In today’s digital age, there are many ways to bank. But if you’re looking for an alternative that offers you a more personal experience, consider opening a church bank account. Church banks have been around for centuries and offer a unique set of services and products not found elsewhere.

Plus, they give churches an opportunity to interact directly with their community and provide them with financial services they may not be able to find elsewhere. If you’re interested in opening a church bank account, read on for tips on how to go about it. You may be surprised at just how easy it is!

Choosing The Right Bank

Church banks are an excellent way for churches to save money and access the banking system. There are a few things you should consider before opening a church bank account:

The first thing to consider is the purpose of the bank. Church banks can be used for a variety of purposes, including storing church funds, making loans to members and ministries, and providing financing for church projects.

Next, you need to decide which type of bank account is best suited for your church. A checking account is typically the most popular option because it allows churches to transfer money easily between accounts and makes it easy to track spending. However, if your church only needs limited access to its funds or doesn’t require regular transactions, a savings account may be better suited.

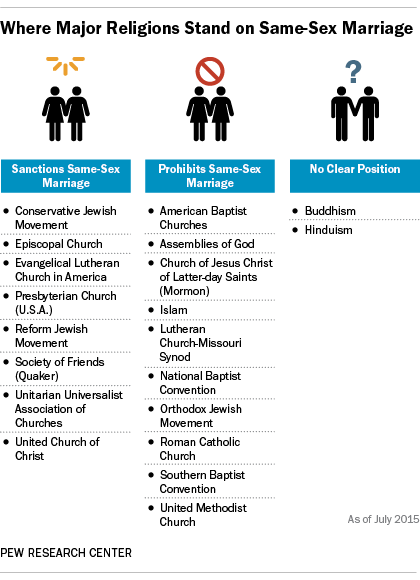

Finally, make sure your bank is religious-friendly. Some banks don’t specifically offer church accounts, but they may be willing to work with you if you provide proof that your church is legitimate.

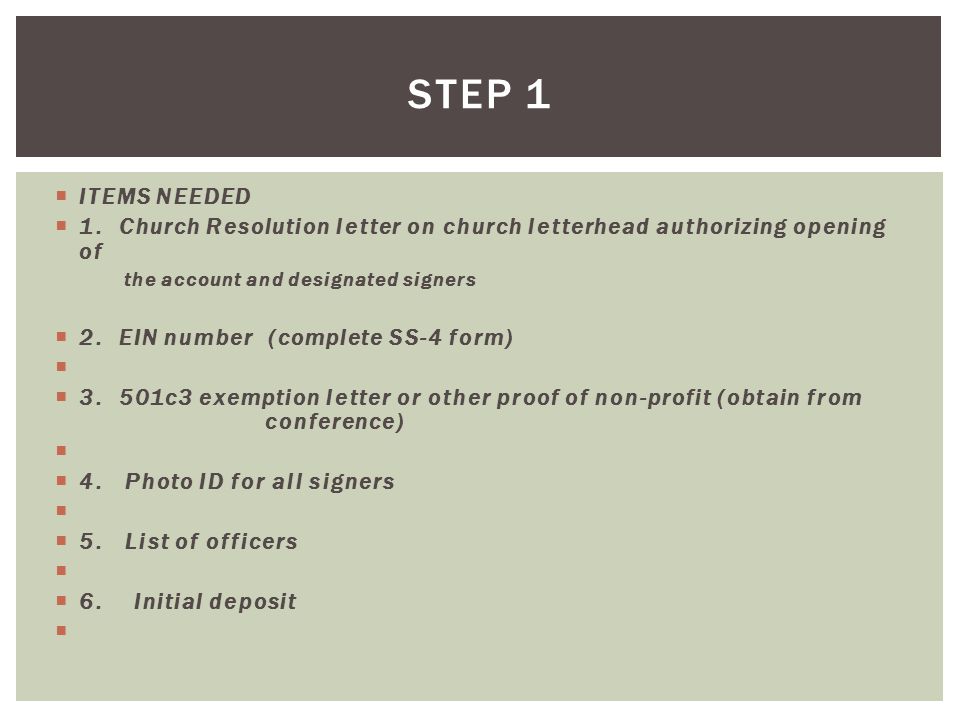

Opening An Account

If you’re thinking of starting your own church, or if you work for a church that wants to start its own bank account, then this guide is for you. There are several things to consider before opening a church bank account: the purpose of the account, who will manage it, and how banks view churches.

Purpose of Church Bank Account

The first step in opening a church bank account is determining the purpose of the account. If the church only needs to deposit funds and make occasional withdrawals, then a basic checking account may be sufficient. However, if the church plans on investing money or issuing loans, a different type of account may be more appropriate.

Churches should also think about what they want their bank to do for them. Some banks offer specific services such as providing automated banking software or giving priority service to religious organizations.

Who Manages Church Bank Accounts?

Once the purpose of the church bank account is determined, who will manage it is next. Most churches choose an organization like a financial consultant or an accountant to help with this task. This person will need access to all accounts in the bank and enough experience working with churches to manage these finances correctly.

It’s important to select someone who has reasonable rates and won’t charge excessive fees. Banks view churches differently than other organizations so it’s important that whoever manages the bank understands this difference as well.

How Banks View Churches One final factor to Setting Up Your Church Bank Account

Setting up your church bank account can be a great way to increase your organization’s financial stability and management. By setting up an account with a reputable bank, you will be able to store funds safely and easily, making it easier to manage your finances and keep track of your organization’s overall progress. There are a few things to keep in mind when Setting up your Church bank account:

–Choose a Bank that is Reliable and Compatible with Your Organization: When choosing a bank, make sure the bank is reliable and compatible with your organization. Consider what type of banking services your church needs (loans, investments, etc.), as well as whether the bank has branches near where you meet.

–Create an Effective Banking Strategy: Once you have chosen a bank, create an effective banking strategy for your church. This includes understanding how funds are deposited and withdrawn from the account, as well as setting up advanced banking features such as online accounts and 24/7 customer service.

–Prepare Financial Statements: It is important to prepare financial statements regularly to track The progress of your ministry. These statements should include information on income and expenses, as well as cash flow reports.

Adding Funds To Your Church Bank Account

When establishing a church bank account, it is important to review which services the institution offers and make sure the account meets your specific needs. Some common benefits of opening a church bank account include easier accounting and financial management, decreased need for PayPal or check processing fees, and increased transparency in financial reporting.

Church banks typically offer lower fees than other commercial banks, making them an attractive option for churches looking to save on overall expenses. In addition to traditional banking services, many church bank accounts offer special features designed specifically for religious institutions, such as online billpay and prayer requests.

To open a church bank account, it is important to consider the institution’s specific features and requirements. Some common questions to ask include: what type of security does the institution offer? What are the monthly fees? How many transactions can be processed per month? What type of software is offered to manage finances? Once you have determined these factors, contact the bank and request an application be sent directly to you.

Checking Accounts And Online Banking

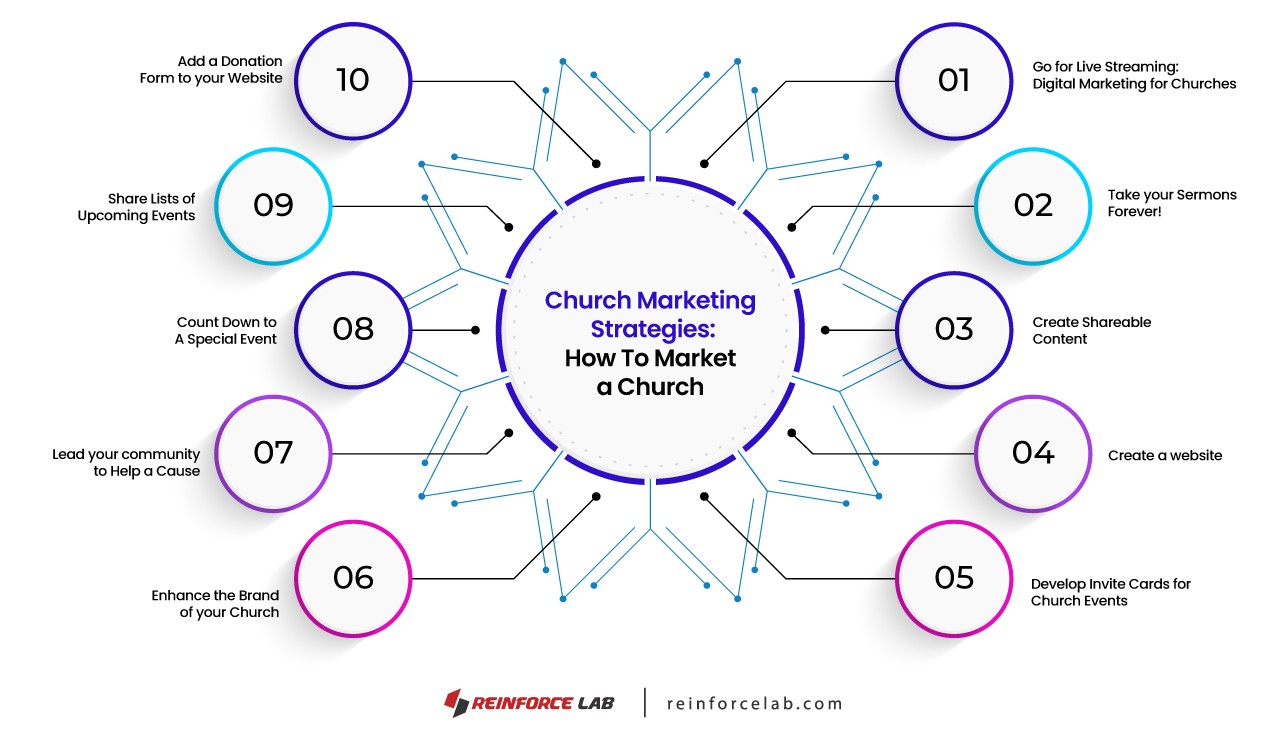

If you are planning to start or expand your ministry into the world of online banking, there are a few key things to keep in mind. First and foremost, you will want to make sure that your church bank account is setup and operational. This can be done through a variety of means, but the most common way is for churches to partner with an online banking provider.

Once your account has been set up, you will need to familiarize yourself with its features in order to effectively use them. One especially important feature is being able to easily deposit and withdraw funds. Additionally, church bank accounts offer a variety of other benefits that can be helpful in your ministry.

For example, they often allow for discounted rates on loans and mortgages, free access to financial calculators and software applications, as well as special discounts on insurance products. It is important to note that not all online banks are created equal and some may not have the features that you require for your ministry. Do plenty of research before signing up for an account so that you can get the best possible deal.

Once you have opened a church bank account it is important to keep it updated with changes made to federal regulations affecting 501(c)(3) organizations like churches. These changes can include new guidelines governing the types of investments that 501(c)(3)s can make and how they must disclose their investments to their donors. Most importantly, 501(c)(3) organizations must now follow guidance issued by the IRS concerning political

Debit Cards And ATMs

If you’re planning to start a church bank account, there are a few things you’ll need to do before you can open an account. First, find out if your church is eligible for a bank account. Generally, churches that have at least 500 active members are eligible. Churches with more than 1,000 members may be eligible if they meet certain other requirements.

Once your church is eligible, you’ll need to apply for a bank account. You’ll need to provide information about your church and its leaders, as well as information about the church’s finances. You’ll also need to fill out an application form and submit it to the bank.

Once your application is complete, the bank will review it and determine whether or not your church is eligible for a bank account. If your church is approved, the bank will then process your application and set up the account for you.

If you are looking to start a church, it is important to have an account with the bank. Opening an account will help you store your donations and track your finances. There are different ways to open a church bank account, so be sure to research which method is best for you.

Read Also: