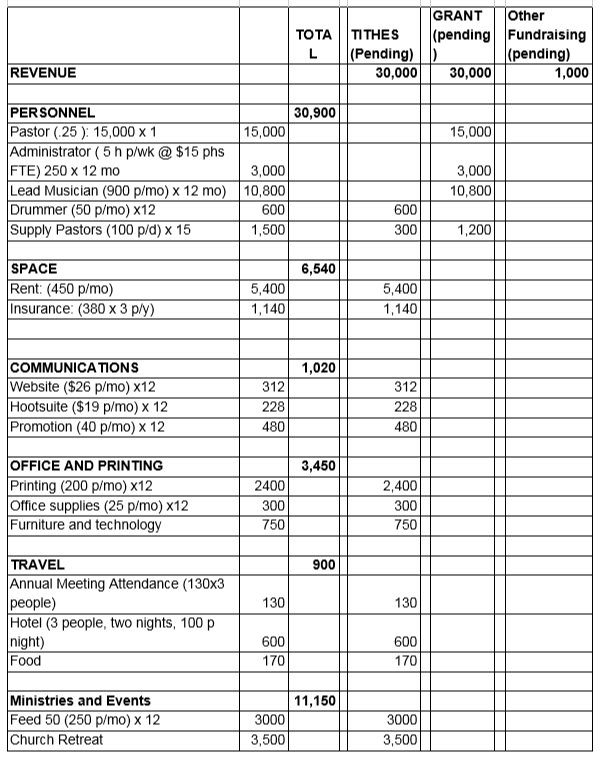

There are a number of different types of income that churches can expect to receive. Contributions from members, donations from individuals or organizations, and revenue generated from services or events are all common sources of income. Other sources of income include investments, rental properties, and royalties.

It is important to keep track of expenses in order to maintain a balanced budget. This includes items like salaries for clergy and employees, operating expenses such as rent, utilities, and advertising, and capital expenditures such as new buildings or equipment. A church budget should be updated annually in order to remain accurate and reflect changing circumstances.

How to Make Changes to Your Church Budget

Church budgets can be an incredibly important tool for ministry. By taking the time to develop a budget, you can ensure that your resources are being used in the most efficient way possible. Below are some tips on how to develop a church budget:

1. Decide Your Purpose For The Budget.

One of the first steps in developing a church budget is deciding what your purpose for it is. Are you looking to track expenses? To make sure that your funds are going towards the right things? Or do you simply want an overview of where your money is going? Once you know your purpose, you can start to develop specific goals and objectives for the budget.

2. Analyze Your Current Financial Situation.

Once you have decided what your purpose for the budget is, it’s important to analyze your current financial situation before making any major changes. Are there any areas where you could save money? Are there any areas where you might be overspending? Once you have a good understanding of where your money is currently going, it will be much easier to make informed decisions about how to allocate funds in the future.

3. Establish Guidelines For Expenses & Income.

After analyzing your finances, it’s important to establish guidelines for expenses and income – this will help keep everything organized and consistent from month-to-month! Try to set thresholds for each category so that you know immediately when something exceeds or falls below those parameters – this will help

Conclusion

Developing a church budget can be a daunting task, but with the right planning and strategy, it can be an incredibly successful endeavor. When creating your budget, it is important to remember that you are not only managing money for your church facility and ministries, but also for the members of your congregation. It is also important to consider how you will fund specific ministry goals or objectives. With these tips in mind, developing a church budget can be an easy and rewarding process.