If you’re a church trustee, do you know who your legal liability is if something goes wrong? If not, you should. Trustees are legally vulnerable if they fail to comply with their fiduciary duties, which can include violating state or federal law. If something goes wrong and someone files suit against the church, trustees could be held accountable for any damages awarded.

In fact, if trustees don’t take action to remedy any wrongdoing, they may even face criminal charges. So what should trustees do if they think they may have violated law? The first step is to speak with an experienced attorney to get a full understanding of your legal rights and obligations. After that, it’s important to take all necessary steps to correct the situation and protect yourself from potential litigation.

What Is A Church Trustee?

Church trustees are responsible for overseeing the financial health and operations of a church. They play an important role in ensuring that the church remains open and accessible to its members. Trustees also have the responsibility of ensuring that the church’s mission continues to be fulfilled.

Trustees should be well-versed in church law, accounting and finance, and have strong business acumen. They should also be able to articulate the goals and objectives of the church to its members. In addition, trustees should be familiar with the IRS rules governing churches and their 501(c)(3) status.

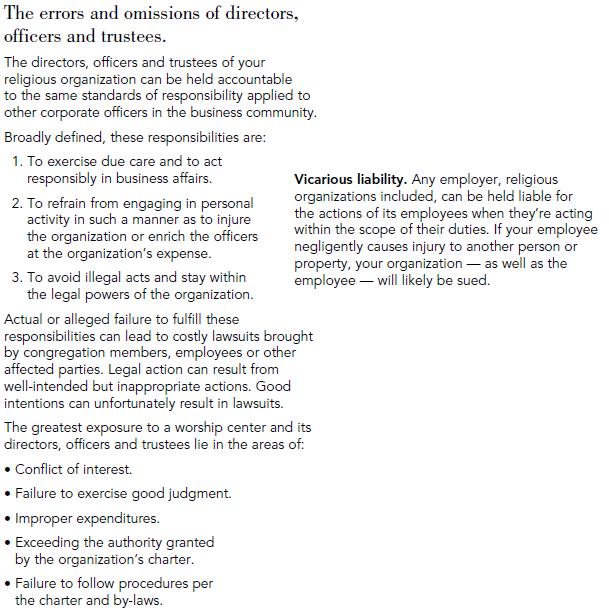

If a trustee is found negligent or commits a wrongdoing, he or she may be liable for damages awarded by a court or settlement reached between the trustee and the church’s board of directors.

What Are Church Trustees Responsible For?

Church trustees are responsible for overseeing the finances, property, and activities of a church. They also have the responsibility to manage religious ceremonies and to make decisions that will protect the interest of the church. Many times trustees also serve as members of the clergy.

Types Of Church Trustees

Church trustees are appointed by a church congregation to oversee its finances and its management.

The U.S. legal system generally holds church trustees accountable for the financial management of their churches, though this responsibility may be limited in scope by provincial or state law. In order to minimize potential liability, trustees should carefully consider their fiduciary obligations and ensure that their actions comply with applicable legal requirements.

Trustees must act prudently and with the best interests of the congregation in mind when making decisions about how money is spent, managing assets, and conducting religious ceremonies. In some cases, trustees may be held liable for mismanagement if they fail to adhere to these responsibilities.

Fiduciaries owe a duty of care to their clients, which includes protecting them from harm caused by their negligence. This includes ensuring that trustees have taken proper precautions to protect themselves from personal liability in case any wrong doing occurs while they are serving as church trustees.

Statutory Liabilities Of Church Trustees

Church trustees are people who are appointed to manage church assets. They may be volunteers or employees of the church. Church trustees have a statutory responsibility to protect the interests of the church and its members.

Trustees must act in the best interests of the church and its members. This means they cannot use their positions to benefit themselves personally or to advantage the church in any way. Church trustees must also take reasonable care to ensure that their actions do not harm the financial position of the church.

If a trustee breaches these responsibilities, they may be liable for damages incurred as a result. For example, if they misuse funds or cause damage to property, they could be sued by the church or its members. Trustees can avoid these potential liabilities by taking appropriate precautions and following guidelines set out by their governing body.

Damages Awarded To Church Trustees

Church trustees are not liable for the personal injuries or property damage that occurs while they are performing their duties as trustees, according to a recent decision by the New York State Court of Appeals. The court ruled that trustees are immune from liability for injuries sustained when they were responding to an emergency call.

The Church Trustees Association (CTA) brought the suit on behalf of four Church trustees who were injured while responding to a 911 call. The plaintiffs alleged that the defendants negligently prepared them for what would happen during the emergency and failed to provide adequate training on how to respond to a 911 call.

The CTA argued that because church trustees have a fiduciary duty to protect the assets of the church, they should be held liable for any injury or damage incurred while fulfilling this duty. However, the court ruled that because trustees are not employees of the church, they are not entitled to employee protections such as immunity from personal injury lawsuits.

Church trustees are liable for the actions of their parishioners, as laid out in Louisiana law. This means that, even if a parishioner does something illegal or unethical while acting within the scope of their job duties, the trustees are still responsible. In order to minimize trustee liability and protect themselves from costly lawsuits, trustees should be familiar with Louisiana Church Trust Law and take appropriate steps to protect themselves and their ministries.